Published: | Market Analysis

Executive Summary

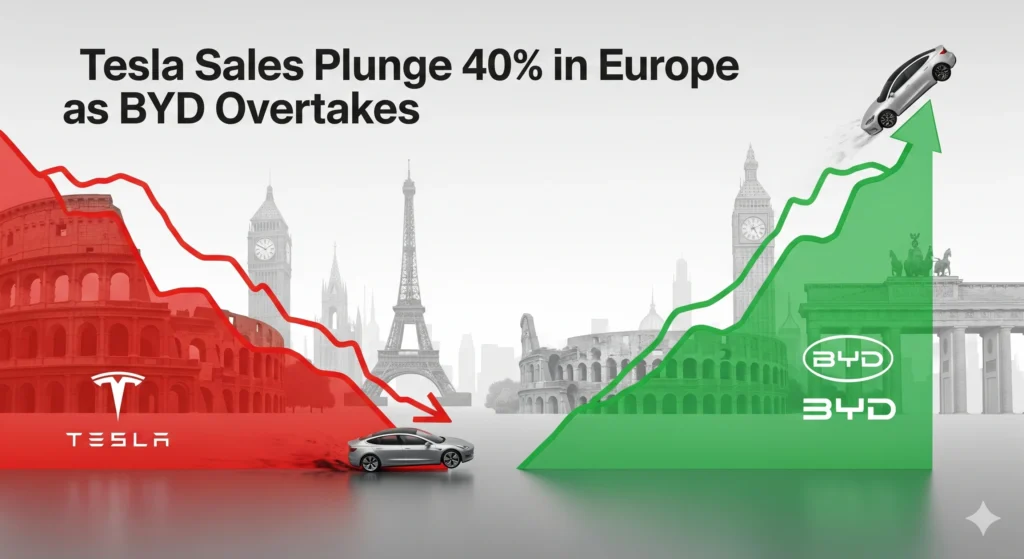

- Tesla’s sales in Europe dropped 40% in July 2025 compared to a year ago, registering only 8,837 vehicles.

- BYD’s European sales soared 225%, with 13,503 vehicles registered, overtaking Tesla for monthly sales in the region.

- Tesla’s European market share fell close to 0.8%, while BYD now commands about 1.2%.

- The main drivers: consumer backlash against Elon Musk’s political activities and BYD’s affordable product lineup and rapid expansion.

- Despite Tesla’s woes, the European EV market overall grew 33.6% in July, with battery-electric cars now at 15.6% market share.

- For investors, these dynamics highlight new risks and opportunities in the EV sector.

Tesla sales in Europe plummeted 40% in July, marking the seventh consecutive month of decline for the electric vehicle manufacturer amid a growing consumer backlash against CEO Elon Musk’s political activities. Chinese rival BYD capitalized on Tesla’s struggles, with its July sales surging 206% compared to the same month last year, according to data released Thursday by the European Automobile Manufacturers’ Association.

The dramatic shift in market dynamics saw BYD surpass Tesla in monthly sales for the first time in Europe, with BYD registering 9,698 new vehicles compared to Tesla’s 6,600 in July across the EU. BYD now holds 1.1% of the European market share while Tesla has dropped to just 0.7%.

Political Backlash Fueling Sales Decline

Tesla’s European woes are largely attributed to widespread consumer rejection of Musk following his political involvement. The billionaire has endorsed far-right parties across Europe, including Germany’s Alternative for Deutschland (AfD) and Spain’s Vox party, while publicly attacking European leaders.

According to PBS, Musk has “alienated many European customers by engaging in political discourse, endorsing far-right candidates, labeling a British prime minister as an ‘evil tyrant’ deserving of imprisonment, and warning Germans that ‘things will get very, very much worse’ if they don’t support” the AfD.

The political backlash has manifested in protests across European cities, with effigies of Musk being hung in Milan and posters in London comparing him to Nazi figures. A January survey by Electrifying.com found that 60% of participants were deterred from purchasing a Tesla due to Musk’s behavior, with over 70% of respondents in the UK and Germany holding an unfavorable opinion of the Tesla CEO.

BYD’s Strategic European Expansion

While Tesla struggles, BYD has aggressively expanded its European footprint by opening new showrooms and introducing competitively priced vehicles. The Chinese automaker’s success stems from several factors, according to Yahoo Finance analysis.

BYD offers significantly more affordable pricing than Tesla, with models like the BYD Dolphin Surf available for €19,990, making it competitive with traditional petrol vehicles. The company also provides a diverse vehicle lineup ranging from compact urban cars to SUVs, unlike Tesla’s limited model range.

In March, BYD unveiled battery charging technology that can deliver 250 miles of range in five minutes, surpassing Tesla’s ability to add 200 miles in 15 minutes. The company also introduced its ‘God’s Eye’ technology, competing with Tesla’s full self-driving features, at no extra charge for most vehicles.

Latest Sales Data: Tesla vs. BYD in Europe

| Brand | July 2025 Vehicle Registrations | Year-on-Year Change |

|---|---|---|

| Tesla | 8,837 | -40% |

| BYD | 13,503 | +225% |

This is the first time BYD has outsold Tesla in Europe on a monthly basis.

Tesla’s July sales cratered to half the level seen a year ago in key markets like Germany and the Nordic region.

BYD rapidly gained visibility by launching new showrooms and pricing vehicles below Tesla’s, starting around €20,000 for models like the Dolphin Surf.

Tesla’s 2025 Downtrend: Monthly Sales Overview

Tesla’s European sales have dropped for seven straight months in 2025, sinking with each passing month:

| Month | Estimated Tesla Sales (Europe) |

|---|---|

| January | 20,000 |

| February | 18,000 |

| March | 16,500 |

| April | 13,700 |

| May | 11,400 |

| June | 10,009 |

| July | 8,837 |

Data from ACEA and industry estimates

Key Highlights

- France: Tesla sales dropped 27%.

- Netherlands: Down 62%.

- Denmark: Down 52%.

- Sweden: Down 86%.

Tesla’s decline goes far beyond just one country—core European markets all saw sharp drops in registrations.

Why Tesla Is Falling Behind

1. Political Backlash and Brand Reputation

Elon Musk’s outspoken involvement in far-right European politics, including endorsement of Germany’s AfD, has incited widespread consumer backlash and protests. This is especially true in environmentally conscious and politically moderate European countries, where Musk’s brand is directly linked with Tesla’s success or failure.

2. Stagnant Model Lineup and Rising Competition

While Tesla’s new Model Y update did not generate much enthusiasm, competitors like BYD have introduced new, affordable vehicles across segments – from city cars to SUVs – at much lower prices. BYD’s technological innovations, such as lightning-fast battery charging and “God’s Eye” ADAS, have won over tech-savvy European customers.

3. Currency and Market Access Issues

Tesla has also faced pricing challenges due to unfavorable currency movements and its “premium” strategy, while BYD benefited from aggressive pricing, government backing, and local partnerships.

BYD’s Winning Formula in Europe

BYD’s strategy involved three main pillars:

- Expansion: Opening showrooms in major European cities and expanding distribution.

- Affordability: Pricing its Dolphin Surf just below €20,000, matching or undercutting ICE rivals.

- Tech Edge: Deploying rapid charging tech and comprehensive driver assistance without premium charges.

Sales Impact

| Brand | July 2024 Sales | July 2025 Sales | YoY Change |

|---|---|---|---|

| BYD | 4,154 | 13,503 | +225% |

| Tesla | 15,000 | 8,837 | -40% |

Approximate values based on ACEA and industry reports

European EV Market: A Bigger Picture

Despite Tesla’s slide, Europe’s EV market continues to surge:

- Total BEV registrations in July grew 33.6%.

- BEVs now hold 15.6% of the passenger car market in 2025, vs. 12.5% in 2024.

- Hybrids hold the largest alternative fuel share at 34.8%, but BEVs are closing the gap.

- Plug-in hybrids also increased, representing 8.4% of the EU market.

| Powertrain Type | H1 2024 Share | H1 2025 Share | H1 2025 Registrations |

|---|---|---|---|

| Battery-Electric | 12.5% | 15.6% | 869,271 |

| Hybrid-Electric | 29.4% | 34.8% | 1,942,762 |

| Plug-in Hybrid | 6.9% | 8.4% | 469,410 |

| Petrol/Diesel | 48.2% | 37.8% | — |

ACEA, Jan-Jun 2025

Tesla vs. BYD: Share Market Implications

Tesla’s Stock Performance

- Tesla share price in global markets dropped over 13% year-to-date amid sliding international sales and negative headlines.

- Stock volatility has increased, with sentiment closely tied to sales results and CEO activities.

BYD’s Market Traction

- BYD’s growth in Europe signals its global ambitions and enhances its investment narrative, despite regulatory scrutiny on Chinese EVs.

- The company benefits from both scale and public interest in affordable EVs and battery tech.

What Does This Mean for New Investors?

Key Lessons

- Brand and Leadership Matter: CEO actions and public perception can strongly impact a stock’s performance and sales—especially in consumer-focused industries like auto.

- Market Trends Are Fluid: A brand at the top (like Tesla) can quickly lose ground to competitors by failing to innovate or respond to consumer sentiment.

- Region-Specific Strategies: Understanding geographic market trends (such as Europe’s affinity for affordable EVs) helps identify promising investments.

How to Research and Buy EV Shares

Track Sales and Market Data

Use official sources like the European Automobile Manufacturers’ Association (ACEA), automaker investor relations sites, and leading financial news publications.

Analyze Stock Trends

Review historic share price movements for both Tesla (TSLA) and BYD (1211.HK or BYDDY OTC ADR) across major exchanges. Assess volatility, 52-week highs and lows, and analyst coverage.

Evaluate Company Reports and News

Study earnings releases, competitor positioning, and CEO statements. Pay attention to macro factors: tax policies, government incentives, and expanding tech (such as hybrid and battery innovations).

Choose a Reputable Broker

Opt for platforms with robust research tools and user-friendly interfaces (e.g., E*Trade, Fidelity, Interactive Brokers).

Diversify

Never bet on a single company. Consider EV ETFs that include Tesla, BYD, Nio, and others for broader coverage and reduced risk.

Steps for Beginners: Investing in the EV Market

Understand the EV Landscape

Study the competitive environment—major players, innovations, and trends in each region.

Open a Brokerage Account

Select an account with access to the U.S., Chinese, and European markets, depending on the stocks of interest. Go through KYC procedures and fund your account.

Research Companies

Read the latest news and sales reports. Focus on sales growth, market share shifts, and earnings guidance. Track share price movement and volatility.

Place Your First Order

Use simple “buy” orders for long-term positions. Set stop-loss orders if you want to limit downside risk.

Monitor and Adjust

Revisit your portfolio regularly (monthly/quarterly) to adapt to new market developments, such as those affecting Tesla and BYD in 2025.

Market Outlook: Risks and Opportunities

For Tesla

- Short-term: Continued pain in Europe; brand damage and political backlash could linger.

- Mid-term: Watch for new model launches, management changes, and tech breakthroughs.

- Long-term: As macro trends favor electrification, Tesla must restore its European image and innovate to regain share.

For BYD

- Short-term: Accelerated growth, but at risk of future regulatory headwinds (EU anti-dumping investigations on Chinese cars are looming).

- Mid-term: Greater brand recognition in Europe, but must expand service and support networks fast.

- Long-term: If BYD sustains growth, it may become a household name in global EVs.

Conclusion

For investors new to the share market, Tesla’s 40% European plunge and BYD’s record growth are a lesson in the volatility and dynamism of the EV space. Brand perception, localized strategy, political factors, and innovation collectively move not only sales but stock prices—sometimes with dramatic consequences.

Emerging data from July-August 2025 offers both a warning and an opportunity: don’t rely solely on a company’s past prestige. Stay alert to consumer sentiment, market share shifts, and competitive moves to make the most informed investment decisions possible.