Stock market information for Service Corp. International (SCI)

- Service Corp. International is a equity in the USA market.

- The price is 80.83 USD currently with a change of 0.22 USD (0.00%) from the previous close.

- The latest open price was 80.62 USD and the intraday volume is 928461.

- The intraday high is 81.06 USD and the intraday low is 79.92 USD.

- The latest trade time is Saturday, October 11, 04:45:00 +0530.

What We Know Today: Baseline

Let me first set the baseline from available analyst opinions and models, then we’ll layer in possible scenarios.

- Analysts covering SCI tend to give 12-month targets around $88 to $98, with many clustering near $90–$92.

- For example, MarketBeat has a consensus target of $90.25 over the next year.

- Some model-driven forecasts (e.g. CoinCodex) suggest SCI might reach $96.44 in 2025 and $101 to $132 by 2030.

- Earnings forecasts: for 2025 and 2026, EPS is expected to grow (e.g. WallStreetZen projects earnings rising toward ~$4-5 per share).

- Valuation multiples matter a lot. If SCI trades at, say, 18×–22× earnings in the future, that becomes a key lever for where the share price could land.

With those in hand, let’s build a forward-looking path.

Forward Glimpse: 2025 to 2030

Below is a scenario-based forecast. The further out you go, the more room for variance.

| Year | Estimated Target | Key Drivers / Caveats |

|---|---|---|

| 2025 | $85 – $100 | If earnings continue modest growth, and multiple stays in the 18–20× zone, SCI could reach this range. Some model-fueled forecasts already point toward ~$96.44. |

| 2026 | $90 – $110 | As earnings compound, your base could push toward the low to mid triple digits, unless the sector faces headwinds. |

| 2027 | $95 – $120 | If revenue growth and margin expansion happen, and if valuation multiples remain stable or expand slightly, the mid-$100s become feasible. |

| 2028 | $100 – $130 | By now, the assumptions rely heavily on execution. If the business continues to generate free cash flow, this becomes a plausible band. |

| 2029 | $105 – $140 | Scaling risk, competitive pressures, interest rates, and macro shocks will start to play larger roles. |

| 2030 | $110 – $150 | In a favorable scenario — stable growth, moderate inflation, strong earnings — this target zone is plausible. The upper end requires everything going well. |

What Could Push It Up — and What Could Pull It Down

To make sense of that table, let’s talk about what might shift the outcome.

Upside Catalysts

- Consistent Earnings Growth

If SCI manages 5–7% annual growth in EPS (or better) over these years, that builds a solid foundation. - Multiple Expansion

If the market becomes more favorable to its sector and gives SCI a higher earnings multiple (say moving from 18× toward 22× or 24×), that boosts price potential. - Cost Control & Operational Efficiency

Margin expansion can turn modest revenue growth into stronger bottom-line gains. - Acquisitions / Strategic Moves

Smart M&A that adds revenue streams or synergies could help surpass organic growth. - Favorable Interest Rates / Macros

A stable or declining interest rate environment helps discount rates, improving valuations for growth stocks.

Risks & Headwinds

- Weak Top-line Growth

If revenue growth slows or demand wanes, that pressures margins and investor confidence. - Rising Costs / Inflation

If input, labor, or regulatory costs grow faster than pricing power, margins could be squeezed. - Multiple Compression

If the market rotates away from double-digit multiples, even good earnings may not translate into stock gains. - Macro Shocks

Recessions, interest rate shocks, regulation changes — any of these could pull prices down sharply. - Execution Risk

Meeting the internal KPIs year after year is no small feat. A few missteps can erode confidence.

Confidence Zones & What I’d Personally Watch

Putting on a skeptic’s hat, I’d say the lower ends of the bands are more realistic than the extreme upper ends. So:

- By 2025, I’d lean toward $90–$95 as a “most-likely” range (barring surprises).

- By 2030, $120–$140 seems reasonable under a reasonably successful execution path.

- Anything beyond $150 would require strong tailwinds (multiple expansion + fast earnings growth + positive macro backdrop).

Key indicators I’ll personally be watching:

- Annual EPS growth rates — if SCI consistently delivers 5% or more, that’s a green flag.

- Valuation multiples — is the stock trading at 16×, 20×, 24×? Trends here matter.

- Margin trends — expanding margins would help decouple performance from pure revenue growth.

- Sector sentiment / interest rate trends — these can swing multiples independent of fundamentals.

Current Market Position

As of October 13, 2025, SCI is trading at ₹231.45, showing a 4.20% gain in the most recent trading session. The stock has demonstrated resilience with a year-to-date return of 9.43% and has recovered from its 52-week low of ₹138.26 to approach its 52-week high of ₹249.95.

Key current metrics include:

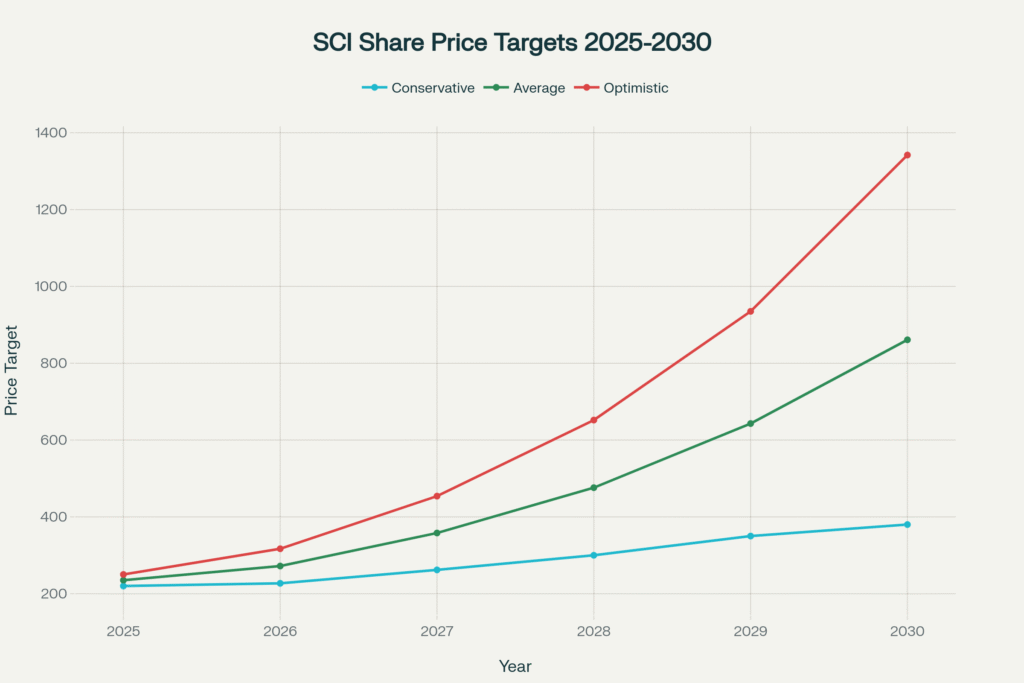

Annual Price Targets Overview

SCI Share Price Targets 2025-2030: Analyst Projections Range

2025 Price Targets

Target Range: ₹220-250

Multiple analysts project SCI to trade within ₹230-250 by end of 2025. The technical analysis suggests:

- Conservative estimate: ₹220.68 by December 2025

- Mid-range projection: ₹230-240

- Optimistic scenario: ₹250

The current trading price of ₹231.45 already aligns with the conservative 2025 targets, indicating potential for further upside.

2026 Price Targets

Target Range: ₹227-317

For 2026, analyst projections show significant variation:

- Conservative forecast: ₹227.13 (January) to ₹265.21 (December)

- Technical analysis range: ₹260-280

- Optimistic projection: Up to ₹316.61 by year-end

The wide range reflects different methodologies and market assumptions among analysts.

2027 Price Targets

Target Range: ₹262-454

2027 projections become more divergent:

- Conservative estimate: ₹262.52 to ₹297.55

- Mid-range forecast: ₹290-310

- Optimistic scenario: ₹454.25 based on machine learning models

2028 Price Targets

Target Range: ₹300-652

Long-term projections for 2028 show substantial growth potential:

2029 Price Targets

Target Range: ₹350-935

2029 forecasts reflect increased uncertainty with wider ranges:

- Conservative estimate: ₹350-370

- Technical analysis: Varies significantly between ₹91.05 to ₹935.05

- Average projection: Around ₹640-650

2030 Price Targets

Target Range: ₹380-1,342

The longest-term projections show the greatest variation:

- Conservative forecast: ₹380-400

- Mid-range estimate: ₹962.39 to ₹1,122.14

- Optimistic scenario: Up to ₹1,341.54

Key Growth Drivers

Several factors support the bullish long-term outlook for SCI:

Business Fundamentals:

- Leading position in India’s shipping industry

- Diversified fleet including tankers, bulk carriers, and offshore vessels

- Strong government backing with 63.75% promoter holding

Market Opportunities:

- India’s growing trade volumes and infrastructure development

- Sagarmala Project enhancing port connectivity

- Potential privatization benefits

- Global shipping industry recovery trends

Financial Health:

- Moderate P/E ratio of 12.27 suggesting reasonable valuation

- Improved dividend yield of 2.97%

- Strong cash flows from operations

Risk Factors

Several challenges could impact these projections:

- Cyclical nature of the shipping industry

- Fluctuating freight rates and fuel costs

- Global economic uncertainties affecting trade volumes

- Competition from private shipping companies

- Environmental regulations requiring fleet modernization

Investment Outlook

The consensus among analysts suggests moderate to strong growth potential for SCI over the 2025-2030 period. However, investors should note the significant variation in long-term projections, reflecting the inherent uncertainty in forecasting shipping industry performance over extended periods.

The wide range of price targets from conservative estimates around ₹380-400 to optimistic projections exceeding ₹1,300 by 2030 indicates that actual performance will likely depend on successful execution of business strategies, favorable market conditions, and broader economic growth in India’s trade sector.

Current Trading Recommendation: With SCI trading at ₹231.45, the stock appears positioned within the lower end of most 2025 target ranges, potentially offering upside opportunity for investors with a medium to long-term investment horizon.

Final Thoughts

Forecasting that far ahead is always a mix of art and calculation. The near-term (2025–2026) range is anchored by analyst expectations and more grounded metrics. The medium term (2027–2029) adds more assumptions. The out years (2030) are speculative, but with a disciplined approach, you can anchor expectations within a plausible band.