CG Power Share is a bullish trend in the share market. During share ups and downs, you should know all about share details before investing. In this blog, we are going to discuss CG Power Share Price Target 2025, 2027, 2028, 2030, 2040. We will try to analyze the share base in the company’s overall performance.

We also look after the company’s profit growth in the last 5 years, the last 5 year’s sales growth, and the last 5 years’ ROE percentage similarly we also compare the CG Power Share growth, the share price return amount of the share become increasing or decreased through the last 5 year’s. We also take advice from experts about which time we should invest in the share it may be helpful for you also. Let’s have a look at CG Power Share Price Target from 2025 to 2040.

Overview Of CG Power Limited

CG Power and Industrial Solutions Limited was founded in 1937, and its headquarters are in Mumbai. The company is an Indian multinational whose main products are transformers, pumps, LT Motors, DC Motors, Railway Signaling, etc. In 1937, the company was established as Crompton Parkinson Work Private Limited.

Fundamental Analysis Of CG Power Limited

| Company Name | CG Power and Industrial Solutions |

| Market Cap | ₹1,06,270.45 Crore |

| Book Value | ₹26.68 |

| Face Value | ₹2 |

| 52 Week High | ₹875.12 |

| 52 Week Low | ₹518.35 |

| P/B | 25.98 |

| DIV. YIELD | 0.20% |

| ROE | 35.57% |

| ROA | 22.10% |

| Current Ratio | 1.81% |

Dividend History Of CG Power Limited

| Year | Dividend Medium | Dividend Amount Per Share |

| 2024 | Interim | ₹1.3000 (65%) |

| 2023 | Interim | ₹1.5000 (75%) |

| 2015 | Interim | ₹0.4000 (20%) |

| 2014 | Interim | ₹0.4000 (20%) |

| 2013 | Final | ₹0.4000 (20%) |

CG Power Share Price Target 2025

CG Power Share Price Target 2025 forecast may vary from ₹675.29 to ₹705.29.

CG Power Limited is the top 10 transformer manufacturer in India. The range of power transformers offered by the company is from 25 kVA to 1500 MVA. These products conform to IEC, BS, IS, and other international standards. Distribution transformer unit manufacturers have a wide range of power and distribution transformers ranging from 160kVA to 1500 MVA. The company has 2 plants to manufacture transformers, one is located in Bhopal for power transformers, and the one is located in Gwalior for distribution transformers.

| Month | CG Power Share Price Target 2025 (1st Price Target) | CG Power Share Price Target 2025 (2nd Price Target) |

| June | ₹675.29 | ₹692.36 |

| July | ₹687.55 | ₹691.50 |

| August | ₹689.82 | ₹695.62 |

| September | ₹693.37 | ₹698.85 |

| October | ₹694.26 | ₹702.15 |

| November | ₹692.84 | ₹702.22 |

| December | ₹695.80 | ₹705.29 |

Also Read – Tata Steel Share Price Target

CG Power Share Price Target 2027

CG Power Share Price Target 2027 forecast may vary from ₹738.69 to ₹770.25.

CG Power is a pioneer in providing solutions for Railways in rolling stock and signaling equipment with the most comprehensive product portfolio. CG Railway business started its business in the year 1982 to develop different products of Indian Railways. Today, CG Power is a major supplier of traction machines & systems and coaches products of the Indian Railways. The company also manufactures and supplies track-side transformers, stamping for traction motors, auxiliary motors for locomotives, circuit breakers, etc.

| Month | CG Power Share Price Target 2027 (1st Price Target) | CG Power Share Price Target 2027 (2nd Price Target) |

| January | ₹738.69 | ₹746.82 |

| February | ₹744.17 | ₹751.59 |

| March | ₹735.10 | ₹742.95 |

| April | ₹739.67 | ₹746.61 |

| May | ₹744.93 | ₹752.49 |

| June | ₹749.91 | ₹756.61 |

| July | ₹754.49 | ₹761.44 |

| August | ₹758.81 | ₹765.50 |

| September | ₹755.20 | ₹764.92 |

| October | ₹762.80 | ₹770.15 |

| November | ₹762.23 | ₹768.89 |

| December | ₹764.49 | ₹770.25 |

CG Power Share Price Target 2028

CG Power Share Price Target 2028 forecast may vary from ₹775.58 to ₹810.29.

CG Power Limited’s product range includes Motors and Generators ranging from 25 MW to 100 MW, drives up to 3 MW, domestic and commercial pumps, and funs. The company enjoys market leadership for AC Motors and occupies the second position in AC generators and DC motors in India. CG Power Limited is the largest manufacturer of low-tension motors in India and offers AC and DC Motors ranging from 0.18 kW to 450 kW in various standards.

| Month | CG Power Share Price Target 2028 (1st Price Target) | CG Power Share Price Target 2028 (2nd Price Target) |

| January | ₹775.58 | ₹781.23 |

| February | ₹779.64 | ₹785.90 |

| March | ₹765.59 | ₹771.23 |

| April | ₹769.80 | ₹775.51 |

| May | ₹773.48 | ₹778.82 |

| June | ₹775.23 | ₹781.23 |

| July | ₹779.92 | ₹785.61 |

| August | ₹783.34 | ₹788.82 |

| September | ₹787.23 | ₹792.69 |

| October | ₹789.81 | ₹794.61 |

| November | ₹792.55 | ₹801.32 |

| December | ₹802.22 | ₹810.29 |

CG Power Share Price Target 2030

CG Power Share Price Target 2030 forecast may vary from ₹835.59 to ₹862.17.

CG Power Company has a total of 9 manufacturing units in India. The company in the Cold War collaborated with the USSR and the Eastern Bloc for the technology transfer of new electrical technologies. CG Power is special in turnkey substation projects up to 765 kV. Besides this, we completed several rural electrification projects as well as HV transmission lines, which came along with some of the turnkey substation projects.

| Year | CG Power Share Price Target 2030 |

| 1st Price Target | ₹835.59 |

| 2nd Price Target | ₹862.17 |

CG Power Share Price Target 2040

CG Power Share Price Target 2040 forecast may vary from ₹1,215.19 to ₹1,248.37.

CG Transmission and Distribution Systems has extensive experience in the supply of total solutions packages in the field. These solutions also include civil works as well like turnkey air-insulated substations up to 765 kV and turnkey Gas-insulated substations up to 400 kV. The company also manufactures instant water heaters and storage water heaters. The company also manufactures residential, agricultural, and specialty pumps. If we look at the CG Power Share Price Target 2040 forecast, the 1st Price Target is ₹9,240.18 and the 2nd Price Target is ₹9,640.80.

| Year | CG Power Share Price Target 2040 |

| 1st Price Target | ₹1,215.19 |

| 2nd Price Target | ₹1,248.37 |

The Few Years’ Performance Of CG Power Limited

Profit Growth

The company’s last 5 years’ profit growth percentage is described in the portion below.

- In the last 5 years, 22.60%

- In the last 3 years, 13.80%

- In the last 1 year, 28.01%

The Net Profit Amount of the company was ₹786.12 Crore in March 2023, which increased to ₹1,006.85 Crore in March 2024. The Operating Profit of the company was ₹937.12 Crore in March 2023, which increased to ₹1,078.23 Crore in March 2024.

Sales Growth

The last 5 years’ Sales growth percentage of the company is described in the portion below.

- In the last 5 years, 7.95%

- In the last 3 years, 45.01%

- In the last 1 year, 16.01%

The Net Sales amount of the company was ₹6,585.14 Crore in March 2023, which increased to ₹7,645.12 Crore in March 2024.

ROE Percentage

The company’s last 5 years’ ROE percentage is described below.

- In the last 5 years, 37.85%

- In the last 3 years, 40.89%

- In the last 1 year, 35.74%

ROCE Percentage

The company’s last 5 years’ ROCE percentage is described below.

- In the last 5 years, 28.96%

- In the last 3 years, 42.85%

- In the last 1 year, 45.56%

The Net Cash Flow Amount

The Net Cash Flow amount of the company was ₹313.01 Crore in March 2023, which decreased to ₹-496.25 Crore in March 2024.

Total Liabilities

The company’s Total Liabilities were ₹3,820.56 Crore in March 2023, increasing to ₹5,278.12 Crore in March 2024.

Total Assets Amount

The Total Assets amount was ₹3,915.42 Crore in March 2023, which increased to ₹5,345.12 Crore in March 2024.

Total Expenditure Amount

The Total Expenditure of the company was ₹5,643.12 Crore in March 2023, which increased to ₹6,589.25 Crore in March 2024.

Other Income Amount

The Other Income Amount was ₹79.86 Crore in March 2023, which increased to ₹151.23 Crore in March 2024.

Also Read – Castrol India Share Price Target

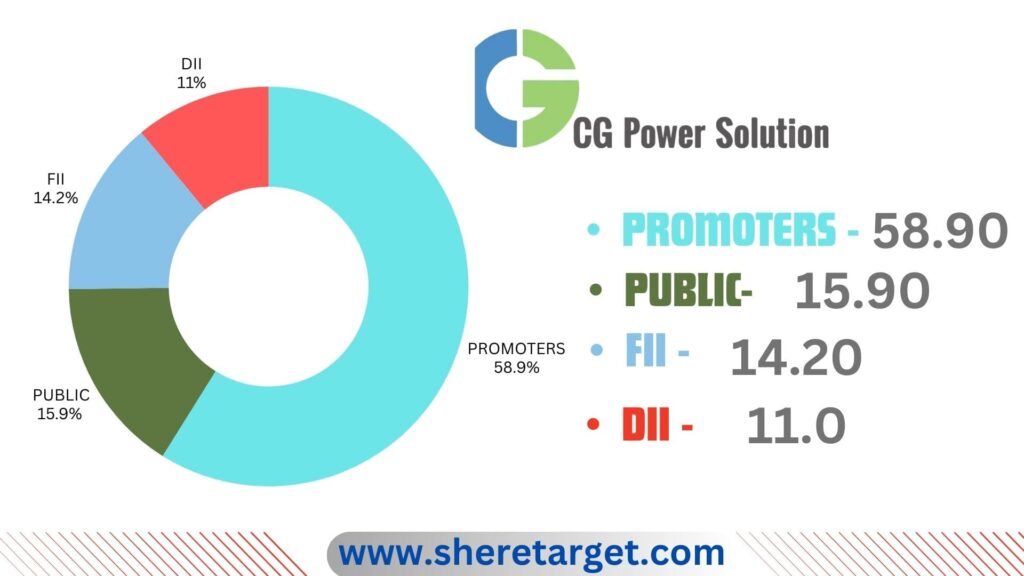

Discussion About Shareholding Pattern Of CG Power Limited

CG Power Limited mainly has four types of shareholding patterns: promoter holding, public holding, DII, and FII. We can majorly influence the company’s growth depending on the shareholding pattern.

Promoter Holding

Promoter Holding capacity is the percentage of the share owned by the company’s promoter or the company’s owner. The Promoter Holding Capacity in the company’s share is 58.90%.

Public Holding

Public Holding capacity is the indicator of the percentage that is held by the public rather than the promoters. The public holding capacity of the company’s share is 15.90%.

FII

The full form of FII is Foreign Institutional Investor, which invests funds from outside of its home country. The FII investor percentage in the company’s shares is 14.20%.

DII

The full form of DII is Domestic Institutional Investor, which means some Indian institutions like mutual funds, insurance companies, and pension funds invest money in the country’s assets. The DII investor percentage in the company’s shares is 11.00%.

Peers Company Of CG Power Limited

| Company Name | Market Cap (Crore) |

| ABB India | ₹163,004.52 |

| Advik Capital | ₹147.01 |

| Apar Ind | ₹38,895.23 |

| Alfa Transforme | ₹108.96 |

| Artemis Elect | ₹691.23 |

CG Power Share Price Target Prediction In The Last Few Years

For the last few years, CG Power Share increased rapidly. The last 6 months’ share growth was +185.60 (34.25%), the last 1 month’s share growth was -52.15 (-6.80 %), the last 1 year’s share growth was +358.26 (97.26%), the last 5 year’s share growth was +717.01 (4,890.26%) and the maximum share growth was +727.02 (15,723.52%).

CG Power Share Price return amount was -6.8% in the last 1 month, the last 3 months’ share price return amount was 4.87%, the last 1 year’s share price return amount was 90.85%, the last 3 year’s share price return amount was 409.19% and the last 5 year’s share price return amount was 4873.12%. CG Power shares always give a good return to investors. If anyone wants to invest in the share, it will be profitable on a long-term basis.

Should I Invest In CG Power Share Right Now?

Positive Sides

- The last 3 years’ revenue growth of the company was very good, which was 44.52%.

- In the last 3 years, the ROE percentage of the company was good, which was 40.89%.

- In the last 3 years, the ROCE percentage of the company was very good, which was 42.85%.

- The company is virtually debt-free and has a healthy interest coverage ratio of 484.25.

- The company has an efficient cash conversion cycle of 21.52 days.

- The promoter holding capacity of the company is very good, which is 58.90%.

- The company has good cash flow management,and PAT stands at 1.22.

Negative Sides

- The company is trading at a high EBITDA of 86.09.

- The company is trading at a high PE of 123.52.

What is the future growth of CG Power Limited?

Strength

- The company’s total transmission capacity is to be increased.

- The company is mainly present in the domestic market and has a wide installed equipment/ provides customer base products.

- The absorption of significant technology and the company’s adaptation to suit local needs is very important for the company’s growth.

- Strong financial stability is the major key to the company’s growth.

- Governmental policies are very important for the electricity sector.

- Prompt after-sales service, a good understanding of market conditions, and geographically widespread operations are the key factors of the company’s growth.

- The company has a wide range of products to provide end-to-end solutions to customers across various segments.

- The company has highly committed engineers and technical and managerial support.

Weakness

- A delay in the completion of any project may negatively affect the company’s growth.

- Increasing competition from large companies with strong financial support.

- International leaders are unwilling to set up local manufacturing bases.

- Any changes in government policies may affect the company’s growth.

Also Read – TVS Motor Share Price Target

FAQ

Is CG Power an MNC Company?

Yes, CG Power Limited is an Indian Multinational Company.

Who is the CEO of CG Power Limited?

The CEO of CG Power Limited is Mr. Susheel Todi.

What is the CG Power Share Price Target for 2025?

CG Power Share Price Target for 2025 is ₹675.29 to ₹705.29.

What is the CG Power Share Price Target for 2027?

CG Power Share Price Target for 2027 is ₹738.69 to ₹770.25.

What is the CG Power Share Price Target for 2028?

CG Power Share Price Target for 2028 is ₹775.58 to ₹810.29.

What is the CG Power Share Price Target for 2030?

CG Power Share Price Target for 2030 is ₹835.59 to ₹862.17.

What is the CG Power Share Price Target for 2040?

CG Power Share Price Target for 2040 is ₹1,215.19 to ₹1,248.37.

Conclusion

This website is written to help the investor gain some basic knowledge about the market strategy of CG Power Share. For making this blog, we take consultation from experts and do research about the company. It is expected that the CG Power Share Price Target will be a good choice to invest in on a long-term basis. The power sectors in India and outside the country are always increasing as a result of the company, and the share may increase rapidly.

We try to give an in-depth idea about the share. If you think it is helpful to you, you can share it. If you have any questions, please let us know through the comment box. We will try to reply to your questions and solve your problem. Thanks for visiting this website and thanks for being with us.

Disclaimer – We are not SEBI-registered advisors. A financial market is always risky to anyone. This website is only for training and educational purposes. So, before investing, we are requested to discuss certified expertise. We will not be responsible for anyone’s profit or loss.