HFCL Share is in a bullish trend in the share market. During share ups and downs, you should know all about share details before investing. In this blog, we are going to discuss the HFCL Share Price Target 2025, 2026, 2028, 2030, and 2035. We will try to analyze the share base in the company’s overall performance.

We also look at the company’s profit growth in the last 5 years, the last 5 years’ sales growth, and the last 5 years’ ROE percentage. Similarly, we also compare the share growth, the share price return, and whether the share has increased or decreased over the last 5 years. We also take advice from experts about when we should invest in the share, which may be helpful for you. Let’s have a look at the HFCL Share Price Target from 2025 to 2035.

Overview Of HFCL Limited

HFCL Limited is an Indian technology company that designs, develops, and manufactures telecommunications equipment, fiber-optic cables, and other related electronics. The company serves various industries such as telecommunications, security, railways, textiles, and cable fiber.

Fundamental Analysis Of HFCL Limited

| Company Name | HFCL Limited |

| Market Cap | ₹11,906,85 Crore |

| P/E | ₹32.2 |

| P/B | ₹2.96 |

| 52-Week High | ₹172.36 |

| 52-Week Low | ₹71.50 |

| Face Value | ₹1 |

| Book Value | ₹28.96 |

| DIV. YIELD | 0.26% |

| ROE | 9.18% |

| ROA | 5.96% |

HFCL Share Price Target 2025

HFCL Share Price Target 2025 forecast may vary from ₹79.20 to ₹129.56.

Influencing Key Factors Of HFCL Share Price Target 2025

- Connected Future Through Technology

- HFCL Limited is a dynamic and technology-driven enterprise, providing next-generation communication products and integrated network solutions to the telecom, defense, and railway sectors. With a focus on innovation, seamless execution, and strong industry collaborations, the company has established a distinguished position in its core domains.

- Catering To The TELECOM Industry

- HFCL Limited provides comprehensive solutions for building wireless and telecommunication netwok, including optical transport and fiber-to-the-home networks, among others. The company is a leading manufacturer of optical fiber (OF), optical fiber cables (OFC), and a range of telecom and networking products, The company also caters to evolving customer needs. In the financial year 2023, out of the company’s total revenue, 83% came from the telecom industry.

- Catering To The Defence Sector

- As one of India’s most prominent defence network implementers, the company offers end-to-end solutions, including an optical transmission backbone network, a GIS-based optical fiber network for multiple hybrid microwave broadband radio links in remote areas, and an MPLS-based dedicated communication network for defense and more. In the financial year 2023, from the defence sector, the company’s revenue percentage was 15%.

| Month | HFCL Share Price Target 2025 (1st Price Target) | HFCL Share Price Target 2025 (2nd Price Target) |

| April | ₹79.20 | ₹86.12 |

| May | ₹82.98 | ₹92.45 |

| June | ₹88.14 | ₹96.03 |

| July | ₹88.58 | ₹99.26 |

| August | ₹95.82 | ₹108.42 |

| September | ₹105.06 | ₹114.11 |

| October | ₹108.15 | ₹117.10 |

| November | ₹115.42 | ₹123.31 |

| December | ₹119.52 | ₹129.56 |

HFCL Share Price Target 2026

HFCL Share Price Target 2026 forecast may vary from ₹125.15 to ₹178.03.

Influencing Key Factors Of HFCL Share Price Target 2026

- Catering To The Railways Sector

- HFCL Limited designs modern communications systems for metros, main-line railways, and freight corridors, leveraging its capabilities in cutting-edge telecom products and solutions. It implements modern railway communication systems like video management systems for the Indian Railways. The company’s revenue was 2% from this sector in the year 2023.

- Ventured Into New Geographies

- With an eye on global expansion, the company has ventured into new geographies by establishing subsidiaries and deploying dedicated teams across the international markets to earn more revenue growth for the company.

| Month | HFCL Share Price Target 2026 (1st Price Target) | HFCL Share Price Target 2026 (2nd Price Target) |

| January | ₹125.15 | ₹132.77 |

| February | ₹129.64 | ₹136.95 |

| March | ₹102.46 | ₹112.85 |

| April | ₹108.52 | ₹121.36 |

| May | ₹118.95 | ₹129.50 |

| June | ₹127.24 | ₹138.43 |

| July | ₹135.57 | ₹147.65 |

| August | ₹145.12 | ₹152.59 |

| September | ₹149.85 | ₹158.79 |

| October | ₹152.77 | ₹159.80 |

| November | ₹157.40 | ₹168.69 |

| December | ₹165.24 | ₹178.03 |

Also Read – Indus Towers Share Price Target

HFCL Share Price Target 2028

HFCL Share Price Target 2028 forecast may vary from ₹227.16 to ₹280.44.

Influencing Key Factors Of HFCL Share Price Target 2028

- Dedicated R&D Capabilities

- HFCL Company has a strong position in the industry because of its strong R&D team of the company. The company has invested in R&D and new product developments to meet emerging customer needs. The company has 3 R&D centers and also has a 252-member in-house R&D team. The company also has a roubst in-house R&D team of professionals specialising in communication, 5G technologies, optical fiber cables, defence, and other technologies.

- The Company’s Global Reach

- Over the last few years, the HFCL has widened its reach by establishing strategically located manufacturing facilities in India. The company has also been expanding its business operations across the globe to deliver its products and provide comprehensive network solutions. The company has 5 manufacturing facilities in India and over 45 countries

| Month | HFCL Share Price Target 2028 (1st Price Target) | HFCL Share Price Target 2028 (2nd Price Target) |

| January | ₹227.16 | ₹233.62 |

| February | ₹230.55 | ₹242.46 |

| March | ₹238.15 | ₹246.47 |

| April | ₹240.72 | ₹256.20 |

| May | ₹250.13 | ₹258.59 |

| June | ₹255.01 | ₹266.49 |

| July | ₹262.89 | ₹274.35 |

| August | ₹270.22 | ₹278.64 |

| September | ₹272.50 | ₹284.61 |

| October | ₹281.52 | ₹292.32 |

| November | ₹258.41 | ₹266.02 |

| December | ₹269.84 | ₹280.44 |

HFCL Share Price Target 2030

HFCL Share Price Target 2030 forecast may vary from ₹331.25 to ₹382.64.

Influencing Key Factors Of HFCL Share Price Target 2030

- Market Leader In Fiber Cable Manufacturing

- HFCL Limited ranks among India’s top optical fiber cable manufacturers, signifying its substantial market share in producing Wi-Fi access points, UBR, and diverse telecom products. Presently, the company’s annual optical fibers manufacturing capacity is 10 million fibers km, and the annual capacity of the optical fiber cables manufacturing is 10 million fibers km. The company’s annual capacity for polymer compounds is 24 K/MT.

- Robust Growth In Export Revenues

- The company has maintained roubst growth in export revenues, with a CAGR of 88% over the past 3 years. This sustained performance highlights its resilience in the global markets. In the year 2022, the company’s export revenue share trend was 7.69%, which increased to 17.35% in the year 2023.

| Month | HFCL Share Price Target 2030 (1st Price Target) | HFCL Share Price Target 2030 (2nd Price Target) |

| January | ₹331.25 | ₹346.12 |

| February | ₹342.85 | ₹356.40 |

| March | ₹309.44 | ₹325.15 |

| April | ₹324.50 | ₹338.94 |

| May | ₹335.24 | ₹342.14 |

| June | ₹339.42 | ₹346.17 |

| July | ₹343.28 | ₹354.09 |

| August | ₹351.60 | ₹362.75 |

| September | ₹359.87 | ₹368.15 |

| October | ₹365.24 | ₹374.88 |

| November | ₹370.45 | ₹383.46 |

| December | ₹375.11 | ₹382.64 |

HFCL Share Price Target 2035

HFCL Share Price Target 2035 forecast may vary from ₹642.03 to ₹693.47.

Influencing Key Factors Of HFCL Share Price Target 2035

- Innovation Of New Products

- HFCL Limited is spearheading product innovation through tech-centric R&D initiatives supported by a roubst team. The innovation of the company is 5G indoor and outdoor fixed wireless access customer premises equipment, 5G indoor and outdoor small cells, and 5G radio access network products, etc, in the telecom industry. In the defence sector, the innovative products are software-defined radios, ground surveillance radars, etc.

- Long-Term Customer Relationships

- With a track record of three decades of execution excellence and consistently delivering innovative products, the company has also built a strong reputation in its core domains and has become a preferred global partner for esteemed clients. The company has a collaboration with Jio, Airtel, Vodafone, BSNL, Globe, and many other telecom companies.

| Year | HFCL Share Price Target 2035 |

| 1st Price Target | ₹642.03 |

| 2nd Price Target | ₹693.47 |

Last Few Years’ Performance Of HFCL Limited

Profit Growth

- In the last 5 years, 10.98%

- In the last 3 years, 12.95%

- In the last 1 year, 21.36%

The Net Profit of the company was ₹254.12 Crore in March 2023, which increased to ₹310.52 Crore in March 2024. The Operating Profit of the company was ₹467.52 Crore in March 2023, which increased to ₹484.62 Crore in March 2024.

Sales Growth

The sales growth percentage of the company in the last 5 years is described below.

- In the last 5 years, 1.75%

- In the last 3 years, -0.69%

- In the last year, -7.5%

The Net Sales amount of the company was ₹4,386.25 Crore in March 2023, which decreased to ₹4,078.63 Crore in March 2024.

ROE Percentage

The ROE percentage growth of the company in the last 5 years is described below.

- In the last 5 years, 11.96%

- In the last 3 years, 10.59%

- In the last 1 year, 9.20%

ROCE Percentage

The company’s ROCE percentage growth in the last 5 years is described below, and it has also increased rapidly.

- In the last 5 years, 16.52%

- In the last 3 years, 15.24%

- In the last 1 year, 13.25%

Total Expenditure Amount

The company’s total expenditure was ₹3,985.24 Crore in March 2023, which decreased to ₹3,624.15 Crore in March 2024.

The Net Cash Flow Amount

The company’s Net Cash flow was ₹47.95 Crore in March 2023, which became -₹40.95 Crore in March 2024.

Total Assets Amount

The company’s Total Assets were ₹5,086.24 Crore in March 2023, which increased to ₹6,124.32 Crore in March 2024.

Also Read – Zee Entertainment Share Price Target

Peer Company Of HFCL Limited

| Company Name | Market Cap (Crore) |

| Bharti Hexacom | ₹79,128.36 |

| Black Box | ₹6,185.95 |

| Indus Towers | ₹105,947.32 |

| Optiemus Infra | ₹4,321.90 |

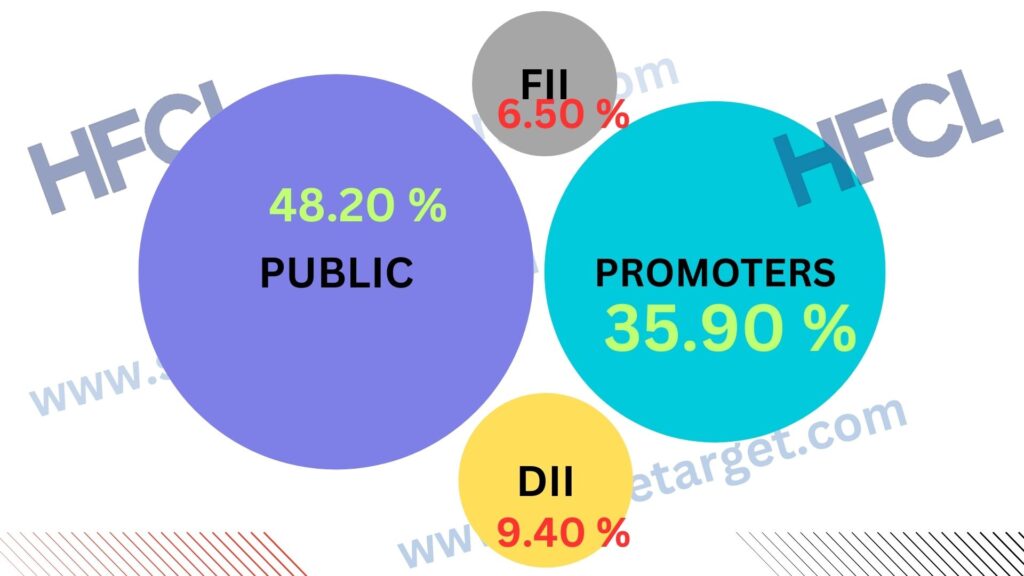

Discussion About Shareholding Pattern Of HFCL Limited

HFCL Limited mainly has four types of shareholding patterns, such as promoter holding, public holding, DII, and FII. Depending on the shareholding pattern, we can majorly influence the company’s growth.

| Investor Type | Percentage |

| Promoter Holding (Owned by the company’s promoter) | 35.90% |

| Public Holding (Held by the public) | 48.20% |

| FII (Invest by Foreign Institutional Investor) | 6.50% |

| DII (Invest money by Domestic Institutional Investor) | 9.40% |

The Last Few Years’ Share Price Updation Of HFCL Share

HFCL Share always gives investors good returns, as described in the portion below.

- The last 6 months’ share growth was -46.87 (-36.03%).

- The last 1 month’s share growth was +2.76 (3.43%).

- The last 1 year’s share growth was -9.10 (-9.86%).

- The last 5 years’ share growth was +72.00 (642.86%).

- The maximum share growth was +46.55 (127.01%).

- HFCL Share Price Return Percentage was 7.29% in the last 1 month.

- The last 3 months’ share price return percentage was -19.71%.

- The last 1 year’s share price return percentage was -11.53%.

- The last 3 years’ share price return percentage was 3.55%.

- The last 5 years’ share price return percentage was 644.12%.

If anyone wants to invest in HFCL shares, it will be profitable on a long-term basis.

What Is The Expert Advice About The Investment In HFCL shares

Positive Sides

- The company has an efficient cash conversion cycle of 69.10 days.

- The company has a healthy liquidity position with a current ratio of 2.10.

- In the last 1 year’s the company has good profit growth, which was 21.36%.

- The last 3 years’ ROE percentage was 10.59%.

- The company has a good promoter holding capacity, which is 35.90%.

- The last 3 years ROCE percentage was good, which was 15.24%.

Negative Sides

- In the last 3 years, the company’s revenue growth was not good, which was -0.26%.

- The company has a high PE ratio of 32.2.

- The company has a negative cash flow from operations of -110.56.

Also Read – IRCTC Share Price Target

FAQ

What is the HFCL Share Price Target for 2025?

HFCL Share Price Target for 2025 is ₹79.20 to ₹129.56.

What is the HFCL Share Price Target for 2026?

HFCL Share Price Target for 2026 is ₹125.15 to ₹178.03.

What is the HFCL Share Price Target for 2028?

HFCL Share Price Target for 2028 is ₹227.16 to ₹280.44.

What is the HFCL Share Price Target for 2030?

HFCL Share Price Target for 2030 is ₹331.25 to ₹385.64.

What is the HFCL Share Price Target for 2035?

HFCL Share Price Target for 2035 is ₹642.03 to ₹693.47.

Who is the CEO of HFCL Limited?

Mr. Mahendra Nahata is the CEO of HFCL Limited.

Is HFCL Limited a government or private company?

HFCL Limited is a private company.

Conclusion

This website is written to help the investor gain some basic knowledge about the market strategy of HFCL shares. For making this blog, we consulted experts and researched the company. It is expected that the HFCL Share Price Target will be a good choice to invest in on a long-term basis. The demand for the manufacture of telecommunications equipment, fiber-optic cables, and other related electronics in India and outside of the country always increases as a result of the company, and the share may increase rapidly.

We try to give an in-depth idea about the share. If you think it is helpful to you you can share it. If you have any questions please let us know through the comment box we will try to reply to your questions and solve your problem. Thanks for visiting this website and thanks for being with us.

Disclaimer – We are not SEBI-registered advisors. A financial market is always risky to anyone. This website is only for training and educational purposes. So before investing, we are requested to discuss certified expertise. We will not be responsible for anyone’s profit or loss.