Current Status and Market Overview

Adobe Inc. (NASDAQ: ADBE) is currently trading at $346.26 as of December 7, 2025, with a market capitalization of approximately $145 billion. The stock has experienced significant volatility in 2025, declining 21.48% year-to-date and 35.67% over the past 12 months from December 2024, when it traded at $538.22. Despite the recent weakness, Adobe maintains a forward price-to-earnings (P/E) ratio of 13.93—56% below its 10-year historical average of 47.16—suggesting the stock may be trading at attractive valuation levels relative to its fundamentals.

Historical Price Performance (2020-2025)

Adobe’s stock price trajectory over the past five years reveals a volatile growth pattern marked by significant boom-and-bust cycles:

Adobe (ADBE) Historical Stock Price: December 2020 – December 2025

Adobe began December 2020 at $492.25 and has declined 29.66% over the five-year period to its current level. The stock’s 2021 performance was exceptional, delivering a 16.84% annual return and reaching its five-year high of $688.37. However, 2022 proved catastrophic, with a -40.37% annual decline triggered by broader tech sector weakness and valuation compression. The company rebounded strongly in 2023 with a +77.07% gain as investors regained confidence in its business model, but subsequent years have been challenging with -23.34% in 2024 and -21.48% in 2025.

Adobe Annual Returns: 2020-2025

Year-by-Year Breakdown

| Year | Opening Price | Closing Price | Annual High | Annual Low | Return |

|---|---|---|---|---|---|

| 2020 | $492.25 | $500.12 | $504.17 | $475.91 | +1.60% |

| 2021 | $485.34 | $567.06 | $688.37 | $421.20 | +16.84% |

| 2022 | $564.37 | $336.53 | $564.37 | $275.20 | -40.37% |

| 2023 | $336.92 | $596.60 | $633.66 | $320.54 | +77.07% |

| 2024 | $580.07 | $444.68 | $634.76 | $437.39 | -23.34% |

| 2025 | $441.00 | $346.26 | $464.11 | $312.40 | -21.48% |

Financial Performance and AI-Driven Growth Catalyst

Adobe’s recent business fundamentals remain robust despite stock price weakness. In Q3 fiscal 2025, the company reported record revenue of $5.99 billion, up 11% year-over-year, with non-GAAP diluted EPS reaching $5.31 and exceeding analyst expectations. The company’s gross margins remain impressive at 89%, providing significant operating leverage.

The most significant development for Adobe is its accelerating artificial intelligence monetization. The company reported AI-influenced Annual Recurring Revenue (ARR) surpassing $5 billion in Q3 2025—representing approximately 26.9% of Digital Media ARR—indicating substantial integration of AI tools like Firefly and Acrobat AI Assistant across its product suite. Importantly, Adobe’s AI-first products (those launched with AI as a core feature) exceeded the full-year 2025 revenue target by Q3, and AI-influenced ARR is projected to eventually comprise 100% of the company’s business.

Digital Media ARR reached $18.59 billion, growing 11.7% year-over-year, while Digital Experience revenue grew 10% to $1.48 billion. The company raised its fiscal 2025 revenue guidance to $23.65-$23.70 billion (from $23.50-$23.60 billion) and adjusted EPS guidance to $20.80-$20.85 (from $20.50-$20.70), reflecting confidence in AI monetization.

Analyst Price Targets for 2025-2030

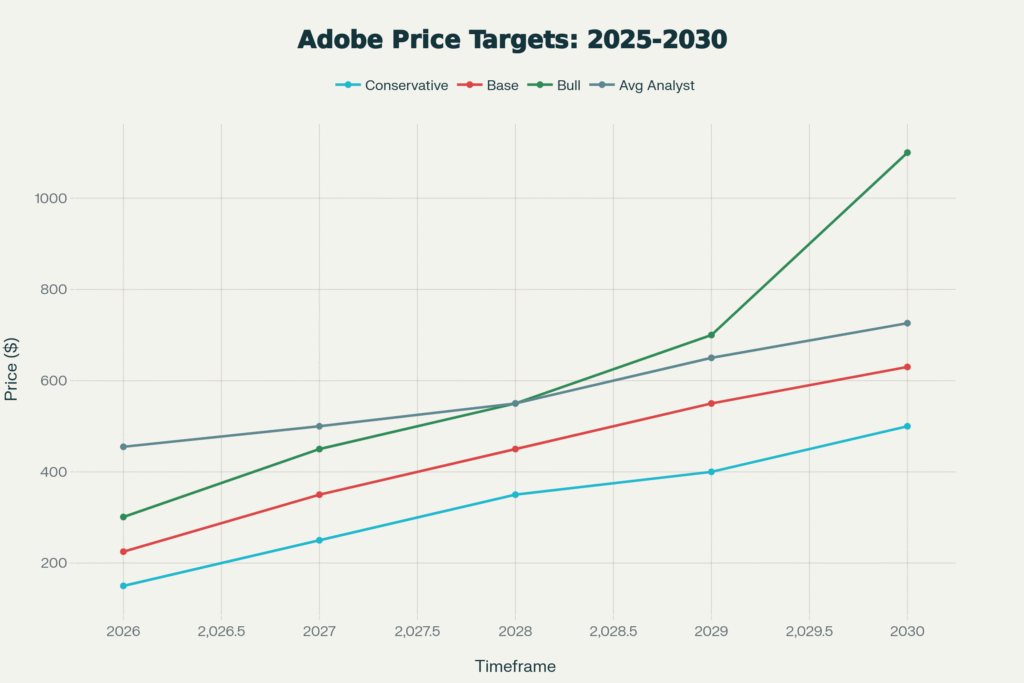

Adobe Price Target Scenarios 2025-2030: Conservative, Base, and Bull Cases

The consensus among 21 covering analysts reflects cautious optimism with a “Buy” rating and an average price target of $454.90, representing 31.38% upside from current levels. Specific analyst targets vary considerably:

Near-Term Targets (2025-2026):

- Morgan Stanley: $600 (+73% upside)

- TipRanks Average: $468 (+35% upside)

- StockAnalysis Consensus: $455 (+31% upside)

- Analyst Range: $280-$600 (with outliers from Redburn at $280 to Morgan Stanley at $600)

Long-Term Targets (2030):

- Northwise Project Base Case: $1,100 (implies 8-10% revenue CAGR to $38-42B and 30-35% operating margins)

- Northwise Project Bull Case: $1,630 (assumes 12% revenue CAGR and 40× forward P/E expansion)

- Northwise Project Bear Case: $630 (assumes 8% revenue CAGR and 20× forward P/E compression)

- StockScan (2030): $726 (109.75% upside)

- TradersUnion (2030): $512 (48% upside)

- Consensus Range: $512-$1,100

The average 2030 price target across major forecasters is $723.60, with a median of $650, implying a compound annual growth rate (CAGR) between 8.14% and 26.01% through 2030.

Bullish Investment Thesis

Adobe’s bull case rests on three primary pillars. First, the company’s AI integration strategy is demonstrably working, with $5 billion in AI-influenced ARR already generating meaningful revenue contribution at scale. Analysts emphasize that AI capabilities enhance user engagement, create pricing power for premium features, and improve average revenue per user across both professional and enterprise segments.

Second, Adobe’s market position remains defensible. Despite competitive threats from Canva (230 million monthly active users) and Figma (now acquired by Adobe for $20 billion), Adobe controls the professional and enterprise design software market with superior functionality, deep ecosystem integration, and strong switching costs. The Figma acquisition eliminates a significant competitive threat while enhancing Adobe’s cloud collaboration capabilities.

Third, valuation appears attractive. At a forward P/E of 13.93—56% below historical averages—and with a simplywallst DCF analysis suggesting 39.2% undervaluation with an intrinsic value of $530.57, the stock may offer meaningful upside if execution continues. Remaining Performance Obligations (RPO) of $20.44 billion provide strong revenue visibility.

Risk Factors and Bearish Considerations

Despite fundamental strengths, significant headwinds challenge Adobe’s growth trajectory. Competitive disruption from AI-powered alternatives represents the primary risk. Google has launched advanced image editing within Gemini, directly competing with Photoshop, while Canva generates 800 million monthly AI interactions compared to Firefly’s lower engagement among general users. Figma’s 48% revenue growth in 2024 demonstrated the vulnerability of Adobe’s traditional dominance. These competitors are democratizing design tools through freemium models and AI accessibility, threatening Adobe’s pricing power in consumer and small-business segments.

Valuation risk remains material. While the current forward P/E of 13.93 appears attractive versus history, high valuation multiples require flawless execution and sustained growth acceleration. The 41% decline from 2024 highs suggests the market remains skeptical about Adobe’s ability to maintain premium growth rates in an increasingly competitive, AI-saturated landscape.

Macroeconomic sensitivity presents indirect exposure. Though software generally has minimal tariff impact, an economic slowdown would reduce corporate spending on creative software and marketing tools, pressuring subscription growth and renewal rates despite software’s exemption from trade tariffs. Rising customer acquisition costs in the maturing SaaS market could also compress profitability.

Monetization uncertainty around AI features persists despite positive Q3 results. While $5 billion in AI-influenced ARR is significant, questions remain about how much incremental pricing Adobe can sustain and whether customers will pay premium rates for AI capabilities that increasingly commoditize. The ability to sustain 10-12% revenue growth alongside margin expansion through 2030 remains unproven at scale.

Valuation Scenarios and 2030 Outlook

The Northwise Project analysis provides the most detailed framework for long-term valuation across three scenarios:

Bear Case: 8% revenue CAGR to $26.5B, 8% EPS growth to $25, and 20× forward P/E compression yields an implied 2030 stock price of $630. This assumes competitive losses, execution challenges, and multiple compression in a maturing market.

Base Case: 10% revenue CAGR to $38-42B, 12% EPS growth to $35-40, and 30× forward P/E maintain an implied 2030 stock price of $1,100. This scenario assumes Adobe successfully monetizes AI while defending core markets and expanding internationally.

Bull Case: 12% revenue CAGR and 15% EPS growth with 40× forward P/E expansion yields $1,630. This presumes Adobe transforms into an AI-first platform while preserving market leadership.

Key Metrics to Monitor

Investors should closely track several indicators of Adobe’s strategic execution. Digital Media ARR growth rates (target: 11.3% in FY2025) provide direct evidence of subscription health. AI-influenced ARR as a percentage of total revenue trending toward Adobe’s stated target of becoming 100% AI-influenced offers visibility into AI monetization success. Quarterly subscription retention and net dollar retention rates reveal customer stickiness. Competitive response data including Canva and Figma adoption trends will determine whether Adobe maintains pricing power. Finally, operating margin expansion (Adobe targets 30-35% by 2030) indicates whether AI investments drive operating leverage as expected.

Investment Perspective

Adobe represents a classic risk-reward binary for investors. The stock’s 35% decline from 12-month highs and 29.66% decline over five years has created a valuation floor at current levels, with consensus analyst targets suggesting 31-35% near-term upside to $455-470. The company’s strong fundamentals—89% gross margins, $5 billion AI-influenced ARR, $20.4 billion RPO, and market leadership position—support a constructive longer-term view.

However, realizing bull case scenarios ($1,100-$1,630 by 2030) requires Adobe to successfully execute a complex strategy: monetize AI features at premium pricing, defend market share against nimble competitors like Canva and Figma, maintain subscription growth in a maturing market, and deliver 10-12% revenue growth with margin expansion. Valuation is attractive, but execution risk is elevated.

The consensus view—a “Buy” with average target of $454.90—represents a reasonable middle ground, implying modest upside with acceptable downside risk given the stock’s already-depressed valuation. Conservative investors might wait for confirmation of Q4 2025 AI monetization metrics before committing new capital.