The Indian automotive battery sector stands at a fascinating juncture, with traditional lead-acid battery manufacturers pivoting toward next-generation energy solutions. Amara Raja Energy & Mobility Limited (formerly Amara Raja Batteries), one of India’s leading battery manufacturers, finds itself at the center of this transformation. For investors seeking to understand the company’s trajectory and share price potential, the current market presents both compelling opportunities and notable challenges.

Current Market Position and Analyst Consensus

Amara Raja Batteries target price ₹1163.2, a slight upside of 18.51% compared to current price of ₹974.05. According to 15 analysts rating, the stock shows modest optimism from the analytical community. However, this consensus masks significant variation in individual projections and timeframes.

See 8 recent research reports for ARE&M, BSE:500008 Amara Raja Energy & Mobility Ltd. from 6 source(s) with an average share price target of 1321. This suggests a more bullish perspective when examining focused research coverage, indicating potential upside of approximately 35% from current levels.

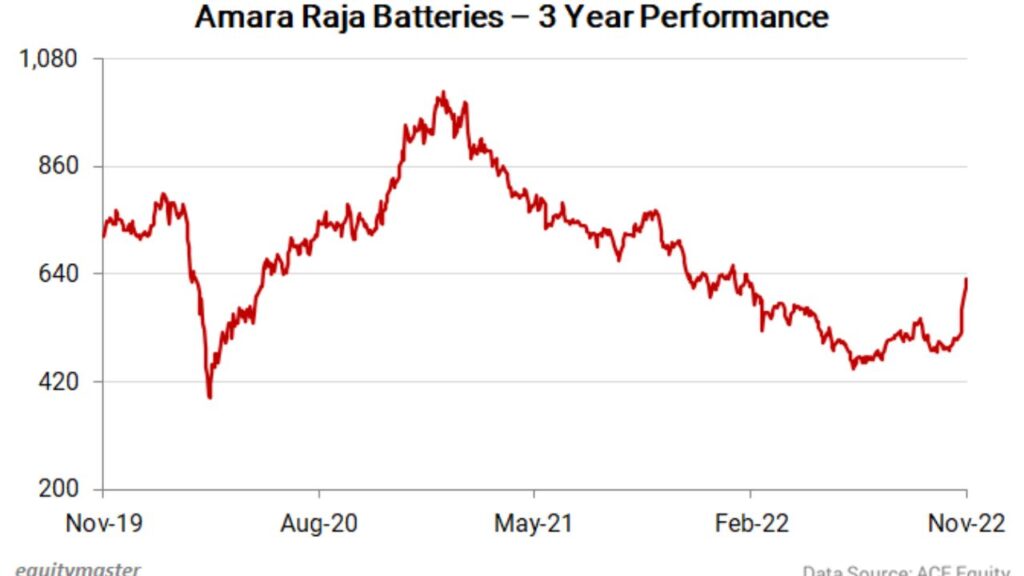

The stock has experienced considerable volatility over the past year, with Mkt Cap: 17,895 Crore (down -29.8% in 1 year). This decline reflects broader market sentiment toward traditional automotive suppliers amid concerns about electric vehicle adoption and battery technology transitions.

Financial Health and Operational Metrics

Amara Raja’s financial fundamentals present a mixed but stable picture. Revenue: 12,624 Cr · Profit: 913 Cr · Company has a low return on equity of 13.5% over last 3 years. While profitability remains solid, the return on equity suggests room for improvement in capital efficiency.

The company maintains reasonable valuation metrics compared to peers. The P/B ratio of Amara Raja Energy & Mobility Ltd is 2.32 times as on 06-Aug-2025, a 71% discount to its peers’ median range of 8.02 times. The P/E ratio of Amara Raja Energy & Mobility Ltd is 18.15 times. This valuation discount could indicate either market skepticism about future prospects or potential value opportunity for contrarian investors.

Credit quality remains robust, with CRISIL Ratings has reaffirmed its ‘CRISIL AA+/Stable/CRISIL A1+’ ratings on the bank loan facilities of Amara Raja Energy & Mobility Ltd. This high credit rating reflects the company’s financial stability and strong business fundamentals.

Short-Term and Medium-Term Price Targets

Various analysts project different trajectories depending on their assessment timeframes and methodology. For 2024-2025, most projections cluster around specific ranges:

Near-term targets (6-12 months): experts suggest buying on dips and maintaining holdings, with short-term aims at ₹1,350 and long-term targets at ₹1,600 in the following year. This represents approximately 25-40% upside potential from current levels.

Medium-term outlook (2025-2026): Amara Raja Batteries share price target 2025 can be Rs 2200 to Rs 2555. While aggressive, these projections assume successful execution of the company’s transformation strategy and favorable market conditions.

More conservative estimates suggest Amara Raja Batteries share price target 2024 Expected target could be ₹1815, which would still represent substantial gains but acknowledges potential headwinds.

Investment Thesis and Strategic Considerations

The investment case for Amara Raja hinges on several key factors that investors must carefully weigh:

Brand Strength and Market Position: The company operates established brands including Amaron and Powerzone, distributed through an extensive pan-India network. This infrastructure provides competitive moats that newer entrants find difficult to replicate quickly.

Technology Transition Opportunities: While electric vehicle adoption poses challenges to traditional battery manufacturers, it also creates opportunities in lithium-ion battery manufacturing, energy storage solutions, and charging infrastructure. Amara Raja’s technical expertise and manufacturing capabilities position it to participate in these growing segments.

Market Dynamics: The replacement battery market remains substantial and stable, providing cash flow to fund investments in new technologies. Additionally, India’s automotive sector continues growing, supporting baseline demand.

Financial Flexibility: The company’s strong credit rating and stable cash generation provide financial flexibility to invest in new technologies and capacity expansion without compromising financial stability.

Risk Factors and Potential Headwinds

Several challenges could constrain share price performance and investor returns:

Technology Disruption: The transition to electric vehicles threatens traditional lead-acid battery demand. Companies unable to successfully pivot to new battery chemistries and applications face declining relevance.

Competitive Pressures: Both domestic and international competitors are investing heavily in advanced battery technologies. Battery competition is fierce, potentially compressing margins and market share.

Capital Intensity: Transitioning to new battery technologies requires substantial capital investments in manufacturing facilities, research and development, and technology partnerships. These investments may pressure near-term profitability.

Regulatory and Policy Uncertainty: Government policies regarding electric vehicle adoption, battery manufacturing incentives, and environmental regulations could significantly influence industry dynamics and company performance.

Long-Term Outlook and Strategic Positioning

Looking beyond immediate price targets, Amara Raja’s long-term prospects depend largely on successful execution of its transformation strategy. The company must balance maintaining its traditional business while investing in future technologies.

The Indian energy storage market presents substantial opportunities as renewable energy adoption accelerates and grid stability becomes increasingly important. Companies positioning themselves in this space could benefit from multi-decade growth trends.

However, investors should recognize that this transformation involves significant execution risk. Success requires not only technological capability but also market timing, customer relationships, and capital allocation discipline.

Investment Recommendations and Portfolio Considerations

Current analyst sentiment suggests cautious optimism, with According to analyst recommendations, Amara Raja Energy & Mobility Ltd Share has a “Buy” rating for the long term. However, investors should consider their risk tolerance and investment timeframe carefully.

For Growth-Oriented Investors: The stock offers exposure to India’s automotive and energy storage sectors with potential for significant upside if transformation strategies succeed. However, volatility and execution risk make it suitable primarily for investors comfortable with cyclical and transition-story investments.

For Value Investors: The current valuation discount to peers and stable cash flow generation could provide attractive entry points for patient investors willing to wait for market recognition of the company’s strategic progress.

For Income-Focused Investors: While not primarily a dividend play, the company’s stable cash generation and conservative financial management suggest potential for consistent returns, though growth investments may limit dividend yields.

Conclusion: Balancing Opportunity and Uncertainty

Amara Raja Energy & Mobility represents a classic transformation story, with established market positions providing stability while new technology investments offer growth potential. The diverse price targets from ₹1,163 to over ₹2,200 reflect genuine uncertainty about the company’s ability to execute its strategic pivot successfully.

Investors considering the stock should focus on management’s progress in new technology segments, market share trends in traditional businesses, and financial metrics indicating successful capital allocation. The company’s strong credit profile and market position provide downside protection, while successful transformation could deliver substantial returns.

The key to successful investment lies in realistic expectations about timeframes and probability-weighted outcomes rather than focusing solely on optimistic price targets. As with any transition story, careful monitoring of strategic progress and competitive positioning will prove more valuable than short-term price movements in determining long-term investment success.