If you’ve ever looked at stock charts filled with green and red candlesticks and thought, “This looks like another language,” you’re not alone. The world of stock trading can feel intimidating from the outside — full of strange acronyms, unpredictable moves, and people online bragging about their “wins.”

But here’s the truth: learning to trade the stock market isn’t about secret formulas or luck. It’s about understanding how money moves, how people behave, and how to make decisions that protect you first, profit second.

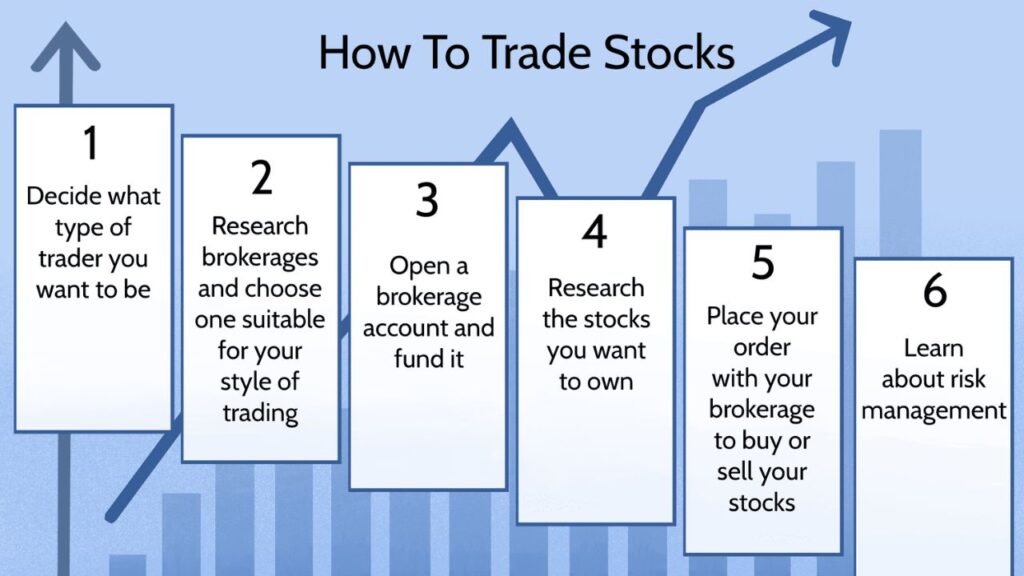

Whether you’re starting with $100 or $10,000, you can learn the principles that traders use every day — without turning it into a full-time job or a stressful obsession. Let’s walk through it, step by step.

1. Know What Trading Actually Means

Before you learn how to trade, you need to understand what trading really is.

Trading means buying and selling stocks — pieces of ownership in companies — with the goal of making a profit from price changes. Unlike long-term investing, which focuses on holding good companies for years, trading is about taking advantage of shorter-term movements.

You might hold a stock for a few hours, a few days, or a few weeks. The goal isn’t to marry the company — it’s to date the opportunity.

But here’s the key idea: trading is a game of probabilities, not guarantees. You can do everything “right” and still lose money sometimes. The goal is to manage risk so that your losses are small and your wins are larger.

2. Start With the Basics — Not the Hype

Before you think about profits, think about education. Most beginners skip this part and try to copy what someone else is doing on social media. Don’t.

Instead, focus your first few weeks on learning the basic building blocks of the market. Here are a few terms worth knowing:

- Stock: A share of ownership in a company.

- Ticker symbol: The short code used to identify a company (like AAPL for Apple).

- Brokerage account: The platform that lets you buy and sell stocks.

- Order types: “Market” means you buy/sell right now at the current price; “limit” means you set your own price.

- Liquidity: How easy it is to buy or sell a stock without affecting its price.

- Volatility: How much a stock’s price tends to move in a short time.

You don’t need to memorize a dictionary of finance terms. Just get comfortable enough that these words don’t sound foreign. Once you can read a basic stock chart and understand what you’re seeing, everything else starts making sense.

3. Choose a Good Learning Source

This is where many people get stuck — not because information is scarce, but because there’s too much of it. You can find endless YouTube videos, Reddit threads, and TikToks about trading, and most of them contradict each other.

Here’s a simple way to separate useful content from noise:

- Avoid anyone promising you’ll “get rich fast” or “never lose again.”

- Look for teachers who explain why something works, not just what to buy.

- Prioritize clear, slow instruction over flashy results.

Start with a couple of free online courses or books that focus on trading psychology, risk management, and technical analysis. You don’t need to pay for an expensive course — the good stuff is usually available for free or cheap.

Some solid beginner-friendly books:

- “How to Make Money in Stocks” by William O’Neil

- “The New Trading for a Living” by Alexander Elder

- “Technical Analysis of Financial Markets” by John Murphy (more advanced, but worth skimming later)

4. Pick the Right Broker and Tools

You can’t trade without a broker, so you’ll need to open a brokerage account. This is basically your gateway to the market — where you place trades and see your portfolio.

For beginners, look for a broker that:

- Has no account minimums

- Offers a simple, intuitive mobile or web app

- Lets you practice with a demo account (paper trading)

- Provides basic research tools and charting features

Examples include TD Ameritrade, Fidelity, E*TRADE, or platforms like TradingView for chart practice.

Paper trading (also called simulated trading) is your best friend at this stage. It lets you place pretend trades with fake money using real market data. You’ll learn how orders work, how fast prices move, and how your emotions react — without risking a dime.

Spend a few weeks here before you ever place a real trade. Think of it as flight simulation before flying the plane.

5. Learn the Language of Charts

Every trader, at some point, has to face the charts. They’re not as scary as they look. Charts are just visual stories of how people have been buying and selling.

The simplest way to start is with candlestick charts. Each “candle” shows how the price moved in a set period (like one day or one hour).

Here’s what matters:

- The body shows where the price opened and closed.

- The wicks show the highs and lows.

- Green candles mean price went up; red means it went down.

Once you’re comfortable reading these, learn about support and resistance.

- Support is a price level where buyers tend to step in.

- Resistance is a level where sellers often appear.

These levels help you understand where a stock might bounce or stall — kind of like knowing where the walls are in a room before you start moving around.

6. Understand Technical vs. Fundamental Analysis

You’ll hear traders talk about two main ways of analyzing stocks:

- Fundamental analysis looks at the company itself — revenue, profits, debt, and business model. It answers, “Is this a good company?”

- Technical analysis focuses on charts and price patterns. It answers, “Is this a good time to buy or sell?”

Even though trading leans more on technical analysis, you should still know the basics of both. A company’s financial health can influence how its stock behaves.

For example, a trader might buy a strong company (good fundamentals) when the chart shows the price breaking above a key level (technical signal). That’s where the two worlds meet.

7. Master the Art of Risk Management

If you remember one thing from this article, make it this:

Risk management is more important than finding the “perfect” trade.

Professional traders don’t focus on being right every time — they focus on staying in the game. You do that by controlling how much you lose when you’re wrong.

Here’s how to think about it:

- Never risk more than 1–2% of your total account on a single trade.

- Always set a stop-loss — a price where your position automatically closes to limit your loss.

- Use position sizing to decide how many shares to buy based on your risk.

Example: If your account has $1,000 and you’re willing to risk 2% ($20) on a trade, and your stop-loss is $2 away from your entry price, you can buy 10 shares.

That’s it. No guessing. No emotion. You’ve defined your risk before you even buy.

8. Pay Attention to Your Psychology

This is the part no one talks about enough.

Trading isn’t just a math problem — it’s a mental one. You’ll deal with fear, greed, and impatience. You’ll second-guess yourself. You’ll chase moves you should’ve left alone.

Learning to control your emotions is the hardest part of trading. Some people even say trading is 80% psychology and only 20% strategy.

To stay balanced:

- Accept that losses are part of the game.

- Don’t trade when you’re emotional or tired.

- Keep a trading journal where you record every trade, including why you took it and how you felt.

Over time, this journal becomes your best teacher. You’ll start to notice patterns in your behavior — maybe you rush into trades after a loss, or sell too early when you panic. Once you see those patterns, you can change them.

9. Start Small — Really Small

When you’re ready to trade with real money, start with the smallest amount possible.

You don’t need to go all in — the goal isn’t to make big money yet, it’s to make smart decisions under real pressure.

Even if you only trade a few shares at a time, you’ll start to feel how emotions change once real money is involved. It’s a totally different experience from paper trading.

At this stage, focus on consistency, not profits. The goal is to execute your plan exactly as you designed it — follow your rules, manage your risk, and stay calm. The profits will come naturally once the discipline is there.

10. Build a Simple Trading Plan

Every trader needs a plan — even a beginner.

A trading plan is a short document that explains exactly how you’ll trade:

- What types of stocks you’ll trade (e.g., large companies, ETFs, tech stocks)

- What setups you’ll look for (e.g., breakout above resistance, pullback to support)

- How you’ll manage risk (stop-loss, position size)

- When you’ll trade (time of day, days per week)

Think of your plan as your rulebook. You can always change it as you learn, but you should never trade without it.

If you follow your plan and lose money, that’s fine — you learned something. If you break your plan and make money, that’s actually dangerous, because it reinforces bad habits.

11. Learn from Real Traders (Not Influencers)

It helps to watch how real traders think and make decisions — but be careful who you follow.

A few good ways to learn:

- Watch live trading streams where people explain their reasoning.

- Join trading communities focused on education, not signals.

- Ask questions in forums that encourage discussion, not hype.

The best mentors aren’t the ones flashing profits — they’re the ones talking about losses, patience, and process.

12. Keep Your Expectations Grounded

This part might sting a little: most beginners don’t make money right away. That’s normal. Trading is a skill, and like any skill, it takes time.

Think of your first year as tuition — not in the sense that you’re “paying” with losses, but that you’re investing in your learning curve. The more seriously you treat that process, the faster you’ll improve.

If you stay disciplined, focus on risk control, and treat trading as a long-term skill to master (not a quick way out of your job), you’ll have a real shot at becoming consistently profitable.

13. Keep Learning, Keep Adjusting

The market changes all the time, but your ability to adapt is what keeps you in the game.

Review your trades weekly or monthly. Look for what’s working and what’s not. Study charts from the past — not just to find patterns, but to understand how traders reacted in different conditions.

The goal isn’t to predict the market — it’s to respond intelligently to whatever it’s doing.

Final Thoughts

Trading can be one of the most rewarding skills you’ll ever learn — not just for the money, but for what it teaches you about patience, discipline, and self-awareness.

You don’t have to be a math genius or have insider connections. You just need to respect the process, protect your capital, and give yourself time to learn the craft properly.

Start slow. Learn the rules. Manage your emotions.

If you can do that, you’ll already be ahead of most people who ever open a trading app.