GRSE Share is in a bullish trend in the share market. During share ups and downs, you should know all about share details before investing. In this blog, we are going to discuss the GRSE Share Price Target 2025, 2026, 2028, 2030, and 2035. We will try to analyze the share base in the company’s overall performance.

We also look at the company’s profit growth in the last 5 years, the last 5 years’ sales growth, and the last 5 years’ ROE percentage. Similarly, we also compare the share growth, the share price return, amount whether the share has increased or decreased over the last 5 years. We also take advice from experts about when we should invest in the share, which may be helpful for you. Let’s have a look at the GRSE Share Price Target from 2025 to 2035.

Overview Of GRSE (Garden Reach Shipbuilders & Engineers Limited)

Garden Reach Shipbuilders & Engineers Limited, which is abbreviated as GRSE, is one of India’s leading defence shipyards, located in Kolkata. It builds and repairs commercial and naval vessels. The company also exports the ships that the company builds. The company was established in the year 1884 as a small, privately-owned company.

Fundamental Analysis Of GRSE Limited

| Company Name | Garden Reach Shipbuilders & Engineers Limited |

| Market Cap | ₹25,912.36 Crore |

| Book Value | ₹181.54 |

| Face Value | ₹10 |

| 52 Week High | ₹2,846.29 |

| 52 Week Low | ₹973 |

| P/B | 12.96 |

| P/E | 49.85 |

| ROA | 3.36% |

| ROE | 23.56% |

| DIV. YIELD | 0.63% |

GRSE Share Price Target 2025

GRSE Share Price Target 2025 forecast may vary from ₹1,852.36 to ₹2,986.92.

Influencing Key Factors Of GRSE Share Price Target 2025

- About The Company

- GRSE is a premier shipbuilding company in India under the administrative control of the Ministry of Defence, primarily catering to the shipbuilding requirements of the Indian Navy and the Indian Coast Guard. GRSE is a diversified, profit-making, and dividend-paying company and the first shipyard in the country to export warships and deliver more than 100 warships to the Indian Navy and Indian Coast Guard.

- Shipbuilding Prowess

- GRSE’s shipbuilding division is a beacon of India’s maritime manufacturing capabilities. With an impressive product range and even more remarkable clientele, the division is a testament to India’s self-reliance and prowess in shipbuilding. As the seas continue to be a crucial frontier for global geopolitics, establishments like GRSE are a major contributor in ensuring that India remains ever-prepared and ever-resilient.

- Production Unit

- Presently, the company has 5 production units in West Bengal, one of which is situated in Ranchi. In addition, there is one Technical Training Centre. The Corporate Office is within the premises of the Park Unit.

| Month | GRSE Share Price Target 2025 (1st Price Target) | GRSE Share Price Target 2025 (2nd Price Target) |

| May | ₹1,852.36 | ₹2,310.22 |

| June | ₹2,305.15 | ₹2,485.49 |

| July | ₹2,472.03 | ₹2,611.25 |

| August | ₹2,624.68 | ₹2,759.77 |

| September | ₹2,750.92 | ₹2,986.75 |

| October | ₹2,975.44 | ₹3,076.52 |

| November | ₹2,801.75 | ₹2,886.39 |

| December | ₹2,801.49 | ₹2,986.92 |

Also Read – Cochin Shipyard Share Price Target

GRSE Share Price Target 2026

GRSE Share Price Target 2026 forecast may vary from ₹2,912.36 to ₹3,552.68.

Influencing Key Factors Of GRSE Share Price Target 2026

- The Company’s Values

- GRSE Limited visualises itself as building a strong reputation for fair dealing by encouraging vendors, independent contractors, business partners, and customers to do business with it again and again. The company is walking strongly on the path of bringing in absolute transparency in all its transactions within as well as outside the organisation.

- Shipbuilding Capabilities

- GRSE Limited has 3 separate facilities for shipbuilding, all of which are located in close vicinity of each other in Kolkata and interconnected by the Hooghly River. The shipbuilding has the facilities of Anti-Submarine Warfare Corvette, Survey Vessel, Fast Interceptor Boat, Landing Craft Utility, Anti-submarine Shallow Water Craft, Fast Patrol Vessel, etc.

- Diesel Engine Plant

- The Diesel Engine Plant (DEP) at Ranchi is engaged in the testing and overhauling of marine propulsion engines and the assembly of semi-knockdown units of Diesel Engines. This division supplies and overhauls MTU 396-04, MTU 1163, and MTU 538 class diesel engines.

| Month | GRSE Share Price Target 2026 (1st Price Target) | GRSE Share Price Target 2026 (2nd Price Target) |

| January | ₹2,912.36 | ₹2,995.34 |

| February | ₹2,982.60 | ₹3,085.89 |

| March | ₹2,759.55 | ₹2,889.14 |

| April | ₹2,880.45 | ₹2,995.38 |

| May | ₹2,990.11 | ₹3,084.82 |

| June | ₹3,078.36 | ₹3,236.33 |

| July | ₹3,229.52 | ₹3,388.06 |

| August | ₹3,385.59 | ₹3,488.26 |

| September | ₹3,484.05 | ₹3,596.83 |

| October | ₹3,593.80 | ₹3,624.66 |

| November | ₹3,610.79 | ₹3,686.49 |

| December | ₹3,498.26 | ₹3,552.68 |

GRSE Share Price Target 2028

GRSE Share Price Target 2028 forecast may vary from ₹4,085.36 to ₹4,632.49.

Influencing Key Factors Of GRSE Share Price Target 2028

- Business Diversification

- In addition to core manufacturing activities for shipbuilding, the company offers diversified products and services to its customers, including portable bridges, deck machinery items, pumps, and engines. The company has a dedicated deck machinery equipment facility, both of which are essential for the shipbuilding and testing process.

- Make In India Initiative

- The company has an advantage over global shipyards in securing contracts to valid vessels for the Indian Navy and Indian Coast Guard, because it qualifies for the ‘Make In India’ initiative grants indigenous manufacturers a competitive advantage when supplying to the domestic market. The Indian Navy and Indian Coast Guard are the company’s repeat customers.

- Deck Machinery Unit

- The Deck Machinery Unit of the company is engaged in the manufacturing and supply of various Deck Machinery Equipment, comprising Anchor Capstan, Anchor Windlass, Mooring Capstan, Dock Capstan, General Purpose Davits, Electric Boat Davits, Electro-Hydraulic Boat Davits, Helo Traversing System (Both Rail-Based and Rail-Less Type) & various types of Naval Pumps Consisting of marine fresh water and sea water pumps of different discharge.

| Month | GRSE Share Price Target 2028 (1st Price Target) | GRSE Share Price Target 2028 (2nd Price Target) |

| January | ₹4,085.36 | ₹4,136.49 |

| February | ₹4,129.54 | ₹4,205.94 |

| March | ₹3,853.62 | ₹3,986.47 |

| April | ₹3,979.74 | ₹4,086.62 |

| May | ₹4,079.42 | ₹4,188.55 |

| June | ₹4,180.95 | ₹4,296.76 |

| July | ₹4,295.24 | ₹4,384.02 |

| August | ₹4,379.61 | ₹4,494.83 |

| September | ₹4,489.70 | ₹4,578.06 |

| October | ₹4,574.37 | ₹4,692.07 |

| November | ₹4,501.46 | ₹4,589.75 |

| December | ₹4,596.50 | ₹4,632.49 |

GRSE Share Price Target 2030

GRSE Share Price Target 2030 forecast may vary from ₹5,324.68 to ₹5,986.02.

Influencing Key Factors Of GRSE Share Price Target 2030

- Strong Design Capabilities and Provides End to End Solution

- GRSE has a dedicated Central Design Office (CDO), which undertakes design, research, and development, with a highly skilled workforce of 100 members. Its CDO team uses various software, ranging from Aveva Marine, NAPA for Naval Architectural Design, AutoCAD for drafting work, and other software for structural analysis.

- Value Of Production Of Deck Machinery Unit

- During the year 2021-22, the total value of production of the Deck Machinery Unit was ₹20.63 Crore, out of the total value of production Deck Machinery division stands at ₹11.80 Crore, excluding internal consumption. Equipment and spares with a sale value of ₹6.05 Crore have been supplied to various new construction yards as well as to operational ships of the Indian Navy and the Indian Coast Guard.

- Next Generation Electric Ferry

- The company has developed a concept design for a fully electric battery-operated ferry for the transportation of passengers in the inland waters. This 24m long aluminium vessel shall have a max speed of 8 knots and a capacity of carrying 145 passengers. This will be a pioneering effort in promoting green technologies in the Inland Water transportation sector in the country.

| Year | GRSE Share Price Target 2030 |

| 1st Price Target | ₹5,324.68 |

| 2nd Price Target | ₹5,986.02 |

GRSE Share Price Target 2035

GRSE Share Price Target 2035 forecast may vary from ₹9,425.67 to ₹10,085.35.

Influencing Key Factors Of GRSE Share Price Target 2035

- Export Initiative

- GRSE Limited is the first Indian Shipyard company to export a warship, an offshore Patrol Vessel, to Mauritius in the year 2014. The company also exported a fast patrol vessel, ‘SCG PS Zoroaster’, to the Govt of Seychelles and completed its Guarantee Refit & Dry Docking in March 2022. In that year, the company’s export order of 12.74 million USD for the supply of an Ocean Going Vessel to the Republic of Guyana.

- Upgradation Of Fitting Out Jetty Unit (FOJ Unit)

- The Finger Jetty has been refurbished, including structural strengthening and replacement of all Fenders & Bollards. For streamlining the activities of OEMs/contractors and more effective utilisation of space, Vendor Sheds with allied facilities have been created for a maximum of 50 contractors’ offices/stores/workshops in a collocated.

- Innovation

- Innovators in business are constantly looking for emerging customer needs and designing best-in-class solutions to address those needs. Innovation allows a company to improve the quality of life for its customers. Making constant innovation a core value helps a corporation grow in the face of ever-increasing competition because it can take advantage of emerging opportunities before competitors can.

| Year | GRSE Share Price Target 2035 |

| 1st Price Target | ₹9,425.67 |

| 2nd Price Target | ₹10,085.35 |

Also Read – Adani Ports Share Price Target

Last Few Years’ Performance Of GRSE Limited

Profit Growth

- In the last 5 years, 27.24%

- In the last 3 years, 33.25%

- In the last 1 year, 57.12%

The Net Profit of the company was ₹229.86 Crores in March 2023, which increased to ₹358.69 Crores in March 2024. The Operating Profit of the company was ₹153.40 Crores in March 2023, which increased to ₹239.46 Crores in March 2024.

Sales Growth

The sales growth percentage of the company in the last 5 years is described below.

- In the last 5 years, 21.98%

- In the last 3 years, 47.36%

- In the last year, 40.58%

The Net Sales amount of the company was ₹2,596.36 Crore in March 2023, which increased to ₹3,596.75 Crore in March 2024.

ROE Percentage

The ROE percentage growth of the company in the last 5 years is described below.

- In the last 5 years, 17.96%

- In the last 3 years, 19.01%

- In the last 1 year, 24.86%

ROCE Percentage

The company’s ROCE percentage growth in the last 5 years is described below, and it has also increased rapidly.

- In the last 5 years, 23.24%

- In the last 3 years, 24.68%

- In the last 1 year, 30.25%

Total Expenditure Amount

The Total Expenditure of the company was ₹2,456.36 Crore in March 2023, which decreased to ₹3,396.45 Crore in March 2024.

The Net Cash Flow Amount

The Net Cash Flow amount of the company was ₹4.28 Crore in March 2023, which decreased to -₹8.96 Crore in March 2024.

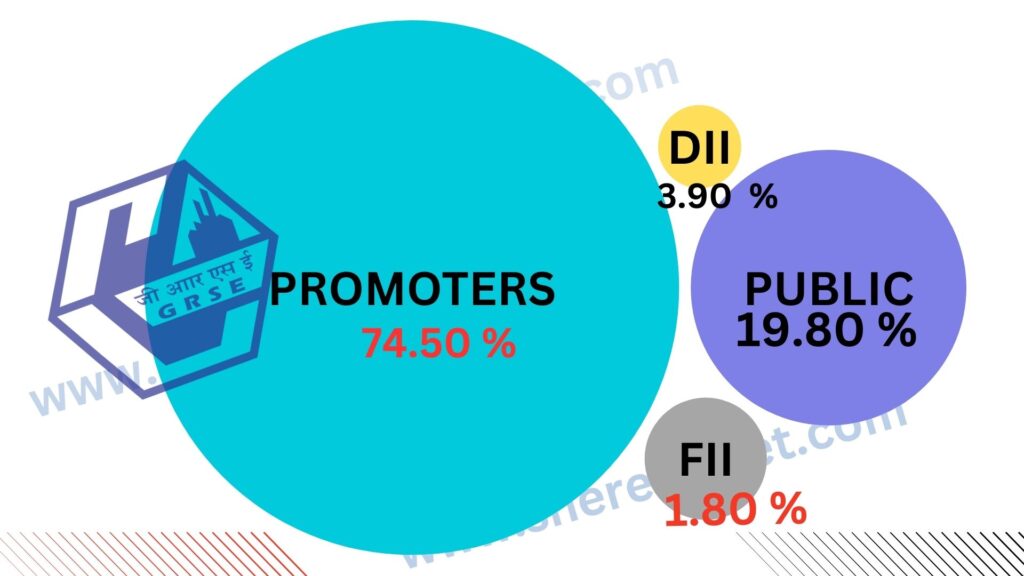

Discussion About Shareholding Pattern Of GRSE Limited

GRSE Limited mainly has four types of shareholding patterns such as promoter holding, public holding, DII, and FII. Depending on the shareholding pattern, we can majorly influence the company’s growth.

| Investor Type | Percentage |

| Promoter Holding (Owned by the company’s promoter) | 74.50% |

| Public Holding (Held by the public) | 19.80% |

| FII (Invest by Foreign Institutional Investor) | 3.90% |

| DII (Invest money by Domestic Institutional Investor) | 1.80% |

Peer Company Of GRSE Limited

| Company Name | Market Cap (Crore) |

| Cochin Shipyard | ₹53,527.63 |

| Mazagon Dock | ₹143,182.96 |

| VMS Industries | ₹69.98 |

| Laxmipati Eng. | ₹131.82 |

| ABG Shipyard | ₹11.18 |

The Last Few Years’ Share Price Updation Of GRSE Share

GRSE Share always gives investors good returns, as described in the portion below.

- The last 1 month’s share growth was +765.10 (44.44%).

- The last 6 months’ share growth was +1,099.20 (79.23%).

- The last 1 year’s share growth was +1,495.70 (150.94%).

- The last 5 years’ share growth was +2,342.25 (1,622.62%).

- The maximum share growth was +2,453.10 (7,322.69%).

- GRSE Share price return percentage was 44.26% in the last 1 month.

- The last 3 months’ share price return percentage was 83.72%.

- The last 1 year’s share price return percentage was 150.46%.

- The last 3 years’ share price return percentage was 794.352%.

- The last 5 years’ share price return percentage was 1620.53%.

What Is The Expert Analysis About GRSE Share Right Now?

Positive Sides

- In the last 3 years, the company had a good profit growth, which was 33.25%.

- In the last 3 years, the company provided a good revenue growth which was 46.92%.

- The company is virtually debt-free and has a healthy interest cover ratio of 30.48.

- The company has a good promoter holding capacity of 74.50%.

- The company has an efficient cash conversion cycle of -420.63 days.

- The company decreased its debt amount by 246.85 crores.

- The company has been maintaining a good ROCE ratio in the last 3 years, which was 24.68%.

- In the last 3 years, the company had a good sales growth which was 47.36%.

Negative Sides

- The company has a negative cash flow margin from operations, which was -707.23.

- The company is trading at a high EBITDA of 33.01.

- The company has contingent liabilities of 6,524.53 crores.

Risk Factors Of GRSE Limited

- GRSE Limited’s product is mainly supplied to the Indian Army and Navy sectors. Different types of changes in Government policies may affect the company’s growth.

- Supply chain disruption may affect the company’s profit growth.

- Due to a lack of technological improvement in the shipbuilding sector, the company may face many problems.

Also Read – Adani Enterprises Share Price Target

FAQ

What is the GRSE Share Price Target for 2025?

GRSE Share Price Target for 2025 is ₹1,852.36 to ₹2,986.92.

What is the GRSE Share Price Target for 2026?

GRSE Share Price Target for 2026 is ₹2,912.36 to ₹3,552.68.

What is the GRSE Share Price Target for 2028?

GRSE Share Price Target for 2028 is ₹4,085.36 to ₹4,632.49.

What is the GRSE Share Price Target for 2030?

GRSE Share Price Target for 2030 is ₹5,324.68 to ₹5,986.02.

What is the GRSE Share Price Target for 2035?

GRSE Share Price Target for 2035 is ₹9,425.67 to ₹10,085.35.

Conclusion

This website is written to help the investor gain some basic knowledge about the market strategy of GRSE Share. For making this blog, we take consultation from experts and research the company. It is expected GRSE Share Price Target will be a good choice to invest in on a long-term basis. The demand for the shipyards manufacturer sector in India and outside of the country always increases, as a result of which the company and its share may increase rapidly.

We try to give an in-depth idea about the share. If you think it is helpful to you, you can share it. If you have any questions, please let us know through the comment box. We will try to reply to your questions and solve your problem. Thanks for visiting this website, and thanks for being with us.

Disclaimer – We are not SEBI-registered advisors. A financial market is always risky to anyone. This website is only for training and educational purposes. So, before investing, we are requested to discuss certified expertise. We will not be responsible for anyone’s profit or loss.