Patel Engineering Share is a bullish trend in the share market. During share ups and downs, you should know all about share details before investing. In this blog, we are going to discuss Patel Engineering Share Price Target 2025, 2027, 2028, 2030, 2040. We will try to analyze the share base in the company’s overall performance.

We also look after the company’s profit growth in the last 5 years, the last 5 year’s sales growth, and the last 5 years’ ROE percentage similarly we also compare the Patel Engineering Share growth, the share price return amount of the share become increasing or decreased through the last 5 year’s. We also take advice from experts about which time we should invest in the share it may be helpful for you also. Let’s have a look at Patel Engineering Share Price Target from 2025 to 2040.

Overview Of Patel Engineering Limited

Patel Engineering Limited was established in the year 1949. It is one of the major infrastructure and construction services companies in India. The company is mainly attached to the infrastructure industry from dams, tunnels, highways, roads, bridges, railways, refineries, irrigation projects, real states, and townships. The company has a power generation capacity of up to 8000 MW and has a tunnel manufacturing history of 180 km.

Fundamental Analysis Of Patel Engineering Limited

| Company Name | Patel Engineering Limited |

| Market Cap | ₹4,315.78 Crore |

| Book Value | ₹42.78 |

| Face Value | ₹1 |

| 52 Week High | ₹80 |

| 52 Week Low | ₹41.99 |

| P/B | 1.3 |

| DIV. YIELD | 0% |

Some Basic Performance Of Patel Engineering Limited

When we want to analyze the overall company’s performance, we should gather some basic data about the company, such as the PE Ratio, Current Ratio, ROA percentage, and ROE Percentage. Through these parameters, we can easily calculate the company’s performance.

| PE Ratio | Current Ratio | Return On Assets (ROA)% | Return On Equity (ROE)% | Operating Margin |

| 19.50 | 1.45 | 3.48% | 9.53% | 15.09% |

Dividend History Of Patel Engineering Limited

| Year | Dividend Medium | Dividend Amount Per Share |

| 2012 | Final | ₹0.30000 (30%) |

| 2011 | Final | ₹1.0000 (100%) |

| 2010 | Interim | ₹2.0000 (200%) |

| 2009 | Final | ₹0.95000 (95%) |

| 2008 | Final | ₹0.2000 (20%) |

Patel Engineering Share Price Target 2025

In the year 2024, the company’s total project number is 49. The order book amount is ₹1,86,631 Mn. The company’s CAGR amount was ₹2,09,068 Mn year 2023 which became ₹1,86,631 Mn in the year 2024. In recent times in India, total Hydropower projects have been 18,000 MW under which the company is involved in the construction of 8000 MW. Tunneling projects range from road and rail tunnels to unity and water conveyance tunnels, each requiring meticulous planning and execution to ensure structural integrity and safety. If we look at the Patel Engineering Share Price Target 2025 forecast, the 1st Price Target is ₹57.25 and the 2nd Price Target is ₹68.36.

| Year | Patel Engineering Share Price Target 2025 |

| 1st Price Target | ₹57.25 |

| 2nd Price Target | ₹68.36 |

Patel Engineering Share Price Target 2027

In the financial year 2023, 8% of revenue came from Hydroelectric Power, 21% of revenue came from tunnel construction, 13% of revenue came from Irrigation, 6% of revenue came from road construction, 52% of revenue came from HydroEnergy, and 8% of revenue came from other section. The company also works on the construction of various water tunneling projects, in Maharashtra. Microtunneling & Pipe Jacking for water in Maharashtra, indoor sports stadium, Surat- Gujarat. If we look at the Patel Engineering Share Price Target 2027 forecast, the 1st Price Target is ₹74.89 and the 2nd Price Target is ₹85.99.

| Year | Patel Engineering Share Price Target 2027 |

| 1st Price Target | ₹74.89 |

| 2nd Price Target | ₹85.99 |

Also Read – Cochin Shipyard Share Price Target

Patel Engineering Share Price Target 2028

In recent times Patel Engineering Company has spread its business over 15 different states. The total working tunnel amount is more than 300 Km, the total dam number is 87, and the total road amount is more than 1200 Km. The KWAR Hydroelectric project is a significant infrastructure located in Jammu Kashmir which has a generation capacity of 1,976.54 million units. The company achieved a major milestone by reaching a total length of 698 meters by the year 2023. If we look at the Patel Engineering Share Price Target 2028 forecast, the 1st Price Target is ₹84.56 and the 2nd Price Target is ₹92.30.

| Year | Patel Engineering Share Price Target 2028 |

| 1st Price Target | ₹84.56 |

| 2nd Price Target | ₹92.30 |

Patel Engineering Share Price Target 2030

In India, transportation-related infrastructure has expanded. The Patel Engineering Company is also included in it. The project also includes the Sela bi-lane road tunnel which is located at the highest elevation of 13,000 ft above sea level and 25 km long East-West corridor in Assam. The shareholder’s funds amount was ₹28,880.57 Million in the year 2023 which increased to ₹31,537.20 Million in the year 2024. If we look at the Patel Engineering Share Price Target 2030 forecast, the 1st Price Target is ₹103.78 and the 2nd Price Target is ₹112.49.

| Year | Patel Engineering Share Price Target 2030 |

| 1st Price Target | ₹103.78 |

| 2nd Price Target | ₹112.49 |

Patel Engineering Share Price Target 2040

Patel Engineering Company achieved significant growth in the year 2024. The company’s consolidated revenues from operations increased by 16.9% to ₹45,442.10 million which was ₹38,925.52 million in the year 2023. The standalone revenues increased by 15.62% to ₹44,125.62 million compared to ₹38,172.52 million in the year 2023. The debt-to-equity ratio was 0.60% in the year 2023 which amount is the same as 0.60% in the year 2024. If we look at the Patel Engineering Share Price Target 2040 forecast, the 1st Price Target is ₹215.57 and the 2nd Price Target is ₹228.41.

| Year | Patel Engineering Share Price Target 2040 |

| 1st Price Target | ₹215.57 |

| 2nd Price Target | ₹228.41 |

The Few Year’s Performance Of Patel Engineering Limited

Profit Growth

The company’s last 5 year’s profit growth percentage is described in the below portion.

- In the last 5 years 28.09%

- In the last 3 years 60.01%

- In the last 1 year 84.01%

The Net Profit amount of the company was ₹156.12 Crore in March 2023 which increased to ₹286.01 Crore in March 2024. The operating profit amount of the company was ₹541.01 Crore in March 2023 which increased to ₹621.23 Crore in March 2024.

Sales Growth

The last 5 year’s Sales growth percentage of the company is described in the below portion.

- In the last 5 years 15.91%

- In the last 3 years 37.85%

- In the last 1 year 17.95%

The Net Sales amount of the company was ₹1,091.52 Crore in June 2023 which decreased to ₹1,085.45 Crore in June 2024.

ROE Percentage

The company’s last 5 year’s ROE percentage is described below.

- In the last 5 years 2.73%

- In the last 3 years 5.94%

- In the last 1 year 9.54%

ROCE Percentage

The company’s last 5 year’s ROCE percentage is described below.

- In the last 5 years 10.58%

- In the last 3 years 13.52%

- In the last 1 year 15.87%

Total Expenditure Amount

The Total Expenditure amount of the company was ₹2,957.85 Crore in March 2023 which increased to ₹3,498.23 Crore in June 2024.

Total Assets Amount

The Total Assets amount was ₹8,083.14 Crore in March 2023 which increased to ₹8,691.85 Crore in March 2024.

The Net Cash Flow Amount

The Net Cash Flow amount of the company was ₹-38.12 Crore in March 2023 which increased to ₹15.95 Crore in March 2024.

Total Liabilities

The Total Liabilities amount of the company was ₹8,0942.12 Crore in March 2023 which increased to ₹8,695.23 Crore in March 2024.

Also Read – Ambuja Cement Share Price Target

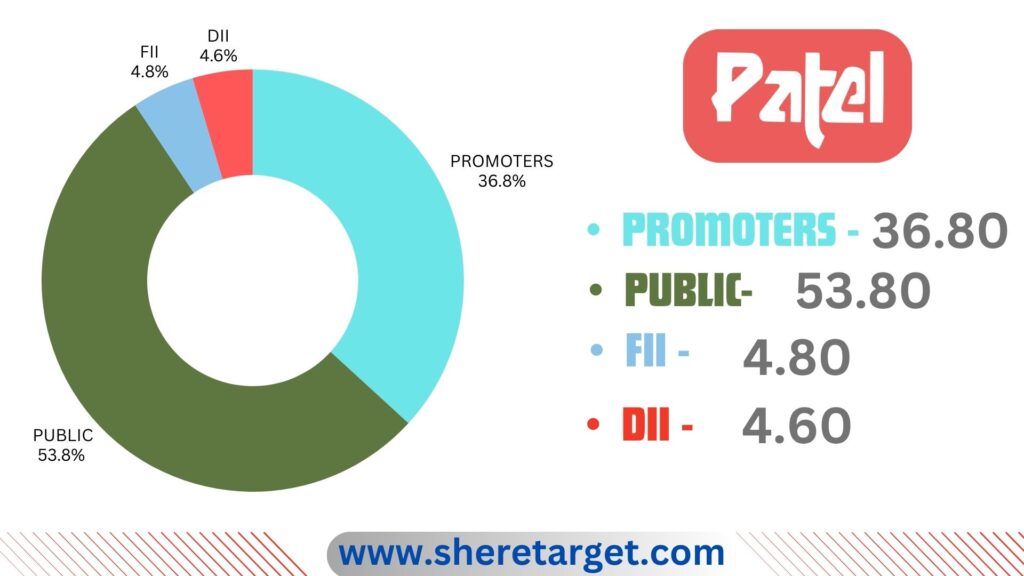

Discussion About Share Holding Pattern Of Patel Engineering Limited

Patel Engineering Limited mainly has four types of shareholding patterns such as promoter holding, public holding, DII, and FII. We can majorly influence the company’s growth depending on the shareholding pattern.

Promoter Holding

Promoter Holding capacity is the percentage of the share owned by the company’s promoter or the company’s owner. The Promoter Holding Capacity in the company’s share is 36.80%.

Public Holding

Public Holding capacity is the indicator of the percentage that is held by the public rather than the promoters. The public holding capacity of the company’s share is 53.80%.

FII

The full form of FII is Foreign Institutional Investor which invests funds from outside of its home country. The FII investor percentage in the company’s share is 4.80%.

DII

The full form of DII is Domestic Institutional Investor which means some Indian Institutes like mutual funds, insurance companies, and pension funds invest money in the country’s assets. The DII investor percentage in the company’s share is 4.60%.

Peers Company Of Patel Engineering Limited

| Company Name | Market Cap(Crore) |

| Aadhar Housing | ₹17,796.58 |

| Adhbhut Infra | ₹26.85 |

| Advait Infratec | ₹1,716.68 |

| ARSS Infra | ₹40.12 |

Patel Engineering Share Price Target Prediction In The Last Few Years

For the last few years, Patel Engineering Share increased rapidly. The last 6 months’ share growth was -11.78 (-18.42 %), the last 1 month’s share growth was -8.22 (-13.56%), the last 1 year’s share growth was +5.69 (12.52%), the last 5 year’s share growth was +41.30 (375.35%) and the maximum share growth was -35.64 (-40.25%).

Patel Engineering Share Price return percentage was -17.25% in the last 1 month, the last 3 month’s share price return percentage was -14.99%, the last 1 year’s share price return percentage was 7.46%, the last 3 year’s share price return percentage was 105.13%, the last 5 year’s share price return percentage was 353.59%. It is predicted that Patel Engineering Share will be profitable on a long-term investment basis.

Should I invest in Patel Engineering share right now?

Positive Sides

- The last 3 year’s profit growth was very good which was 60.01%.

- The revenue growth of the company was very good which was 38.01%.

- The company’s PEG ratio is 0.45.

- The company has good cash flow management, PAT stands at 4.91.

- The company’s sales growth was good which was 37.85% in the last 3 years.

Negative Sides

- The ROE ratio of the company was very poor which was 5.94% in the last 3 years.

- The promoter pledging capacity of the company is very high was 88.95%.

- The FII investor ratio of the company should be high which is 4.80%.

What Is The Future Growth Of Patel Engineering Limited?

Strength

- The company leverages experience in hydropower projects and urban infrastructure segments which is also supported by the Indian Government.

- The company also capitalizes on new technologies to execute projects and expand its knowledge base.

- The company also owns assets in the power, real estate, and road sectors by completing different projects in different states.

- India started to begin in real state and also started to the development of urban and rural areas so the company will be more developed in the future time.

- The sales and profit growth of the company are also very good so it will be profitable to invest in the share on a long-term basis.

Weakness

- Any changes in government policies may affect the company’s growth.

- There are many competitor companies in the same industry which may affect the company’s growth.

Also Read – TVS Motor Share Price Target

FAQ

What is Patel Engineering Limited’s main function?

The company mainly works for the construction of dams, tunnels, hydroelectric power projects, micro-tunnels, roads, bridges, highways, malls, etc.

Who is the CEO of Patel Engineering Share?

Mr. Janky Patel is the CEO of Patel Engineering Share.

What is the Patel Engineering Share Price Target for 2024?

Patel Engineering Share Price Target for 2024 is ₹51.24 to ₹60.95.

What is the Patel Engineering Share Price Target for 2025?

Patel Engineering Share Price Target for 2025 is ₹57.25 to ₹68.36.

What is the Patel Engineering Share Price Target for 2027?

Patel Engineering Share Price Target for 2027 is ₹74.89 to ₹85.99.

What is the Patel Engineering Share Price Target for 2028?

Patel Engineering Share Price Target for 2028 is ₹84.56 to ₹92.30.

What is the Patel Engineering Share Price Target for 2030?

Patel Engineering Share Price Target for 2030 is ₹103.78 to ₹112.49.

What is the Patel Engineering Share Price Target for 2040?

Patel Engineering Share Price Target for 2040 is ₹215.57 to ₹228.41.

Conclusion

This website is written to help the investor gain some basic knowledge about the market strategy of Patel Engineering Share. For making this blog we take consultation from expertise and doing research about the company. It is expected that the Patel Engineering Share Price Target will be a good choice to invest in on a long-term basis. The construction sectors in India and outside of the country always increase as a result of the company and the share may increase rapidly.

We try to give an in-depth idea about the share. If you think it is helpful to you you can share it. If you have any questions please let us know through the comment box we will try to reply to your questions and solve your problem. Thanks for visiting this website and thanks for being with us.

Disclaimer – We are not SEBI-registered advisors. A financial market is always risky to anyone. This website is only for training and educational purposes. So before investing, we are requested to discuss certified expertise. We will not be responsible for anyone’s profit or loss.