The Pakistan Stock Exchange (PSX) has emerged as one of the world’s most remarkable success stories in 2024-2025, defying economic challenges and geopolitical uncertainty to deliver exceptional returns to investors. As of September 2025, PSX lists 525 companies with a total market capitalization of approximately PKR 18.276 trillion (about $64.83 billion USD), marking a significant recovery from years of underperformance. This comprehensive analysis examines the market capitalization dynamics, historical performance, key drivers, and future outlook of Pakistan’s premier stock exchange.

Current Market Capitalization: The Numbers That Matter

Overall Market Cap Statistics

Pakistan Market Cap: PSX: All Shares data was reported at 13,520,596.056 PKR million in April 2025. This records a decrease from the previous number of 14,374,200.085 PKR million for March 2025. The data shows monthly fluctuations typical of emerging markets navigating economic and political transitions.

The data reached an all-time high of 14,495,888.757 PKR million in December 2024 and a record low of 285,126.330 PKR million in September 2001, highlighting the extraordinary journey of Pakistan’s capital markets over two decades.

Key Market Cap Metrics (2025):

- Total Market Capitalization: PKR 18.28 trillion (~$64.8 billion USD) as of September 2025

- Listed Companies: 525 firms across diverse sectors

- Market Depth: 11 billion-dollar companies (up from 6 in December 2023)

- Foreign Institutional Investors: 1,886 registered FIIs actively trading

- Average Daily Trading Volume: 1.1-1.5 billion shares

PSX as a Corporate Entity

Pakistan Stock Exchange has a market cap or net worth of 30.76 billion as of October 13, 2025. Its market cap has increased by 177.31% in one year. This refers to PSX Limited itself as a listed company trading under the symbol “PAKS.”

The Pakistan Stock Exchange stock price today is 36.90. The Pakistan Stock Exchange dividend yield is 4.61%, making the exchange itself an attractive investment proposition for those seeking exposure to Pakistan’s financial infrastructure.

Historical Performance: From Crisis to Triumph

The Dramatic Recovery (2023-2025)

PSX has experienced a remarkable comeback in the year 2024, following years of lacklustre performance. Stocks surged by 84.34%, making it the second-best-performing market globally. This exceptional performance stands in stark contrast to the challenges Pakistan faced just two years earlier.

Over the last 18 months, the PSX has been the top-performing market in the world with a 178% gain. This represents the strongest performance in Pakistan’s 77-year history over such a short period.

KSE-100 Index Milestones

The benchmark KSE-100 Index has shattered record after record throughout 2024-2025:

- December 2024: The Pakistan Stock Market (PSX) achieved a remarkable milestone as the benchmark KSE-100 Index soared to a peak of 115,000 points

- January 2025: The PSX’s benchmark KSE-100 Index closed the last trading day of 2024 nearly flat, settling at 115,126.90

- June 2025: The KSE-100 Index closed at a new record high on Monday, the last day of the fiscal year 2024-25… the benchmark index settled at 125,627.31 level, an increase of 1,248.25 points or 1%

- July 2025: The Pakistan Stock Exchange (PSX) started fiscal year 2025-26 with a strong performance, as the benchmark KSE-100 Index reached an all-time high… closing at 128,199.42 points, up by 2,572.11 points or 2.05%

- September 2025: The benchmark KSE 100 Index reached 156,181 Points, reflecting a 51.7% increase from the previous year

- October 2025: The benchmark KSE-100 Index settled at an all-time high of 162,257.00 points, up 2,976.91 points, or 1.87%, from the previous close of 159,280.09

Long-Term Growth Trajectory

On year-on-year (YoY) basis, the KSE-100 was up 60% in PKR terms and 57% in USD terms in FY25. Over the past two years (FY24 and FY25), the PSX has recorded a total gain of 203% in PKR terms and 206% in USD terms, representing one of the most spectacular bull markets in emerging market history.

Key Drivers of Market Cap Growth

1. Macroeconomic Stabilization

The macroeconomic stability country has achieved with the support of the IMF programme has been foundational to market confidence restoration.

IMF Program Impact:

- Completion of the first IMF review of March 2025 provided crucial validation

- $7 billion Extended Fund Facility approved in September 2024

- Additional $1.3 billion Resilience and Sustainability Facility expected

- Foreign exchange reserves rebuilt to ~$14 billion (from $3 billion crisis levels)

GDP Growth Recovery: According to the IMF, Pakistan’s GDP growth is projected at 3.5% in 2025 and 4.3% in 2026, though more recent revisions show fluctuation. The IMF has lowered Pakistan’s GDP growth forecast for the fiscal year 2024-25 to 2.6%, down from the earlier projection of 3.2%, reflecting weaker first-half performance but maintaining medium-term optimism.

2. Monetary Policy Easing

Aggressive monetary easing from 20.5% to 11% has been a game-changer for equity markets. Lower interest rates make stocks relatively more attractive compared to fixed-income instruments, driving capital rotation from bonds to equities.

Inflation Trajectory: Inflation is expected to remain high at 23.6% in 2025, easing to 14.3% in 2026, showing gradual normalization from the crisis peak of 29% in 2023.

3. Credit Rating Improvements

Improvement in country’s credit rating by Fitch from CCC+ to B- marked a crucial turning point, signaling to international investors that Pakistan’s default risk has materially declined.

Bloomberg reporting that Pakistan led global emerging markets (EMs) in default risk reduction, with probability falling from 59% to 47%—the sharpest drop worldwide.

4. Foreign Investment Inflows

Strong liquidity inflows, backed by improved geopolitical outlook and signs of domestic macroeconomic stability have powered the rally. The exchange’s 1,886 registered foreign institutional investors provide depth and international credibility.

5. Corporate Earnings Growth

Billion-dollar listed firms in Pakistan rose to 11 from 6 since Dec 2023 to date, demonstrating strong corporate profit growth amid economic recovery.

6. Attractive Valuations

Despite this record-breaking rally, Pakistan stocks are still trading at an average forward P/E ratio of 6.3x, signalling the significant potential for further growth. This valuation compares extremely favorably to regional peers:

- India: P/E of 20-22x

- Bangladesh: P/E of 12-14x

- Sri Lanka: P/E of 8-10x

- Global EM average: P/E of 12-15x

Market Structure and Operations

Institutional Framework

The Pakistan Stock Exchange operates as a demutualised entity under the Stock Exchanges (Corporatisation, Demutualisation and Integration) Act, 2012. This modernization separated ownership from trading rights, improving governance and attracting strategic investors.

Strategic Partnership: In 2017, a consortium of Chinese exchanges including the Shanghai Stock Exchange, Shenzhen Stock Exchange, and the China Financial Futures Exchange acquired a 40% strategic stake in PSX, making China its single largest foreign shareholder. This partnership provided technological expertise and linked PSX with Chinese capital markets.

Trading Infrastructure

Trading is conducted electronically through the Karachi Automated Trading System (KATS), which provides nationwide connectivity. Clearing, settlement, and custodial services are provided through the Central Depository Company of Pakistan (CDC) and the National Clearing Company of Pakistan (NCCPL). Settlement typically takes place on a T+2 basis, in line with international practice.

Key Market Indices

The exchange operates several key indices, including the KSE 100 Index, KSE-30 Index, and KMI 30 Index, which are widely used benchmarks for market performance in Pakistan. The KMI 30 Index is particularly significant as a Sharia-compliant benchmark for Islamic investors.

Sectoral Composition and Market Leaders

Dominant Sectors

The PSX market capitalization is concentrated in several key sectors:

1. Banking and Financial Services (30-35% of market cap) Major players include:

- Habib Bank Limited (HBL)

- MCB Bank

- United Bank Limited (UBL)

- Meezan Bank (largest Islamic bank)

- National Bank of Pakistan (NBP)

2. Oil & Gas Exploration (20-25% of market cap) Key companies:

- Pakistan Petroleum Limited (PPL)

- Oil & Gas Development Company (OGDC)

- Mari Petroleum Company Limited (MARI)

3. Cement (8-10% of market cap) Leading firms:

- Lucky Cement

- DG Khan Cement

- Maple Leaf Cement

4. Fertilizer (6-8% of market cap)

- Fauji Fertilizer Company (FFC)

- Engro Fertilizers

5. Power Generation (5-7% of market cap)

- Hub Power Company (HUBCO)

- K-Electric

6. Telecommunications (4-6% of market cap)

- Pakistan Telecommunication Company Limited (PTCL)

Challenges and Risk Factors

1. Political Instability

In recent years, PSX has faced significant volatility amid macroeconomic challenges such as currency depreciation, political instability, and inflationary pressures. Pakistan’s political landscape remains contentious, with frequent changes in government affecting policy continuity.

2. Geopolitical Tensions

In May 2025, the KSE-100 index dropped over 5.5% following cross-border tensions and military escalations, but subsequently rebounded due to positive investor sentiment from the release of an IMF tranche. Regional tensions, particularly with India, create periodic volatility.

3. Currency Depreciation Risk

The Pakistani Rupee has depreciated significantly over the past decade, from ~PKR 100/USD in 2013 to ~PKR 280-285/USD in 2025. This creates:

- Import inflation pressures

- External debt servicing challenges

- Reduced USD-denominated returns for foreign investors

4. External Account Vulnerabilities

The current account deficit is forecast to decline from 1.8% of GDP in 2025 to 1.3% in 2026, showing improvement but remaining a constraint. Pakistan’s narrow export base and high import dependence create recurring balance of payments pressures.

5. Energy Sector Circular Debt

Pakistan’s chronic energy sector circular debt (~PKR 2.5-3 trillion) affects power generation companies’ cash flows and profitability, creating systemic risk for a significant portion of market capitalization.

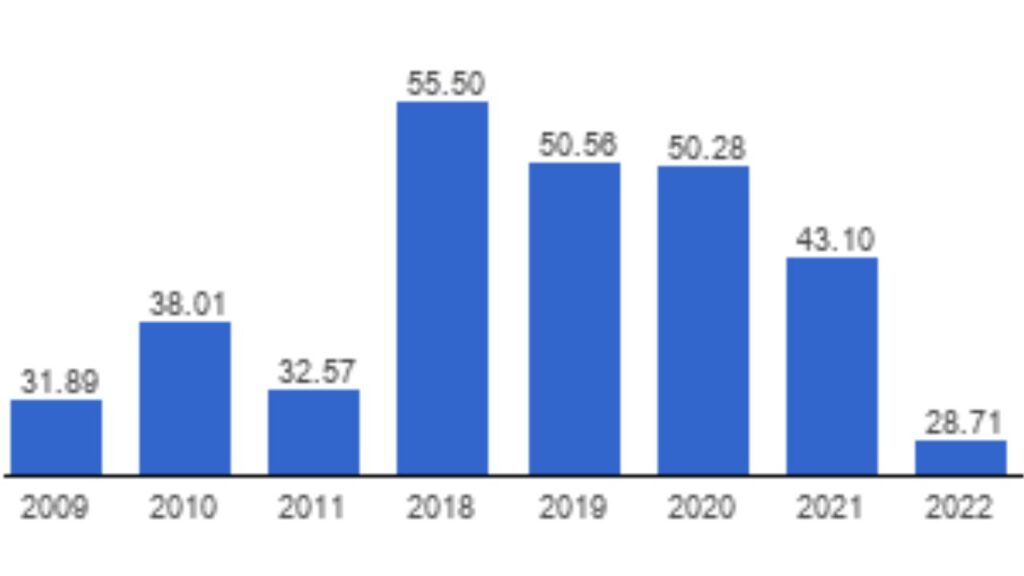

6. Limited Foreign Participation

Despite improvements, foreign investor participation remains modest compared to peak levels in the mid-2000s. Capital controls, repatriation concerns, and country risk perceptions limit international portfolio flows.

Future Outlook: Growth Projections and Catalysts

Short-Term Outlook (2025-2026)

Bullish Case: If macroeconomic stability continues and IMF program remains on track:

- Market Cap Target: PKR 20-22 trillion by end-2026 (15-25% growth)

- KSE-100 Target: 175,000-185,000 points

- Key Catalysts:

- Continued monetary easing (policy rate to 9-10%)

- IMF second and third review completions

- Foreign portfolio inflows resuming ($1-2 billion)

- Corporate earnings growth of 20-25%

Base Case: Moderate progress with some volatility:

- Market Cap Target: PKR 18-20 trillion by end-2026 (5-15% growth)

- KSE-100 Target: 165,000-175,000 points

- Assumptions:

- GDP growth of 3-3.5%

- Inflation declining to 12-15%

- Stable political environment

- IMF program maintained with minor delays

Bearish Case: Policy slippage or external shocks:

- Market Cap: PKR 15-17 trillion (15-20% decline)

- KSE-100: 130,000-145,000 points

- Risk Triggers:

- IMF program derailment

- Political crisis or early elections

- External shock (oil price spike, regional conflict)

- Currency crisis 2.0

Medium-Term Outlook (2026-2030)

Structural Growth Drivers:

1. Demographic Dividend: Pakistan’s population of 255 million (median age 23) provides a massive consumption base and labor force. As incomes rise, domestic consumption will drive corporate profitability.

2. Digital Economy Transformation: Fintech, e-commerce, and digital services sectors are nascent but growing rapidly. New-age company listings (like Airlift, Bykea, Foodpanda entities) could add ₹500-1,000 billion to market cap.

3. CPEC Phase-II: China-Pakistan Economic Corridor’s second phase focusing on industrialization and agriculture could generate ₹2-3 trillion in new industrial capacity, creating listing opportunities.

4. Privatization Pipeline: Government plans to privatize Pakistan International Airlines, Roosevelt Hotel, Pakistan Steel Mills, and stakes in banks could add ₹300-500 billion to market cap.

5. MSCI Emerging Market Status: The PSX was granted affiliate status by the World Federation of Exchanges (WFE) in March 2023. Elevation to MSCI Emerging Markets status (from Frontier Markets) could trigger $3-5 billion passive inflows.

Medium-Term Target (2030):

- Market Cap: PKR 35-45 trillion ($110-140 billion at stable PKR 300-320/USD)

- KSE-100: 250,000-300,000 points

- Listed Companies: 600-650 firms

- Implied CAGR: 14-16% in PKR terms, 10-12% in USD terms

Long-Term Vision (Beyond 2030)

By 2035, if Pakistan achieves its “Vision 2035” development goals:

- GDP: $1 trillion economy (from current $340 billion)

- Market Cap: PKR 80-100 trillion ($200-250 billion)

- Market Cap-to-GDP Ratio: Improving from current 25% to 35-40%

- Regional Positioning: Among top 3 South Asian markets by size

Transformation Requirements:

- Political stability and policy continuity (15+ years)

- Average GDP growth of 6-7% annually

- Fiscal consolidation (debt-to-GDP below 60%)

- Energy sector reforms resolving circular debt

- Export competitiveness (doubling exports to $60-70 billion)

- Financial sector deepening (credit-to-GDP from 15% to 40%)

Investment Strategies for Different Investor Profiles

For International Investors

Opportunities:

- Extremely attractive valuations (6.3x P/E vs. EM average 12-15x)

- High dividend yields (many stocks yielding 7-12%)

- Positive reform momentum and IMF backing

- Undervalued relative to regional peers

Risks:

- Currency depreciation eroding USD returns

- Repatriation challenges during crisis periods

- Political and geopolitical volatility

- Limited liquidity for large positions

Recommendation: ALLOCATE 0.5-1.5% of emerging market portfolio to PSX via:

- KSE-100 Index ETFs or mutual funds

- Blue-chip stocks (HBL, MCB, OGDC, PPL, Lucky Cement)

- Sector-specific exposure (banks, oil & gas)

For Pakistani Domestic Investors

Asset Allocation Guidance:

- Conservative Investors (65+ years): 15-20% equity allocation, focus on dividend stocks

- Moderate Investors (40-65 years): 30-40% equity allocation, balanced portfolio

- Aggressive Investors (<40 years): 50-70% equity allocation, growth-oriented

Stock Selection Strategy:

- Core Holdings (60-70%): Blue chips with stable dividends (banks, oil & gas majors)

- Growth Allocation (20-30%): Mid-caps with high growth (consumer goods, pharma, tech)

- Tactical Opportunities (10-20%): Beaten-down sectors poised for recovery

Recommended Approach:

- Systematic Investment Plan (SIP) in equity mutual funds

- Direct stock portfolios for sophisticated investors

- Avoid leverage/margin trading given volatility

- 5-10 year minimum investment horizon

For Corporate Entities

IPO Pipeline Opportunities: Pakistan needs 100-150 new listings over next 5-10 years to deepen capital markets. Sectors ripe for listings:

- Technology and fintech startups

- Renewable energy projects

- Logistics and supply chain companies

- Healthcare and pharmaceuticals

- Agri-business and food processing

Listing Benefits:

- Access to growth capital without diluting to private equity

- Brand visibility and credibility enhancement

- Employee stock option plans for talent retention

- Currency for M&A transactions

- Liquidity for existing shareholders

Conclusion: A Market Reborn

The Pakistan Stock Exchange has undergone a remarkable transformation in 2024-2025, evolving from a crisis-ridden, underperforming market to one of the world’s best-performing bourses. The total market capitalization of approximately PKR 18.276 trillion (about $64.83 billion USD) as of September 2025 represents not just numerical growth but a fundamental shift in investor confidence and economic trajectory.

Over the last 18 months, the PSX has been the top-performing market in the world with a 178% gain, representing the strongest performance in Pakistan’s 77-year history—a testament to the power of macroeconomic stabilization, policy reform, and market-friendly measures.

Yet significant challenges remain. Political instability, external vulnerabilities, structural fiscal deficits, and geopolitical tensions create ongoing risks that could derail the recovery. The sustainability of this bull market depends critically on continued IMF program compliance, political stability, and structural reform implementation.

For investors, PSX offers a compelling risk-reward proposition: Pakistan stocks are still trading at an average forward P/E ratio of 6.3x, signalling the significant potential for further growth, even after the extraordinary 2024-2025 rally. This valuation discount reflects real risks, but also genuine opportunity for those with conviction and patience.

Final Investment Rating: CAUTIOUSLY OPTIMISTIC

Target Allocation:

- International Investors: 0.5-1.5% of EM portfolio (opportunistic allocation)

- Pakistani Domestic Investors: 30-50% of investment portfolio (core strategic allocation)

- Risk-Averse Investors: 15-25% allocation in blue-chip dividend stocks

- Growth Investors: 50-70% allocation with mid-cap exposure

Key Monitoring Parameters:

- IMF program compliance and review completions

- Foreign exchange reserve levels (maintain above $12 billion)

- Political stability and policy continuity

- Inflation trajectory and monetary policy stance

- KSE-100 technical levels: Support at 140,000-145,000; Resistance at 170,000-175,000

The Pakistan Stock Exchange’s journey from crisis to triumph offers valuable lessons about emerging market resilience, the power of policy reform, and the importance of valuation discipline. While the road ahead remains uncertain, the foundation for sustained growth has been established. For investors willing to navigate volatility and political risk, PSX may well be South Asia’s next great investment frontier.

Disclaimer: This analysis is for informational purposes only and should not be construed as investment advice. Investing in emerging markets like Pakistan carries significant risks including political instability, currency depreciation, liquidity constraints, and capital controls. Past performance does not guarantee future results. International investors should carefully assess country risk, currency exposure, and repatriation policies before investing. Consult qualified financial advisors familiar with Pakistani capital markets before making investment decisions.