AI Overview

BETA

Current Price

₹311.55

Market Cap

₹64,743Cr

PE Ratio

40.58x

Profit Margin

33.99%

Q1 Revenue Growth

+21% YoY

Third-party Cargo

52%

Expert Price Targets by Timeline

2030: ₹850-₹962 (Bullish)

2030: ₹232-₹241 (Conservative)

Consensus: ₹1,000+

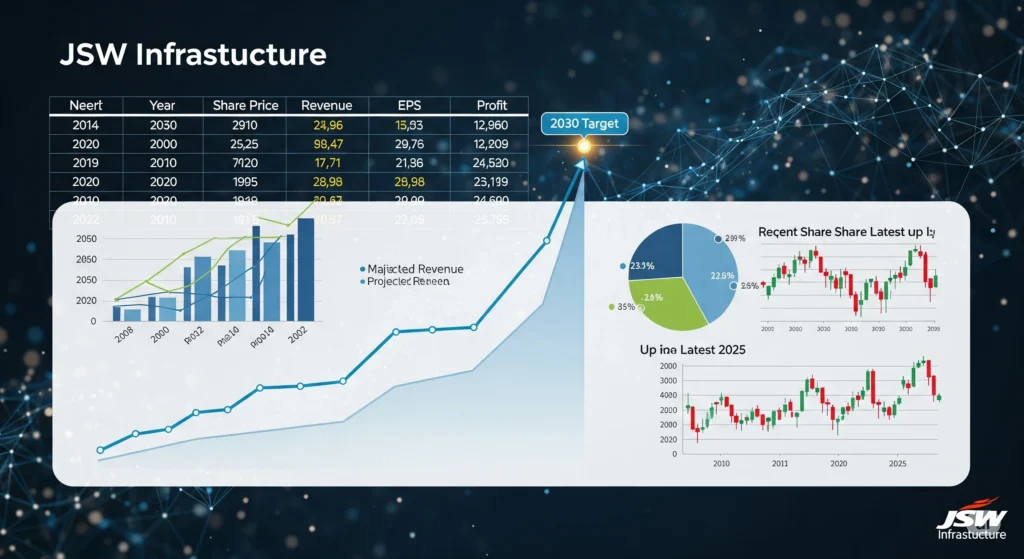

Financial Growth Trajectory

Revenue (₹Cr) PAT (₹Cr) Cargo (MT)

Revenue CAGR

19%

PAT CAGR

22%

ROE

17.17%

ROCE

15.46%

🚀 Key Growth Drivers

Leading port operator with 52% third-party cargo reducing group dependence. Industry-leading 33.99% net profit margin. Strong positioning for India’s port infrastructure expansion and trade growth.

📊 Financial Performance

Q1 FY26: Revenue +21% YoY to ₹1,224Cr, PAT +31% YoY to ₹390Cr. Cargo volume CAGR of 13% (FY20-FY25). ROE of 17.17% with consistent margin expansion.

Investment Risk Notice: High-growth infrastructure stock with premium valuation (PE 40.58x). Suitable for long-term investors comfortable with port sector cyclicality and execution risks.

Sources & References

🔍 Comprehensive Investment Analysis

PEER COMPARISON

vs Adani Ports: Smaller scale but higher margins

Market Position: #2 in Indian ports

Valuation: Premium to peers (PE 40.58x vs 25.85x)

Market Position: #2 in Indian ports

Valuation: Premium to peers (PE 40.58x vs 25.85x)

GROWTH OUTLOOK

✓ Third-party cargo expansion

✓ India trade growth tailwinds

⚡ Capex execution critical

✓ India trade growth tailwinds

⚡ Capex execution critical

📈 Price Target Analysis

BULLISH SCENARIO

₹850-₹962

Based on sector growth

CONSENSUS TARGET

₹1,000+

If growth sustains

CONSERVATIVE

₹232-₹241

Algorithmic models

💡 Investment Recommendation

Suitable for: Long-term investors seeking India infrastructure exposure with high operational leverage and blue-chip group backing. Monitor quarterly results and capex execution closely.