Eicher Motors Share is a bullish trend in the share market. During share ups and downs, you should know all about share details before investing. In this blog, we are going to discuss Eicher Motors Share Price Target 2025, 2027, 2028, 2030, and 2040. We will try to analyze the share base in the company’s overall performance.

We also look at the company’s profit growth in the last five years, sales growth in the last five years, and ROE percentage in the last five years. Similarly, we compare share growth and the share price return amount if the share has increased or decreased over the last five years. We also seek advice from experts about which time to invest in the share; it may be helpful for you, too. Let’s have a look at the Eicher Motors Share Price Target from 2025 to 2040.

Overview About Eicher Motors

Eicher Motors Limited is an Indian multinational automotive company that was established in 1948. The company mainly manufactures motorcycles and commercial vehicles. The headquartered of the company is situated in New Delhi. The company is the parent company of Royal Enfield. The company was first known as Good Earth Company.

Fundamental Analysis Of Eicher Motors Limited

| Company Name | Eicher Motors Limited |

| Market Cap | ₹1,46,828.96 Crore |

| Book Value | ₹604.52 |

| Face Value | ₹1 |

| 52 Week High | ₹5,335 |

| 52 Week Low | ₹3,562.45 |

| P/B | 8.84 |

| P/E | 36.63 |

| DIV. YIELD | 0.96% |

| ROE | 26.38% |

Influencing Key Factors Of Eicher Motors Share Price

Products Performance

The company launched many products, and Royal Enfield got a lot of good feedback from customers. Royal Enfield launched the all-new Hunter 350 motorcycle in a different format. It gives a good return from the national and the international market.

Increases Motorcycle Sales Amount

After the innovation of new products, the company’s sales increase. In the financial year 2022-23, the company’s Motorcycle Sales were 8,25,067, which increased by 11% to 9,13,004.

Commercial Vehicle Sales Amount Increases

The commercial vehicle sales amount also increased, in the financial year 2022-23 the sales amount was 79,624 which increased to 7.5% and reached 85,561 in the year 2023-24.

India’s Economic Condition

India’s economic condition also may be an influencing factor for Eicher Motors Share. Any economic breakdown may affect the company’s share growth and the company’s growth.

Eicher Motors Share Price Target 2025

The range of Eicher Motors Share Price Target for 2025 may vary from ₹5,325.86 to ₹6,941.12.

Influencing Key Factors Of Eicher Motors Share

- Increases The Company’s Income Amount

- Rapidly increasing the company’s income may also affect the share. In the financial year 2022-23, the company’s comprehensive income was ₹2,924.63 Crore, which increased to ₹3,990.46 Crore in the year 2023-24, which increased 36% compared to the previous year.

- Expansion Of Company’s Network Out Side Of Countries

- The company also expanded its retail outlets in 65 different countries including Austria, France, Germany, Morocco, Netherlands, Spain, Turkey, Mexico, Brazil, Singapore, and many other countries which also affect the share price. Total 1,085 retail outlets spread outside of India.

- Expansion Of Retail Outlets In Indian Market

- Eicher Motors Limited spread its retail outlets in more than 2,000 places. In India, the company has 1,102 exclusive stores and 901 studio stores which increase the selling rate and affect the company’s share also.

| Year | Eicher Motors Share Price Target 2025 |

| 1st Price Target | ₹5,325.86 |

| 2nd Price Target | ₹6,941.12 |

Risk Factors

- Increases in the price rate of raw materials like Aluminium, Steel, and Rubber may affect the company’s manufacturing capacity and profit growth and share.

- In the era of the advancement of new technologies, a company may face problems if it is unable to adapt new technologies in the product manufacturing fields.

Also Read – TVS Motor Share Price Target

Eicher Motors Share Price Target 2027

The Eicher Motors Share Price Target 2027 range may vary from ₹8,550.60 to ₹10,140.33.

Influencing Key Factors For Eicher Motors Share Price Target 2027

- Diversification Of New Products

- The company also started to expand its products. The company included Volvo-branded trucks and buses. The company also has a manufacturing capacity of Light Duty Trucks, Medium Duty Trucks, Heavy Duty Trucks, and buses with a capacity of 12-62 seats. During the financial year 2022-23, the company also delivered the first batch of 40 Electric Buses to the city of Chandigarh. This product diversification also helps to capture market share.

- Established Vendor Relation

- To minimize material delay risks and achieve a more flexible supply chain, the company tries to establish vendor relations in different locations in different areas, which increases the company’s sales rate capacity.

- Past History Of Eicher Motors Share

- Eicher Motors Share is a multi-bagger share that runs up the stairs. In 1998 (29th January), the price rate was ₹1.25, which became ₹22.01 in 2008 (10th October), and in 2024 (21st May), it became ₹4,672.95.

| Year | Eicher Motors Share Price Target 2027 |

| 1st Price Target | ₹8,550.60 |

| 2nd Price Target | ₹10,140.33 |

Risk Factors

- A shortage of semiconductor (microchip) products and a rise in commodity prices like oil can impact production capacity and input costs.

- The company’s manufacturing facility is only concentrated in a single location in Chennai which may increase project delays, construction costs, operational disruption, and natural disasters.

Eicher Motors Share Price Target 2028

The Eicher Motors Share Price Target 2028 range may vary from ₹10,150.19 to ₹11,735.98.

Influencing Key Factors For Eicher Motors Share Price Target 2028

- Market Share Of Royal Enfield

- After the launching of the 350CC segment of Royal Enfield, the company’s market share increased to 90% in the year 2023, which is a very high percentage.

- Establishment Of Assembly

- The company also established 5 CKD (assembly) units in different locations outside of India. Each unit is designed to serve a local cluster of nearby countries, which helps to diversify the company’s products.

- Collaboration With Spanish Company

- To gain advanced technology knowledge to build up more strengthen the EV development platform the company also collaborates with the Spanish Company Stark Future. The company also focused on leisure motorcycling through strategic investment.

| Year | Eicher Motors Share Price Target 2028 |

| 1st Price Target | ₹10,150.19 |

| 2nd Price Target | ₹11,735.98 |

Risk Factors

- To compete with Royal Enfield’s in-market share, other multinational companies also tie up with each other, like Hero Motors, which is tied up with Harley Davidson Motor Company, and Bajaj Auto Company, which is tied up with Triumph Motor to capture market share.

- Sudden policy changes for ICE Vehicles or stricter regulation on EVs can impact the company’s business and sales growth.

Eicher Motors Share Price Target 2030

The Eicher Motors Share Price Target 2030 range may vary from ₹14,014.13 to ₹15,625.74.

Influencing Key Factors For Eicher Motors Share Price Target 2030

- Retail Touchpoints

- In the financial year 2022-23, Royal Enfield expanded to 1,150 new retail touchpoints across different countries including 207 exclusive stores and 950 multi-brand outlets.

- Distribution Facility In India

- The company has a strong distribution facility in India also. Currently, the company has 175 distribution and market points in India. The company exports to 30 different countries in India and outside of India.

- Increases Production Capacity

- From the financial year 2013 after starting the commercial production from the new site at Oragadam, Chennai, and India the company increased its production capacity to 1,00,000 units.

All those factors are related to the increase in the share price of the company.

| Year | Eicher Motors Share Price Target 2030 |

| 1st Price Target | ₹14,014.13 |

| 2nd Price Target | ₹15,625.74 |

Risk Factors

- Low-selling prices associated with EV business in India can impact the business profit growth and share price rate also.

- The company also faces a problem with the shortage of skilled experienced employees which may affect the production facility and the share growth also.

Also Read – Amara Raja Share Price Target

Eicher Motors Share Price Target 2040

The Eicher Motors Share Price Target 2040 range may vary from ₹31,625.78 to ₹33,226.44.

Influencing Key Factors For Eicher Motors Share Price Target 2040

- Joint Venture With VolvoGroup

- In the year 2008, the company formed a 50:50 joint venture with Volvo Group named VE Commercial Vehicles which designs, manufactures and markets commercial vehicles. This joint venture also provides engineering components and provides engineering design. At present Volvo Group owns 45.6% and Eicher Motors owns 54.4% of the Joint Ventures.

- Tractors Business

- Eicher Motors Limited also has business branches in the tractors segment. In the year 2005, the company sold its tractors and engines business to TAFE Tractors (which is a tractor & Farm Equipment Limited) of Chennai. In the year 1982, the company also collaborated with Mitsubishi for the manufacturing of light commercial vehicles which also increased the profit growth of the company.

- Expanding Asia-Specific Network

- Royal Enfield expanded its retail network in the Asia-specific network in the Philippines, Vietnam, Mongolia, and Thailand with the addition of 6 exclusive stores in the financial year 2022-23 which also stands at 155 touchpoints with 49 exclusive stores and 106 MBOS.

All those factors are related to the increase in the share price of the company.

| Year | Eicher Motors Share Price Target 2040 |

| 1st Price Target | ₹31,625.78 |

| 2nd Price Target | ₹33,226.44 |

Risk Factors

- Low Mileage in bikes can decrease the sales rate of the company.

- Fuel Rise can cause a decrease in the sales rate.

The Last Year’s Performance Of Eicher Motors Limited

Profit Amount

The company’s last 5 year’s profit growth percentage is described in the below portion.

- In the last 5 years 12.96%

- In the last 3 years 41.69%

- In the last 1 year 43.20%

The Net Profit amount of the company was ₹2,653.16 Crore in March 2023 which increased to ₹3,763.16 Crore in March 2024. The Operating Profit amount of the company was ₹3,410.23 Crore in March 2023 which increased to ₹4,385.79 Crore in March 2024.

Sales Growth

The last 5 year’s Sales growth percentage of the company is described in the below portion.

- In the last 5 years 10.46%

- In the last 3 years 24.52%

- In the last 1 year 14.89%

The Net Sales amount of the company was ₹14,253.67 Crore in March 2023 which increased to ₹16,124.30 Crore in March 2024.

ROE Percentage

The company’s last 5 year’s ROE percentage is described below.

- In the last 5 years 20.96%

- In the last 3 years 22.10%

- In the last 1 year 26.98%

ROCE Percentage

The company’s last 5 year’s ROCE percentage is described below.

- In the last 5 years 27.59%

- In the last 3 years 29.15%

- In the last 1 year 34.28%

The Net Cash Flow Amount

The company’s Net Cash Flow was ₹-28.93 Crore in March 2023, increased to ₹54.26 Crore in March 2024.

Total Liabilities

The company’s Total Liabilities were ₹16,910.26 Crore in March 2023, increased to ₹ 20,495.86 Crore in March 2024.

Total Expenditure Amount

The company’s Total Expenditure was ₹10,712.84 Crore in March 2023, which increased to ₹11,715.66 Crore in March 2024.

Other Income Amount

The Other Income Amount was ₹640.53 Crore in March 2023 which increased to ₹1,185.95 Crore in March 2024.

Tax Amount

The Tax amount of the company was ₹886.19 Crore in March 2023 which increased to ₹1,225.46 Crore in March 2024.

Market Capitalisation Amount

The Market Capitalisation amount was ₹80,646.69 Crore in March 2023 which increased to ₹1,10,052.76 Crore in March 2024.

EBITDA Margin

The EBITDA Margin was 24.63% in the year 2023 which increased to 28.2% in the year 2024.

Eicher Motors Share Price Performance For The Last Few Years

Eicher Motors Share is under both the Indian Stock Exchange BSE (Bombay Stock Exchange) and NSE (National Stock Exchange).

- The last 6 months’ share growth was +572.70 (12.09%).

- The last 1 months share growth was +1.90 (0.036%).

- The last 1 year’s share growth was +1,432.95 (36.96%).

- The last 5 years’ share growth was +3,191.07 (150.60%).

- The maximum share growth was +5,308.78 (435,145.90%).

- Eicher Motors share price return percentage was 9.64% in the last 1 month.

- The last 3 month’s share price return percentage was 11.26%.

- The last 1 year’s share price return percentage was 36.96%.

- The last 3 year’s share price return percentage was 96.14%.

- The last 5 year’s share price return percentage was 150.89%.

Peer Company Of Eicher Motors Limited

| Company Name | Market Cap (Crore) |

| Maruti Suzuki India Limited | ₹3,73,176.69 |

| Tata Motors Limited | ₹2,82,588.73 |

| Bajaj Auto Limited | ₹2,54,357.37 |

| Mahindra & Mahindra Limited | ₹3,99,173.65 |

Is Eicher Motors Share profitable for investors to invest right now?

Positive Sides

- The last 3 year’s profit growth of the company was 41.69% which was very good.

- The last 3 year’s revenue growth of the company was 23.56%.

- The last 3 year’s ROE percentage was 22.10% which was very good.

- For the last 3 years, the ROCE percentage was 29.15%.

- The company has good cash flow managment, PAT stands at 1.05.

- The company has an efficient cash conversation cycle of -42.36 days.

- The company’s PEG ratio is 0.86.

- The company is virtually debt-free and the company has a healthy interest cover ratio of 259.63.

- In the last 5 years, the company has been maintaining an effective average operating margins of 23.36%.

- The last 3 year’s Sales Growth was 24.52% which was also very good.

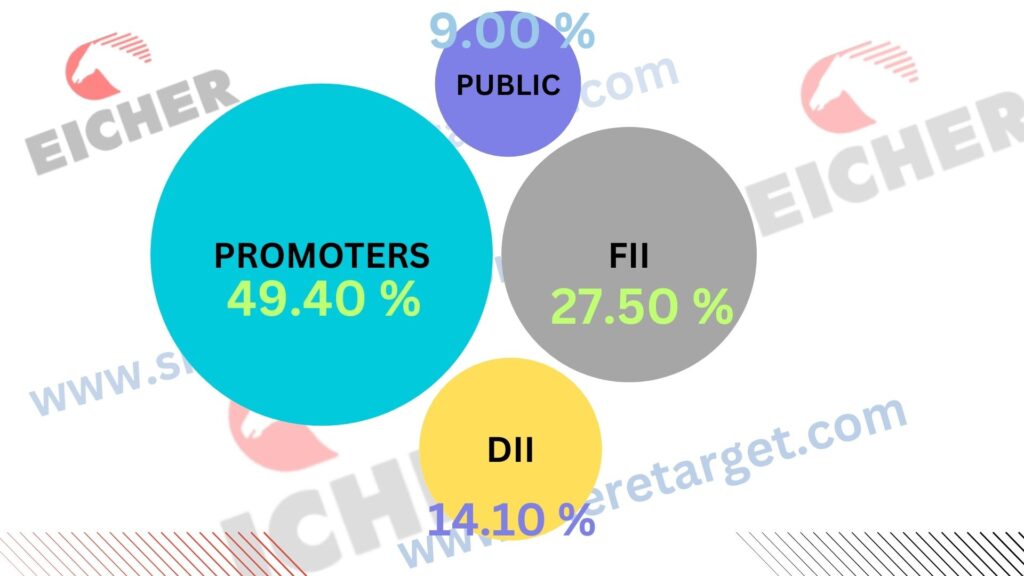

- The company has a good promotor holding capacity which is 49.40% means many good investor wants to invest in the share.

- The FII investor percentage of the company is 27.50% which is very good for the company’s growth.

Negative Sides

Eicher Motors Share may be profitable for long-term investment but before investing you should consult with an expert.

Discussion About Share Holding Pattern Of Eicher Motors Limited

Eicher Motors Limited mainly has four types of shareholding patterns such as promoter holding, public holding, DII, and FII. We can majorly influence the company’s growth depending on the shareholding pattern.

| Investor Type | Percentage |

| Promoter Holding (Owned by the company’s promoter) | 49.40% |

| Public Holding (Held by the public) | 9.00% |

| FII (Invest by Foreign Institutional Investor) | 27.50% |

| DII (Invest money by Domestic Institutional Investor) | 14.10% |

Also Read – Bharat Electronics Share Price Target

Dividend History Of Eicher Motors Limited

| Year | Dividend Medium | Dividend Amount Per Share |

| 2024 | Final | ₹54.00 |

| 2023 | Interim | ₹37.00 |

| 2022 | Final | ₹21.00 |

| 2021 | Final | ₹17.00 |

| 2020 | Interim | ₹125.00 |

FAQ

Who is the CEO of Eicher Motors Limited?

Mr. Siddhartha Lal is the CEO of Eicher Motors Limited.

What is the Eicher Motors Share Price Target 2025?

Eicher Motors Share Price Target for 2025 is ₹5,325.86 to ₹6,941.12.

What is the Eicher Motors Share Price Target 2027?

Eicher Motors Share Price Target for 2027 is ₹8,550.60 to ₹10,140.33.

What is the Eicher Motors Share Price Target 2028?

Eicher Motors Share Price Target for 2028 is ₹10,150.19 to ₹11,735.98.

What is the Eicher Motors Share Price Target 2030?

Eicher Motors Share Price Target for 2030 is ₹14,014.13 to ₹15,625.74.

What is the Eicher Motors Share Price Target 2040?

Eicher Motors Share Price Target for 2040 is ₹31,625.78 to ₹33,226.44.

Conclusion

This website is written to help the investor gain some basic knowledge about the market strategy of Eicher Motors Share. For making this blog we take consultation from expertise and doing research about the company. It is expected that the Eicher Motors Share Price Target will be a good choice to invest in on a long-term basis. The motorcycles and commercial vehicles in India and outside of the country always increase as a result of the company and the share may increase rapidly.

We try to give an in-depth idea about the share. If you think it is helpful to you you can share it. If you have any questions please let us know through the comment box we will try to reply to your questions and solve your problem. Thanks for visiting this website and thanks for being with us.

Disclaimer – We are not SEBI-registered advisors. A financial market is always risky to anyone. This website is only for training and educational purposes. So before investing, we are requested to discuss certified expertise. We will not be responsible for anyone’s profit or loss.