JSW Energy Share is a bullish trend in the share market. During share ups and downs, you should know all about share details before investing. In this blog, we are going to discuss JSW Energy Share Price Target 2025, 2027, 2028, 2030, 2040. We will try to analyze the share base in the company’s overall performance.

We also look after the company’s profit growth in the last 5 years, the last 5 years’ sales growth, and the last 5 years’ ROE percentage similarly we also compare the Share growth, the share price return amount of the share increasing or decreased through the last 5 years. We also take advice from experts about which time we should invest in the share it may be helpful for you also. Let’s have a look at JSW Energy Share Price Target from 2025 to 2040.

Overview Of JSW Energy Limited

JSW Energy Limited is an Indian power company that is mainly engaged in power generation, transmission, hydroelectricity, mining, and manufacturing of power plant equipment. The company was established in the year 1994 under the JSW Group. The company mainly generated 6,677 MW power plants, out of which 3.158 MW is thermal power plant. The company is present across several Indian States and has stakes in natural resource companies in South Africa.

Fundamental Analysis Of JSW Energy Limited

| Company Name | JSW Energy Limited |

| Market Cap | ₹90,544.26 Crore |

| P/B | 4.25 |

| Face Value | ₹10 |

| Book Value | ₹123.01 |

| 52 Week High | ₹805.36 |

| 52 Week Low | ₹451.80 |

| P/E | 79.95 |

| ROE | 6.65% |

| ROA | 3.77% |

| DIV. YIELD | 0.40% |

The Last Few Year’s Performance Of JSW Energy Limited

Profit Growth

The company’s last 5 year’s profit growth percentage is described in the below portion.

- In the last 5 years 30.52%

- In the last 3 years 72.53%

- In the last 1 year 34.01%

The company’s Net Profit was ₹712.63 Crore in March 2023, increasing to ₹951.87 in March 2024. The Operating Profit was ₹394.55 Crore in September 2023, decreasing to ₹250.49 Crore in September 2024.

Sales Growth

The last 5 year’s Sales growth percentage of the company is described in the below portion.

- In the last 5 years 0.05%

- In the last 3 years 21.36%

- In the last 1 year -10.65%

The company’s Net Sales were ₹1,133.15 Crore in September 2023, decreasing to ₹968.26 Crore in September 2024.

ROE Percentage

The company’s last 5 year’s ROE percentage is described below.

- In the last 5 years 4.67%

- In the last 3 years 5.49%

- In the last 1 year 6.65%

ROCE Percentage

The company’s last 5 year’s ROCE percentage is described below.

- In the last 5 years 6.47%

- In the last 3 years 7.38%

- In the last 1 year 7.99%

Total Expenditure Amount

The Total Expenditure amount of the company was ₹739.01 Crore in September 2023 which decreased to ₹718.53 Crore in September 2024.

Total Assets Amount

The Total Assets amount was ₹23,837.26 Crore in March 2023 which increased to ₹26,683.52 Crore in March 2024.

The Net Cash Flow Amount

The company’s Net Cash Flow was ₹86.98 Crore in March 2023, which increased to ₹533.89 Crore in March 2024.

Profit Before Tax Amount

The Profit Before Tax amount was ₹192.15 Crore in September 2023 which increased to ₹289.26 Crore in September 2024.

EBITDA Amount

The EBITDA amount of the company was ₹3,819 Crore in March 2023 which was 35% in margin. The amount also increased to 4,546 Crore in March 2024 which was 50% in margin.

JSW Energy Share Price Target 2025

JSW Energy Share Price Target for 2025 range may vary from ₹540.59 to ₹665.46.

Influencing Factors For JSW Energy Share Price Target 2025

- Increase Power Generation Capacity

- The Wind Power generation capacity was 3.6 GW in the year 2024, which increased by 37% compared to the previous year. The Hydroelectric power generation capacity was 1.6 GW in the year 2024, which increased by 17%. The Solar power generation capacity was 0.7 GW in the year 2024, which increased by 7%, and the thermal power generation capacity increased to 3.9 GW in the year 2024, which increased by 39% compared to the previous year. The company’s profit growth increased with the increasing power generation capacity.

- Increase Energy Storage Capacity

- The company’s manufacturing product’s Battery Storage Capacity increased to 1.0 GWh in the year 2024 and Hydro Pump Storage capacity increased to 2.4 GWh in the year 2024. This energy storage capacity of the products increased the product’s demand which increased the Sales Volume of the company.

- Mining Capacity

- The major portion of the company’s power projects undertaken by thermal power is coal-based generation capacity. The company also tied up with various coal supplier companies like Coal Idia Limited, Icchapur Coal Mine and many others company. The company also has long-term coal contracts with Indonesia, Mozambique, JSW Energy Natural Resources South Africa, etc which ensure the fuel capacity of the company.

| Month | JSW Energy Share Price Target 2025 (1st Price Target) | JSW Energy Share Price Target 2025 (2nd Price Target) |

| January | ₹540.56 | ₹555.15 |

| February | ₹554.28 | ₹566.10 |

| March | ₹525.48 | ₹533.91 |

| April | ₹530.69 | ₹541.75 |

| May | ₹539.44 | ₹547.17 |

| June | ₹544.01 | ₹569.79 |

| July | ₹568.77 | ₹590.69 |

| August | ₹589.50 | ₹615.76 |

| September | ₹614.14 | ₹634.80 |

| October | ₹630.45 | ₹642.00 |

| November | ₹640.12 | ₹652.31 |

| December | ₹651.48 | ₹665.46 |

Risk Factors

- As the company is dependent on imported fuel, so the high fuel cost may affect the company’s revenue growth.

- The company’s revenue may be affected by a fall in merchant power demand and rates.

Also Read – KPI Green Energy Share Price Target

JSW Energy Share Price Target 2027

JSW Energy Share Price Target for 2027 range may vary from ₹780.41 to ₹849.93.

Influencing Factors For JSW Energy Share Price Target 2027

- Equipment Manufacturing Capability

- JSW Energy Limited also joined a joint venture with JSW Steel Limited and Toshiba Corporation. For the design, engineering, manufacturing, assembly, and sale of sub-critical steam turbines, the company also set up a joint venture with Toshiba JSW Turbine and Generator Pvt Limited. The company’s generators range from 500 MW to 1000 MW. This manufacturing capacity increases the company’s net profitability.

- Increasing FII Investor In The Share

- The most important thing about this share is that the FII investor percentage of the company also increases yearly. The FII percentage was 5.6% in September 2022 which increased to 8.8% in September 2023 and 14.90% in September 2025.

- Increasing Wind Power Projects

- The company increased wind power project generation which was commissioned to 232.2 MW by the third quarter of the financial year 2024. This increasing capacity also increases the company’s net profitability.

| Month | JSW Energy Share Price Target 2027 (1st Price Target) | JSW Energy Share Price Target 2027 (2nd Price Target) |

| January | ₹780.41 | ₹795.96 |

| February | ₹794.77 | ₹802.16 |

| March | ₹735.25 | ₹746.18 |

| April | ₹744.47 | ₹757.72 |

| May | ₹756.02 | ₹769.63 |

| June | ₹768.14 | ₹780.46 |

| July | ₹779.69 | ₹789.75 |

| August | ₹785.29 | ₹798.44 |

| September | ₹797.15 | ₹812.62 |

| October | ₹813.11 | ₹827.54 |

| November | ₹825.86 | ₹838.67 |

| December | ₹837.55 | ₹849.93 |

Risk Factors

- JSW Energy Share fell after JSW Renewable failed to get CERC approval on the proposed tariff of battery energy storage systems which was 500 MW/1000 MWh projects won by the co from SECI. CERC noted that the proposed tariff is not aligned with prevailing market prices.

- Delay in any project execution may affect the company’s profit growth.

JSW Energy Share Price Target 2028

JSW Energy Share Price Target for 2028 range may vary from ₹851.45 to ₹956.20.

Influencing Factors For JSW Energy Share Price Target 2028

- Current Operational Capacity Of JSW Energy In Pan India Basis

- The company’s operational capacity is increasing all over India. In the last financial year 2024, Punjab’s solar power generation capacity was 50 MW, Himachal Pradesh’s was 1,391 MW, and Tamil Nadu’s was 637 MW. The total power generation capacity was 7,189 MW in different states.

- Tied Up Under Long-Term PPA

- The company has an 85% product portfolio tied up under a long-term PPA, which has averaged 24 years or 18 years. This long-term product portfolio will help maintain the company’s profit growth.

- Increase In Power Generation Capacity

- The company has been commissioned to increase its energy storage capacity to 40 GWh/5GW by the financial year 2030. The company’s storage-locked capacity increased to 3.4 GWH in 1 GWH of BESS and 2.4 GWH of HPSP). The company’s large resources secured 80 GWh PSP. All those increased parameters of power generation will help the company’s profit margin.

| Month | JSW Energy Share Price Target 2028 (1st Price Target) | JSW Energy Share Price Target 2028 (2nd Price Target) |

| January | ₹851.45 | ₹865.79 |

| February | ₹863.44 | ₹885.10 |

| March | ₹830.18 | ₹845.24 |

| April | ₹843.51 | ₹855.02 |

| May | ₹854.66 | ₹875.10 |

| June | ₹873.26 | ₹892.70 |

| July | ₹890.06 | ₹915.49 |

| August | ₹914.70 | ₹936.51 |

| September | ₹934.85 | ₹946.75 |

| October | ₹945.49 | ₹957.70 |

| November | ₹955.11 | ₹969.49 |

| December | ₹945.16 | ₹956.20 |

Risk Factors

- Any changes in governmental policies may affect the company’s profit growth.

- The company’s thermal power plants are dependent upon the supply of coal. Any disruption of the supply chain may affect the company’s profit growth.

JSW Energy Share Price Target 2030

JSW Energy Share Price Target for 2030 range may vary from ₹1065.16 to ₹1178.36.

Influencing Factors For JSW Energy Share Price Target 2030

- Solar Plant Availability

- The Solar Plant availability percentage was 96.78% in the financial year 2023 which increased to 99.14% in the year 2024. The increase in solar power plants also influences the power generation capacity and the net profit amount.

- Wind Machine Availability

- The company’s wind machine availability was 86% in quarter three of the financial year 2023 which increased to 98% in the three of the financial year 2024 which arises +1031 bps.

- Wind Power Generation & Solar Power Generation Capacity Compare To 2023 & 2024

- With the increase of the year, the company also increases its equipment for increases of more power generation of wind & solar power plant. The last 2 years power generation capacity is described in the below portion.

| Year | Wind Power Generation Capacity | Solar Power Generation Capacity |

| 2023 (Q3) | 10% | 18% |

| 2023 (9M) | 23% | 18% |

| 2024 (Q3) | 12% | 19% |

| 2024 (9M) | 25% | 20% |

| Month | JSW Energy Share Price Target 2030 (1st Price Target) | JSW Energy Share Price Target 2030 (2nd Price Target) |

| January | ₹1065.16 | ₹1079.40 |

| February | ₹1075.61 | ₹1089.90 |

| March | ₹1040.44 | ₹1052.60 |

| April | ₹1050.79 | ₹1065.04 |

| May | ₹1064.92 | ₹1078.40 |

| June | ₹1076.52 | ₹1090.37 |

| July | ₹1089.01 | ₹1099.63 |

| August | ₹1098.49 | ₹1120.58 |

| September | ₹1119.04 | ₹1136.21 |

| October | ₹1135.15 | ₹1158.60 |

| November | ₹1157.82 | ₹1170.28 |

| December | ₹1169.52 | ₹1178.36 |

Risk Factors

- The power generation of renewable energy sources is dependent upon climatic changes. Hydropower generation may be harmful during the drought season.

- Irregular cash flow management may affect the company’s production capability.

JSW Energy Share Price Target 2040

JSW Energy Share Price Target for 2040 range may vary from ₹2,279.26 to ₹2,389.41.

Influencing Factors For JSW Energy Share Price Target 2040

- Financial Support From Government

- As a renewable energy source, the company earns financial support from the Indian Government. The government also provides support through supportable rules and regulations to promote renewable energy sources.

- Order Received In The Year 2024

- In the year 2024, JSW Neo Energy received an order to develop a 300 MW Solar Power project in Karnataka.

- In the same year, JSW Neo Energy received an order for a 500 MW ISts-connected solar power project with 250 MW/500 MWh of energy storage.

- In the year 2024, JSW Neo Energy received a letter of intent for a 192 MW grid-connected hydride power project. After receiving all those big projects offered the company may gain more profit.

- Largest Green Hydrogen Generation Plant

- JSW Energy Limited is India’s largest commercial-scale plant for the production of green hydrogen (capacity 3,800 TPA). Signed MoU with JSW Steel for 85-90 KTPA of green hydrogen & 720 KTPA of Green Oxygen by the year 2030.

| Year | JSW Energy Share Price Target 2040 |

| 1st Price Target | ₹2,279.26 |

| 2nd Price Target | ₹2,389.41 |

Risk Factors

- With the grown-up of renewable energy, many private sectors also started up businesses with renewable energy so it is difficult to maintain the profit growth.

- As JSW Energy does business in different International countries any changes in trade policies may affect the company’s profit rate.

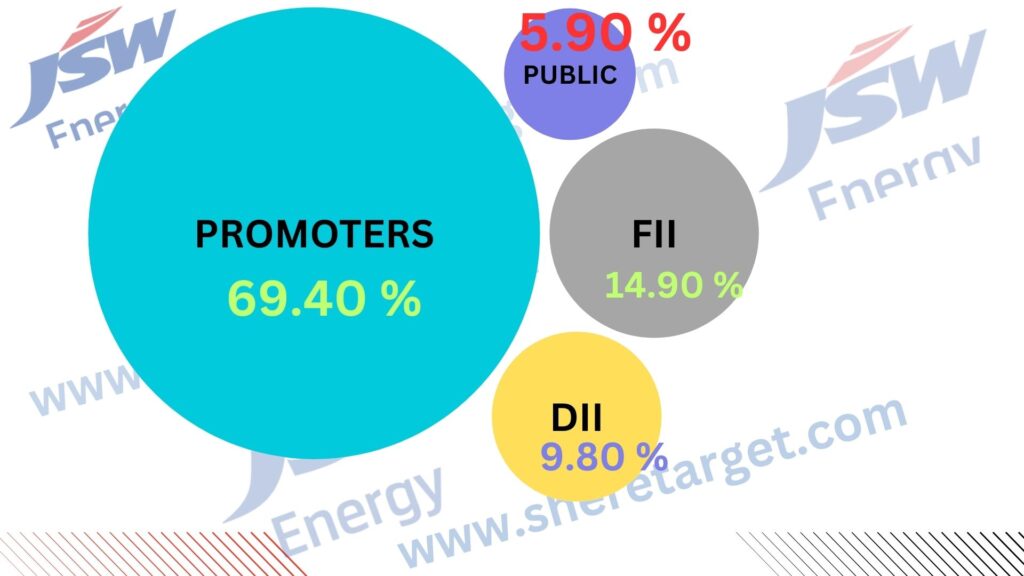

Discussion About Share Holding Pattern Of JSW Energy Limited

JSW Energy Limited mainly has four shareholding patterns: promoter holding, public holding, DII, and FII. We can majorly influence the company’s growth depending on the shareholding pattern.

| Investor Type | Percentage |

| Promoter Holding (Owned by the company’s promoter) | 69.40% |

| Public Holding (Held by the public) | 5.90% |

| FII (Invest by Foreign Institutional Investor) | 14.90% |

| DII (Invest money by Domestic Institutional Investor) | 9.80% |

Peers Company Of JSW Energy Limited

| Company Name | Market Cap (Crore) |

| NTPC Limited | ₹3,12,506.49 |

| Adani Power Limited | ₹2,12,862.69 |

| Power Grid Corporation Of India Limited | ₹2,78,763.29 |

| Adani Green Energy Limited | ₹1,64,948.37 |

| Tata Power Company Limited | ₹1,17,790.69 |

JSW Energy Share Price Target Prediction In The Last Few Years

For the last few years, JSW Energy Share increased rapidly. JSW Energy Share is under both the Indian Stock Exchange BSE (Bombay Stock Exchange) and NSE (National Stock Exchange).

- The last 6 month’s share growth was -137.60 (-19.43%).

- The last 1 month’s share growth was -118.20 (-17.16%).

- The last 1 year’s share growth was +105.15 (22.58%).

- The last 5 year’s share growth was +503.30 (746.18%).

- The maximum share growth was +457.65 (404.64%).

- JSW Energy Share Price return percentage was -17.25 % in the last 3 months.

- The last 1 year’s share price return percentage was 22.53%.

- The last 3 year’s share price return percentage was 86.29%.

- The last 5 year’s share price return percentage was 745.87%.

If anyone wants to invest in JSW Energy Share it will be profitable on a long-term basis. But before investing you may consult with expertise.

What Is The Expert Analysis To Invest In JSW Energy Share Right Now?

Positive Sides

- The last 3 year’s profit growth of the company was 72.53% which was very good.

- The last 3 year’s revenue growth of the company was 20.99% which was good for the company.

- The company has a good cash conversation cycle of 66.06 days.

- The company has good cash flow managment, PAT stands at 1.59.

- The company has been maintaining an effective average operating margin of 25.96% in the last 5 years.

- The company’s FII investor percentage increased to 14.90% which is also good.

- In the last 3 years Sales Growth of the company was 21.36% which was also very good.

Negative Sides

- The company has a high trading PE of 79.95.

- The company is trading at a high EBITDA of 52.83.

- The last 3 year’s ROE of the company is not so high which was 5.49%.

FAQ

Who is the CEO of JSW Energy Limited?

Mr. Jayant Acharya is the CEO of JSW Energy Limited.

Is JSW Energy a private or government sector?

JSW Energy Limited is a private sector.

What is the JSW Energy Share Price Target for 2025?

JSW Share Price Target for 2025 is ₹540.59 to ₹665.46.

What is the JSW Energy Share Price Target for 2027?

JSW Share Price Target for 2027 is ₹780.41 to ₹849.93.

What is the JSW Energy Share Price Target for 2028?

JSW Share Price Target for 2028 is ₹851.45 to ₹956.20.

What is the JSW Energy Share Price Target for 2030?

JSW Share Price Target for 2030 is ₹1065.16 to ₹1178.36.

What is the JSW Energy Share Price Target for 2040?

JSW Share Price Target for 2040 is ₹2279.26 to ₹2389.41.

Conclusion

This website is written to help the investor gain some basic knowledge about the market strategy of JSW Energy Share. For making this blog we take consultation from expertise and doing research about the company. It is expected that the JSW Energy Share Price Target will be a good choice to invest in on a long-term basis. The demand for renewable energy power generation sectors in India and outside of the country always increases as a result of the company and the share may increase rapidly.

We try to give an in-depth idea about the share. If you think it is helpful to you you can share it. If you have any questions please let us know through the comment box we will try to reply to your questions and solve your problem. Thanks for visiting this website and thanks for being with us.

Disclaimer – We are not SEBI-registered advisors. A financial market is always risky to anyone. This website is only for training and educational purposes. So before investing, we are requested to discuss certified expertise. We will not be responsible for anyone’s profit or loss.