Blue Star Share is a bullish trend in the share market. During share ups and downs, you should know all about share details before investing. In this blog, we are going to discuss Blue Star Share Price Target 2025, 2026, 2028, 2030, and 2035. We will try to analyze the share base in the company’s overall performance.

We also look at the company’s profit growth in the last 5 years, the last 5 years’ sales growth, and the last 5 years’ ROE percentage. Similarly, we also compare the share growth, the share price return, amount whether the share has increased or decreased over the last 5 years. We also take advice from experts about when we should invest in the share, which may be helpful for you. Let’s have a look at the Blue Star Share Price Target from 2025 to 2035.

Overview Of Blue Star Limited

Blue Star Limited is an Indian multinational home appliances company which was established in the year 1943. The headquarters of the company is situated in Mumbai. The company mainly manufactures air conditioning, commercial refrigeration, and MEP (mechanical, electrical, plumbing, and firefighting). The country is the second largest homegrown player in the air conditioning space.

Fundamental Analysis Of Blue Star Limited

| Company Name | Blue Star Limited |

| Market Cap | ₹43,178.79 Crore |

| Book Value | ₹132 |

| Face Value | ₹2 |

| P/E | 91.65 |

| P/B | 16.89 |

| 52 Week High | ₹2,519.38 |

| 52 Week Low | ₹1,222 |

| DIV. YIELD | 0.35% |

| ROE | 19.38% |

| ROA | 6.72% |

Last Few Years’ Performance Of Blue Star Limited

Profit Growth

The profit growth percentage of the company in the last 5 years is described below.

- In the last 5 years, 25.12%

- In the last 3 years, 77.36%

- In the last 1 year, 0.29%

The Net Profit amount of the company was ₹366.96 Crore in March 2023, which increased to ₹368.24 Crore in March 2024. The Operating Profit amount of the company was ₹443.95 Crore in March 2023, which increased to ₹547.29 Crore in March 2024.

Sales Growth

The sales growth percentage of the company in the last 5 years is described below.

- In the last 5 years, 14.05%

- In the last 3 years, 33.25%

- In the last year, 23.06%

The Net Sales amount of the company was ₹2,129 Crore in September 2024, which increased to ₹2,745.36 in December 2024.

ROE Percentage

The ROE percentage growth of the company in the last 5 years is described below.

- In the last 5 years, 18.26%

- In the last 3 years, 22.38%

- In the last 1 year, 19.38%

ROCE Percentage

The company’s ROCE percentage growth in the last 5 years is described below, and it has also increased rapidly.

- In the last 5 years, 20.96%

- In the last 3 years, 25.12%

- In the last 1 year, 24.96%

Total Expenditure Amount

The company’s total expenditure was ₹1999.23 Crore in September 2023, which increased to ₹2,525.36 Crore in December 2024.

The Net Cash Flow Amount

The company’s Net Cash flow was ₹-30.12 Crore in March 2023, increasing to ₹88.26 Crore in March 2024.

Total Assets Amount

The company’s Total Assets were ₹4,912.36 Crore in March 2023, which increased to ₹6,125.38 Crore in March 2024.

Also Read – Eicher Motors Share Price Target

Blue Star Share Price Target 2025

Blue Star Share Price Target 2025 forecast may vary from ₹1,563.90 to ₹1,865.46.

Influencing Key Factors Of Blue Star Share Price Target 2025

- Commercial Air Conditioning Systems

- The revenue growth of Blue Star Limited was mainly driven by its product portfolio and channel expansion. The growth is driven by demand from industrial, healthcare, hospitality, retail, educational institutions, and data centers. The launch of VRF Lite has enabled the company to address the chiller, which remains strong. The company continued to maintain the company’s position in conventional and inverter ducted Air Conditioning System as well as scroll chillers and second position in VRFs and screw chillers.

- Increases Revenue Growth

- The revenue grew 20.3% to ₹1506.83 Crores in the fourth quarter of the year 2024 as compared to ₹1252.62 Crores in the third quarter of the year 2023. Segment result was ₹112.53 Crore (7.5% of revenue) in the fourth quarter of the year 2024 as compared to ₹99.21 Crores (7.9% of revenue) in the fourth quarter result of the year 2023.

- International Business

- Due to global disturbance, the nascent international business saw a subdued performance. The company also focused on product exports and invested in R&D to expand its product portfolio. The subsidiaries in the US and Europe are also engaging with customers and expect the business to pick up traction soon.

| Month | Blue Star Share Price Target 2025 (1st Price Target) | Blue Star Share Price Target 2025 (2nd Price Target) |

| May | ₹1,563.90 | ₹1,612.07 |

| June | ₹1,602.29 | ₹1,672.31 |

| July | ₹1,665.52 | ₹1,695.78 |

| August | ₹1,694.65 | ₹1,736.67 |

| September | ₹1,728.54 | ₹1,775.22 |

| October | ₹1,768.79 | ₹1,798.07 |

| November | ₹1,790.98 | ₹1,846.07 |

| December | ₹1,795.67 | ₹1,865.46 |

Blue Star Share Price Target 2026

Blue Star Share Price Target 2026 forecast may vary from ₹1,870.66 to ₹2,242.69.

Influencing Key Factors Of Blue Star Share Price Target 2026

- Cooling and Purification Products Business

- Momentum gained during the festive season in the third quarter of the year 2024 was further bolstered by a stellar performance in the fourth quarter of the year 2024. The exceptionally strong demand in the southern region and the product diversification, especially with a range of Affordable Room ACs, helped us surpass the milestone of 1 million units. The company’s market share during the year improved and is estimated to be at 13.75% compared to 13.50% in the financial year 2023.

- Packaged Air-Conditioning System

- The window and split air conditioners are usually used for small air conditioning capacities up to 5 tons. The central air conditioning systems are used where the cooling loads extend beyond 20 tons. The packaged air conditioners are available in the fixed rated capacities of 3,5,7, 10, and 15 tons. These units are commonly used in places like restaurants, telephone exchanges, small halls, etc.

- Company’s Manufacturing Units

- Blue Star Limited company has 5 state-of-the-art, automated factories, which are situated in Dadra, Himachal, Wada, Ahmedabad, 2 modern plants at Samba, Jammu, and Sri City, Andhra Pradesh, in the offing. Through those plant units, the company also increased its manufacturing facilities.

| Month | Blue Star Share Price Target 2026 (1st Price Target) | Blue Star Share Price Target 2026 (2nd Price Target) |

| January | ₹1,870.66 | ₹1,901.63 |

| February | ₹1,893.76 | ₹1,936.08 |

| March | ₹1,929.67 | ₹1,975.92 |

| April | ₹1,970.90 | ₹1,998.85 |

| May | ₹1,990.78 | ₹2,056.63 |

| June | ₹2,043.07 | ₹2,086.57 |

| July | ₹ 2,075.62 | ₹2,135.85 |

| August | ₹2,129.88 | ₹2,176.90 |

| September | ₹2,169.74 | ₹2,198.98 |

| October | ₹2,195.09 | ₹2,232.82 |

| November | ₹2,225.67 | ₹2,276.80 |

| December | ₹ 2,175.62 | ₹2,242.69 |

Blue Star Share Price Target 2028

Blue Star Share Price Target 2028 forecast may vary from ₹2,647.90 to ₹2,867.33.

Influencing Key Factors Of Blue Star Share Price Target 2028

- The Company’s Manufacturing Facilities

- The company specializes in manufacturing a variety of highly engineered and custom-built products. Manufacturing footprint of 1 lakh square metre. Over 300 models manufactured across 25 product lines. The manufacturing excellence programme for continuous productivity enhancement.

- Research And Development Field

- The company has a high level of product development and testing capabilities, and it has several patents for breakthrough products, and the in-house capacity for testing and certification for safety compliance. The company also enhances its capability in reliability and electronics for digital and smart products.

- Supply Of Water Purifiers

- Recently, the Blue Star Limited company forayed into the residential water purifiers business with a stylish and differentiated range. The company also launched a range of 13 models, the largest by any new entrant in the category. Market pegged at about ₹4200 crores increasing at a CAGR of 22%.

| Month | Blue Star Share Price Target 2028 (1st Price Target) | Blue Star Share Price Target 2028 (2nd Price Target) |

| January | ₹2,647.90 | ₹2,685.87 |

| February | ₹2,669.65 | ₹2,692.23 |

| March | ₹2,510.73 | ₹2,575.89 |

| April | ₹2,569.55 | ₹2,597.54 |

| May | ₹2,589.17 | ₹2,598.76 |

| June | ₹2,576.21 | ₹2,601.88 |

| July | ₹2,596.77 | ₹2,650.56 |

| August | ₹2,639.65 | ₹2,698.70 |

| September | ₹2,695.34 | ₹2,752.45 |

| October | ₹2,746.40 | ₹2,789.53 |

| November | ₹2,785.57 | ₹2,833.99 |

| December | ₹2,812.65 | ₹2,867.33 |

Also Read – TVS Motor Share Price Target

Blue Star Share Price Target 2030

Blue Star Share Price Target 2030 forecast may vary from ₹3,056.36 to ₹3,288.65.

Influencing Key Factors Of Blue Star Share Price Target 2030

- Central AC Products

- The company’s central AC products are highly efficient centrifugal chillers, and those are flexible, energy-efficient scroll chillers. This process chiller is used for industrial and non-comfort cooling applications, which are air-cooled and water-cooled variants, and has a huge market value, gaining a huge profit margin.

- Sales Services Of Air Conditioning

- Blue Star is India’s largest air conditioning and refrigeration service provider, maintaining around 2 million tons of refrigeration equipment. The company also focuses on service delivery quality through a service quality assurance group, a service specialist group for high-tech technical requirements.

- Presence In Different Countries

- Blue Star has a presence in 18 different countries in the Middle East, Africa, SAARC, and ASEAN regions. Blue Star has three Joint Ventures in Oman, Malaysia, and Qatar. The company has subsidiaries in the UAE, Qatar, and India. The company serves the Middle East market via its USA subsidiary. The company’s subsidiary in India is called Blue Star Engineering & Electronics Limited. Through those subsidiaries, the company provides its business in different countries.

| Year | Blue Star Share Price Target 2030 |

| 1st Price Target | ₹3,056.36 |

| 2nd Price Target | ₹3,288.65 |

Blue Star Share Price Target 2035

Blue Star Share Price Target 2035 forecast may vary from ₹4,448.08 to ₹4,671.65.

- Entered Into Different Segment

- In the late 2000s, Blue Star ventured into the electrical, plumbing, and fire-fighting contracting businesses, offering customers an integrated mechanical, electrical, and plumbing solution. A few years later, the company forayed into the residential air conditioning segment, and recently, it entered the water and air purification segments as well as the engineering facility management space.

- Growth Of Supply Chain Management

- Rapid Growth Coupled with Volatility of Input Costs necessitated an agile and adaptable supply chain. The Blue Star focused on the efficiency and responsiveness of all supply chain aspects by improving overall execution capability. The growing supply chain management also helps the company to earn the net profit amount.

- Increasing EBITDA Amount

- The company’s EBITDA is increasing rapidly. In the financial year 2024, the company’s EBITDA amount was ₹241.92 Crore (EBITDA margin 7.3% of revenue) as compared to ₹179.17 Crores (EBITDA margin 6.8% of revenue in the fourth quarter of the financial year 2023).

| Year | Blue Star Share Price Target 2035 |

| 1st Price Target | ₹4,448.08 |

| 2nd Price Target | ₹4,671.65 |

Peer’s Company Of Blue Star Limited

| Company Name | Market Cap (Crore) |

| Havells India Limited | ₹92,757.04 |

| Dixon Technologies (India) Limited | ₹78,496.62 |

| Voltas Limited | ₹47,823.78 |

| Kaynes Technology India Limited | ₹27,755.44 |

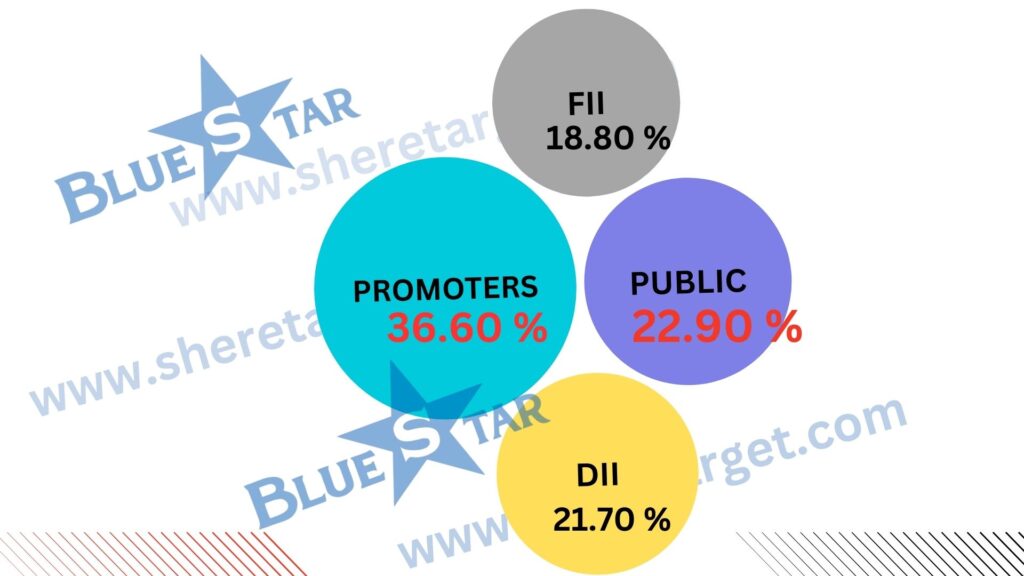

Discussion About Shareholding Pattern Of Blue Star Limited

Blue Star Limited mainly has four types of shareholding patterns such as promoter holding, public holding, DII, and FII. Depending on the shareholding pattern, we can majorly influence the company’s growth.

| Investor Type | Percentage |

| Promoter Holding (Owned by the company’s promoter) | 36.60% |

| Public Holding (Held by the public) | 22.90% |

| FII (Invest by Foreign Institutional Investor) | 18.80% |

| DII (Invest money by Domestic Institutional Investor) | 21.70% |

What Is The Expert Advise About The Investment In The Blue Star Share

Advantages

- In the last 3 years, the company had a good profit growth which was 77.36%.

- In the last 3 years, the company’s revenue was very good, which was 32.89%.

- The company’s debt amount decreased day by day, which decreased by ₹241.67 Crore.

- The company maintains a healthy ROE ratio, which was 22.38%.

- In the last 3 years, the company had a good sales growth, which was 33.25%.

- The company maintains a good ROCE ratio, which was 25.12%.

Disadvantages

- The company has a trading PE ratio which was 91.65.

- The company has a traditional EBITDA of 54.78.

Risk Factors Of Blue Star Limited

- Many competitors introduce new products in the market, so the company should always maintain an innovative product portfolio to compete with other companies.

- As the company deals with many international countries, the fluctuation of currency may affect the company’s profit growth.

- A shortage of raw materials may affect the company’s profit growth.

- Increases in tax rate, export/import rate may affect the company’s profit growth.

Also Read – Bharat Electronics Share Price Target

FAQ

What is Blue Star Share Price Target for 2025?

Blue Star Share Price Target for 2025 is ₹1,563.90 to ₹1,865.46.

What is Blue Star Share Price Target for 2026?

Blue Star Share Price Target for 2026 is ₹1,870.66 to ₹2,242.69.

What is Blue Star Share Price Target for 2028?

Blue Star Share Price Target for 2028 is ₹2,647.90 to ₹2,867.33.

What is Blue Star Share Price Target for 2030?

Blue Star Share Price Target for 2030 is ₹3,056.36 to ₹3,288.65.

What is Blue Star Share Price Target for 2035?

Blue Star Share Price Target for 2035 is ₹4,448.08 to ₹4,671.65.

Conclusion

This website is written to help the investor gain some basic knowledge about the market strategy of the Blue Star Share. For making this blog, we take consultation from experts and research the company. It is expected that the Blue Star Share Price Target will be a good choice to invest in on a long-term basis. The demand for the electrical equipment sector in India and outside of the country always increases as a result of the company, and the share may increase rapidly.

We try to give an in-depth idea about the share. If you think it is helpful to you you can share it. If you have any questions please let us know through the comment box we will try to reply to your questions and solve your problem. Thanks for visiting this website and thanks for being with us.

Disclaimer – We are not SEBI-registered advisors. A financial market is always risky to anyone. This website is only for training and educational purposes. So before investing, we are requested to discuss certified expertise. We will not be responsible for anyone’s profit or loss.