Torrent Pharmaceuticals Share is experiencing a bullish trend in the share market. You should know all about the share details before investing during the ups and downs. In this blog, we will discuss the Torrent Pharmaceuticals Share Price Target 2025, 2026, 2028, 2030, and 2035. We will try to analyze the share base in the company’s overall performance.

We also look at the company’s profit growth in the last 5 years, the last 5 years’ sales growth, and the last 5 years’ ROE percentage. Similarly, we also compare the share growth, the share price return, and whether the share has increased or decreased over the last 5 years. We also take advice from experts about when we should invest in the shares, which may be helpful for you. Let’s have a look at the Torrent Pharmaceuticals Share Price Target from 2025 to 2035.

Overview Of Torrent Pharmaceuticals Limited

Torrent Pharmaceuticals Limited is an Indian multinational pharmaceutical company that is a part of the Torrent Group, and the headquarters of the company are situated in Ahmedabad. The company operates in more than 40 countries and has over 2,000 product registrations globally. The company is active in the therapeutic areas of cardiovascular, central nervous system, gastro-intestinal, diabetology, anti-infective, and pain managment segments.

Fundamental Analysis Of Torrent Pharmaceuticals Limited

| Company Name | Torrent Pharmaceuticals Limited |

| Marketcap | ₹1,10,236.85 Crore |

| Book Value | ₹237.25 |

| P/B | 14.01 |

| P/E | 60.86 |

| 52 Week High | ₹3,590.86 |

| 52 Week Low | ₹2,519.95 |

| Face Value | ₹5 |

| ROE | 20.53% |

| DIV. YIELD | 0.90% |

Last Few Years’ Performance Of Torrent Pharmaceuticals Limited

Profit Growth

- In the last 5 years, 13.20%

- In the last 3 years, 6.35%

- In the last 1 year, 31.20%

The Net Profit of the company was ₹1,096.85 Crore in March 2023, which increased to ₹1,386.30 Crore in March 2024. The Operating Profit of the company was ₹2,486.32 Crore in March 2023, which increased to ₹2,896.43 Crore in March 2024.

Sales Growth

The sales growth percentage of the company in the last 5 years is described below.

- In the last 5 years, 8.96%

- In the last 3 years, 10.63%

- In the last year, 11.53%

The company’s Net Sales were ₹7,712.30 Crores in March 2023, increased to ₹8,693.52 Crores in March 2024.

ROE Percentage

The ROE percentage growth of the company in the last 5 years is described below.

- In the last 5 years, 18.96%

- In the last 3 years, 17.59%

- In the last 1 year, 21.03%

ROCE Percentage

The company’s ROCE percentage growth in the last 5 years is described below, and it has also increased rapidly.

- In the last 5 years, 18.63%

- In the last 3 years, 19.54%

- In the last 1 year, 21.10%

Total Expenditure Amount

The company’s total expenditure was ₹5,285.13 Crore in March 2023, which increased to ₹5,896.43 Crore in March 2024.

The Net Cash Flow Amount

The company’s Net Cash flow was ₹20.43 Crore in March 2023, which decreased to ₹19.86 Crore in March 2024.

Total Assets Amount

The company’s Total Assets were ₹12,896.37 Crore in March 2023, which decreased to ₹12,325.61 Crore in March 2024.

Also Read – Cipla Share Price Target

Torrent Pharmaceuticals Share Price Target 2025

Torrent Pharmaceuticals Share Price Target 2025 forecast may vary from ₹3,356.79 to ₹3,835.64.

Influencing Key Factors Of Torrent Pharmaceuticals Share Price Target 2025

- Joint Venture With Sanofi Limited

- In 1997, Torrent Pharma and Sanofi established a 50:50 joint venture called Sanofi Torrent to sell Torrent Pharma’s products. Torrent exited the joint venture by selling its stake to Sanofi in 2002.

- The Company Acquired The Domestic Business

- In 2013, Torrent Pharma acquired the domestic business of Unichem Laboratories for ₹3,600 Crore (US$552.81 million).

- Acquired Skincare Manufacturer

- In 2022, the company acquired skincare manufacturer Curatio Healthcare for ₹2,000 Crore (US$254.44 million).

| Month | Torrent Pharmaceuticals Share Price Target 2025 (1st Price Target) | Torrent Pharmaceuticals Share Price Target 2025 (2nd Price Target) |

| May | ₹3,356.79 | ₹3,398.35 |

| June | ₹3,389.53 | ₹3,459.62 |

| July | ₹3,450.02 | ₹3,536.78 |

| August | ₹3,529.16 | ₹3,598.64 |

| September | ₹3,592.81 | ₹3,686.59 |

| October | ₹3,679.25 | ₹3,769.15 |

| November | ₹3,760.43 | ₹3,805.33 |

| December | ₹3,785.76 | ₹3,835.64 |

Torrent Pharmaceuticals Share Price Target 2026

Torrent Pharmaceuticals Share Price Target 2026 forecast may vary from ₹3,828.46 to ₹4,342.75.

Influencing Key Factors Of Torrent Pharmaceuticals Share Price Target 2026

- Issued Equity Shares

- In the year 1994, the company issued 1,74,146 Equity Shares of ₹10 each as fully paid up shares to the shareholders of TMSL after cancelling 9,300 shares held by the company in TMSL.

- Launched New Products

- Torrent Pharmaceuticals Limited is the first company to launch ranitidine (Ranitin), nifedipine (Calcigard), atenolol (Betacard), and domperidone (Domstal), amiodorane (cordarone), Lisinopril (Listril), etc in the Indian market.

- Increasing EBITDA

- The company achieved significant growth in the branded generics business in the year 2022-23, with India and Brazil leading the way, followed by the RoW. In Brazil, the company established a strong foothold by launching six products in the CNS, diabetic, and cardio segments. Among these products, desvenlafaxine was the biggest success, with market share in prescriptions rising to 9% in just 10 months.

| Month | Torrent Pharmaceuticals Share Price Target 2026 (1st Price Target) | Torrent Pharmaceuticals Share Price Target 2026 (2nd Price Target) |

| January | ₹3,828.46 | ₹3,895.03 |

| February | ₹3,887.23 | ₹3,946.38 |

| March | ₹3,704.56 | ₹3,779.36 |

| April | ₹3,772.52 | ₹3,831.50 |

| May | ₹3,829.75 | ₹3,898.06 |

| June | ₹3,895.59 | ₹3,936.72 |

| July | ₹3,929.50 | ₹4,005.73 |

| August | ₹4,002.72 | ₹4,087.66 |

| September | ₹4,079.23 | ₹4,163.88 |

| October | ₹4,159.26 | ₹4,203.86 |

| November | ₹4,195.69 | ₹4,276.76 |

| December | ₹4,242.16 | ₹4,342.75 |

Torrent Pharmaceuticals Share Price Target 2028

Torrent Pharmaceuticals Share Price Target 2028 forecast may vary from ₹4,912.52 to ₹5,486.95.

Influencing Key Factors Of Torrent Pharmaceuticals Share Price Target 2028

- Agreement With Novo Nordisk

- Torrent Pharmaceuticals signs agreement with Novo Nordisk Denmark to establish new, dedicated formulation and packaging facility for Insulin, exclusively for Novo Nordisk.

- Strategic Themes

- Torrent Pharma has six strategic themes, aligning with its short-term, medium-term, and long-term goals, which are to improve market share in core markets, invest in tomorrow’s growth engines, operational excellence, engage and empower stakeholders, deploy digital technologies and responsible actions which helps the company’s growth.

- Developing Niche Solutions

- Torrent Pharma has developed a portfolio with high chronicity and reputable brands. In India, Torrent Pharma has 13 brands over ₹100 crores and 18 brands in the Top 500 brands of IPM. There are significant number of brands in the range of ₹75-100 crores and ₹50-75 Crores, with potential for inclusion in the ₹100 crore club over the medium term.

| Month | Torrent Pharmaceuticals Share Price Target 2028 (1st Price Target) | Torrent Pharmaceuticals Share Price Target 2028 (2nd Price Target) |

| January | ₹4,912.52 | ₹5,056.30 |

| February | ₹5,039.46 | ₹5,102.65 |

| March | ₹4,998.80 | ₹5,086.91 |

| April | ₹5,072.43 | ₹5,168.13 |

| May | ₹5,159.10 | ₹5,286.03 |

| June | ₹5,279.60 | ₹5,379.46 |

| July | ₹5,370.15 | ₹5,402.65 |

| August | ₹5,276.03 | ₹5,356.81 |

| September | ₹5,345.76 | ₹5,486.29 |

| October | ₹5,477.58 | ₹5,595.46 |

| November | ₹5,549.15 | ₹5,598.37 |

| December | ₹5,495.76 | ₹5,486.95 |

Torrent Pharmaceuticals Share Price Target 2030

Torrent Pharmaceuticals Share Price Target 2030 forecast may vary from ₹6,072.93 to ₹6,679.46.

Influencing Key Factors Of Torrent Pharmaceuticals Share Price Target 2030

- Established Subsidaries In Germany

- In the year 2003, Torrent Pharma set a wholly owned subsidiaries in Germany and Brazil. In the year 2004, Torrent Pharmaceuticals Limited signed a non-exclusive agreement with Dr. Reddy’s Laboratories Limited for licensing and supplying the formulation of one of Torrent’s blockbuster drugs, Domstal O, in the Gastrointestinal Segment.

- Torrent Pharmaceuticals Research Centre

- The Torrent Research Centre is a complex of research laboratories with supporting facilities and infrastructures, located on the outskirts of Ahmedabad. The building is India’s largest passive cooled building for the last 14 years.

- Business In International Countries

- International sales were boosted by noticeable performance in the US, Europe, and Germany. Due to investment in new therapeutic areas and field force expansion, adjusting for investment in new markets, international margins improved, partially offset by adverse currency movements.

| Year | Torrent Pharmaceuticals Share Price Target 2030 |

| 1st Price Target | ₹6,072.93 |

| 2nd Price Target | ₹6,679.46 |

Torrent Pharmaceuticals Share Price Target 2035

Torrent Pharmaceuticals Share Price Target 2035 forecast may vary from ₹9,023.78 to ₹9,598.46.

Influencing Key Factors Of Torrent Pharmaceuticals Share Price Target 2035

- USA Market Expansion

- From the financial year 2011-12, the company highlights improving market share in all commercialized molecules: Citalopram 28%, Zolpidem 22%. Higher sales lead to operating profits before R&D, and 25 ANDAs have been actively approved to date.

- All Subsidiaries

- The company has subsidiaries in Torrent do Brasil Ltda, Brazil

- ZAO Torrent Pharma, Russia

- Torrent Pharma GmbH, Germany

- Torrent Pharma Canada Inc., Canada

- Torrent Pharma UK United Kingdom

- Torrent Pharma Philippines Inc, Philippines

- Torrent Pharma Inc., United States

| Year | Torrent Pharmaceuticals Share Price Target 2035 |

| 1st Price Target | ₹9,023.78 |

| 2nd Price Target | ₹9,598.46 |

Also Read – Godfrey Phillips Share Price Target

Peer Company Of Torrent Pharmaceuticals Limited

| Company Name | Market Cap (Crore) |

| Sun Pharmaceuticals Industries Limited | ₹4,39,126.53 |

| Divis Laboratories Limited | ₹1,16,589.63 |

| Cipla Limited | ₹1,25,638.14 |

| Mankind Pharma | ₹1,01,685.19 |

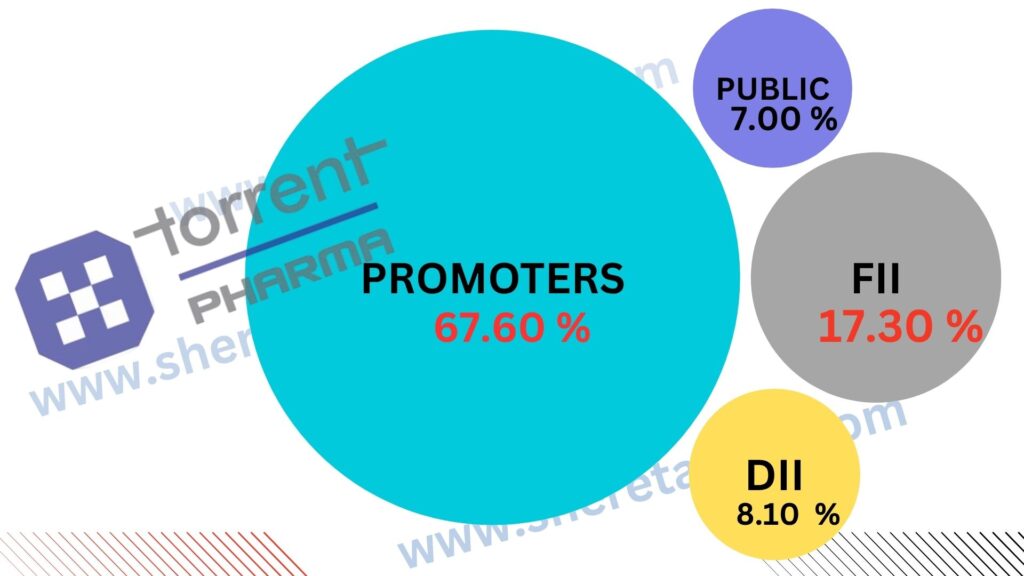

Discussion About Shareholding Pattern Of Torrent Pharmaceuticals Limited

Torrent Pharmaceuticals Limited mainly has four types of shareholding patterns, such as promoter holding, public holding, DII, and FII. We can majorly influence the company’s growth depending on the shareholding pattern.

| Investor Type | Percentage |

| Promoter Holding (Owned by the company’s promoter) | 67.60% |

| Public Holding (Held by the public) | 7.00% |

| FII (Invest by Foreign Institutional Investor) | 17.30% |

| DII (Invest money by Domestic Institutional Investor) | 8.10% |

The Last Few Years’ Share Price Updation Of Torrent Pharmaceuticals Limited Share

Torrent Pharmaceutical’s Share always gives good returns to investors, which is described in the portion below.

- The last 6 months’ share growth was +125.75 (3.93%).

- The last 1 month’s share growth was +142.40 (4.47%).

- The last 1 year’s share growth was +656.30 (24.58%).

- The last 5 years’ share growth was +2,153.60 (183.64%).

- The maximum share growth was +3,319.26 (47,148.58%).

- Torrent Pharmaceutical’s share price return percentage was 4.35% in the last 1 month.

- The last 3 months’ share price return percentage was 3.56%.

- The last 1 year’s share price return percentage was 25.71%.

- The last 3 years’ share price return percentage was 136.08%.

- The last 5 years’ share price return percentage was 183.28%.

What Is The Expert Advice About The Investment In Torrent Pharmaceuticals Share

Positive Sides

- The company has a high promoter holding capacity, which is

- The company has an effective cash conversion cycle of 4.35 days.

- The company has a good flow managment, PAT stands at 1.92.

- In the last 3 years, the company has had a good profit margin which is 31.20%.

Negative Sides

- In the last 3 years, the company’s revenue growth was 10.2%.

- The company has a high PE ratio of 61.96.

- The company has a high EBITDA of 32.65.

Also Read – Varun Beverages Share Price Target

FAQ

What is Torrent Pharmaceuticals Share Price Target 2025?

Torrent Pharmaceuticals Share Price Target for 2025 is ₹3,356.79 to ₹3,835.64.

What is Torrent Pharmaceuticals Share Price Target 2026?

Torrent Pharmaceuticals Share Price Target for 2026 is ₹3,828.46 to ₹4,342.75.

What is Torrent Pharmaceuticals Share Price Target 2028?

Torrent Pharmaceuticals Share Price Target for 2028 is ₹4,912.52 to ₹5,486.95.

What is Torrent Pharmaceuticals Share Price Target 2030?

Torrent Pharmaceuticals Share Price Target for 2030 is ₹6,072.93 to ₹6,679.46.

What is Torrent Pharmaceuticals Share Price Target 2035?

Torrent Pharmaceuticals Share Price Target for 2035 is ₹9,023.78 to ₹9,598.46.

Conclusion

This website is written to help the investor gain some basic knowledge about the market strategy of Torrent Pharmaceuticals shares. For making this blog, we consulted experts and researched the company. It is expected that the Torrent Pharmaceuticals Share Price Target will be a good choice to invest in on a long-term basis. The demand for the pharmaceuticals sector in India and outside of the country always increases, as a result of the company, and the share may increase rapidly.

We try to give an in-depth idea about the share. If you think it is helpful to you, you can share it. If you have any questions, please let us know through the comment box. We will try to reply to your questions and solve your problem. Thanks for visiting this website and thanks for being with us.

Disclaimer – We are not SEBI-registered advisors. A financial market is always risky to anyone. This website is only for training and educational purposes. So, before investing, we are requested to discuss certified expertise. We will not be responsible for anyone’s profit or loss.