Reliance Power Share Price Analysis – July 2025

Market Update as of July 21, 2025 | Comprehensive Stock Analysis

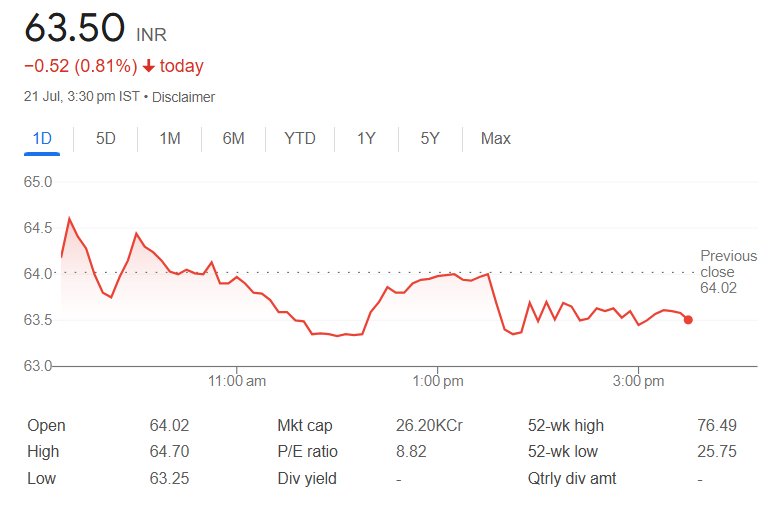

Current Price (NSE)

₹63.39

52-Week High

₹76.49

52-Week Low

₹25.75

Market Cap

₹26,270 Cr

Current Market Snapshot

| Exchange | Open | High | Low | Close | Volume |

|---|---|---|---|---|---|

| NSE | ₹64.02 | ₹64.70 | ₹63.25 | ₹63.39 | 4,434,236 |

| BSE | ₹63.61 | ₹64.89 | ₹63.00 | ₹64.00 | 1,483,503 |

The stock has shown 0.25% decline compared to previous close of ₹65.11, with moderate trading volumes.

Financial Performance Highlights

Q1 FY26 Results (April-June 2025)

- Net Profit: ₹44.68 crore (positive turnaround from losses)

- Net Sales: ₹1,885.58 crore (down 5.35% YoY)

- EBITDA: ₹704.77 crore (down 3.14% YoY)

- EPS: ₹0.11

- Debt Servicing: ₹584 crore paid in Q1

Share Performance & Returns

| Time Period | Return | Performance |

|---|---|---|

| 1 Week | -2.71% | Volatile |

| 1 Month | -0.05% | Stable |

| 3 Months | +51.96% | Strong Growth |

| 1 Year | +129.38% | Exceptional |

| 5 Years | +1,678% | Massive Rally |

Key Developments & News

- Profit Turnaround: First profitable quarter after years of losses

- Major Project Win: 350MW solar + 175MW/700MWh battery storage project awarded

- Operational Efficiency: 97% PLF at Rosa plant, 91% at Sasan

- Debt Reduction: Significant progress in deleveraging

Analyst Outlook & Valuation

| Metric | Value | Sector Average |

|---|---|---|

| P/E Ratio | 8.9 | 27.27 |

| P/B Ratio | 1.82-2.73 | 3.5 |

| Market Cap Rank | 16th in Power Sector | – |

Price Targets: Support at ₹63.66, Resistance at ₹67.99. Mid-term target range ₹76-81 if momentum continues.

Historical vs Current Performance

| Parameter | Current (2025) | Historical (2019-2024) |

|---|---|---|

| Net Profit | ₹44.68 Cr (Q1) | Frequent losses |

| EPS | ₹0.10 | Often below -₹1 |

| Sales Growth | -5.35% YoY | ~0% 5yr CAGR |

| ROE (3yr avg) | Improving | -9.59% |

Investment Considerations

Strengths

- Strong operational turnaround with profitable quarter

- Major project wins in renewable energy sector

- Significant debt reduction progress

- Attractive valuation compared to sector peers

Risks

- Flat sales growth over 5 years (~0.05%)

- History of financial volatility

- July typically negative month for stock

- High beta stock – prone to sharp swings