About the Hang Seng Index

The Hang Seng Index (HSI) is Hong Kong’s primary stock market index, designed to track the performance of the largest and most liquid companies listed on the Hong Kong Stock Exchange. Its creation and history reflect both Hong Kong’s growth as a financial hub and the region’s economic developments.

Origins and Key Milestones

Key Characteristics

- Calculation: Free-float market capitalization-weighted, with caps on individual component weights

- Composition: 82 companies (as of 2023), representing 58-65% of HKEX market cap

- Sectors: Four main sub-indexes: Finance, Utilities, Properties, and Commerce & Industry

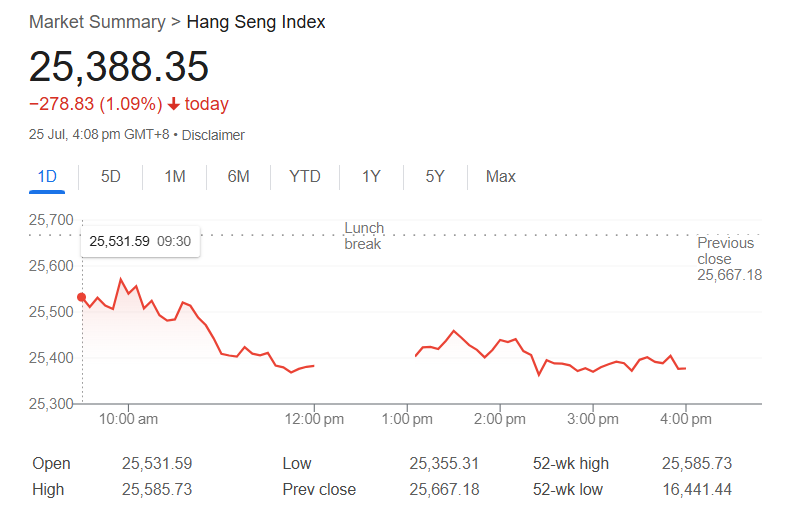

Market Overview – July 25, 2025

Final Close: The Hang Seng Index (HSI) closed at 25,388 points, down 1.1% (loss of 279 points) from the previous session, snapping a five-session winning streak. The index hit a near four-year high during the session and finished lower as traders locked in profits and sentiment turned cautious before a key Politburo meeting and further U.S.-China trade talks.

Range: The index opened at 25,576, dipped to an intraday low of 25,449, and reached an intraday high of 25,744 points.

Volume: Trading volumes remained robust, with several billion shares traded as profit-taking activity increased.

Intraday Details

| Time | Level |

|---|---|

| Opening | 25,576 |

| Intraday High | 25,744 |

| Intraday Low | 25,449 |

| Closing | 25,388 |

Day’s Performance

Change: -1.1% from previous close.

Weekly Change: Despite today’s loss, the index gained 2.3% for the week, marking the third straight week of gains.

Monthly & Yearly Trend: The index has climbed 4.15% over the past month and is up 48.8% compared to the same time last year.

Historical Context

Yearly Trends and Volatility

The HSI has shown significant volatility during major global and regional events:

- Asian Financial Crisis (1997): Major declines

- Dot-com bubble (2000): Global stock corrections

- Global Financial Crisis (2008): More than 50% value lost in a year

- 2010s: Rapid recoveries with the index repeatedly surpassing previous highs

Current Context (2025): As of July 25, 2025, the index stands around 25,388 points, having shown robust gains over the past year. While below its all-time high of 33,484.08 points (January 2018), the HSI remains a key barometer of Hong Kong’s stock market and broader Asian economic sentiment.

Sector & Stock Highlights

Major Outperformers & Decliners

| Stock | Price (HK$) | Change (%) | One-Year Change (%) |

|---|---|---|---|

| Tencent Holdings | 548.00 | -1.62 | 56.04 |

| China Mobile | 86.50 | -0.92 | 15.72 |

| Meituan | 130.90 | -2.60 | 22.22 |

| Kuaishou Tech | — | -4.9 | — |

| Alibaba | 118.50 | -1.5 | — |

| Semiconductor Manufacturing Int’l | 52.75 | +4.98 | 213.99 |

| Xiaomi | 58.45 | +0.09 | 260.80 |

| Hang Seng Bank | 122.80 | +1.32 | 20.63 |

Notable Trends:

Tech: Technology stocks faced selling pressure: Kuaishou -4.9%, Alibaba -1.5%, Tencent -1.62%, Meituan -2.6%.

Financials: Financial stocks were mixed, AIA Group led declines at -1.89%, Ping An Insurance -0.45%, HK Exchanges -0.27%, HSBC -0.78% (holding above HK$100).

Other movers: Semiconductor Manufacturing International rose 4.98% as a standout gainer; Xiaomi was virtually flat with a minimal gain.

Market Sentiment & Drivers

Profit-Taking: The index dropped from its recent high as investors cashed in gains ahead of upcoming political and economic events.

Key Resistance: The market encountered technical resistance at ~25,750 and a break below 25,260 could reinforce a short-term corrective decline; support is observed near 24,940/24,850.

Macro Drivers: Cautious outlook driven by the anticipation of a key Chinese Politburo meeting, skepticism over fresh stimulus, and upcoming U.S.-China trade negotiations (a potential trade truce extension is in focus).

Technical Analysis

Momentum: The Hang Seng Index has rallied for two weeks, nearing the top of a long-term ascending channel.

Risk: Short-term momentum indicators show a bearish breakdown, suggesting the uptrend is at risk of a minor corrective pullback unless the index reclaims levels above 25,750.

Global & Regional Context

Asia Market Trend: Other major Asian indices also declined (Nikkei -0.9%, Shanghai Composite -0.3%).

Wall Street Influence: Losses followed a pullback in U.S. markets, particularly driven by uncertainty in technology and AI stock sectors.

Trade Uncertainty: Global attention is on upcoming U.S.-China trade talks, with potential tariff increases looming, influencing investor sentiment in Hong Kong.

Hang Seng Index: Frequently Asked Questions (FAQs)

The Hang Seng Index (HSI) is a free-float market capitalization-weighted index that tracks the performance of the largest and most liquid companies listed on the Hong Kong Stock Exchange (HKEX). Launched in 1969, the HSI is widely regarded as the benchmark equity index for Hong Kong and a barometer for the broader Asian markets.

The HSI is divided into four key sectors: Finance (largest weighting, includes banks and financial institutions), Utilities (essential services like electricity and water), Properties (real estate and property management firms), and Commerce & Industry (technology, retail, manufacturing, and more).

Direct investment is not possible, but exposure can be gained through Exchange Traded Funds (ETFs) tracking the HSI, Mutual funds or index funds, and Futures and options contracts based on the HSI.

Risks include market volatility and fluctuations in Hong Kong and global markets, geopolitical and economic conditions impacting Hong Kong, and currency risks for international investors.