Bharat Dynamics Share is in a bullish trend in the share market. During share ups and downs, you should know all about share details before investing. In this blog, we are going to discuss the Bharat Dynamics Share Price Target 2025, 2026, 2028, 2030, and 2035. We will try to analyze the share base in the company’s overall performance.

We also look at the company’s profit growth in the last 5 years, the last 5 years’ sales growth, and the last 5 years’ ROE percentage. Similarly, we also compare the share growth, the share price return, amount whether the share has increased or decreased over the last 5 years. We also take advice from experts about when we should invest in the share, which may be helpful for you. Let’s have a look at the Bharat Dynamics Share Price Target from 2025 to 2035.

Overview Of Bharat Dynamics Limited (BDL)

Bharat Dynamics Limited (BDL) is one of India’s manufacturers of ammunition and missile systems. The company was founded in the year 1970 in Hyderabad, India. The company has been working in collaboration with DRDO & Foreign Original Equipment Manufacturers (OEMs) for the manufacture and supply of various missiles and allied equipment to the Indian Armed Forces.

Fundamental Analysis Of Bharat Dynamics Limited

| Company Name | Bharat Dynamics Limited |

| Market Cap | ₹67,585.37 Crore |

| P/B | 17.53 |

| P/E | 120.43 |

| 52 Week High | ₹1,852.36 |

| 52 Week Low | ₹897.15 |

| Book Value | ₹105.86 |

| Face Value | ₹5 |

| DIV. YIELD | 0.30% |

| ROE | 18.01% |

| ROA | 6.50% |

Last Few Years’ Performance Of Bharat Dynamics Limited

Profit Growth

- In the last 5 years, 7.95%

- In the last 3 years, 34.12%

- In the last 1 year, 74.24%

The Net Profit of the company was ₹354.86 Crore in March 2023, which increased to ₹623.58 Crore in March 2024. The Operating Profit of the company was ₹410.86 Crore in March 2023, which increased to ₹539.53 Crore in March 2024.

Sales Growth

The sales growth percentage of the company in the last 5 years is described below.

- In the last 5 years, -5.63%

- In the last 3 years, 8.20%

- In the last year, -5.68%

The Net Sales amount of the company was ₹2,596.32 Crore in March 2023, which decreased to ₹2,453.66 Crore in March 2024.

ROE Percentage

The ROE percentage growth of the company in the last 5 years is described below.

- In the last 5 years, 15.86%

- In the last 3 years, 15.23%

- In the last 1 year, 17.64%

ROCE Percentage

The company’s ROCE percentage growth in the last 5 years is described below, and it has also increased rapidly.

- In the last 5 years, 22.10%

- In the last 3 years, 21.86%

- In the last 1 year, 24.79%

Total Expenditure Amount

The company’s Total Expenditure was ₹446.12 Crore in September 2024, increasing to ₹706.22 Crore in December 2024.

The Net Cash Flow Amount

The Net Cash Flow amount of the company was ₹788.63 Crore in March 2023, which decreased to -₹460.38 Crore in March 2024.

Also Read – Azad Engineering Share Price Target

Bharat Dynamics Share Price Target 2025

Bharat Dynamics Share Price Target 2025 forecast may vary from ₹1,829.44 to ₹2,079.37.

Influencing Key Factors Of Bharat Dynamics Share Price Target 2025

- Missile Development Programme

- India began to develop an indigenous missile through the Integrated Guided Missile Development Programme (IGMDP), which allowed the company to be closely involved with the programme, wherein it was identified as the prime production agency. This opened up a plethora of opportunities to assimilate advanced manufacturing and programme management technologies and skills.

- The Company’s Technological Support

- The company has forayed into the field of underwater weapon systems, air-to-air missiles, and associated equipment, with technology support from the Defence Research and Development Organisation (DRDO) and other players.

- Indigenous Missiles

- The company is the nodal agency for producing missiles developed by India. The first such missile that entered production of dynamics with the company was the Prithvi missile. Bharat Dynamics manufactures a range of missiles for the Indian Armed Forces, some prominent products are Agni, Akash, Konkurs, etc.

| Month | Bharat Dynamics Share Price Target 2025 (1st Price Target) | Bharat Dynamics Share Price Target 2025 (2nd Price Target) |

| May | ₹1,829.44 | ₹1,892.76 |

| June | ₹1,886.28 | ₹1,920.37 |

| July | ₹1,915.86 | ₹1,978.35 |

| August | ₹1,968.52 | ₹1,989.14 |

| September | ₹1,980.65 | ₹2,024.28 |

| October | ₹2,019.40 | ₹2,086.79 |

| November | ₹2,079.22 | ₹2,092.38 |

| December | ₹2,015.55 | ₹2,079.37 |

Bharat Dynamics Share Price Target 2026

Bharat Dynamics Share Price Target 2026 forecast may vary from ₹2,105.78 to ₹2,485.49.

Influencing Key Factors Of Bharat Dynamics Share Price Target 2026

- Quality Systems

- As a missile manufacturer that produces single-shot devices, product quality is critical, and the company’s products must operate the first time, every time. Three production units (Kanchanbagh, Bhanur, and Vizag) have been recertified with ISO 14001:2015 w.e.f. April 2023 by the Certification Body, M/s International Certification Services Pvt Ltd.

- Exports Of Products

- The company has placed significant emphasis on the export of Weapon Systems. To explore the export potential of its products, identify potential markets, and pursue export opportunities, an export cell has been established within the Business Development Division of the company. The products offered by the company are state-of-the-art, designed indigenously, competitively priced, and not heavily reliant on any foreign Original Equipment Manufacturers.

- Export Orders

- With existing facilities, the company is well prepared to meet both domestic and export demands. Several leads have been received from various friendly foreign countries for the export of products such as the Akash Weapon System, Air-to-Air Missile (Astra), Smart Anti-Airfield Weapon, Helina (Air-to-Surface Weapons), Lightweight Torpedo, Heavyweight Torpedo, Anti-Submarine Warfare Suite, etc. The export cell actively pursues these leads and interacts with overseas customers to achieve export targets.

| Month | Bharat Dynamics Share Price Target 2026 (1st Price Target) | Bharat Dynamics Share Price Target 2026 (2nd Price Target) |

| January | ₹2,105.78 | ₹2,162.37 |

| February | ₹2,158.34 | ₹2,197.46 |

| March | ₹1,954.02 | ₹1,986.29 |

| April | ₹1,983.66 | ₹2,045.62 |

| May | ₹2,039.45 | ₹2,085.37 |

| June | ₹2,079.40 | ₹2,105.50 |

| July | ₹2,103.13 | ₹2,163.26 |

| August | ₹2,158.60 | ₹2,215.05 |

| September | ₹2,210.61 | ₹2,272.50 |

| October | ₹2,269.20 | ₹2,310.33 |

| November | ₹2,305.19 | ₹2,369.57 |

| December | ₹2,365.35 | ₹2,485.49 |

Bharat Dynamics Share Price Target 2028

Bharat Dynamics Share Price Target 2028 forecast may vary from ₹2,805.32 to ₹3,154.62.

Influencing Key Factors Of Bharat Dynamics Share Price Target 2028

- Indigenization

- The Ministry of Defence has taken numerous steps for self-reliance in the sector and positive indigenization. Out of the total 56 items, the company has achieved indigenisation for 44 items, and the remaining items are under various stages of indigenization. Honorable Raksha Mantri released a 5th positive indigenization list of 98 Defence products, out of which 3 belong to the company.

- Manufacturing Units

- The company has 3 manufacturing facilities located in Hyderabad, Bhanur, and Vishakhapatnam. All the manufacturing facilities have been certified with ISO 14001:2015 Environmental Management System. All production Divisions are certified to AS 9100D Standard for Aerospace Quality Managment System. The company is also setting up additional manufacturing facilities in Ibrahimpatnam (near Hyderabad), VSHORAD rockets and propellants for various ATGMs.

- Counter Measures Dispensing Systems

- Counter Measures Dispensing System (CMDS) is a chaff and flare dispensing system. CMDS is an airborne defensive system providing self-protection to the aircraft by passive ECM against radar-guided and IR-seeking, air and ground-launched missiles.

| Month | Bharat Dynamics Share Price Target 2028 (1st Price Target) | Bharat Dynamics Share Price Target 2028 (2nd Price Target) |

| January | ₹2,805.32 | ₹2,862.75 |

| February | ₹2,859.60 | ₹2,910.34 |

| March | ₹2,747.43 | ₹2,794.75 |

| April | ₹2,779.02 | ₹2,825.82 |

| May | ₹2,818.58 | ₹2,876.64 |

| June | ₹2,873.25 | ₹2,901.23 |

| July | ₹2,898.64 | ₹2,932.06 |

| August | ₹2,925.52 | ₹2,978.07 |

| September | ₹2,974.06 | ₹3,012.49 |

| October | ₹3,003.16 | ₹3,053.90 |

| November | ₹3,049.73 | ₹3,080.27 |

| December | ₹3,085.49 | ₹3,154.62 |

Bharat Dynamics Share Price Target 2030

Bharat Dynamics Share Price Target 2030 forecast may vary from ₹3,524.55 to ₹3,821.78.

Influencing Key Factors Of Bharat Dynamics Share Price Target 2030

- Policy Of The Indian Government

- The announcements made by the Government of India on ‘Atmanirbhar Bharat’ cover a wide range of opportunities for the Indian Industry, paving the way for a self-reliant India in the coming years. The company has taken up several measures, such as the creation of the Seeker Facility Centre and Warheads production facility, the launch of indigenously designed and developed equipment by the company, namely Konkurs Missile Test Equipment and Konkurs Launcher Test Equipment, setting up of new facilities.

- Different Policies Announced By The Defence Sector

- Among the various policies announced by the Government in the Defence Sector, the creation of a negative list of imports will also develop the defence manufacturing sector. Bharat Dynamics Limited is also offering various items for the indigenization of various missiles to the industry, including MSMEs.

| Year | Bharat Dynamics Share Price Target 2030 |

| 1st Price Target | ₹3,524.55 |

| 2nd Price Target | ₹3,821.78 |

Also Read – HAL Share Price Target

Bharat Dynamics Share Price Target 2035

Bharat Dynamics Share Price Target 2035 forecast may vary from ₹5,306.27 to ₹5,612.83.

Influencing Key Factors Of Bharat Dynamics Share Price Target 2035

- Upgradation Of Technology

- Bharat Dynamics Limited is constantly upgrading its manufacturing technologies and processes to state-of-the-art, including industry 4.0, Robotics-operated Workshops, latest surface-mounted devices assembly lines, and has always maintained the highest quality standards in its products by adopting to best QA practices like AS 9100, Zero defect, etc. The pursuit has resulted in a reduction in production cost, benchmarking of productivity norms, and modernization of the managment system.

- Expert R&D Team

- As a part of its R&D efforts, the company has developed Amogna-3, he third generation Anti-Tank Guided Missile. The missile will be offered after successful completion of user trials to the Indian Armed Forces as well as the export market. The company has entered into an MoU with the International Institute of Information Technology, Hyderabad, India, for its range of products.

| Year | Bharat Dynamics Share Price Target 2035 |

| 1st Price Target | ₹5,306.27 |

| 2nd Price Target | ₹5,612.83 |

Peer Company Of Bharat Dynamics Limited

| Company Name | Market Cap (Crore) |

| Hindustan Aeron | ₹343,875.96 |

| Bharat Electronics | ₹267,004.75 |

| Data Patterns | ₹16,123.44 |

| Azad Engineering | ₹11,826.67 |

| NIBE | ₹2,253.62 |

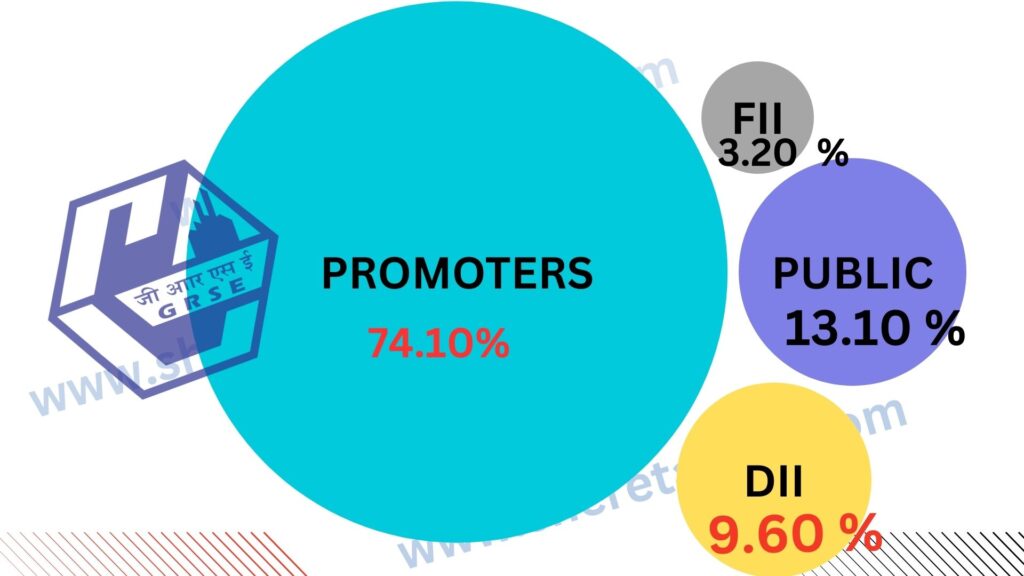

Discussion About Shareholding Pattern Of Bharat Dynamics Limited

Bharat Dynamics Limited mainly has four types of shareholding patterns, such as promoter holding, public holding, DII, and FII. Depending on the shareholding pattern, we can majorly influence the company’s growth.

| Investor Type | Percentage |

| Promoter Holding (Owned by the company’s promoter) | 74.10% |

| Public Holding (Held by the public) | 13.10% |

| FII (Invest by Foreign Institutional Investor) | 3.20% |

| DII (Invest money by Domestic Institutional Investor) | 9.60% |

What Is The Expert Advice About The Investment In Bharat Dynamics Share

Positive Sides

- In the last 3 years, the company has shown a good profit, which was 34.12%.

- The company is virtually debt-free, and the company has a good interest cover ratio of 230.86.

- In the last 3 years, the company has been maintaining a good ROCE, which was 21.86%.

- The company has an efficient cash conversion cycle of 71.53 days.

- The company has been maintaining effective average operating margins of 21.53% in the last 5 years.

- The company has a healthy liquidity position with a current ratio of 3.08.

- The company has a good cash flow managment, PAT stands at 2.08.

Negative Sides

- In the last 3 year’s the company had a poor revenue growth of 7.39%.

- The company is trading at a high EBITDA of 76.53.

The Last Few Years’ Share Price Updation Of Bharat Dynamics Share

Bharat Dynamics Share always gives good returns to investors, which is described in the portion below.

- The last 1 month’s share growth was +385.30 (26.99%).

- The last 6 months’ share growth was +845.00 (87.44%).

- The last 1 year’s share growth was +543.80 (42.85%).

- The last 5 years’ share growth was +1,700.32 (1,510.59%).

- Maximum share growth was +1,619.00 (830.68%).

- Bharat Dynamics share price return percentage was 30.23% in the last 1 month.

- The last 3 months’ share price return percentage was 73.08%.

- The last 1 year’s share price return percentage was 48.70%.

- The last 3 years’ share price return percentage was 404.62%.

- The last 5 years’ share price return percentage was 1505.23%.

Also Read – Bharat Electronics Share Price Target

FAQ

What is Bharat Dynamics Share Price Target for 2025?

Bharat Dynamics Share Price Target for 2025 is ₹1,829.44 to ₹2,079.37.

What is Bharat Dynamics Share Price Target for 2026?

Bharat Dynamics Share Price Target for 2026 is ₹2,105.78 to ₹2,485.49.

What is Bharat Dynamics Share Price Target for 2028?

Bharat Dynamics Share Price Target for 2028 is ₹2,805.32 to ₹3,154.62.

What is Bharat Dynamics Share Price Target for 2030?

Bharat Dynamics Share Price Target for 2030 is ₹3,524.55 to ₹3,821.78.

What is Bharat Dynamics Share Price Target for 2035?

Bharat Dynamics Share Price Target for 2035 is ₹5,306.27 to ₹5,612.83.

Conclusion

This website is written to help the investor gain some basic knowledge about the market strategy of Bharat Dynamics Share. For making this blog, we take consultation from experts and research the company. It is expected that Bharat Dynamics Share Price Target will be a good choice to invest in on a long-term basis. The demand for the manufacturers of ammunition and missile systems sector in India and outside of the country always increases, as a result of which the company and its share may increase rapidly.

We try to give an in-depth idea about the share. If you think it is helpful to you, you can share it. If you have any questions, please let us know through the comment box. We will try to reply to your questions and solve your problem. Thanks for visiting this website and thanks for being with us.

Disclaimer – We are not SEBI-registered advisors. A financial market is always risky to anyone. This website is only for training and educational purposes. So, before investing, we are requested to discuss certified expertise. We will not be responsible for anyone’s profit or loss.