Astra Microwave Share is in a bullish trend in the share market. During share ups and downs, you should know all about share details before investing. In this blog, we are going to discuss the Astra Microwave Share Price Target 2025, 2026, 2028, 2030, and 2035. We will try to analyze the share base in the company’s overall performance.

We also look at the company’s profit growth in the last 5 years, the last 5 years’ sales growth, and the last 5 years’ ROE percentage. Similarly, we also compare the share growth, the share price return, amount whether the share has increased or decreased over the last 5 years. We also take advice from experts about when we should invest in the share, which may be helpful for you. Let’s have a look at the Astra Microwave Share Price Target from 2025 to 2035.

Overview Of Astra Microwave Limited

Astra Microwave Products Limited mainly designs, develops, manufactures, and sells sub-systems for radio frequency and microwave systems used in defence, space, meteorology, and telecommunication applications in India. The company was established in the year 1991, and the headquarters are situated in Hyderabad, India.

Fundamental Analysis Of Astra Microwave Limited

| Company Name | Astra Microwave Products Limited |

| Market Cap | ₹10,248.59 Crore |

| Book Value | ₹109.52 |

| Face Value | ₹2 |

| P/E | 87.25 |

| P/B | 10.6 |

| 52 Week High | ₹1,120 |

| 52 Week Low | ₹584.20 |

| DIV. YIELD | 0.20% |

Astra Microwave Share Price Target 2025

Astra Microwave Share Price Target 2025 forecast may vary from ₹836.30 to ₹1,327.24.

Influencing Key Factors Of Astra Microwave Share Price Target 2025

- Product’s Diversification

- The company also manufactures associated digital electronics for OEMs of radars, telemetry equipment, ground-based surveillance, satellite communications, equipment used in the defence sector, like missiles, light combat aircraft, and types of equipment used for meteorology, etc.

- Production Facility

- The company has 4 production facilities in Telangana (two in Medak District and two in Ranga Reddy District). R&D centers in Ranga Reddy District, Telangana and Bengaluru, Karnataka recognized by Ministry Of Science & Technology, Department of Scientific and Industrial Research.

- Journey Of The Company

- In the year 2013, the company received a ₹3,100mn offset order from an overseas customer. In the year 2015, the company was recognised as a leading technology company in the Deloitte Technology Fast 50 India 2015 programme. In the year 2013, the company incorporated Bhavyabhanu Electronics Private Limited as a wholly owned subsidiary company in India.

| Month | Astra Microwave Share Price Target 2025 (1st Price Target) | Astra Microwave Share Price Target 2025 (2nd Price Target) |

| May | ₹836.30 | ₹1,096.22 |

| June | ₹1,094.56 | ₹1,157.34 |

| July | ₹1,154.95 | ₹1,196.61 |

| August | ₹1,194.24 | ₹1,225.69 |

| September | ₹1,220.15 | ₹1,276.80 |

| October | ₹1,270.32 | ₹1,316.72 |

| November | ₹1,308.47 | ₹1,342.28 |

| December | ₹1,285.26 | ₹1,327.24 |

Also Read – Bharat Dynamics Share Price Target

Astra Microwave Share Price Target 2026

Astra Microwave Share Price Target 2026 forecast may vary from ₹1,330.63 to ₹1,768.75.

Influencing Key Factors Of Astra Microwave Share Price Target 2026

- Discover For Space World

- The company discovered type-D mobile satellite terminals, automatic weather stations, 16-channel transceivers, and an L-band TR module, all these systems were for Ground Base. In the onboard (shuttle/space) area, the company also discovered C-band T/R modules, S-band transmitter, TR controller units, Ku band MMIC receivers, etc.

- The Company’s R&D Strengths

- The company has a well-established team of 165 employees as of October 2015. R&D professionals with a decade-plus experience with the Government research organisation. The company’s R&D labs are recognised by the Ministry of Science &Technology, GoI. The company also has In-house MMIC design, testing, and manufacturing capabilities.

- Strong Track Record Of New Product Development

- In the Defence Sectors, the company developed sub-systems for various defence programmes and new technologies in India, such as AESA radars, BFSR, and Electronic warfare equipment. In the space area, the company developed sub-systems for India’s RISAT programme. In the Meteorology area, the company developed and manufactured automatic weather stations along with met towers.

| Month | Astra Microwave Share Price Target 2026 (1st Price Target) | Astra Microwave Share Price Target 2026 (2nd Price Target) |

| January | ₹1,330.63 | ₹1,386.29 |

| February | ₹1,379.20 | ₹1,435.48 |

| March | ₹1,429.33 | ₹1,486.34 |

| April | ₹1,480.92 | ₹1,523.03 |

| May | ₹1,518.72 | ₹1,552.57 |

| June | ₹1,548.02 | ₹1,586.43 |

| July | ₹1,579.44 | ₹1,624.90 |

| August | ₹1,485.28 | ₹1,518.30 |

| September | ₹1,516.18 | ₹1,567.47 |

| October | ₹1,586.91 | ₹1,615.36 |

| November | ₹1,609.49 | ₹1,695.68 |

| December | ₹1,705.27 | ₹1,768.75 |

Astra Microwave Share Price Target 2028

Astra Microwave Share Price Target 2028 forecast may vary from ₹2,104.37 to ₹2,438.32.

Influencing Key Factors Of Astra Microwave Share Price Target 2028

- Macroeconomic Environment

- The defence expenditure amount came to almost 2% of the Indian GDP & 14% of Central Government Expenditure. Procurement expansion & modernization needs of Indian defence forces through indigenous sources of 30% to 70% over the next decade. The company increased allocation to the infrastructure sector, including telecommunications, including telecommicastions, in the Union Budget in the year 2016-17.

- Increased Foreign Direct Investment

- An increase in foreign direct investment in defence has provided new opportunities for bringing in new technologies, which, when coupled with high entry barriers, can help the company in grabbing significant market share in the defence sector of India.

- Functional Testing

- The company also manufactures some functional testing equipment like Microwave frequency counters, Power meters, Solar Equipment, Far Field Test Range, Noise Figure Meters, Open air antenna test range, Vector Network Analyzer, Signal generators, etc.

| Month | Astra Microwave Share Price Target 2028 (1st Price Target) | Astra Microwave Share Price Target 2028 (2nd Price Target) |

| January | ₹2,104.37 | ₹2,176.29 |

| February | ₹2,174.16 | ₹2,210.80 |

| March | ₹2,006.31 | ₹2,075.75 |

| April | ₹2,069.27 | ₹2,103.62 |

| May | ₹2,101.52 | ₹2,175.66 |

| June | ₹2,170.10 | ₹2,224.82 |

| July | ₹2,218.64 | ₹2,263.49 |

| August | ₹2,259.20 | ₹2,292.34 |

| September | ₹2,289.37 | ₹2,317.49 |

| October | ₹2,310.07 | ₹2,365.26 |

| November | ₹2,359.22 | ₹2,384.70 |

| December | ₹2,379.52 | ₹2,438.32 |

Astra Microwave Share Price Target 2030

Astra Microwave Share Price Target 2030 forecast may vary from ₹2,824.60 to ₹3,250.37.

Influencing Key Factors Of Astra Microwave Share Price Target 2030

- Solutions That Drive Innovation

- At Astra Microwave Products Limited, the company develops cutting-edge solutions for space, defence, and hydro-meteorological applications that involve pushing the boundaries of technology, engineering, and scientific research, involving interdisciplinary collaboration and innovation to address complex challenges and drive progress.

- Build To Specifications

- Astra Microwave started its journey in the year 1991 with customers under the Built to Specification mode. In the space industry, Build To Specification plays a vital role in the production of electronics for satellites, spacecraft, and space exploration missions. These electronics meet the unique demands of the space environment, such as extreme temperatures, vacuum, radiation, and vibration.

- Quality Control

- The company prioritizes quality in everything of produces. The company’s comprehensive quality control processes span the entire product lifecycle. From initial design and prototyping to manufacturing, testing, and post-production support, the company has implemented rigorous measures to ensure that every product or service the company delivers meets the highest quality standards.

| Year | Astra Microwave Share Price Target 2030 |

| 1st Price Target | ₹2,824.60 |

| 2nd Price Target | ₹3,250.37 |

Astra Microwave Share Price Target 2035

Astra Microwave Share Price Target 2035 forecast may vary from ₹5,380.25 to ₹5,827.64.

Influencing Key Factors Of Astra Microwave Share Price Target 2035

- Customers Satisfaction

- Customer Satisfaction is at the core of the company’s quality control efforts. The company strives to understand and exceed the customer’s expectations by actively listening to customer feedback, addressing their concerns and consistently delivering products and services that meet their requirments.

- Application Of Meteorology

- The company manufactures application-based systems Doppler Weather Radars, Automatic Rain Gauges, Automatic Weather Stations (AWS), Agromet Meteorological Stations (AMS), Water Level Measurement, Automatic Rain Gauges (ARG), Satellite-Based Multi-Mission Meteological Data Receiving Earth Station, and Avalanche Radars which used in meteorogical sector.

- Testing and Inspection In Quality Control

- In the extensive testing and inspection procedures, the company employs a variety of testing methods, including functional testing, performance testing, durability testing, and reliability testing, to verify that the company’s products meet or exceed specified requirements. The company’s state-of-the-art testing facilities and equipment enable it to conduct thorough evaluations and identify potential issues.

| Year | Astra Microwave Share Price Target 2035 |

| 1st Price Target | ₹5,380.25 |

| 2nd Price Target | ₹5,827.64 |

Also Read – Zomato Share Price Target

Last Few Years’ Performance Of Astra Microwave Products Limited

Profit Growth

- In the last 5 years, 55.29%

- In the last 3 years, 68.02%

- In the last 1 year, 47.92%

The company’s Net Profit was ₹77.29 Crore in March 2023, which increased to ₹113.62 Crore in March 2024. The company’s Operating Profit was ₹150.37 Crore in March 2023, which increased to ₹194.63 Crore in March 2024.

Sales Growth

The sales growth percentage of the company in the last 5 years is described below.

- In the last 5 years, 25.96%

- In the last 3 years, 15.38%

- In the last year, 12.63%

The Net Sales amount of the company was ₹809.26 Crore in March 2023, which decreased to ₹910.36 Crore in March 2024.

ROE Percentage

The ROE percentage growth of the company in the last 5 years is described below.

- In the last 5 years, 9.36%

- In the last 3 years, 12.36%

- In the last 1 year, 14.25%

ROCE Percentage

The company’s ROCE percentage growth in the last 5 years is described below, and it has also increased rapidly.

- In the last 5 years, 24.10%

- In the last 3 years, 15.66%

- In the last 1 year, 19.35%

Total Expenditure Amount

The company’s Total Expenditure was ₹658.63 Crore in March 2023, increasing to ₹712.36 Crore in March 2024.

The Net Cash Flow Amount

The Net Cash Flow amount of the company was ₹26.85 Crore in March 2023, which increased to ₹3.59 Crore in March 2024.

Peer Company Of Astra Microwave Products Limited

| Company Name | Market Cap (Crore) |

| Paras Defence | ₹6,448.35 |

| Zen Tech | ₹17,256.82 |

| Bharat Electronics Limited | ₹2,66,854.11 |

| Solar Industries India Limited | ₹1,24,105.80 |

| Bharat Dynamics Limited | ₹65,957.62 |

| Mazagon Dock Shipbuilders Limited | ₹1,35,308.29 |

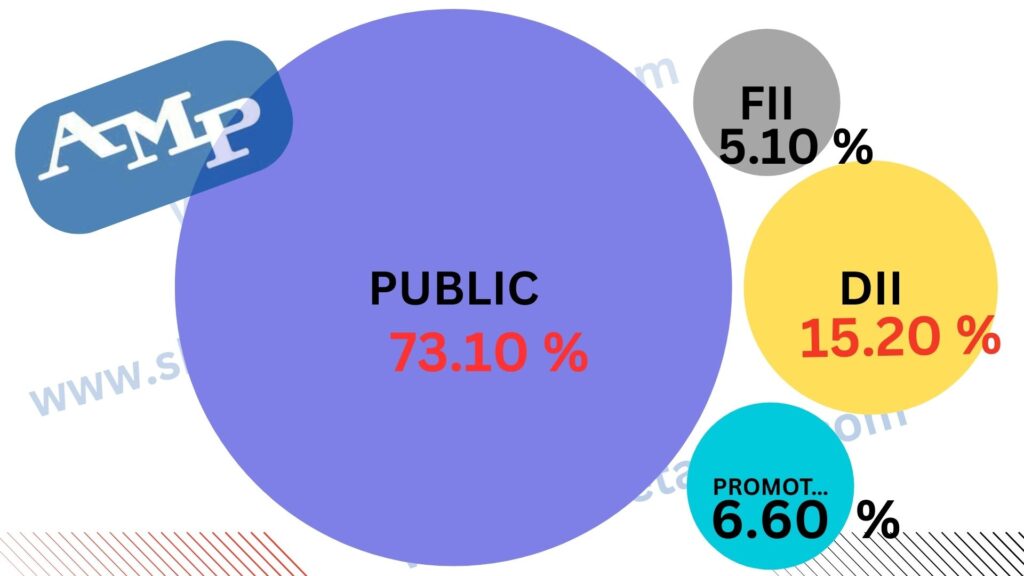

Discussion About Shareholding Pattern Of Astra Microwave Limited

Astra Microwave Limited mainly has four types of shareholding patterns, such as promoter holding, public holding, DII, and FII. Depending on the shareholding pattern, we can majorly influence the company’s growth.

| Investor Type | Percentage |

| Promoter Holding (Owned by the company’s promoter) | 6.60% |

| Public Holding (Held by the public) | 73.10% |

| FII (Invest by Foreign Institutional Investor) | 5.10% |

| DII (Invest money by Domestic Institutional Investor) | 15.20% |

What Is The Expert Advice About The Investment In Astra Microwave Share

Positive Sides

- In the last 3 year’s the company has shown a good profit growth, which was 68.02%.

- The company has a healthy liquidity position with a current ratio of 2.72.

- The company has a strong degree of operating leverage, and average operating leverage stands at 4.68.

- The company has a strong degree of ROCE ratio, which was 15.66%.

Negative Sides

- In the last 3 years, the company showed a poor revenue growth which was 13.62%.

- The company has a negative cash flow from operations, which was -181.92.

- The company has a high PE ratio of 87.25.

- The company is trading at a high EBITDA of 44.36.

- In the last 3 years, the company’s sales growth was poor, which was 15.38%.

Risk Factors Of Astra Microwave Products Limited

- Strategic Risk

- Ongoing R&D could result in higher costs without a proportionate increase in revenues.

- The top 5 customers contribute over 91% of the total income.

- Conversion of orders to a recognizable quantum lies with the Government.

- Operations involve high working capital and need timely payments.

- Businesses are driven by offset provisions of the government, which are lumpy and controlled by export regulations.

- Financial Risk

- Risks arise from a mismatch between financial reporting currencies, currency of revenue, expenses and indebtedness, as well as timing differences.

- For Operations, expected capital expenditure and working capital expenditure, and working capital requirements on favorable terms, or at all.

Also Read – Indus Towers Share Price Target

FAQ

What is Astra Microwave Share Price Target for 2025?

Astra Microwave Share Price Target for 2025 is ₹836.30 to ₹1,327.24.

What is Astra Microwave Share Price Target for 2026?

Astra Microwave Share Price Target for 2026 is ₹1,330.63 to ₹1,768.75.

What is Astra Microwave Share Price Target for 2028?

Astra Microwave Share Price Target for 2028 is ₹2,104.37 to ₹2,438.32.

What is Astra Microwave Share Price Target for 2030?

Astra Microwave Share Price Target for 2030 is ₹2,824.60 to ₹3,250.37.

What is Astra Microwave Share Price Target for 2035?

Astra Microwave Share Price Target for 2035 is ₹5,380.25 to ₹5,827.64.

Conclusion

This website is written to help the investor gain some basic knowledge about the market strategy of Astra Microwave Share. For making this blog, we take consultation from experts and research the company. It is expected that the Astra Microwave Share Price Target will be a good choice to invest in on a long-term basis. The demand for the manufacturers of sub-systems for radio frequency and microwave systems sector in India and outside of the country always increases, as a result of which the company and its share may increase rapidly.

We try to give an in-depth idea about the share. If you think it is helpful to you, you can share it. If you have any questions, please let us know through the comment box. We will try to reply to your questions and solve your problem. Thanks for visiting this website and thanks for being with us.

Disclaimer – We are not SEBI-registered advisors. A financial market is always risky to anyone. This website is only for training and educational purposes. So, before investing, we are requested to discuss certified expertise. We will not be responsible for anyone’s profit or loss.