If you’ve been following Micron Technology’s stock journey, you know it’s been anything but boring. From near-bankruptcy lows to AI-driven highs, MU has delivered the kind of volatility that either makes fortunes or breaks hearts. Here’s the complete story of where it’s been, where it stands, and where it might be heading.

Current Stock Position: Riding Near All-Time Highs

Current Stock Price: $157.23 (as of September 12, 2025) All-Time High: $158.28 (reached September 12, 2025) 52-Week Range: $61.54 – $129.85 Market Performance: Up 34.99% over the past 12 months

Let’s be clear: Micron is trading near its historical peak right now. The stock has hit all-time highs this month, which means anyone buying today is paying premium prices for a company that’s seen dramatic swings throughout its history.

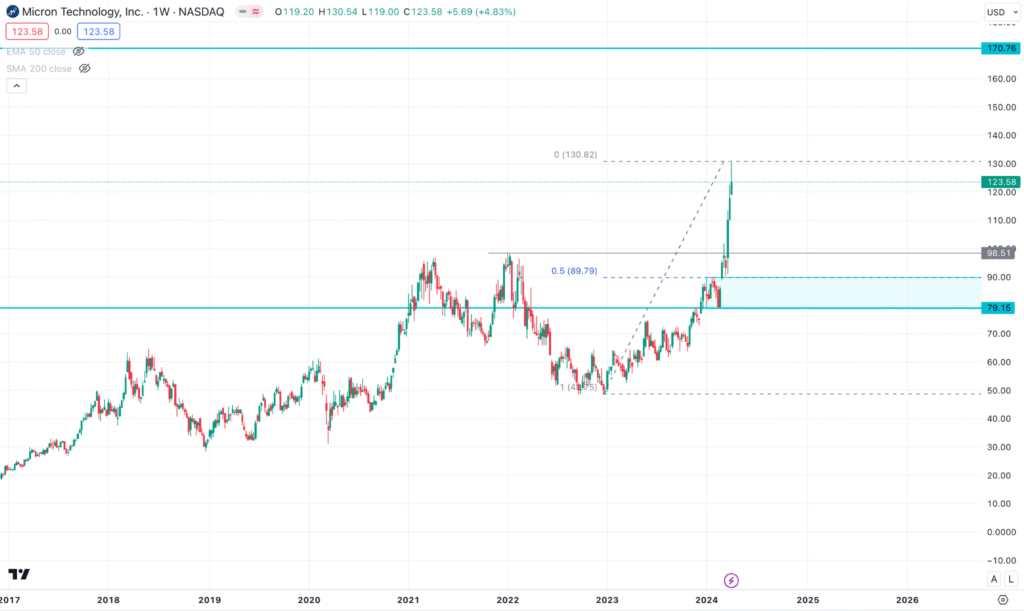

The Historical Rollercoaster: From $0.34 to $158

Micron’s stock history reads like a masterclass in semiconductor cyclicality. The stock hit its all-time low of $0.34 in December 1986, shortly after going public. But that’s ancient history compared to the modern drama.

The Boom-Bust Cycles:

- 2000 Dot-Com Peak: Like most tech stocks, MU soared during the internet bubble

- 2008 Financial Crisis: Memory demand collapsed, stock plummeted

- 2010-2018 Recovery: Gradual recovery with multiple ups and downs

- 2018-2019 Trade War Impact: China trade tensions hammered the stock

- 2020-2022 Pandemic Volatility: Initial crash, then recovery as tech demand surged

- 2022-2023 Memory Downturn: Another cyclical low as demand cooled

- 2024-2025 AI Boom: Current rally driven by artificial intelligence memory demands

The pattern is clear: Micron’s stock moves in dramatic cycles tied to memory demand, economic conditions, and now AI trends.

Present Situation: AI-Driven Renaissance

Strong Financial Performance: The company’s recent results show the power of AI-driven demand:

- Q1 2025 revenue: $8.71 billion (up from $4.73 billion year-over-year)

- GAAP net income: $1.87 billion ($1.67 per share)

- Operating cash flow: $3.24 billion

The AI Memory Goldmine: With AI advancement, there’s high demand for High Bandwidth Memory (HBM) devices for AI data centers. The company has already sold out its HBM supply for 2025, showing just how hot this market is.

Market Position: Data center markets now represent 55% of Micron’s revenue, positioning the company perfectly for the AI infrastructure buildout happening globally.

Future Predictions: The Bull and Bear Cases

The Bull Case: AI Demand Explosion

Analysts are raising price targets, with some setting $175 targets and EPS estimates 26% above consensus. Here’s why bulls are excited:

- HBM Market Dominance: Micron is one of only three companies (alongside Samsung and SK Hynix) that can produce high-bandwidth memory critical for AI chips

- Supply Constraints: Already sold out HBM inventory for 2025 creates pricing power

- Data Center Growth: Continued memory upturn driven by better-than-expected data center demand

- Margin Expansion: Company maintains healthy gross margin of 34.73%

Price Targets from Analysts:

- Bullish Target: $175 (11% upside from current levels)

- Conservative Estimates: $150-160 range

The Bear Case: Cyclical Reality Check

The semiconductor industry, particularly memory, is highly cyclical, and several factors could derail the rally:

- AI Demand Sustainability: Risks include AI demand slowdown and cyclical pressures

- Competition Intensifies: Aggressive competitors could pressure margins even amid surging demand

- Market Weakness: Weakness in NAND market and softer consumer-oriented DRAM demand

- Valuation Concerns: At all-time highs, the stock has limited margin for disappointment

Risk Analysis: What Could Go Wrong

High-Risk Factors:

- Market Cyclicality: Memory market cyclicality remains the biggest long-term risk. When cycles turn, they turn hard.

- Competition: Samsung and SK Hynix are formidable competitors with similar capabilities. Market share battles could pressure margins.

- AI Demand Volatility: If AI infrastructure spending slows or shifts, Micron’s core growth driver disappears.

- Geopolitical Risks: China tensions, export controls, and supply chain disruptions remain ongoing threats.

- Valuation Risk: Trading near all-time highs leaves little room for execution mistakes or market disappointments.

Medium-Risk Factors:

- Inventory Cycles: Memory companies must balance supply and demand precisely. Overproduction leads to price crashes.

- Capital Intensity: Semiconductor manufacturing requires massive ongoing capital investments that can pressure cash flow.

- Technology Transitions: Failure to keep pace with memory technology evolution could lose market position.

Safety Analysis: Is MU a Safe Investment?

The Honest Assessment: Micron is not a “safe” stock in traditional terms. Here’s the reality:

Financial Stability: ✅ Strong

- Solid balance sheet with manageable debt

- Strong cash generation capabilities

- Diversified customer base

Business Model Stability: ⚠️ Moderate Risk

- Highly cyclical industry with boom-bust patterns

- Dependent on technology capex cycles

- Subject to global economic fluctuations

Competitive Position: ✅ Strong

- One of only three major HBM producers globally

- Technology leadership in memory solutions

- Strong relationships with major tech companies

Valuation Safety: ❌ High Risk

- Trading at all-time highs

- Limited downside protection at current prices

- High expectations already priced in

Investment Strategy: How to Approach MU

For Aggressive Investors: If you believe in the AI revolution and can stomach volatility, MU offers significant upside potential. AI-driven growth outlook justifies a bullish stance for risk-tolerant investors.

For Conservative Investors: Wait for a pullback. Memory stocks always cycle, and buying at all-time highs rarely ends well for conservative money.

For Dollar-Cost Averaging: MU could work for systematic investing if you can handle 30-50% drawdowns during cyclical downturns.

Position Sizing Recommendations:

- Aggressive portfolios: Up to 5-7% allocation

- Moderate portfolios: 2-3% allocation maximum

- Conservative portfolios: Consider waiting or avoiding entirely

Key Dates and Catalysts to Watch

Immediate Catalysts:

- Fiscal Q4 2025 earnings report on September 23, 2025

- AI infrastructure spending guidance updates

- HBM production capacity announcements

Medium-Term Catalysts:

- 2026 memory market outlook

- Competition from Samsung/SK Hynix developments

- AI demand sustainability indicators

The Bottom Line: Opportunity with Serious Risk

Micron represents one of the purest plays on AI infrastructure demand, but it comes with semiconductor cyclicality baggage. The stock has delivered massive returns for those who bought during the 2022-2023 downturn, but today’s buyers are paying premium prices.

The Trade-Off:

- Upside: Significant if AI demand continues growing

- Downside: Substantial when (not if) the memory cycle turns

Final Verdict: MU is a high-risk, high-reward stock that’s not suitable for conservative investors. If you’re buying today, you’re betting that AI demand will continue exceeding supply, maintaining pricing power and margins. That could work—but history suggests memory cycles always turn eventually.

For most investors, waiting for a better entry point makes more sense than chasing all-time highs. But for those willing to accept the volatility, Micron offers one of the most direct ways to profit from the AI revolution’s memory demands.

Investment Rating: High Risk, High Reward – Suitable only for aggressive investors with strong risk tolerance.