Raymond Ltd: What Happened After the Big Split?

Raymond Ltd, the company that dressed generations of Indians in sharp suits, made headlines in 2025 for something completely different. When the 100-year-old firm decided to split its clothing business from its real estate operations, it sent shockwaves through the stock market. Here’s what actually happened.

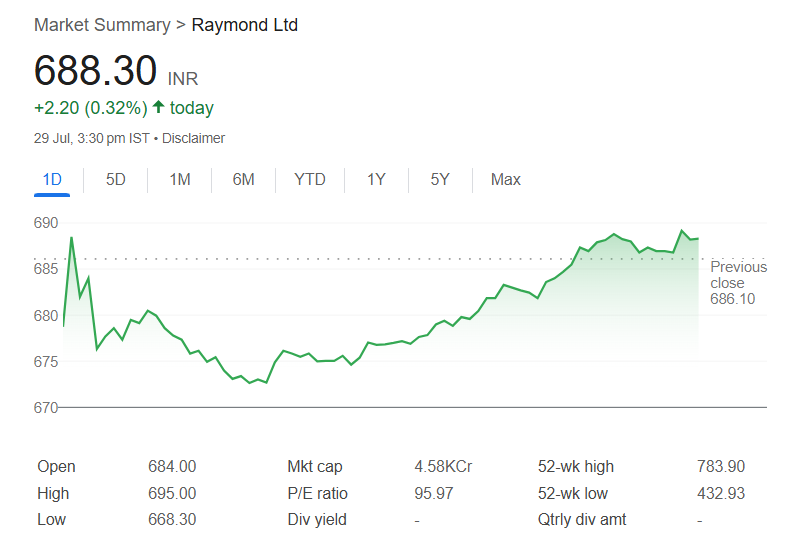

Where Raymond Stands Today

As of late July 2025, Raymond shares trade around ₹680 – a far cry from their ₹2,182 peak last year. But that drop tells only half the story. Investors who held on through the changes now own shares in two separate companies.

How We Got Here

Raymond didn’t become a real estate player overnight. The company had been quietly building this side of the business since 2019, accumulating land in Mumbai’s Thane district worth thousands of crores.

Raymond’s board gives the green light to separate the real estate business

Shareholders get 1 Raymond Realty share for each Raymond share they own

The big drop: Raymond’s stock falls 66% overnight as the split takes effect

Raymond Realty begins trading at ₹1,000 per share

That Scary 66% Drop Explained

When Raymond’s stock price collapsed in May, many investors panicked. But this wasn’t like other stock crashes we’ve seen.

It Was Just Math

Imagine you have a ₹100 note. If you exchange it for two ₹50 notes, you haven’t lost money – you just have your wealth in different forms. That’s essentially what happened with Raymond’s shares.

The “missing” value didn’t vanish – it moved to the new Raymond Realty shares that investors received.

What Happened Next

After the initial shock, both stocks began finding their footing:

| Date | What Happened | Raymond Stock | Raymond Realty |

|---|---|---|---|

| May 15 | First trading after split | +6% | Not yet trading |

| June 30 | Before Realty listing | +15% | IPO priced at ₹1,039 |

| July 1 | Realty debut | +8% | Opens at ₹1,000 |

Two Companies Now

The Original Raymond

What remains in the main company:

Textiles Engineering Auto parts

Good news: Their engineering business is growing fast after buying Maini Precision, with sales doubling last year.

Bad news: Overall profits dipped slightly to ₹52 crore from ₹54 crore the year before.

Raymond Realty

The new real estate company started strong:

100 acres in Thane ₹636 crore sales last quarter

With properties that could be worth ₹40,000 crore when fully developed, this is now the exciting part of the old Raymond business.

What Experts Are Saying

“We think Raymond could reach ₹903 in a year,” says Antique Stock Broking, pointing to the company’s focus on precision engineering components for cars and aircraft.

Other analysts warn that building all those apartments and offices won’t be easy, especially if the economy slows down.

By the Numbers

| Time Period | Price Change | What It Means |

|---|---|---|

| Last 5 Years | +183% | Long-term investors still ahead |

| Last 1 Year | -66.5% | Mostly due to the split |

| Last 3 Months | -54% | Adjusting to new structure |

| Last 1 Month | +9.6% | Starting to recover |

What This Means for Investors

- That huge price drop wasn’t a crash – it was just accounting

- You’re now invested in two different businesses with separate futures

- The real estate part could be big, but has risks

- The original company is becoming more focused on industrial products

- Most analysts think there’s room for the stock to grow from here

Raymond’s story shows how even well-established companies can change dramatically. While the transition has been bumpy, the company’s century of experience suggests it may yet make this transformation work.