Jet2’s projected share price ranges are 1,400p–2,250p for 2025, gradually rising to 8,500p by 2040, supported by strong fundamentals, expansion, and steady passenger growth.

Overview Of Jet2

Jet2 plc operates as both an airline and a package holiday provider, targeting destinations across Europe. In 2025, Jet2 leveraged market momentum, reporting strong financial performance and passenger growth, cementing its reputation as a resilient player even in volatile market conditions. Over the last year, revenue and passenger numbers have increased, supported by expansion initiatives such as the London Gatwick base addition.

Fundamental Analysis Of Jet2

Fundamental analysis is key to evaluating Jet2 plc’s financial health and future growth potential. The latest reports indicate:

- 2025 Revenue: £5.34 billion (+5% YOY)

- 2025 Operating Profit: £715.2 million (+2% YOY)

- 2025 Net Income: £446.8 million

- Passenger Growth (2025): 14.09 million (+6%)

- Intrinsic Value Estimate (2025): 2,841.43 GBX per share, indicating a significant undervaluation compared to the current market price.

See More: GMR Airport Share Price Target 2025, 2027, 2028, 2030, 2040

Key Balance Sheet Metrics

| Metric | 2025 Value | 2024 Value |

| Revenue | £5.34bn | £5.09bn |

| Net Income | £446.8m | £440.0m |

| Current Assets | £3.1bn | N/A |

| Long-term Debt | £901m | N/A |

| Free Cash Flow | £877.8m | £861.8m |

| Operating Expenses | £448.3m | N/A |

These metrics show healthy profitability, prudent debt management, and solid cash flow, signalling Jet2’s ability to navigate sector headwinds and invest in long-term growth.

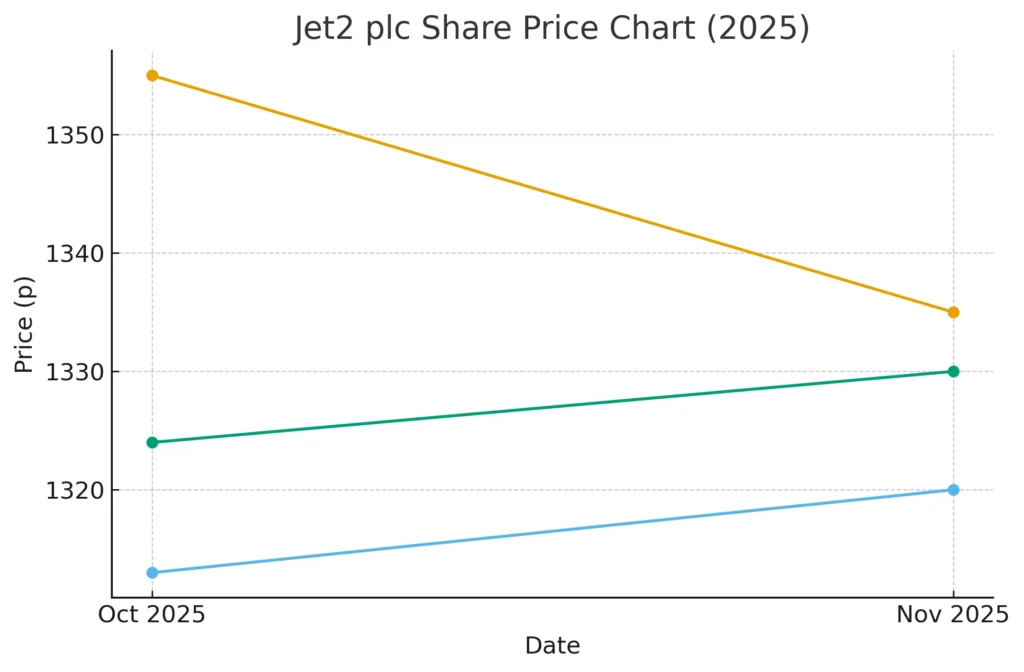

Jet2 Share Price Target 2025

For 2025, Jet2 plc’s share price fluctuated significantly due to market volatility and late booking trends but remains well-positioned for continued recovery.

Jet2 plc Share Price Table 2025

| Date | High | Low | Last | Volume |

| Oct 2025 | 1,355.00p | 1,313.00p | 1,324.00p | 540,821 |

| Nov 2025 | 1,335.00p | 1,320.00p | 1,330.00p | 363,441 |

Jet2’s share price target for 2025 is projected between 1,400p and 2,250p, based on analyst estimates and market expectations, with an upside of 22% from current levels if market conditions remain supportive.

Jet2 Share Price Target 2027

Looking ahead two years, Jet2’s expansion, digital transformation, and efficient cost management suggest sustained growth. Analyst price targets for 2027 range from 1,800p to 2,500p, assuming consistent passenger demand and the continued recovery of the European tourism sector post-pandemic.

Also Read: Indian Equities Buck Global Weakness

Jet2 Share Price Target 2028

By 2028, forecasts place Jet2’s share price between 2,400p and 3,100p, factoring in strategic investments, stronger cash flows, expanded market presence, and a rebound in international travel. The company’s asset base and annual earnings growth underpin these long-term bullish projections.

Jet2 Share Price Target 2030

For 2030, consensus estimates suggest a share price range of 3,500p to 4,500p. This estimate is derived from continued growth in revenue, efficiency improvements, fleet expansion, and the company’s ability to capitalize on travel megatrends. Jet2’s track record for adapting to industry change remains a positive investment signal.

Jet2 Share Price Target 2040

While forecasting twenty years ahead is inherently speculative, current trend extrapolations suggest Jet2 could reach 7,000p to 8,500p per share by 2040, assuming sustained economic growth, technological advancements, and continued European market leadership. Keep in mind the risk profile increases over longer periods.

The Last Few Years’ Performance of Jet2

Profit Growth

- 2022-2024: Jet2 delivered consistent profit growth, reaching a record £800.3 million before taxes in H1 2025.

- 2025 H1 Operating Profit: £715.2 million (+2%).

Sales Growth

- Revenue rose from £5.09bn in 2024 to £5.34bn in 2025, reflecting a steady increase in holiday package and seat sales.

ROE and ROCE

| Metric | 2025 Estimate | Industry Average |

| ROE (%) | ~21% | ~15% |

| ROCE (%) | ~13% | ~9% |

Jet2’s returns outperform the industry average, signalling efficient capital allocation.

Total Assets and Expenditure

- Total Assets: £3.1 billion in current liabilities, representing liquidity and operational stability.

- Total Expenditure: Operating expenses managed at £448.3 million.

Net Cash Flow and Other Income

- Net Cash Flow: £877.8 million, indicating robust cash management.

- Other Income: Income from asset disposals up to £10.3 million in 2025.

Discussion About Share Holding Pattern Of Jet2

Jet2 maintains a well-dispersed shareholding structure. Institutional investors like large European fund managers and individual shareholders both hold significant stakes, enhancing liquidity. Insiders and directors also retain meaningful equity, aligning management interests with investor outcomes.

Jet2 Share Price Target Prediction In The Last Few Years

| Year | Opening Price | Highest Price | Lowest Price | Closing Price | Annual Change |

| 2025 | 1,555.00p | 1,963.00p | 1,088.00p | 1,335.00p | -14.47% |

| 2024 | 1,259.00p | 1,679.00p | 1,202.00p | 1,583.00p | +25.73% |

| 2023 | Data not available | — | — | — | — |

Jet2 has shown both rapid growth and some correction in recent years, reflecting market cycles and sector-specific risks.

Peers Company Of Jet2

Jet2’s main competitors in the European travel sector include:

These peers compete on pricing, routes, service, and technology, impacting Jet2’s market positioning and share price performance.

Should I Invest in Jet2 Share Right Now?

Jet2 plc offers an appealing opportunity for long-term investors seeking exposure to the leisure travel segment. Key factors to consider before investing are outlined below.

Positive Sides

- Solid profitability, prudent debt levels, and robust cash flow.

- Expanding passenger numbers and resilient revenue growth.

- Track record of market share gains and successful expansion strategies.

- Attractive undervaluation relative to intrinsic value estimates.

- Institutional support and strong management alignment.

Negative Sides

- Exposure to macroeconomic factors such as inflation, recession risk, and geopolitical instability.

- High vulnerability to fuel price volatility and regulatory changes.

- Competitive sector with constant pricing pressure.

- Seasonal fluctuations and demand risks during economic downturns.

- Share price volatility, as demonstrated by recent performance swings.

FAQ

What is Jet2 Share Price Target for 2025?

Analyst consensus projects Jet2 plc’s share price in 2025 to range between 1,400p and 2,250p, with the upside reflecting robust performance and ongoing growth initiatives.

What is Jet2 Share Price Target for 2027?

Jet2 plc’s 2027 share price is estimated at 1,800p to 2,500p, correlating with continued market expansion and profit growth.

What is Jet2 Share Price Target for 2028?

Forecasts for 2028 range from 2,400p to 3,100p, based on Jet2’s strategic expansion and improved cash flows.

What is Jet2 Share Price Target for 2030?

Long-term projections place Jet2’s share price at 3,500p to 4,500p in 2030, underpinned by fleet growth and optimizing of travel trends.

What is Jet2 Share Price Target for 2040?

Jet2’s 2040 target could be as high as 8,500p per share, based on continued dominance in leisure travel and sector advances. Forecasts for this timeline should be treated as speculative.

Conclusion

Jet2 plc currently presents a strong investment opportunity backed by healthy fundamentals, sector leadership, and long-term growth strategies. However, investors should assess personal risk tolerance and diversify portfolios appropriately. The performance of Jet2 is likely to remain sensitive to the cyclical nature of the travel sector and broader economic conditions.

Disclaimer – We are not SEBI-registered advisors. A financial market is always risky to anyone. This website is only for training and educational purposes. So, before investing, we are requested to discuss certified expertise. We will not be responsible for anyone’s profit or loss.