Tata Power Share is in a bullish trend in the share market. During share ups and downs, you should know all about the share details before investing. In this blog, we are going to discuss the Tata Power Share Price Target 2025, 2026, 2028, 2030, and 2035. We will try to analyze the share base in the company’s overall performance.

We also look at the company’s profit growth in the last 5 years, the last 5 years’ sales growth, and the last 5 years’ ROE percentage. Similarly, we also compare the share growth, the share price return, and whether the share has increased or decreased over the last 5 years. We also take advice from experts about when we should invest in the share, which may be helpful for you. Let’s have a look at the Tata Power Share Price Target from 2025 to 2035.

Overview Of Tata Power Limited

Tata Power Limited is India’s largest integrated power company with a significant international presence. The company is well known for a significant presence in the Wind, Solar, Hydro, and Geothermal Energy space. The company was established in the year 1919. Tata Power became the first Indian company to ship over 1 GW of solar modules.

Fundamental Analysis Of Tata Power Limited

| Company Name | Tata Power Limited |

| Market Cap | ₹1,30,812.36 Crore |

| Book Value | ₹58.12 |

| Face Value | ₹1 |

| 52 Week High | ₹496.28 |

| 52 Week Low | ₹326.25 |

| P/B | 7.10 |

| P/E | 41.59 |

| ROE | 15.23% |

| ROA | 4.53% |

| DIV. YIELD | 0.56% |

| Current Ratio | 0.48% |

Last Few Years’ Performance Of Tata Power Limited

Profit Growth

- In the last 5 years, 4.86%

- In the last 3 years, 97.52%

- In the last 1 year, -31.68%

The company’s Net Profit was ₹3,297.42 Crore in March 2023, which decreased to ₹2,235.64 Crore in March 2024. The company’s Operating Profit was ₹1,689.34 Crore in March 2023, which increased to ₹3,912.03 Crore in March 2024.

Sales Growth

The company’s sales growth percentage over the last 5 years is described below.

- In the last 5 years, 20.15%

- In the last 3 years, 15.69%

- In the last 1 year, 14.26%

The Net Sales amount of the company was ₹5,759.13 Crore in December 2024, which increased to ₹5,995.29 Crore in March 2025.

ROE Percentage

The ROE percentage growth of the company in the last 5 years is described below.

- In the last 5 years, 17.25%

- In the last 3 years, 25.69%

- In the last 1 year, 16.39%

ROCE Percentage

The ROCE percentage growth of the company in the last 5 years is described below.

- In the last 5 years, 12.01%

- In the last 3 years, 15.95%

- In the last 1 year, 14.32%

Total Expenditure Amount

The company’s Total Expenditure was ₹4,623.02 Crore in December 2024 and increased to ₹4,986.25 Crore in March 2025.

The Net Cash Flow Amount

The Net Cash Flow amount of the company was ₹274.36 Crore in March 2023, which increased to ₹325.67 Crore in March 2024.

Tata Power Share Price Target 2025

Tata Power Share Price Target 2025 forecast may vary from ₹403.29 to 431.68.

Influencing Key Factors Of Tata Power Share Price Target 2025

- Thermal Power Station

- The thermal power stations of the company are located at Trombay in Mumbai, Mundra in Gujarat, Jojobera and Maithon in Jharkhand, Kalingaagar in Odisha, Haldia in West Bengal, and Bangalore in Karnataka. The company installed India’s first 500 MW unit at Trombay, the first 150 MW pumped storage unit at Bhira, and a fuel gas desulphurization plant for pollution control at Trombay.

- Hydro Station

- The hydro stations are located in the Western Ghats of Maharashtra, and wind farms in Ahmednagar, Supa, Khanke, Brahmanwel, Gadag, Visapur, and Samana. The company also has the opportunity of 185 MW of Wind Energy, taking total green energy generation to 940 MW.

- Solar Module

- Tata Power has established a 4.3 gigawatt solar module manufacturing plant near Tuticorin in Tamil Nadu, which is expected to be fully functional by the end of October 2024. The company announced on 24th July 2012, the commissioning of the second unit of 525 MW capacity of the Maithon mega thermal project in Dhanbad. The first unit of identical capacity was commissioned in September 2011.

| Month | Tata Power Share Price Target 2025 (1st Price Target) | Tata Power Share Price Target 2025 (2nd Price Target) |

| June | ₹403.29 | ₹411.09 |

| July | ₹409.45 | ₹415.88 |

| August | ₹413.36 | ₹419.74 |

| September | ₹417.52 | ₹422.06 |

| October | ₹420.18 | ₹426.38 |

| November | ₹423.90 | ₹429.86 |

| December | ₹424.06 | ₹431.68 |

Tata Power Share Price Target 2026

Tata Power Share Price Target 2026 forecast may vary from ₹430.06 to ₹ 465.49.

Influencing Key Factors Of Tata Power Share Price Target 2026

- Increasing Revenue

- Tata Power Limited increased its revenue. In the financial year 2023, the company’s revenue was ₹56,034 crore, which increased to ₹61,543 crore in March 2024.

- Approved Science-Based Target

- The science-based targets initiatives have validation of the corporate greenhouse gas emission reduction target submitted by the company. The company commits to reducing the scope 1 GHG emissions by 70.6% per MWH by the financial year 2037 from a FY2022 base year. The company commits to reducing scope 1 and 3 GHG emissions from the generation of all sold electricity by 70.5% within the same time frame. The company also commits to continue active annual sourcing of 100% renewable electricity through the year 2030.

- Partnership With Bhutan

- Tata Power Limited has a partnership with Bhutan’s Druk Green Power Corporation Limited to develop 5,100 MW of clean energy projects in Bhutan. Tata Power signed an MoU with the Asian Development Bank for US$4.25 bn to finance key clean energy power projects.

| Month | Tata Power Share Price Target 2026 (1st Price Target) | Tata Power Share Price Target 2026 (2nd Price Target) |

| January | ₹430.06 | ₹436.82 |

| February | ₹435.29 | ₹442.03 |

| March | ₹440.37 | ₹448.62 |

| April | ₹447.50 | ₹454.26 |

| May | ₹450.23 | ₹458.67 |

| June | ₹457.56 | ₹465.44 |

| July | ₹460.83 | ₹466.38 |

| August | ₹454.02 | ₹461.22 |

| September | ₹459.11 | ₹466.60 |

| October | ₹465.91 | ₹471.06 |

| November | ₹470.68 | ₹474.23 |

| December | ₹458.18 | ₹465.49 |

Also Read – Adani Power Share Price Target

Tata Power Share Price Target 2028

Tata Power Share Price Target 2028 forecast may vary from ₹501.36 to ₹542.03.

Influencing Key Factors Of Tata Power Share Price Target 2028

- Increasing EBITDA Amount

- Tata Power Limited increased its EBITDA amount. In the financial year 2023, the company’s EBITDA was ₹10,069 Crore, which increased to ₹12,795 Crore in the year 2024.

- Delivering Growth Through Customer-Centric Solutions

- The company’s multi-fold growth of solar rooftop and group captive increases the awareness of green energy solutions. The company is expanding its RE portfolio with a focus on flexible dispatchability through complex solutions. The company is empowering RE integration by building transmission and storage portfolios. The company has multiple distribution customers incubating a new-age energy business.

- Increasing The Capacity Of Renewable Energy Generation

- Tata Power Limited has a total of 4,524 MW of renewable energy generation capacity. The conventional energy, including hydro energy generation capacity, is 10,184 MW. The company’s total operational transmission capacity is 4,627 Ckm, and its distribution capacity is 12.6 million. The company’s EV charging infrastructure has 6300 (bus charging points energised across 530 cities and towns).

| Month | Tata Power Share Price Target 2028 (1st Price Target) | Tata Power Share Price Target 2028 (2nd Price Target) |

| January | ₹501.36 | ₹508.64 |

| February | ₹506.11 | ₹513.25 |

| March | ₹511.92 | ₹519.60 |

| April | ₹518.66 | ₹526.93 |

| May | ₹525.40 | ₹532.29 |

| June | ₹531.03 | ₹537.15 |

| July | ₹535.20 | ₹541.29 |

| August | ₹538.60 | ₹545.55 |

| September | ₹530.46 | ₹538.23 |

| October | ₹517.30 | ₹522.76 |

| November | ₹524.69 | ₹534.92 |

| December | ₹536.26 | ₹542.03 |

Tata Power Share Price Target 2030

Tata Power Share Price Target 2030 forecast may vary from ₹586.92 to ₹631.10.

Influencing Key Factors Of Tata Power Share Price Target 2030

- Global Presence

- Tata Power Limited has a notable international footprint in Central and South Asia, Africa, Singapore, and Indonesia, with assets across generation, coal mining, coal logistics, and representative offices. In Punjab, the company has a power generation capacity of 36 MW, in Tamil Nadu, the company has a power generation capacity of 380 MW, and in Andhra Pradesh, the company has a power generation capacity of 322 MW.

- Projects For The Year 2023

- In the year 2023, Tata Power Limited surpassed ₹1 trillion in Market capitalization. TPREL won the 1.3 GW FDRE project from SJVN Limited. The company won bids for the Bikaner-Neemrana and Jalpura-Khurja transmission projects worth ₹2,300 Crore. In the year 2023, TPREL received a 966 MW hybrid RE Project Letter of Approval for Tata Steel.

- Increasing PAT Amount

- The company’s PAT amount was ₹3,810 Crore in the year 2023, which increased to ₹4,285 Crore in the year 2024.

| Year | Tata Power Share Price Target 2030 |

| 1st Price Target | ₹586.92 |

| 2nd Price Target | ₹631.10 |

Tata Power Share Price Target 2035

Tata Power Share Price Target 2035 forecast may vary from ₹865.09 to ₹901.32.

Influencing Key Factors Of Tata Power Share Price Target 2035

- Aims For More Growth Avenue In The Future

- Tata Power’s 4.3GW solar cell and module manufacturing capacity, once ramped up, will help further aid profitability and growth, given synergies with its solar EPC, rooftop, and generation business. It is targeting to add 2.5-2.7 GW RE capacity in the financial year 2026. The solar manufacturing capacity, once ramped up to full capacity, is likely to aid Tata Power in securing suppliers for its EPC.

- Conventional Energy

- It is a sustainable innovation by Tata Power that converts industrial ash into tetrapods, creating environmental and economic wins. By converting heat into electricity and dreams into reality, the company’s supercritical technology is showing high efficiency, reducing the carbon footprint, and fueling India’s growth history.

| Year | Tata Power Share Price Target 2035 |

| 1st Price Target | ₹865.09 |

| 2nd Price Target | ₹901.32 |

Peer Company Of Tata Power Limited

| Company Name | Market Cap (Crore) |

| NTPC Limited | ₹3,27,875.39 |

| Adani Green Energy Limited | ₹1,64,797.82 |

| Power Grid Corporation Of India Limited | ₹2,80,578.28 |

| Inox Wind Energy | ₹13,520.68 |

| Indian Renewable | ₹49,455.39 |

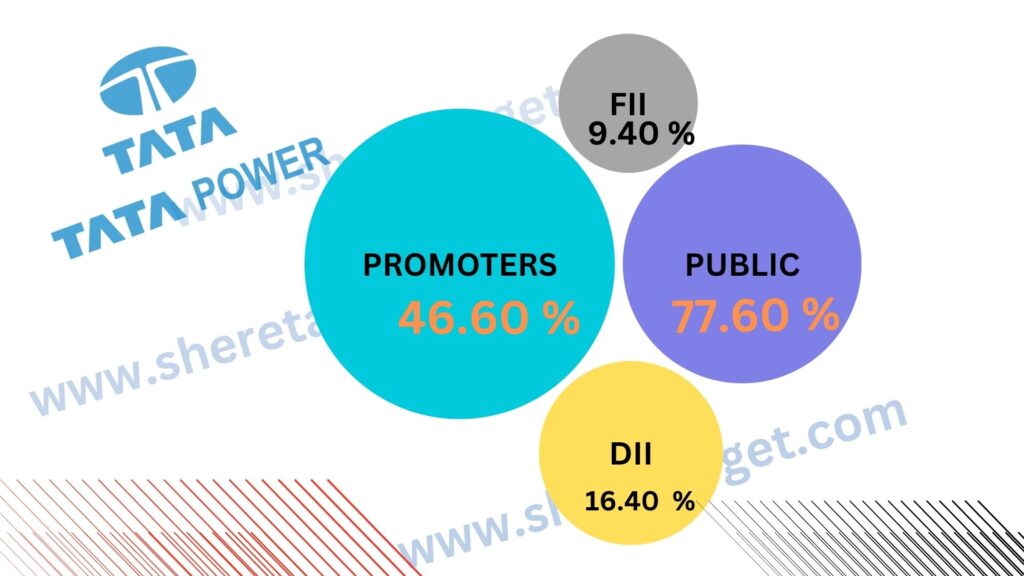

Discussion About Shareholding Pattern Of Tata Power Limited

Tata Power Limited mainly has four types of shareholding patterns, such as promoter holding, public holding, DII, and FII. Depending on the shareholding pattern, we can majorly influence the company’s growth.

| Investor Type | Percentage |

| Promoter Holding (Owned by the company’s promoter) | 46.60% |

| Public Holding (Held by the public) | 27.60% |

| FII (Invest by Foreign Institutional Investor) | 9.40% |

| DII (Invest money by Domestic Institutional Investor) | 16.40% |

What Is The Expert Advice About The Investment In Tata Power Share

Positive Sides

- The company has shown a good profit growth in the last 3 year’s which was 97.52%.

- In the last 3 years, the company’s revenue growth was good, which was 15.96%.

- In the last 3 year’s the company’s ROE ratio was good, which was 25.69%.

- The company has an efficient cash conversion cycle of 73.62 days.

- The company has an efficient cash flow managment, PAT stands at 1.43.

- The company has been maintaning effective average operating margins of 20.36% in the last 3 years.

Negative Sides

- The company’s tax rate is low at 11.62.

- The company is trading at a high PE ratio of 41.59.

The Last Few Years’ Share Price Updation Of Tata Power Share

Tata Power Share always gives good returns to investors, which is described in the portion below.

- The last 1 month’s share growth was +16.85 (4.31%).

- The last 6 months’ share growth was -27.10 (-6.19%).

- The last 1 year’s share growth was -40.10 (-8.95%).

- The last 5 years’ share growth was +366.10 (877.94%).

- The maximum share growth was +397.55 (3,897.55%).

- Tata Power’s share price return percentage was 9.91% in the last 1 month.

- The last 3 months’ share price return percentage was 15.69%.

- The last 1 year’s share price return percentage was -8.98%.

- The last 3 years’ share price return percentage was 77.09%.

- The last 5 years’ share price return percentage was 852.70%.

Risk Factors Of Tata Power Limited

- The company is dependent on external sources for coal.

- The entry of new players like Reliance into the power industry may be harmful to Tata Power Limited.

- Pricing wars between Reliance and Tata regarding power tariffs in Mumbai.

- Revenue loss due to migration of high-end consumers on account of higher tariffs.

- Natural disasters like cyclones, floods, and storms may affect the company’s power generation process.

Also Read – JSW Energy Share Price Target

FAQ

What is the Tata Power Share Price Target for 2025?

Tata Power Share Price Target for 2025 is ₹403.29 to ₹431.68.

What is the Tata Power Share Price Target for 2026?

Tata Power Share Price Target for 2026 is ₹430.06 to ₹465.49.

What is the Tata Power Share Price Target for 2028?

Tata Power Share Price Target for 2028 is ₹501.36 to ₹542.03.

What is the Tata Power Share Price Target for 2030?

Tata Power Share Price Target for 2030 is ₹586.92 to ₹631.10.

What is the Tata Power Share Price Target for 2035?

Tata Power Share Price Target for 2035 is ₹865.09 to ₹901.32.

Conclusion

This website is written to help the investor gain some basic knowledge about the market strategy of Tata Power Share. For making this blog, we take consultation from experts and research the company. It is expected that the Tata Power Share Price Target will be a good choice to invest in on a long-term basis. The demand for the power generation sector in India and outside of the country always increases, as a result of which the company and its share may increase rapidly.

We try to give an in-depth idea about the share. If you think it is helpful to you, you can share it. If you have any questions, please let us know through the comment box. We will try to reply to your questions and solve your problem. Thanks for visiting this website and thanks for being with us.

Disclaimer – We are not SEBI-registered advisors. A financial market is always risky to anyone. This website is only for training and educational purposes. So, before investing, we are requested to discuss certified expertise. We will not be responsible for anyone’s profit or loss.