Triveni Turbine Share is in a bullish trend in the share market. During share ups and downs, you should know all about the share details before investing. In this blog, we are going to discuss the Triveni Turbine Share Price Target 2025, 2026, 2028, 2030, and 2035. We will try to analyze the share base in the company’s overall performance.

We also look at the company’s profit growth in the last 5 years, the last 5 years’ sales growth, and the last 5 years’ ROE percentage. Similarly, we also compare the share growth, the share price return, amount whether the share has increased or decreased over the last 5 years. We also take advice from experts about when we should invest in the share, which may be helpful for you. Let’s have a look at the Triveni Turbine Share Price Target from 2025 to 2035.

Overview Of Triveni Turbines Limited

Triveni Turbines Limited manufactures industrial steam turbines up to 100 MW Electric and refurbishes rotating equipment at its state-of-the-art facilities. The company offers steam turbine solutions for Industrial Captive and Renewable Power.

Fundamental Analysis Of Triveni Turbines Limited

| Company Name | Triveni Turbines Limited |

| Market Cap | ₹19,246.38 Crore |

| P/B | 18.69 |

| P/E | 52.1 |

| 52 Week High | ₹886 |

| 52 Week Low | ₹460.30 |

| Book Value | ₹32.96 |

| Face Value | ₹1 |

| DIV. YIELD | 0.67% |

Triveni Turbine Share Price Target 2025

Triveni Turbine Share Price Target 2025 forecast may vary from ₹605.28 to ₹658.30.

Influencing Key Factors Of Triveni Turbine Share Price Target 2025

- Clear Energy Turbine Solutions

- Triveni Turbine Limited is the world’s largest manufacturer of steam turbines, ranging up to 100 MW, for providing renewable power solutions specifically for Biomass, sugar, and process cogeneration, waste-to-energy, and district heating. Triveni Turbine partners with customers to provide a comprehensive range of service solutions for the complete life cycle of steam turbines.

- Global Presence

- The company’s focus on entering new markets and geographies has led to a strong and credible presence in the global market. The company has already installed globally competitive and technologically advanced products in over 80 countries. The company installed over 6000 steam turbines globally. The company has also built on a foundation of strong and continuosly evolving product research, development, and engineering capabilities.

- Industries And Applications

- Triveni Turbine serves the power generation needs of diverse industry segments, including Steel, Sugar, Cement, Pulp & Paper, Textiles, Palm Oil, Food Processing, Waste-to-Energy, and Geothermal. The turbines are used in a wide range of applications such as cogeneration, Captive Power Generation, Independent Power Generation, etc.

| Month | Triveni Turbine Share Price Target 2025 (1st Price Target) | Triveni Turbine Share Price Target 2025 (2nd Price Target) |

| May | ₹605.28 | ₹620.67 |

| June | ₹618.72 | ₹625.30 |

| July | ₹623.09 | ₹634.16 |

| August | ₹630.18 | ₹642.50 |

| September | ₹640.92 | ₹653.70 |

| October | ₹650.20 | ₹642.01 |

| November | ₹639.52 | ₹650.20 |

| December | ₹648.60 | ₹658.30 |

Also Read – Marksans Pharma Share Price Target

Triveni Turbine Share Price Target 2026

Triveni Turbine Share Price Target 2026 forecast may vary from ₹655.28 to ₹724.77.

Influencing Key Factors Of Triveni Turbine Share Price Target 2026

- Innovation & Technology

- The company’s endeavour towards continuous product development by deploying cutting-edge technology has delivered innovative solutions to customers. The company is constantly working towards developing technologically superior designs using the latest design tools and software, like Turbo-machinary CFD tools, FEA tools, CAD modelling, lateral and torsional rotor dynamics software, that deliver higher performance and add value to customers. The company drew from the extensive knowledge base of domain experts in steam turbine technology.

- Quality Assurance

- The company’s products are manufactured to international standards such as API, AGMA, IEC, CE/PED, NEMA, IEC Mark, among others. The company’s best-in-class testing facilities for extensive validation of design help to ensure excellent products that meet even the most stringent international quality standards. The company ensures that the company’s network quality suppliers and dedicated subcontractors also comply with these standards through QAPs.

- Intellectual Property Rights

- Operating in a technology-intensive industry, the company values Intellectual Property Rights and ensures that the company’s IP team gets involved from the planning and conceptualisation stage to the final design and development of products. The company has a comprehensive IP strategy for the creation and protection of long-term IP assets.

| Month | Triveni Turbine Share Price Target 2026 (1st Price Target) | Triveni Turbine Share Price Target 2026 (2nd Price Target) |

| January | ₹655.28 | ₹667.10 |

| February | ₹665.02 | ₹674.42 |

| March | ₹644.13 | ₹652.80 |

| April | ₹650.71 | ₹661.57 |

| May | ₹659.70 | ₹669.35 |

| June | ₹667.55 | ₹672.32 |

| July | ₹670.15 | ₹683.66 |

| August | ₹680.96 | ₹690.29 |

| September | ₹689.97 | ₹696.65 |

| October | ₹694.22 | ₹706.60 |

| November | ₹704.2 | ₹713.85 |

| December | ₹710.17 | ₹724.77 |

Triveni Turbine Share Price Target 2028

Triveni Turbine Share Price Target 2028 forecast may vary from ₹830.27 to ₹910.26.

Influencing Key Factors Of Triveni Turbine Share Price Target 2028

- Lower Lifecycle Cost

- The company’s products are designed to meet all customer requirements for an economic installation, generating competitive power and reduced operating costs. Maximum availability and extended operating life of the product lead to lower lifecycle cost.

- Higher Sustained Efficiency

- The company’s advanced design concepts have been developed in collaboration with the leading design houses in India & the USA to provide maximum performance. Globally benchmarked, well-proven processes are adopted at the company. The company’s products meet even the most stringent international quality standards, which leads to maintaining efficiency throughout the turbine lifecycle.

- Global Network

- The company spread its business in 80 countries like Australia, Brazil, Costa Rica, Zambia, Switzerland, Sri Lanka, South Africa, Sweden, Mexico, etc.

| Month | Triveni Turbine Share Price Target 2028 (1st Price Target) | Triveni Turbine Share Price Target 2028 (2nd Price Target) |

| January | ₹830.27 | ₹840.30 |

| February | ₹839.62 | ₹847.80 |

| March | ₹818.32 | ₹829.15 |

| April | ₹826.05 | ₹834.29 |

| May | ₹830.44 | ₹842.68 |

| June | ₹839.52 | ₹855.39 |

| July | ₹853.26 | ₹862.95 |

| August | ₹859.83 | ₹872.35 |

| September | ₹870.22 | ₹883.16 |

| October | ₹880.16 | ₹892.37 |

| November | ₹890.25 | ₹898.64 |

| December | ₹896.02 | ₹910.26 |

Triveni Turbine Share Price Target 2030

Triveni Turbine Share Price Target 2030 forecast may vary from ₹1,005.29 to ₹1,129.37.

Influencing Key Factors Of Triveni Turbine Share Price Target 2030

- Comprehensive Service Solutions

- The company offers a unique combination of the latest equipment, a highly skilled team, and OEM expertise to provide a comprehensive range of customised service solutions for industrial steam turbines. The company is offering a full-speed Schenck Rotec Vacuum balancing tunnel for balancing turbines, customization & upgradation of old turbines for both industrial and utility segments, and refurbishment solutions for higher MW turbines, upto 500 MW for all makes.

- Manufacturing Excellence

- The company’s state-of-the-art facility, with an installed capacity to manufacture over 350 turbines annually, is equipped with precision equipment and the latest software for seamless manufacturing of all critical components. The company manufactures all critical components, along with a strong network of global suppliers.

| Year | Triveni Turbine Share Price Target 2030 |

| 1st Price Target | ₹1,005.29 |

| 2nd Price Target | ₹1,129.37 |

Triveni Turbine Share Price Target 2035

Triveni Turbine Share Price Target 2035 forecast may vary from ₹1,679.24 to ₹1,795.64.

Influencing Key Factors Of Triveni Turbine Share Price Target 2035

- Increased EBITDA Amount

- The company’s EBITDA amount increased rapidly in the year 2023 (fourth quarter), the company’s EBITDA amount was ₹789 million, which increased to ₹1,070 million in the year 2024 (fourth quarter).

- Thermal Renewable Fuel-Based Power Generation Increasing

- In the last 10 years, in the overall steam turbine market, fossil fuel-based power generation, previously the main source of fuel, declined to 67% in 2023 from 75% in 2013, whereas thermal renewable fuel-based power generation increased to 7% in 2023 from 5% in 2013.

- Oder Booking

- The aftermarket segment registered order booking of ₹6.18 billion during the financial year 2024, growing by 34% when compared with the corresponding period of the previous year. The aftermarket turnover at ₹5.39 billion during the year 2024 registered a growth of 31% over the previous year. Aftermarket contributed to 33% of the total turnover in the year 2024.

| Year | Triveni Turbine Share Price Target 2035 |

| 1st Price Target | ₹1,679.24 |

| 2nd Price Target | ₹1,795.64 |

Also Read – Inox Wind Share Price Target

Last Few Years’ Performance Of Triveni Turbine Limited

Profit Growth

- In the last 5 years, 19.68%

- In the last 3 years, 34.52%

- In the last 1 year, 45.29%

The Net Profit of the company was ₹145.85 Crore in March 2023, which increased to ₹210.38 Crore in March 2024. The Operating Profit of the company was ₹178.59 Crore in March 2023, which increased to ₹254.37 Crore in March 2024.

Sales Growth

The sales growth percentage of the company in the last 5 years is described below.

- In the last 5 years, 11.29%

- In the last 3 years, 26.98%

- In the last year, 27.15%

The Net Sales amount of the company was ₹441.68 Crore in December 2023, which increased to ₹491.58 Crore in March 2025.

ROE Percentage

The ROE percentage growth of the company in the last 5 years is described below.

- In the last 5 years, 25.98%

- In the last 3 years, 29.86%

- In the last 1 year, 30.59%

ROCE Percentage

The company’s ROCE percentage growth in the last 5 years is described below, and it has also increased rapidly.

- In the last 5 years, 34.59%

- In the last 3 years, 40.92%

- In the last 1 year, 41.59%

Total Expenditure Amount

The company’s Total Expenditure was ₹341.25 Crore in December 2023, increasing to ₹372.59 Crore in March 2025.

The Net Cash Flow Amount

The Net Cash Flow amount of the company was ₹1.30 Crore in March 2023, which decreased to -₹2.59 Crore in March 2024.

Peer Company Of Triveni Turbine Limited

| Company Name | Market Cap (Crore) |

| Aamcol Tools | ₹26.20 |

| AIA Engineering | ₹31,520.38 |

| Algoquant Finte | ₹1,685.27 |

| Anup Engineering | ₹5,658.50 |

| Artson | ₹558.23 |

| Amba Enterprise | ₹203.29 |

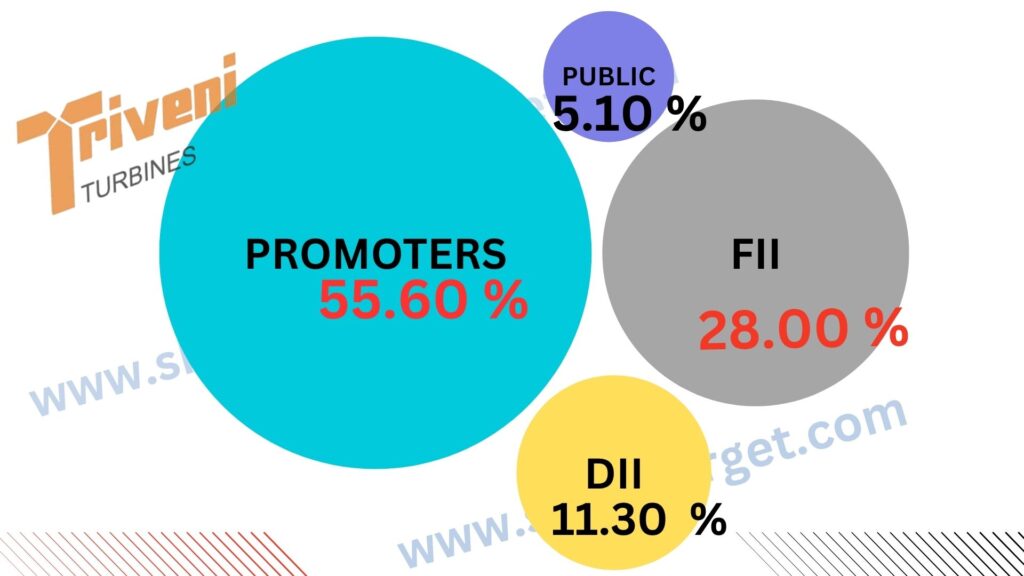

Discussion About Shareholding Pattern Of Triveni Turbine Limited

Triveni Turbine Limited mainly has four types of shareholding patterns, such as promoter holding, public holding, DII, and FII. Depending on the shareholding pattern, we can majorly influence the company’s growth.

| Investor Type | Percentage |

| Promoter Holding (Owned by the company’s promoter) | 55.60% |

| Public Holding (Held by the public) | 5.10% |

| FII (Invest by Foreign Institutional Investor) | 28% |

| DII (Invest money by Domestic Institutional Investor) | 11.30% |

The Last Few Years’ Share Price Updation Of Triveni Turbine Share

Triveni Turbine Share always gives good returns to investors, which is described in the portion below.

- In the last 1 month’s share growth was +68.75 (13.10%).

- The last 6 months’ share growth was -203.75 (-25.57%).

- The last 1 year’s share growth was +20.50 (3.52%).

- The last 5 years’ share growth was +529.70 (834.17%).

- The maximum share growth was +555.45 (1,473.10%).

- Triveni Turbine share price return percentage was 13.06% in the last 1 month.

- The last 3 months’ share price return percentage was 22.16%.

- The last 1 year’s share price return percentage was 3.61%.

- The last 3 years’ share price return percentage was 238.23%.

- The last 5 years’ share price return percentage was 859.62%.

What Is The Expert Advice About The Investment In Triveni Turbine Share

Positive Sides

- In the last 3 years, the company has shown a good profit growth which was 34.52%.

- In the last 3 years, the company has been maintaning a healthy revenue growth which was 25.63%.

- In the last 3 years, the company’s ROE percentage was very good, which was 29.86%.

- The company has been maintaining a good ROCE percentage, which was 40.92%.

- The company is virtually debt-free and has a good interest cover ratio of 65.12.

- The company has a good cash conversion cycle of 24.01 days.

- The company has a good cash flow managment, PAT stands at 1.45.

- The company has a good promoter holding capacity, which is 55.60%.

- The company has a strong degree of operating leverage, average operating leverage stands at 3.80.

- The company had a good sales growth in the last 3 years, which was 26.98%.

Negative Sides

- The company has a healthy PE ratio of 52.1.

- The company is trading at a high EBITDA of 40.26.

Also Read – Indus Towers Share Price Target

FAQ

What is the Triveni Turbine Share Price Target for 2025?

Triveni Turbine Share Price Target for 2025 is ₹605.28 to ₹658.30.

What is the Triveni Turbine Share Price Target for 2026?

Triveni Turbine Share Price Target for 2026 is ₹655.28 to ₹724.77.

What is the Triveni Turbine Share Price Target for 2028?

Triveni Turbine Share Price Target for 2028 is ₹830.27 to ₹910.26.

What is the Triveni Turbine Share Price Target for 2030?

Triveni Turbine Share Price Target for 2030 is ₹1,005.29 to ₹1,129.37.

What is the Triveni Turbine Share Price Target for 2035?

Triveni Turbine Share Price Target for 2035 is ₹1,679.24 to ₹1,795.64.

Conclusion

This website is written to help the investor gain some basic knowledge about the market strategy of Triveni Turbine Share. For making this blog, we take consultation from experts and research the company. It is expected that the Triveni Turbine Share Price Target will be a good choice to invest in on a long-term basis. The demand for the turbine manufacturer sector in India and outside of the country always increases, as a result of which the company and its share may increase rapidly.

We try to give an in-depth idea about the share. If you think it is helpful to you, you can share it. If you have any questions, please let us know through the comment box. We will try to reply to your questions and solve your problem. Thanks for visiting this website and thanks for being with us.

Disclaimer – We are not SEBI-registered advisors. A financial market is always risky to anyone. This website is only for training and educational purposes. So, before investing, we are requested to discuss certified expertise. We will not be responsible for anyone’s profit or loss.