Delhivery Share is in a bullish trend in the share market. During share ups and downs, you should know all about the share details before investing. In this blog, we are going to discuss the Delhivery Share Price Target 2025, 2026, 2028, 2030, and 2035. We will try to analyze the share base in the company’s overall performance.

We also look at the company’s profit growth in the last 5 years, the last 5 years’ sales growth, and the last 5 years’ ROE percentage. Similarly, we also compare the share growth, the share price return, amount whether the share has increased or decreased over the last 5 years. We also take advice from experts about when we should invest in the share, which may be helpful for you. Let’s have a look at the Delhivery Share Price Target from 2025 to 2035.

Overview Of Delhivery Limited

Delhivery Limited is an Indian logistics and supply chain company, which was established in Gurgaon. The company was established in the year 2011. The company was established as SSN Logistics Limited, initially conceptualised as a hyperlocal express delivery service provider for online stores, delivering flowers and food in Gurgaon.

Fundamental Analysis Of Delhivery Limited

| Company Name | Delhivery Limited |

| Market Cap | ₹26,782.96 Crore |

| P/B | 2.76 |

| P/E | 239 |

| 52 Week High | ₹448.69 |

| 52 Week Low | ₹236.80 |

| Book Value | ₹132.15 |

| Face Value | ₹1 |

| DIV. YIELD | 0% |

| ROA | -1.52% |

| ROE | -1.89% |

Delhivery Share Price Target 2025

Delhivery Share Price Target 2025 forecast may vary from ₹316.29 to ₹389.37.

Influencing Key Factors Of Delhivery Share Price Target 2025

- India’s Largest Fully Integrated Logistics Provider

- The company’s world-class logistics infrastructure, combined with industrial engineering expertise and a large network of domestic and global partners, enables it to deliver speed, reliability, flexibility, and efficiency to thousands of customers and millions of Indian households every day. As per the March 2023 report, the company’s total delivery centers were 4,056, total number was 94. The company’s total active customer number was 27,500.

- Transforming Logistics Through Technology

- In this company, more than 500 skilled technology and engineering professionals drive the design, development, and implementation of cutting-edge hardware and software solutions that deliver operational excellence, efficiency, and a better customer experience.

- Supply Chain Services

- Industry-specific integrated warehousing and transportation of auto, FMCG, electronics, chemicals, fashion, industries, F&B, etc. The company also has in-store management, inventory optimisation facilities, and direct-to-consumer fulfilment solutions.

| Month | Delhivery Share Price Target 2025 (1st Price Target) | Delhivery Share Price Target 2025 (2nd Price Target) |

| May | ₹316.29 | ₹348.27 |

| June | ₹345.18 | ₹352.98 |

| July | ₹350.76 | ₹358.32 |

| August | ₹355.22 | ₹368.67 |

| September | ₹365.09 | ₹374.38 |

| October | ₹369.80 | ₹382.55 |

| November | ₹381.35 | ₹388.06 |

| December | ₹381.56 | ₹389.37 |

Also Read – Zomato Share Price Target

Delhivery Share Price Target 2026

Delhivery Share Price Target 2026 forecast may vary from ₹390.73 to ₹465.29.

Influencing Key Factors Of Delhivery Share Price Target 2026

- Express Parcel

- The company provides same-day and next-day delivery services in all major cities with 48-96 delivery timelines pan-India for parcels weighing up to 10 kilograms and for specialised delivery of Heavy Goods like white goods, appliances, furniture, and sports equipment. Consumers can also directly access the company’s services via Delhivery Direct, available on the company’s website and on the iOS and Android app stores.

- Part Truckload Freight

- The company operates one of the largest express Part Truckload Networks in the country, following the company’s acquisition of Spoton in August 2021. The company’s Part Truckload freight and Express networks share teams, fleet, infrastructure, and technology systems, enabling the company to provide e-commerce equivalent turnaround times and provide reach across 18,000 pincodes to freight customers via integrated, automated gateways and a fleet of tractor-trailer trucks across mainline line-haul routes.

- Truckload Freight

- As of the 2022 financial year, over 82,000 trucks have been registered on the Orion platform, with more than 375,000 truck placements completed for external customers, as well as the company’s line-haul requirements. The company’s digital freight brokerage platform provides matching services, connecting shippers with spot and long-term truckload demand to fleet owners and suppliers of truckload capacity.

| Month | Delhivery Share Price Target 2026 (1st Price Target) | Delhivery Share Price Target 2026 (2nd Price Target) |

| January | ₹390.73 | ₹399.34 |

| February | ₹394.26 | ₹406.85 |

| March | ₹405.32 | ₹416.88 |

| April | ₹414.80 | ₹424.95 |

| May | ₹420.72 | ₹428.13 |

| June | ₹426.85 | ₹435.28 |

| July | ₹433.20 | ₹442.35 |

| August | ₹439.71 | ₹447.50 |

| September | ₹445.48 | ₹455.87 |

| October | ₹451.37 | ₹459.76 |

| November | ₹457.09 | ₹462.53 |

| December | ₹459.32 | ₹465.29 |

Delhivery Share Price Target 2028

Delhivery Share Price Target 2028 forecast may vary from ₹573.09 to ₹618.39.

Influencing Key Factors Of Delhivery Share Price Target 2028

- Cross-Border Services

- The company provides door-to-door and port-to-port cross-border express parcel and air freight services to over 220 countries through strategic, reciprocal partnerships with leading global players like FedEx and Aramex, and the company’s global shipping platform, ‘Starfleet’. 871 customers availed of the cross-border services, transacting over 240,000 international express and e-commerce orders, over 5,000 tonnes of air freight in the year 2022.

- Delhivery Team

- More than 94,000 people make up the Delhivery team and form the backbone of the organisation. CAGR from 64.4% from the year 2015 to the financial year 2022, making the company the fastest-growing independent integrated logistics company in India.

- Technology, Data Sciences, and Business Intelligence

- The company launched the Unified Client Portal in 2022, which enables SME clients to self-onboard, access all the company’s services through a single application, and customize pricing and operational parameters. The company also completed the integration of Primaseller with the company’s Godam WMS, enabling D2C brands to seamlessly manage orders, inventory, and fulfillment across channels.

| Month | Delhivery Share Price Target 2028 (1st Price Target) | Delhivery Share Price Target 2028 (2nd Price Target) |

| January | ₹573.09 | ₹561.28 |

| February | ₹559.37 | ₹565.19 |

| March | ₹564.21 | ₹575.92 |

| April | ₹573.27 | ₹581.33 |

| May | ₹579.03 | ₹586.49 |

| June | ₹585.71 | ₹591.28 |

| July | ₹589.36 | ₹598.02 |

| August | ₹595.26 | ₹613.90 |

| September | ₹611.57 | ₹621.09 |

| October | ₹597.36 | ₹619.27 |

| November | ₹604.20 | ₹612.30 |

| December | ₹605.21 | ₹618.39 |

Delhivery Share Price Target 2030

Delhivery Share Price Target 2030 forecast may vary from ₹702.38 to ₹746.09.

Influencing Key Factors Of Delhivery Share Price Target 2030

- Integrated Services

- Revenues from the company’s supply chain services business grew by over 40% during the financial year 2022. In the same year, 2022, the company added almost 1 million square feet of fulfilment centre infrastructure across locations such as Mumbai, Hyderabad, NCR, Bengaluru, and multiple Tier 1 and Tier 2 cities. Today, the company services over 70 leading enterprise customers across industry sectors such as automotives, distribution, chemicals, etc.

- Spoton Integration

- The company completed the acquisition of Spoton, one of India’s leading and fastest-growing PTL networks, in the year 2022. Delhivery and Spoton together formed the fastest-growing and one of the largest Express PTL networks in India. This acquisition will allow the company to realise synergies in network infrastructure as well as expand the company’s tractor-trailer fleet, thereby improving the unit economics of the company’s Express Parcel and PLT business.

- Business Strategy

- The company’s strategy is driven by twin growth flywheels. The company’s world-class logistics infrastructure and industrial engineering, and with a large network of domestic and global partners that allows the company to create large network effects and scale benefits. This network is orchestrated by the company’s proprietary logistics operating system, whose capabilities are enhanced by deep data science and business intelligence capabilities.

| Year | Delhivery Share Price Target 2030 |

| 1st Price Target | ₹702.38 |

| 2nd Price Target | ₹746.09 |

Delhivery Share Price Target 2035

Delhivery Share Price Target 2035 forecast may vary from ₹1,021.31 to ₹1,066.68.

Influencing Key Factors Of Delhivery Share Price Target 2035

- New Products Services

- The company launched a number of new logistics services to expand the customer base and increase the company’s share of the existing clients’ total logistics spend. In December 2021, the company entered into a strategic alliance with FedEx to expand the company’s coverage in North America, Europe, and Australia, thereby extending the company’s cross-border reach. In the year 2022, the company also launched Delhivery Direct, which enables individual consumers to book and track shipments in the company’s network.

- Domestic Rail Transportation

- Domestic rail transportation includes the movement of shipments over public and private rail networks. Rail is one of the most cost-effective modes of bulk freight transportation for shipments like commodities (e.g., coal, iron ore, cement), agricultural products (e.g., fertilisers, food grains, mineral oil), and raw materials.

| Year | Delhivery Share Price Target 2035 |

| 1st Price Target | ₹1,021.31 |

| 2nd Price Target | ₹1,066.68 |

Last Few Years’ Performance Of Delhivery Limited

Profit Growth

- In the last 5 years, 14.59%

- In the last 3 years, 15.27%

- In the last 1 year, 80.69%

The Net Profit of the company was ₹-812.39 Crore in March 2023, which became ₹-168.29 Crore in March 2024. The Operating Profit of the company was ₹-388.96 Crore in March 2023, which increased to ₹189.32 Crore in March 2024.

Sales Growth

The sales growth percentage of the company in the last 5 years is described below.

- In the last 5 years, 36.59%

- In the last 3 years, 30.29%

- In the last 1 year, 13.29%

The Net Sales amount of the company was ₹2,259 Crore in December 2023, which decreased to ₹2,059.36 Crore in March 2025.

ROE Percentage

The ROE percentage growth of the company in the last 5 years is described below.

- In the last 5 years, -11.26%

- In the last 3 years, -12.68%

- In the last 1 year, -1.29%

ROCE Percentage

The ROCE percentage growth of the company in the last 5 years is described below.

- In the last 5 years, -8.25%

- In the last 3 years, -8.69%

- In the last 1 year, -0.88%

Total Expenditure Amount

The company’s Total Expenditure was ₹2,096.38 Crore in December 2024 and decreased to ₹1,956.27 Crore in March 2025.

The Net Cash Flow Amount

The Net Cash Flow amount of the company was ₹87.59 Crore in March 2023, which decreased to ₹11.29 Crore in March 2024.

What Is The Expert Advice About The Investment In Delhivery Share

Positive Sides

- In the last 3 years, the company has been maintaining a good revenue growth which was 29.01%.

- The has significantly decreased its debt amount by 73.30 Crore.

- The company is virtually debt-free.

- The company has an efficient cash conversion cycle of 66.82 days.

- The company has a healthy liquidity position with a current ratio of 4.53.

- In the last 3 years, the company had a good sales growth which was 30.29%.

Negative Sides

- In the last 3 year’s the company had a poor ROE ratio, which was -12.68%.

- In the last 3 years, the company has been maintaning a poor ROCE ratio, which was -8.69%.

- The company is trading at a high EBITDA ratio of 32.69.

- The company has a low EBITDA margin of -3.76% in the last 5 years.

Peer Company Of Delhivery Limited

| Company Name | Market Cap (Crore) |

| Container Corporation Of India Limited | ₹47,365.95 |

| Blue Dart Express Limited | ₹16,125.37 |

| Transport Corporation Of India Limited | ₹8,795.67 |

| Zinka Logistics Solutions Limited | ₹7,972.39 |

| Tiger Logistics | ₹590.76 |

Also Read – Zee Entertainment Share Price Target

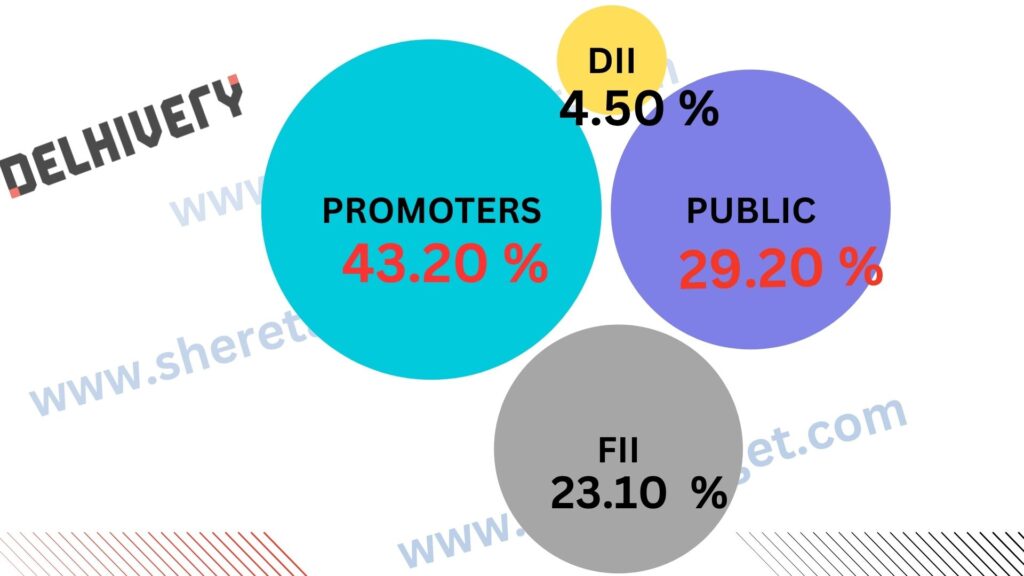

Discussion About Shareholding Pattern Of Delhivery Limited

Delhivery Limited mainly has four types of shareholding patterns, such as promoter holding, public holding, DII, and FII. Depending on the shareholding pattern, we can majorly influence the company’s growth.

| Investor Type | Percentage |

| Promoter Holding (Owned by the company’s promoter) | 43.20% |

| Public Holding (Held by the public) | 29.20% |

| FII (Invest by Foreign Institutional Investor) | 23.10% |

| DII (Invest money by Domestic Institutional Investor) | 4.50% |

The Last Few Years’ Share Price Updation Of Delhivery Share

Delhivery Share always gives good returns to investors, which is described in the portion below.

- The last 1 month’s share growth was +51.15 (16.52%).

- The last 6 months’ share growth was +25.05 (7.49%).

- The last 1 year’s share growth was -42.00 (-10.42%).

- The last 5 years’ share growth was -180.55 (-33.35%).

- The maximum share growth was -180.55 (-33.25%).

- Delhivery share price return percentage was 16.53% in the last 1 month.

- The last 3 months’ share price return percentage was 44.16%.

- The last 1 year’s share price return percentage was -10.68%.

- The last 3 years’ share price return percentage was -33.6%.

FAQ

What is the Delhivery Share Price Target for 2025?

Delhivery Share Price Target for 2025 is ₹316.29 to ₹389.37.

What is the Delhivery Share Price Target for 2026?

Delhivery Share Price Target for 2026 is ₹390.73 to ₹465.29.

What is the Delhivery Share Price Target for 2028?

Delhivery Share Price Target for 2028 is ₹573.09 to ₹618.39.

What is the Delhivery Share Price Target for 2030?

Delhivery Share Price Target for 2030 is ₹702.38 to ₹746.09.

What is the Delhivery Share Price Target for 2035?

Delhivery Share Price Target for 2035 is ₹1,021.31 to ₹1,066.68.

Conclusion

This website is written to help the investor gain some basic knowledge about the market strategy of Delhivery Share. For making this blog, we take consultation from experts and research the company. It is expected that the Delhivery Share Price Target will be a good choice to invest in on a long-term basis. The demand for the Indian logistics and supply chain sector in India and outside of the country always increases, as a result of which the company and its share may increase rapidly.

We try to give an in-depth idea about the share. If you think it is helpful to you, you can share it. If you have any questions, please let us know through the comment box. We will try to reply to your questions and solve your problem. Thanks for visiting this website and thanks for being with us.

Disclaimer – We are not SEBI-registered advisors. A financial market is always risky to anyone. This website is only for training and educational purposes. So, before investing, we are requested to discuss certified expertise. We will not be responsible for anyone’s profit or loss.