Tata Chemicals Share is in a bullish trend in the share market. During share ups and downs, you should know all about the share details before investing. In this blog, we are going to discuss the Tata Chemicals Share Price Target 2025, 2026, 2028, 2030, 2035. We will try to analyze the share base in the company’s overall performance.

We also look at the company’s profit growth in the last 5 years, the last 5 years’ sales growth, and the last 5 years’ ROE percentage. Similarly, we also compare the share growth, the share price return, amount whether the share has increased or decreased over the last 5 years. We also take advice from experts about when we should invest in the share, which may be helpful for you. Let’s have a look at the Tata Chemicals Share Price Target from 2025 to 2035.

Overview Of Tata Chemicals Limited

Tata Chemicals Limited is a sustainable chemistry solutions company, harnessing science and innovation to drive long-term growth and value creation for all its stakeholders. The company was established in the year 1939. The headquarters of the company is situated in Mumbai and operates across India, Europe, North America, and Africa.

Fundamental Analysis Of Tata Chemicals Limited

| Company Name | Tata Chemicals Limited |

| Market Cap | ₹24,102.38 |

| P/B | 1.69 |

| P/E | 46.28 |

| 52 Week High | ₹1,256.38 |

| 52 Week Low | ₹756.45 |

| DIV. YIELD | 1.19% |

| Book Value | ₹715.26 |

| Face Value | ₹10 |

| ROE | 2.86% |

| ROA | 2.43% |

| Current Ratio | 1.19 |

Last Few Years’ Performance Of Tata Chemicals Limited

Profit Growth

- In the last 5 years, -39.86%

- In the last 3 years, -12.25%

- In the last 1 year, -37.92%

The Net Profit of the company was ₹897 Crore in March 2024, which decreased by ₹558 Crore in March 2025. The Operating Profit of the company was ₹869 Crore in March 2024, which decreased to ₹817 Crore in March 2024.

Sales Growth

The sales growth percentage of the company in the last 5 years is described below.

- In the last 5 years, 8.69%

- In the last 3 years, 6.10%

- In the last 1 year, 1.5%

The Net Sales amount of the company was ₹4,369 Crore in March 2024, which increased to ₹4,452 Crore in March 2025.

ROE Percentage

The ROE percentage growth of the company in the last 5 years is described below.

- In the last 5 years, 4.79%

- In the last 3 years, 5.12%

- In the last 1 year, 2.96%

ROCE Percentage

The ROCE percentage growth of the company in the last 5 years is described below.

- In the last 5 years, 6.29%

- In the last 3 years, 6.10%

- In the last 1 year, 4.01%

Total Expenditure Amount

The company’s Total Expenditure was ₹958 Crore in December 2024 and increased to ₹990 Crore in March 2025.

The Net Cash Flow Amount

The Net Cash Flow amount of the company was ₹-3 Crore in March 2024, which increased to ₹21.26 Crore in March 2025.

Tata Chemicals Share Price Target 2025

Tata Chemicals Share Price Target for 2025 forecast may vary from ₹935.29 to ₹994.38.

Influencing Key Factors Of Tata Chemicals Share Price Target 2025

- Digital & AI Adoptation

- The chemical industry is experiencing a notable surge in the integration of AI technology. Generative AI, in particular, is revolutionizing material discovery, expanding time-to-market, and enhancing operational efficiencies. Key areas within the chemical industry impacted by AI adoption include Process Optimisation, Product Development, etc.

- Product Development

- AI-powered modelling and simulation tools accelerate product development and innovation within the chemical industry. Predictive modelling techniques enable virtual screening of chemical compounds, hastening the discovery of new materials, catalysts, and formulations.

- Process Optimisation

- Digitisation and AI facilitate real-time monitoring and control of chemical processes, leading to enhanced efficiency, reduce energy processes, leading to enhanced efficiency, reduced energy consumption, and optimised resource utilisation. This result is heightened productivity and decreased operational costs.

| Month | Tata Chemicals Share Price Target 2025 (1st Price Target) | Tata Chemicals Share Price Target 2025 (2nd Price Target) |

| June | ₹935.29 | ₹947.90 |

| July | ₹945.62 | ₹958.38 |

| August | ₹957.61 | ₹966.06 |

| September | ₹964.52 | ₹976.60 |

| October | ₹974.01 | ₹985.26 |

| November | ₹982.81 | ₹992.11 |

| December | ₹987.29 | ₹994.38 |

Tata Chemicals Share Price Target 2026

Tata Chemicals Share Price Target for 2026 forecast may vary from ₹996.06 to ₹1,062.26.

Influencing Key Factors Of Tata Chemicals Share Price Target 2026

- Business In India

- During the financial year 2023-24, the soda ash markets remained oversupplied in India. On a higher level, growth across end-use segments was marginal. The significant rise in import volumes resulted in lower prices. The market demand for bicarbonate, cement, and other halogen products remained healthy. Salt demand also remained stable. On the raw material cost front, coal prices softened during the year, relative to coke prices, which led to lower input costs.

- Initiatives and Development

- The company’s strengthened supply chain is achieved through an increase in container rake movements and other multi-model solutions. The company focuses on operational excellence, automation, and digitalisation projects for improvment and efficiency enhancement remained unwavering.

- Business in the USA

- North America witnessed a positive Soda Ash market, aided by stable local demand and recovery in the export market. The production process used in the USA for manufacturing natural soda ash is more environmentally friendly, requiring lower amounts of energy and emitting less carbon dioxide. Compared with other regions, the energy costs in the country are expected to remain lower, and both coal and natural gas prices are expected to be stable over the course of the financial year 2024.

| Month | Tata Chemicals Share Price Target 2026 (1st Price Target) | Tata Chemicals Share Price Target 2026 (2nd Price Target) |

| January | ₹996.06 | ₹1,007.36 |

| February | ₹1,005.23 | ₹1,016.52 |

| March | ₹989.19 | ₹998.64 |

| April | ₹996.50 | ₹1,012.23 |

| May | ₹1,008.82 | ₹1,019.66 |

| June | ₹1,018.90 | ₹1,029.32 |

| July | ₹1,010.66 | ₹1,017.25 |

| August | ₹1,001.29 | ₹1,017.52 |

| September | ₹1,019.92 | ₹1,030.14 |

| October | ₹1,029.46 | ₹1,040.65 |

| November | ₹1,039.22 | ₹1,053.83 |

| December | ₹1,052.59 | ₹1,062.26 |

Also Read – Asian Paints Share Price Target

Tata Chemicals Share Price Target 2028

Tata Chemicals Share Price Target for 2028 forecast may vary from ₹1,125.38 to ₹1,185.67.

Influencing Key Factors Of Tata Chemicals Share Price Target 2028

- Expanding Market Presence In Bicarbonate

- With increased production, the company is working on further improving the company’s market footprint across the regions and developing new application areas, like Flue Gas Desulfurisation. The emerging application not only expands the market for Biocarb but also helps in reducing pollution. The company is also engaging with various thermal power plants to assist in the endeavour.

- Revenue Amount

- The company’s revenue amount was ₹16,790 Crore in the year 2022-23, which decreased to ₹15,428 Crore in the year 2023-24. The company’s PAT margin was 15% in the year 2022-23, which decreased to 3% in the year 2023-24.

- Exceptional Customer Value Proposition

- The company has materials expertise for technical and application support. The company’s quick and assured supply, being the only silica plant in the major automobile hub in South India. The company’s customised products and packaging are designed to address customer demand and provide better logistics advantages.

| Month | Tata Chemicals Share Price Target 2028 (1st Price Target) | Tata Chemicals Share Price Target 2028 (2nd Price Target) |

| January | ₹1,125.38 | ₹1,137.92 |

| February | ₹1,134.09 | ₹1,142.61 |

| March | ₹1,105.18 | ₹1,112.25 |

| April | ₹1,110.25 | ₹1,122.61 |

| May | ₹1,109.67 | ₹1,120.72 |

| June | ₹1,090.71 | ₹1,104.38 |

| July | ₹1,107.19 | ₹1,117.91 |

| August | ₹1,118.35 | ₹1,130.67 |

| September | ₹1,132.09 | ₹1,148.68 |

| October | ₹1,149.18 | ₹1,160.91 |

| November | ₹1,162.48 | ₹1,170.14 |

| December | ₹1,172.29 | ₹1,185.67 |

Tata Chemicals Share Price Target 2030

Tata Chemicals Share Price Target for 2030 forecast may vary from ₹1,250.38 to ₹1,311.73.

Influencing Key Factors Of Tata Chemicals Share Price Target 2030

- Manufacturing Units

- The company has a total of 15 manufacturing units located in 4 countries. Mithapur plant is one of its kind globally, having integrated manufacturing across Sodium derivatives. Natural Soda Ash production (in the US and Kenya) has a cost advantage over synthetic Soda Ash and has lower energy usage and carbon intensity. Rails India is amongst India’s leading manufacturing of Agrochemicals and Seeds. The company’s value chain extension into specialty Silica manufacturing.

- Sales and Marketing

- The company’s dedicated product development team works in collaboration with large customers. The complete range of farm solutions and value-added services (crop and weather advisory, and farm mechanisation). The company presence in 80% of India’s districts through 6,800 dealers and 93,000 retailers (Rallis India).

- Product Safety and Quality

- Tata Chemicals conducts risk assessments to ensure that its products are safe to be handled by customers and other end users. The company collaborates with stakeholders on reciprocal projects to promote product and operational safety. The company has prioritised the delivery of customer satisfaction for all the company’s products. The company’s products are designed, manufactured, and supplied to meet all safety and regulatory requirements.

| Year | Tata Chemicals Share Price Target 2030 |

| 1st Price Target | ₹1,250.38 |

| 2nd Price Target | ₹1,311.73 |

Tata Chemicals Share Price Target 2035

Tata Chemicals Share Price Target for 2035 forecast may vary from ₹1,501.92 to ₹1,551.68.

Influencing Key Factors Of Tata Chemicals Share Price Target 2035

- Agrochemicals & Seeds

- The company focused on safer formulation developments (e.g., water-based based vegetable oil-based, non-solvent-based). The company’s exploration of a bio-based reaction system for synthesising the products linked to the biological origin. The company also tries to develop efficient solvent recovery and recycling of reagents across all projects to achieve the process chemistry targets.

- Expanding Product Portfolio

- The company customised HDS products for PCR/TBR and other radial tyre applications. Some new product developments for battery, defoamers, polymers, and the personal care industry will also be a part of the company’s products. The company also imports a substitute for silicone rubber grade silica.

- R&D Department

- The company is also involved in the continuous development of new formulations for FOS applications. Co-creation of customised solutions for silica and the company’s strong R&D, from formulations to AI, for agri-products.

| Year | Tata Chemicals Share Price Target 2035 |

| 1st Price Target | ₹1,501.92 |

| 2nd Price Target | ₹1,551.68 |

Peer Company Of Tata Chemicals Limited

| Company Name | Market Cap (Crore) |

| Chambal Fert | ₹21,762.39 |

| Coromandel Int | ₹68,970.60 |

| Fert and Chem | ₹66,854.29 |

| Monsanto India | ₹3,839.93 |

| NFL | ₹5,337.30 |

| NFL | ₹5,337.92 |

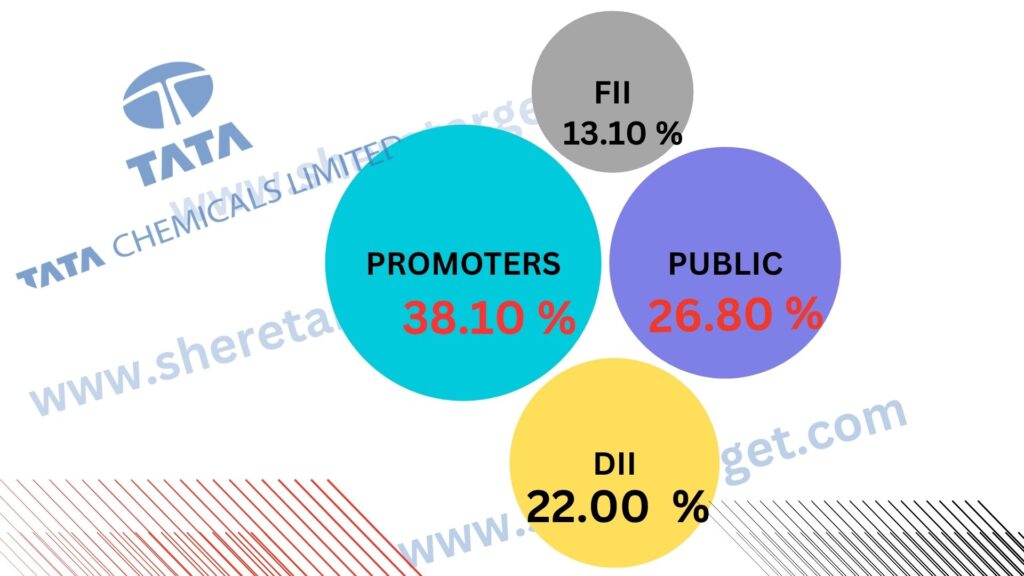

Discussion About Shareholding Pattern Of Tata Chemicals Limited

Tata Chemicals Limited mainly has four types of shareholding patterns, such as promoter holding, public holding, DII, and FII. Depending on the shareholding pattern, we can majorly influence the company’s growth.

| Investor Type | Percentage |

| Promoter Holding (Owned by the company’s promoter) | 38.10% |

| Public Holding (Held by the public) | 26.80% |

| FII (Invest by Foreign Institutional Investor) | 13.10% |

| DII (Invest money by Domestic Institutional Investor) | 22.00% |

What Is The Expert Advice About The Investment In Tata Chemicals Share

Positive Sides

- The company has an efficient cash conversion cycle of -45.10 days.

- The company has a good cash flow managment, PAT stands at 1.05.

Negative Sides

- In the last 3 years, the company has had poor profit growth, which was -12.25%.

- In the last 3 years, the company’s revenue growth was poor, which was 6.10%.

- In the last 3 year’s the company’s ROE ratio was poor, which was 5.12%.

- The company is trading at a high PE ratio of 46.29%.

- In the last 3 year’s the company’s ROCE ratio was poor, which was 6.10%.

Risk Factors Of Tata Chemicals Limited

- Recession Risk

- Recession is fuelled by rising interest rates, impacting demand and price.

- Digitalisation Risk

- Embracing digitalisation as a key lever of business growth.

- High Energy Costs, Risk & Supply Chain Constraints

- High energy costs (high prices of energy sources like oil, natural gas, and coal will impact variable costs) & supply chain constraints (higher freight and longer delivery cycles).

- International debt risk

- Managing international debt & tightening interest rates may affect the company’s profit growth.

The Last Few Years’ Share Price Updation Of Tata Chemicals Share

Tata Chemicals Share always gives good returns to investors, which is described in the portion below.

- The last 1 month’s share growth was +143.30 (17.53%).

- The last 6 months’ share growth was -145.45 (-13.15%).

- The last 1 year’s share growth was -125.40 (-11.55%).

- The last 5 years’ share growth was +648.85 (208.13%).

- Tata Chemicals’ share price return percentage was 17.52% in the last 1 month.

- The last 3 months’ share price return percentage was 17.9%.

- The last 1 year’s share price return percentage was -9.10%.

- The last 3 years’ share price return percentage was 2.0%.

- The last 5 years’ share price return percentage was 207.3%.

Also Read – Varun Beverages Share Price Target

What is the Tata Chemicals Share Price Target for 2025?

Tata Chemicals Share Price Target for 2025 is ₹935.29 to ₹994.38.

What is the Tata Chemicals Share Price Target for 2026?

Tata Chemicals Share Price Target for 2026 is ₹996.06 to ₹1,062.26.

What is the Tata Chemicals Share Price Target for 2028?

Tata Chemicals Share Price Target for 2028 is ₹1,125.38 to ₹1,185.67.

What is the Tata Chemicals Share Price Target for 2030?

Tata Chemicals Share Price Target for 2030 is ₹1,250.38 to ₹1,311.73.

What is the Tata Chemicals Share Price Target for 2035?

Tata Chemicals Share Price Target for 2035 is ₹1,501.92 to ₹1,551.68.

Conclusion

This website is written to help the investor gain some basic knowledge about the market strategy of Tata Chemicals Share. For making this blog, we take consultation from experts and research the company. It is expected that the Tata Chemicals Share Price Target will be a good choice to invest in on a long-term basis. The demand for the chemical manufacturing sector in India and outside of the country always increases, as a result of which the company and its share may increase rapidly.

FAQ

We try to give an in-depth idea about the share. If you think it is helpful to you, you can share it. If you have any questions, please let us know through the comment box. We will try to reply to your questions and solve your problem. Thanks for visiting this website and thanks for being with us.

Disclaimer – We are not SEBI-registered advisors. A financial market is always risky to anyone. This website is only for training and educational purposes. So, before investing, we are requested to discuss certified expertise. We will not be responsible for anyone’s profit or loss.