Glenmark Pharma Share Target :Glenmark Pharmaceuticals has received a lot of attention, and for good reason. The company’s share price has made some exciting moves, especially following that stunning licensing agreement with AbbVie. If you would like to learn what the future Glenmark’s stock potential is, you’re in the right place. We will be looking into the projections, analysis, and all the interesting elements that are affecting its trajectory..

Overview of Glenmark Pharma Share

Glenmark Pharmaceuticals Ltd. is an international company leading researches into medications. They have generics, specialty medications and over-counter (OTC) products in more than 80 countries. Glenmark’s share price reached a new 52-week high on July 11, 2025, touching the upper circuit limit. On BSE it was around Rs 2,095.65 and on NSE it was about Rs 2,094.40. Some reports were higher than that putting it at Rs 2,153.50 which meant a substantial increase of 13.10%.

Such a remarkable increase is attributed to Glenmark’s enormous licensing agreement with AbbVie for the ISB 2001 experimental cancer drug. This deal is substantially large with an upfront fee of USD 700 million, milestone payments of USD 1.225 billion and double digit royalties on net sales. It is certain that this is one of the largest deals in the Indian Pharma sector. Investor confidence has certainly improved. Some analysts like HSBC have raised their target prices significantly while others like Nomura are bearing a more neutral stance. This is undoubtedly part of the dynamic world of stock markets.

Glenmark Pharma Price Target Forecasts for 2025 (January to December)

Hoping to invest in Glenmark Pharmaceuticals by 2025? You’ll be pleased to know experts are predicting shares to trade between ₹1,300 and ₹2,000. Though these numbers are quite broad, let’s try to make sense of this analysis.

Currently (July 2025), Glenmark is trading at ₹1,904. Analysts expect it to dip as low as ₹1,858 or surge to ₹1,965 in the near term. Based on monthly estimates between August and December of 2025, there will be a slight incline in progress towards these targets as well.

| Month | Expected Closing Price (₹) | Maximum Forecast (₹) |

| August 2025 | ~1,890 | |

| September 2025 | ~1,920 | |

| October 2025 | ~1,939 | |

| November 2025 | ~1,952 | |

| December 2025 | ~2,001 | ~2,002 |

Based on current estimates, the average price anticipated for Glenmark over the next year stands at approximately ₹1,679.50, with a maximum forecast of nearly ₹2,011 and a minimum of around ₹1,300. This shows that people expect good things, but also indicates there is some inconsistency in the estimates. Most analysts consider Glenmark as a “buy” which means they expect it to grow throughout 2025. If you are tracking it, there seems to be a clear upward movement which could see it reach ₹2,000 by the end of year.

Glenmark Pharma Price Target Forecasts from 2025 to 2030

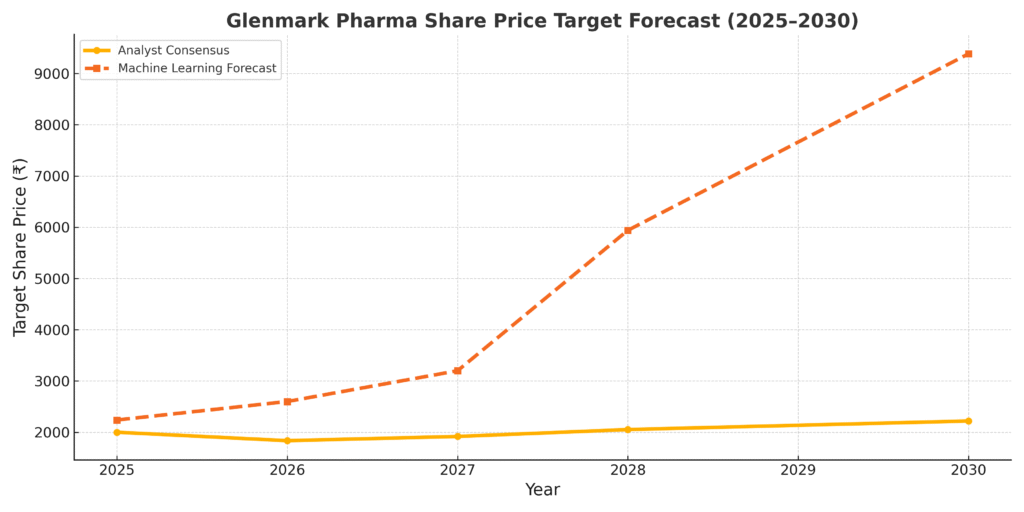

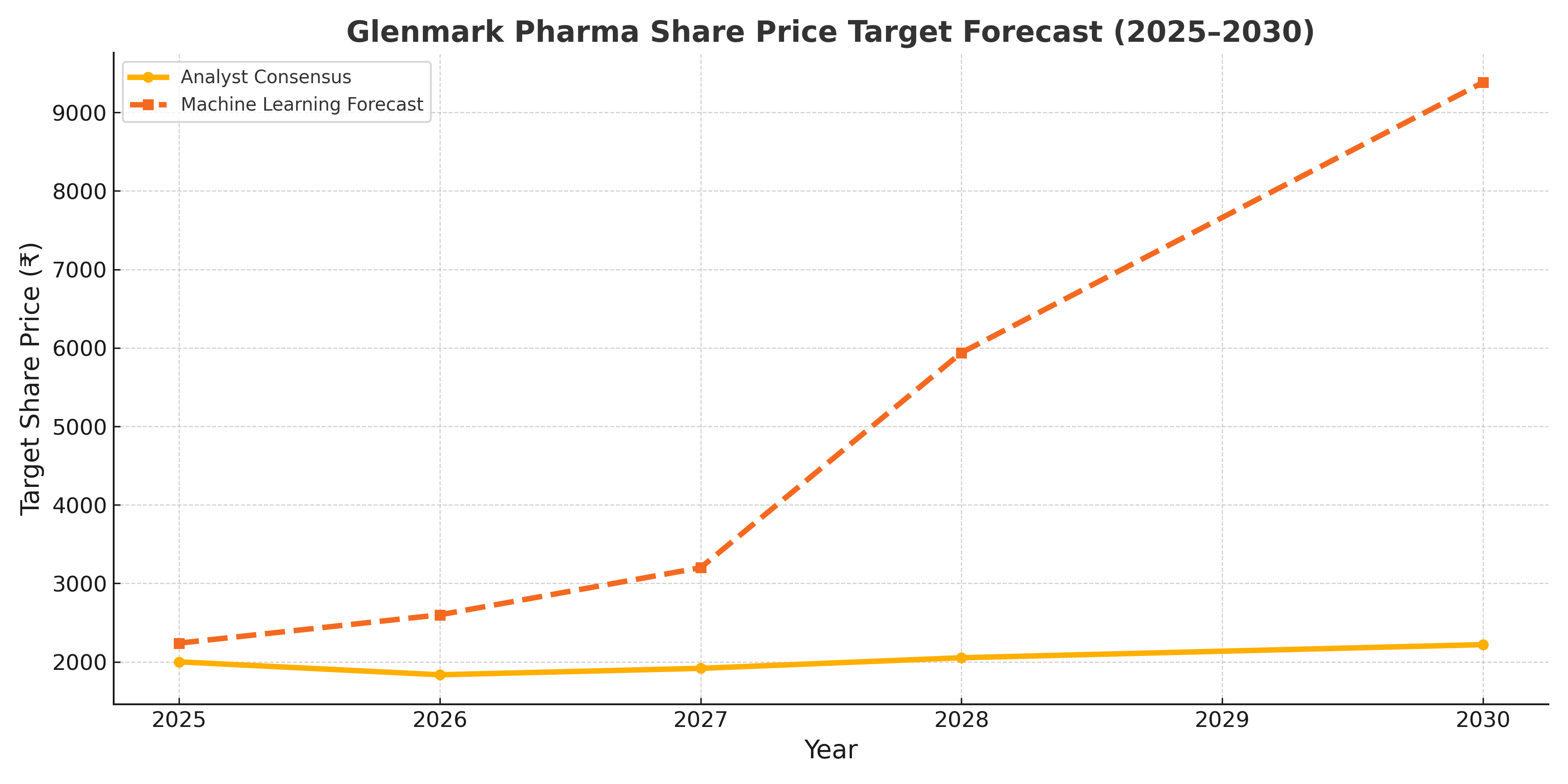

📈 Glenmark Pharma Share Price Target Forecast (2025–2030)

Comparison between Analyst Consensus and Machine Learning predictions for Glenmark Pharma from 2025 to 2030.

Let’s shift our focus to the timeline of Glenmark Pharmaceuticals between 2025 and 2030. The outlook here suggests a relatively strong upwards trajectory for the stock.

The stock is expected to grow steadily during this period. Overall Glenmark’s share price is expected to reach around ₹3,580. Amazing right? Forecasts for 2030 indicate steady growth from ₹3,396 in February to ₹3,580 in July which is what we said previously. The projected monthly growth of ₹3.396 is estimated between 0.4% to 1.4% which, while appearing modest, compounded over time will be significant. It’s so wonderful to observe such an optimistic posture for the future.

Analysis of Glenmark Pharma Share Price Target

Examining the details further, the overall sentiment regarding Glenmark Pharmaceuticals’ share price target is unequivocally optimistic, driven by both underlying factors and technical indicators.

Analyst Consensus: Aggregate opinions from several analysts suggest that the average price target for the next year is in the vicinity of ₹1,679.50, extending into 2026. There are more optimistic analysts with a maximum estimate of approximately ₹2,011. On the more cautious side, a few analysts are placing estimates near ₹1,300. This indicates that there is moderate upside potential as compared to current levels, albeit with a substantial dose of variability.

Technical Analysis: As of now, the 2025 projections seem to suggest a price bracket of ₹2,021 to ₹2,101, indicating a potential 5-9% rise relative to current valuation. The technical targets for 2026 seem even more optimistic, with a projected range of ₹2,567 to ₹2,645. This translates to a whopping 33-38% annual growth rate provided the stock maintains its upward trajectory and remains above key moving averages. In addition, we cannot overlook the remarkable historical returns of over 23% in a year and almost 300% over three years.

Long-Term Machine Learning Forecasts: This section is extremely captivating. More aggressive predictions, sometimes driven by machine learning, estimate the share price of Glenmark could reach ₹2,239 in 2025 and soar to over ₹9,384 by 2030. These models thrive on price history and market behavior and propose a compounded growth over time. It’s certainly thought-provoking!

Fundamental Strength: Glenmark remains at its core a fundamentally sound company. The company has a market cap of approximately ₹537 billion, solid revenues (TTM around ₹134 billion), and growing earnings (EPS ~37.10). Glenmark’s strengthening product portfolio, especially in specialization and OTC pharmaceuticals, as well as the expansion into international markets, support this positive sentiment.

Risks and Considerations: Until now, we have discussed nothing but signals and trends. Everything looks bullish; however, there is a downside estimate around Rs. 1300. Glenmark Pharmaceuticals investors should be mindful of market fluctuations, possible changes in regulations, and the constant rivalry in the pharmaceutical industry.

Short-term (up to 2026) forecasts suggest moderate to strong price appreciation which could see them touch targets of 2000 to 2600. Longer-term (up to 2030) forecasts run into incredibly high optimism, suggesting multi-fold gains. Like all long-term forecasts, it’s best to keep a steady balance with caution.

Glenmark Pharma Share Price Target 2025

Let’s focus on 2025. It certainly seems like Glenmark Pharmaceuticals’ price target for this year is accompanied by some considerable positive revisions from analysts.

For instance, HSBC increased its price target to ₹2,275 from ₹1,720, maintaining a “Buy” rating. With better prospects for R&D, positive indicators in the Indian market, and the validation of Glenmark’s unique BEAT protein platform through that large deal with AbbVie, he had to of course upgrade. Even more bullish is Motilal Oswal with a target of ₹2,430 based on some robust fundamentals and growth expectations.

Stock prices surged recently by 10%, reaching record highs, and this surge has been follows the AbbVie licensing deal which seemed to motivate brokers to raise their targets, some of which are quite high, even to as high as ₹2,430. Looking back at the table we reviewed in the previous section, the monthly price estimates for the remainder of 2025 suggest a gradual increase, peaking in December with closing prices of around ₹2,000 to ₹2,001. Therefore, one can reasonably assert that Glenmark Pharma’s price target for 2025 is indeed very optimistic, standing between ₹2,275 and ₹2,430 as a result of strong market confidence stemming from strategic partnerships, improved earnings guidance, and promising R&D progress.

Glenmark Pharma Share Price Target 2026

The targeted share price for Glenmark Pharmaceuticals is expected to fall between 1680 to 1836, which is in line with other analysts projections and common sentiment. The projection spans until 2026.

One group of 10 analysts appeared to be fairly split with a single price projection for about 1679.50 for 2026. The most optimistic in the group thought they would exceed 2,000 while the bearish sentiment had them below 1300. Regardless of the results, the consensus marking remains labeled “buy” suggesting they believe in some potential moderate upside from the current price. A target of 1836 for 2026 also suggests Glenmark continues the positive trend around the 2025 mark. Moreover, Glenmark projected operating revenue guidance has also confirmed reason to believe the price targets with 10-12% revenue growth expectations for FY 2026. Other models hint to the bullish sentiment as well, forecasting a potential 1,800 price mark in 2026 assuming macro conditions remain favorable and have good company performance during that time.

Glenmark Pharma Share Price Target 2027

Based on estimations, the Glenmark Pharmaceuticals share price target for 2027 is expected to be roughly ₹1,918 per share. This is less than a moderate jump from the 2026 target price which shows steady growth expectations over the next few years.

This prediction aligns well with the broader positive sentiment surrounding Indian equities and Glenmark’s solid financial performance, which includes revenue growth and strategic partnerships. If you analyze the price targets from 2024 to 2030, there is an upward trajectory—some estimates put Glenmark’s share price at about ₹2,220 in 2030.

Glenmark Pharma Share Price Target 2028

For the year 2028, the estimated share price for Glenmark Pharmaceuticals is expected to be around ₹2053 according to some predefined analyst evaluations and projected prices. This indicates that there will be further growth continuing from previous years where it was projected to grow from ₹1918 in 2027 to ₹2053 in 2028.

Though, it does become much more fascinating with alternative forecasts based on machine learning models. These models are far more aggressive, forecasting with aggressive optimism that Glenmark’s share price could possibly soar anywhere from ₹5852 to ₹5940 in 2028. This certainly underlines the opportunity for sustainable long-term bullish movement if the company’s performance, overall market conditions, and the company’s performance align with long-term trends.

Here’s a quick summary to give you a clear picture:

| Source Type | 2028 Price Target (₹) |

| Analyst Consensus | 2,053 |

| Machine Learning | 5,852 – 5,940 |

So, while the analyst consensus offers a more modest, steady growth outlook, the machine learning models open up the possibility of truly substantial appreciation by 2028. As an investor, it’s wise to consider both these perspectives, alongside the fundamental health of the company and broader market factors.

Glenmark Pharma Share Price Target 2030

The Glenmark Pharmaceuticals share price situation tells a different story depending on who you ask and how they’re forecasting up until the year 2030.

Based on current expectations, the combined analysts’ forecasts put Glenmark’s share price somewhere near ₹2,220 by 2030. This projection indicates a moderate growth trajectory which is underpinned by gradual annual increases starting from 2024. It shows that the company has a good long-term outlook and there is a healthy steady growth path.

Aggressive machine learning and quantitative models are able to project a much higher price target than what is currently seen. Forecasts indicate Glenmark reaching approximately ₹3,580 around mid-2030. These models anticipate a much more positive view, relying on Glenmark’s historical price data and market dynamics which are likely to push the stock upward much more quickly than prior expectations.

Here’s a quick table to summarize these differing views for 2030:

| Forecast Type | Price Target (₹) |

| Analyst Consensus | 2,220 |

| Machine Learning Models | 3,580 |

Considering Glenmark’s changing financial details, the current state of the market, and the overall pharmaceutical industry, investors should pay attention to different projections. The more conservative projection suggests steady growth while the aggressive target expects faster growth and expansion. In any case, with the rapid growth pharmacuetical companies are achieving, Glenmark Pharmaceuticals will likely hit ₹2,200 – ₹3,600 by 2030. So far the consensus is that Glenmark will continue to enjoy a solid surge in the market by 2030.

Factors Influencing Glenmark Pharma Share Price Target

What is behind the optimistic wise projection for Glenmark Pharmaceuticals share prices? There are several important reasons that have shaped its trajectory.

A Strong Financial Glenmark: Glenmark is not showboating; the numbers show their revenue increased by 12.8%. Additionally, EBITDA doubled to ₹23,510 million earning a strong 17.6% margin. Glenmark’s PAT (profit after tax) rose significantly as well. No wonder these strong earnings are the reason analysts are now more positive in their price targets.

Geographical Business Growth: Glenmark is not restricted to one market; they are expanding globally. For FY25 Glenmark’s India business est .31.9%, Europe est. -17.6%, and the Rest of the World 1.7%. Specifically for Europe strong YoY Q4 FY27 was up 20%. Global diversification definitely is adding to positive sentiment as well as overall confidence in the market.

Product Portfolio and Innovation: For Glenmark, innovation remains the cornerstone of the company. Branded businesses and specialty products have experienced steady growth, including new launches like Empagliflozin combinations in India and novel product launches in the US. Moreover, their innovation branch, Ichnos Glenmark Innovation (IGI), received Fast Track designation from the US FDA for a biologic cancer therapy ISB 2001. This shows strong research and development pipeline and good prospects for future growth.

Market Position and Share: Glenmark is competitive in the Indian pharmaceutical market, standing 13th with a revenue market share of 2.25% as of March 2025. Glenmark’s leadership in critical therapeutic areas including Dermatology and Cardiology further strengthens competitive advantage and growth potential.

Operational Efficiency: The noticeable increase in EBITDA margin and total profitability stems from refined cost management and excellent operational execution. This increase in EBITDA margin and profitability simultaneously boosts investor confidence, resulting in increased price targets.

Strategic Collaborations and Grants of Regulatory Approvals: Glenmark’s outlook and valuation are now being transformed by strategic partnerships like the recent landmark licensing deal with AbbVie for ISB 2001. Collaborations as well as regulatory approvals like the UK MHRA approval for specialty products are critical for the company’s growth.

Wider Trends Affecting the Economy and Sectors: Looking at the broader scope, I would like to draw attention to something else that deserves mention. The pharmaceutical industry as a whole is remarkably strong and fueled by increasing demand for healthcare services and ever- emerging new products and services. Glenmark has an expanding global footprint which makes it easier for him to take advantage of these trends, thus improving the overall market outlook and resulting in positive revisions.

Last Few Years’ Performance of Glenmark Pharma Share Price

Looking back at the past few years, Glenmark Pharmaceuticals’ share price has certainly been on a rollercoaster, but overall, it shows a strong upward trend, especially over the last three years.

Here’s a snapshot of its performance:

| Year | Performance (%) |

| 2025 (till July) | +18.05% |

| 2024 | +82.49% |

| 2023 | +100.75% |

| 2022 | -27.36% |

| 2021 | +3.27% |

| 2020 | +39.13% |

This stock goes on an unbelievable journey as it experiences a dramatic rise and dip throughout the years. Glenmark experienced a large dip in 2022, but in 2023 they made a comeback and soared by over 100%! In 2024, Glenmark then rose by another 82%. Now in 2025, up to July, they have continued to gain momentum, growing by about 18%.

Even when their stock price dipped aggressively in the past decade or so, Glenmark recently showed a strong recovery and rebound which reflects an improving business situation. Stocks were actively trading at around ₹1,900 to ₹1,920, reaching recent highs of ₹1,920 and lows of about ₹1,810 which shows that investors are interested in purchasing the stock. Overall, gladmark showed tremendous agile recovery and consistent growth since 2022 because of strong earnings and promising strategies.

Why Glenmark Pharma Share Increased in Value

Glenmark Pharmaceuticals recently had a surge in their share price and it is no mystery as to why this happened. The primary catalyst of Glenmarked’s surge was their recent financial results which showed that strong operational factors were driving the fundamental undertoning of the company’s growth.

The first factor that came into play was revenue growth. Glenmark’s consolidated revenue for the fiscal year ending March 31 2025 skyrocketed by 12.8%. Speaking of core markets, Glenmark’s performances in India where it grew 31.9% year on year, 17.6% growth in Europe and 1.7% growth in the rest of the world also deserves a mention. From an investor’s perspective, a company that consistently grows its topline is fantastic!

Cost efficiency and overall productivity have really increased, and this was brought into the spotlight with the boom in their profits. EBITDA increased by more than double, bringing it to ₹23,510 million, and with an EBITDA margin of 17.6% it also indicates a healthy bottom line. Further, Glenmark managed an adjusted profit after tax (PAT) and then also showed significant increases in PAT. All of this proves their increased efficiency and stronger sales.

Performance in particular areas has proven to be essential. Besides the numbers, it was impressive how their India business really prospered with that 31.9% growth, and European operations were up 20% year-on-year in Q4 FY25. Furthermore, the company has gained leadership positions in key therapeutic areas such as dermatology and cardiology in India, which shows a lot about its market penetration and brand strength.

Then, there is product innovation and pipeline strength. For a pharma company, this is pivotal. Glenmark’s innovation division receiving a US FDA Fast Track designation for a biologic cancer therapy is an enormous affirmation of their research trustworthiness. Moreover, the launch of new specialty and over-the-counter (OTC) products in the US and Indian markets adds to their robust footing for growth.

Last but not least, market confidence and strategic execution are crucial elements as well. The company’s investment in execution focus on strategic priorities and expanding globally, along with strong performance from branded businesses, increased investor confidence. All of this along with the good market reception caused by solid financials and growth predictions has increased engagement from investors and, as a result, the stock prices. This demonstrates great management and intelligent business moves!

Expert’s Advice for Glenmark Pharma Share

When it comes to Glenmark Pharmaceuticals, experts have certainly been weighing in, especially after the game-changing AbbVie deal. Their advice generally leans towards optimism, but with a few nuanced perspectives.

Many analysts, including those from HSBC and Axis Capital, have reiterated their “Buy” ratings and significantly increased their price targets. HSBC, for instance, sees the AbbVie deal as “transformative” and has raised its target to ₹2,275. Axis Capital is also bullish, labeling the deal an “ISB-2001 jackpot” and setting a target of ₹2,300. They believe the unique mechanism of action of ISB 2001 and its potential for substantial cash flow ($4 billion!) make a sustainable re-rating of the stock likely. These experts support their positive outlook by highlighting that Glenmark plans to use the deal proceeds for further R&D, debt reduction, and even increased dividend payouts, which are all great signs for investors.

Some technical experts, like Anuj Gupta from Ya Wealth Global Research, see the stock poised for a continued rally. They emphasize the strong technical structure supported by substantial volumes, suggesting further upside. Gupta even believes Glenmark Pharma shares could test levels of ₹2,600 to ₹2,800 in the short term, implying a potential upside of up to 29% from current levels, recommending a “buy on dips” strategy with strong support at ₹1,800.

However, it’s not all uniform bullishness. Brokerages like Nomura maintain a more cautious “Neutral” rating with a target price of ₹1,500. While they acknowledge the AbbVie deal as the largest licensing deal by an Indian pharma company and its value exceeding expectations, they suggest that the positive news might already be factored into the current valuation. Nuvama, too, maintained a “neutral” stance, despite acknowledging the significant financial inflow. They emphasize that while the deal is positive, other factors might temper the overall upside, and that AbbVie will be developing and commercializing the asset globally, with Glenmark retaining rights for emerging markets.

What this mix of advice tells us is that while the underlying sentiment is very positive due to the AbbVie deal and strong fundamentals, different firms have different takes on how much of that upside is already priced in. For investors, the general takeaway is that Glenmark is on a promising path, but it’s always wise to consider both the strong “buy” recommendations and the more cautious “neutral” views. Keep an eye on the company’s future pipeline updates, as analysts are eager to see what other molecules might follow a similar licensing model.

Frequently Asked Questions (FAQs) on Glenmark Pharma Share Price Forecast

Let’s address some common questions you might have about Glenmark Pharma’s share price future.

1. What is the expected price target for Glenmark Pharma in 2025?

The general forecast for Glenmark Pharma’s share price in 2025 ranges from about ₹1,835 to ₹2,000. Monthly projections suggest a steady increase throughout the year, potentially closing around ₹2,000 in December 2025. Some bullish analysts even project targets up to ₹2,430!

2. What is the consensus price target for 2026?

Analysts generally estimate an average price target of ₹1,679.50 for 2026. The maximum forecast is near ₹2,011, and the minimum is around ₹1,300. Overall, the analyst rating is typically a “buy,” indicating moderate upside potential.

3. What factors are primarily driving Glenmark’s price forecast?

Several key factors are at play: strong revenue growth (12.8% year-over-year in FY25), significantly improved profitability, robust performance in their Indian and European markets, progress in their innovation pipeline (including the US FDA Fast Track designation for a cancer therapy), and strategic partnerships like the recent monumental AbbVie deal.

4. How has Glenmark’s share price performed recently?

As of July 2025, Glenmark’s share price is hovering around ₹2,094. It recently surged by about 10% following positive news and analyst upgrades. The stock has shown strong positive momentum, backed by solid earnings growth and increased market confidence.

5. Are there long-term price forecasts beyond 2026?

Absolutely! Forecasts extend to 2027 and beyond. Predicted prices are expected to rise steadily, reaching around ₹1,918 by 2027 and further increases are anticipated in subsequent years, with some machine learning models even projecting targets up to ₹9,384 by 2030, though these should be considered with broader market dynamics in mind.

6. What is the overall analyst sentiment on Glenmark Pharma stock?

Most analysts maintain a “buy” rating for Glenmark. This reflects their confidence in Glenmark’s growth prospects, which are supported by the company’s strong fundamentals and positive trends within the pharmaceutical sector.