Bank Of Baroda Share is a bullish trend in the share market. In the time of share ups and downs, you should know all about share details before investing. In this blog, we are going to discuss the Bank Of Baroda Share Price Target 2025, 2027, 2028, 2030, 2040. We try to analysis about the share base in the company’s overall performance.

We also look at the company’s profit growth in the last 5 years, the last 5 years’ sales growth, and the last 5 years’ ROE percentage Similarly, we also compare the Share growth, the share price return, amount of the share that has increased or decreased over the last 5 years. We also take advice from experts about which time we should invest in the share which may be helpful for you also. Let’s have a look at the Bank Of Baroda Share Price Target from 2025 to 2040.

Overview Of Bank Of Baroda Limited

Bank Of Baroda is an Indian Government public banking sector. Based on the data in the year 2023, the bank is ranked 587 on the Forbes Global 2000 list. The bank was established in the year 1908, and the headquarters are situated in Vadodara, Gujarat. Bank Of Baroda is the third-largest public sector Bank in India after the State Bank Of India.

Fundamental Analysis Of Bank Of Baroda

| Company Name | Bank Of Baroda Limited |

| Market Cap | ₹1,26,821.63 Crore |

| Face Value | ₹2 |

| Book Value | ₹247.96 |

| 52 Week High | ₹299.85 |

| 52 Week Low | ₹190 |

| DIV. YIELD | 3.46 |

| PE | 6.49 |

| ROA | 1.89% |

| ROE | 17.29% |

Dividend History Of Bank Of Baroda Limited

| Year | Dividend Medium | Dividend Amount Per Share |

| 2024 | Final | ₹7.60000 (380%) |

| 2023 | Final | ₹5.5000 (275%) |

| 2022 | Final | ₹2.8500 (142.50%) |

| 2017 | Final | ₹1.2000 (60%) |

| 2015 | Final | ₹3.2000 (160%) |

History Of Bank Of Baroda Share Price Target From The Year 2025 to 2040

| Year | 1st Price Target | 2nd Price Target |

| Bank Of Baroda Share Price Target 2025 | ₹240.39 | ₹270.79 |

| Bank Of Baroda Share Price Target 2027 | ₹298.03 | ₹328.52 |

| Bank Of Baroda Share Price Target 2028 | ₹330.67 | ₹355.01 |

| Bank Of Baroda Share Price Target 2030 | ₹381.03 | ₹406.32 |

| Bank Of Baroda Share Price Target 2040 | ₹605.47 | ₹623.06 |

Bank Of Baroda Share Price Target 2025

Bank Of Baroda Share Price Target 2025 forecast may vary from ₹240.39 to ₹270.79.

Bank Of Baroda provides two-wheeler loans that amount to up to ₹10 lakh, and the maximum tenure is 60 months. Baroda Car Loan is available to purchase an interest rate is 9% to 11.45%. The amount of processing charge for applying for the loan is also very poor, which is ₹1000 for a ₹10 lac loan. The loan is given to salaried employees, businessmen, and corporate employees. For digital car loans, Baroda provides up to ₹50.00 Lakhs.

| Month | Bank Of Baroda Share Price Target 2025 (1st Price Target) | Bank Of Baroda Share Price Target 2025 (2nd Price Target) |

| May | ₹240.39 | ₹244.59 |

| June | ₹242.73 | ₹248.08 |

| July | ₹247.91 | ₹254.37 |

| August | ₹253.82 | ₹259.08 |

| September | ₹257.39 | ₹264.28 |

| October | ₹262.97 | ₹271.33 |

| November | ₹269.08 | ₹275.35 |

| December | ₹264.99 | ₹270.79 |

Bank Of Baroda Share Price Target 2027

Bank Of Baroda Share Price Target 2027 forecast that may vary from ₹298.03 to ₹328.52.

Bank Of Baroda provides Gold Loan facilities, Retail Gold Loans, and Agri Gold Loans. Retail Gold Loan provides loan amounts of up to ₹50 lakhs per borrower, the maximum tenure is 12 months, and the maximum is 36 months for the EMI scheme. The Agri Gold Loan provides loans for agriculture & allied activities, the loan amount is ₹50 lakhs per borrower, and the maximum tenure is 12 months.

| Month | Bank Of Baroda Share Price Target 2027 (1st Price Target) | Bank Of Baroda Share Price Target 2027 (2nd Price Target) |

| January | ₹298.03 | ₹306.29 |

| February | ₹304.18 | ₹311.15 |

| March | ₹309.37 | ₹316.92 |

| April | ₹314.43 | ₹321.65 |

| May | ₹319.25 | ₹323.45 |

| June | ₹294.23 | ₹299.37 |

| July | ₹298.72 | ₹306.50 |

| August | ₹303.29 | ₹309.73 |

| September | ₹307.11 | ₹312.09 |

| October | ₹311.52 | ₹316.82 |

| November | ₹313.67 | ₹319.30 |

| December | ₹318.03 | ₹328.52 |

Bank Of Baroda Share Price Target 2028

Bank Of Baroda Share Price Target 2028 forecast may vary from ₹330.67 to ₹355.01.

Bank Of Baroda provides different types of Home Loans with an interest rate of 8.40% to 10.60% rate of interest depending upon the loan amount. For applying for the loan, the applicant’s minimum age should be 21 years, and the maximum age should be 70 years. The benefit of the bank is providing loans with low interest rates, low processing fees, and no hidden charges allowed by the bank. The bank provides free credit card facilities to customers.

| Year | Bank Of Baroda Share Price Target 2028 |

| 1st Price Target | ₹330.67 |

| 2nd Price Target | ₹355.01 |

Bank Of Baroda Share Price Target 2030

Bank Of Baroda Share Price Target 2030 forecast may vary from ₹381.03 to ₹406.32.

Bank Of Baroda also provides educational loans like Baroda Vidya, in which the loan amount is 4 lakhs and provided to the parents of Indian nationals for schooling at recognized institutes. Another one is Baroda Gyan, in which the maximum loan amount is ₹125 lakhs and the maximum tenure is 10-15 years.

| Year | Bank Of Baroda Share Price Target 2030 |

| 1st Price Target | ₹381.03 |

| 2nd Price Target | ₹406.32 |

Bank Of Baroda Share Price Target 2040

Bank Of Baroda Share Price Target 2040 forecast may vary from ₹605.37 to ₹623.06.

Bank Of Baroda also provides some other types of loans, like Loan For Public Issues-IPO, in which the maximum loan amount is ₹10 lakhs and the maximum tenure is 90 days. Another one is the PM-Surya Ghar Yojana Standalone, in which the maximum loan amount is ₹6.00 lakh and the maximum tenure is 10 years. The bank also provides the facility to the customers of Savings Accounts, Salary Accounts, Fixed Deposits, etc.

| Year | Bank Of Baroda Share Price Target 2040 |

| 1st Price Target | ₹605.37 |

| 2nd Price Target | ₹623.06 |

Also Read – Cochin Shipyard Share Price Target

The Last Few Years Performance Of Bank Of Baroda Limited

Net NPA (Non-Performing Assets) Percentage

The NPA percentage of the company in the last 5 years is described below.

- In the last 5 years, 1.10%

- In the last 3 years, 1.2%

- In the last 1 year, 0.69%

The Net NPA percentage was 0.79 Crore in June 2023 the amount reached ₹0.70 Crore in June 2024. The Gross NPA percentage was 3.52 Crore in June 2023, which decreased to ₹2.89 Crore in June 2024.

NIM (Net Interest Margin)

The NIM percentage of the company in the last 5 years is described below.

- In the last 5 years, 2.76%

- In the last 3 years, 2.87%

- In the last 1 year, 2.93%

The NIM amount was ₹15.35 Crore in June 2023, which decreased to ₹15.02 Crore in June 2024.

ROE Percentage

The ROE percentage growth of the company in the last 5 years is described below.

- In the last 5 years, 8.69%

- In the last 3 years, 13.78%

- In the last 1 year, 16.96%

ROA Percentage

The ROA percentage growth of the company in the last 5 years is described below, which has also increased rapidly.

- In the last 5 years, 0.60%

- In the last 3 years, 0.94%

- In the last 1 year, 1.19%

Profit Amount

The Net Profit of the company was ₹4,075.86 Crore in June 2023, which increased to ₹4,496.23 Crore in June 2024.

The Total Expenditure Amount

The Total Expenditure Amount of the company was ₹85,508.96 Crore in March 2023 which increased to ₹110,313.52 Crore in March 2024.

Assets Amount

The total Assets Amount of the company was ₹14,58,562.85 Crore in March 2023 which increased to ₹15,86,798.52 Crore in March 2024. The other assets of the company were ₹50,669.12 Crore in March 2023, which decreased to ₹47,262.74 Crore in March 2024.

Expenses Amount

The operating expenses amount was ₹6,495.23 Crore in June 2023, which increased to ₹6,958.23 Crore in June 2024.

Peers Company Of The Bank Of Baroda

| Company Name | Market Cap (Crore) |

| HDFC Bank Limited | ₹13,02,689.23 |

| ICICI Bank Limited | ₹9,10,917.52 |

| Axis Bank Limited | ₹3,84,412.52 |

| State Bank Of India | ₹7,06,357.12 |

| Kotak Mahindra Bank Limited | ₹3,72,276.85 |

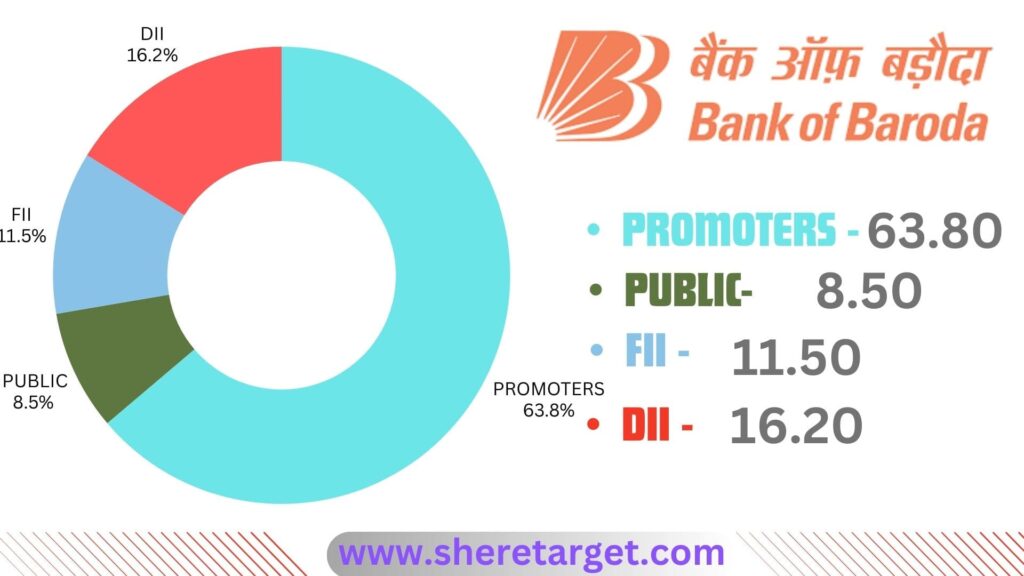

Discussion About Shareholding Pattern Of Bank Of Baroda Limited

Bank Of Baroda Limited mainly has four types of shareholding patterns: promoter holding, public holding, DII, and FII. We can majorly influence the company’s growth depending on the shareholding pattern.

Promoter Holding

Promoter Holding capacity is the percentage of the share owned by the company’s promoter or the company’s owner. The Promoter Holding Capacity in the company’s share is 63.80%.

Public Holding

Public Holding capacity is the indicator of the percentage that is held by the public rather than the promoters. The public holding capacity of the company’s share is 8.50%.

FII

The full form of FII is Foreign Institutional Investor, which invests funds from outside of its home country. The FII investor percentage in the company’s share is 11.50%.

DII

The full form of DII is Domestic Institutional Investor, which means some Indian institutions like mutual funds, insurance companies, and pension funds invest money in the country’s assets. The FII investor percentage in the company’s share is 16.20%.

The Last Few Years Share Price Prediction Of Bank Of Baroda Share

Bank Of Baroda Share always gives good returns to investors which as described portion below. The last 6 months’ share growth was -14.45 (-5.78 %), the last 1 month’s share growth was -18.95 (-7.45%), the last 1 year’s share growth was +21.95 (10.28%), the last 5 years share growth was +135.10 (134.70%) and the maximum share growth was +225.31 (2,233.00%).

Bank Of Baroda Share Price return percentage was -17.45 % in the last 3 months, the last 1 year’s share price return percentage was 10.39%, the last 3 years’ share price return percentage was 200.98%, and the last 5 year’s share price return percentage was 134.10%. Bank Of Baroda Share always gives a good return to investors. If anyone wants to invest in the share, it will be profitable on a long-term basis.

Why Should I Invest in Bank Of Baroda Share Rights Now?

Advantages

- The last 3 years’ ROE percentage of the company is very good, which is 13.78%.

- The last 3 years’ profit growth of the company was very good, which was 177.90%.

- The company has a good capital adequacy ratio, which is 16.59%.

- The CASA ratio of the company stands at 38.79% of total deposits.

- The company has a good promoter holding capacity, which is 63.80%.

- As the company spread its business outside India, the FII investor percentage of the company also increased to 11.50%.

Disadvantages

- The company has a high cost of income ratio, which is a negative point for the company’s growth.

- There are many competitor companies in the area from from banking sector and finance sector, so there may be some difficulties in earning huge profits.

What Is The Future Growth Of Bank Of Baroda Limited

Positive Sides

- The bank tries to reach every corner of India in rural and semi-urban areas.

- The bank started offering different types of personal loans like car loans, gold loans, car loans, business loans, etc, which were attractive to customers.

- The customer had faith in the bank for a long period over the last few years.

- The bank also provides services with low interest and a free credit card facility, which is very attractive to customers.

Negative Sides

- Changes in any government rules may affect the bank’s profit growth.

- The banking sector is always at risk full for economic ups and downs.

FAQ

What Is the Bank Of Baroda Share Price Target for 2025?

Bank Of Baroda Share Price Target for 2025 is ₹240.39 to ₹270.79.

What Is the Bank Of Baroda Share Price Target for 2027?

Bank Of Baroda Share Price Target for 2027 is ₹298.03 to ₹328.52.

What Is the Bank Of Baroda Share Price Target for 2028?

Bank Of Baroda Share Price Target for 2028 is ₹330.67 to ₹355.01.

What Is the Bank Of Baroda Share Price Target for 2030?

Bank Of Baroda Share Price Target for 2030 is ₹381.03 to ₹406.32.

What Is the Bank Of Baroda Share Price Target for 2040?

Bank Of Baroda Share Price Target for 2040 is ₹605.37 to ₹623.06.

Is Bank Of Baroda a private or government-owned company?

Bank Of Baroda is a State-owned banking sector that was established in the year 1908.

Conclusion

This website is written to help the investor gain some basic knowledge about the market strategy of Bank Of Baroda Share. For making this blog, we take consultation from experts and do research about the company. It is expected that the Bank Of Baroda Share Price Target will be a good choice to invest in on a long-term basis. The demand for the banking sector in India and outside of the country always increases as a result of the company, and the share may increase rapidly.

We try to give an in-depth idea about the share. If you think it is helpful to you, you can share it. If you have any questions, please let us know through the comment box. We will try to reply to your questions and solve your problem. Thanks for visiting this website and thanks for being with us.

Disclaimer – We are not SEBI-registered advisors. A financial market is always risky to anyone. This website is only for training and educational purposes. So, before investing, we are requested to discuss certified expertise. We will not be responsible for anyone’s profit or loss.