Adani Power Share Price: Q1 Results and Stock Split Analysis

📌 Key Developments

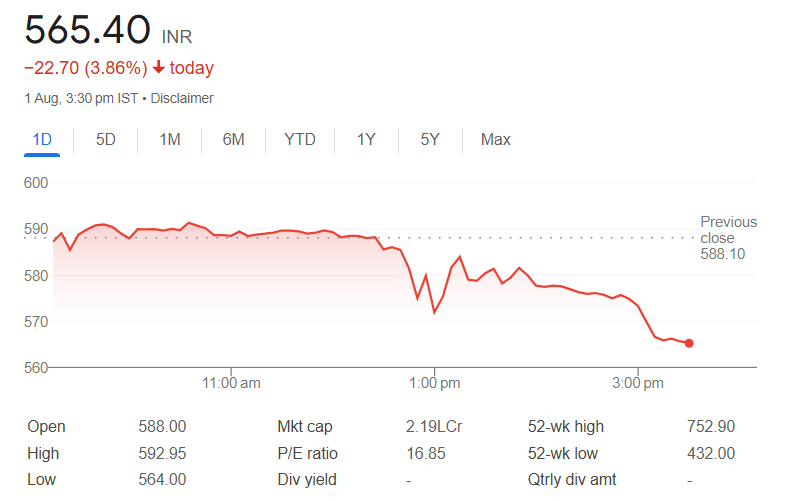

- Shares closed at ₹573.15, down 2.55% post-earnings

- Q1 profit declined 15.5% YoY to ₹3,305 Cr

- Board approves 1:5 stock split (₹10 → 5×₹2 shares)

- EBITDA margins contracted to 40.7% from 43.6% YoY

📉 Today’s Price Action

Adani Power shares witnessed volatile trading on August 1, swinging between ₹564 and ₹592.95 before settling near the day’s low at ₹573.15. The decline comes amid broad profit-booking in power sector stocks following the quarterly results season.

💼 Q1 FY26 Financial Highlights

| Metric | Q1 FY26 | Q1 FY25 | Change |

|---|---|---|---|

| Revenue (Cr) | 14,109 | 14,960 | -5.7% |

| Net Profit (Cr) | 3,305 | 3,913 | -15.5% |

| EBITDA (Cr) | 5,744 | 6,290 | -8.7% |

| EBITDA Margin | 40.7% | 43.6% | -290 bps |

The earnings contraction was primarily driven by lower merchant power tariffs and higher fuel costs. Management noted that 72% of capacity remains tied to long-term PPAs, providing revenue visibility despite current margin pressures.

✂️ 1:5 Stock Split Details

Split Ratio

Each existing ₹10 face value share will be subdivided into five ₹2 shares

Purpose

Enhance liquidity and make shares more accessible to retail investors

Timeline

Record date to be announced after shareholder approval (expected by October 2025)

This marks Adani Power’s first stock split since listing. Historically, splits in large-cap stocks like TCS and ITC have improved retail participation by 18-25% in subsequent quarters.

📊 Valuation Metrics

Analyst Insight: The current P/E of 16.89x represents a 23% discount to the sector average. While margins remain under pressure, the stock split could re-rate valuations if retail participation increases as anticipated.

📈 Performance Trends

While the stock has delivered strong 3-year returns, it remains 24% below its 52-week high of ₹752.90. The underperformance over the past year correlates with rising interest rates impacting power sector valuations.

🔭 Investment Outlook

Potential Upsides

- Stock split could improve liquidity and retail interest

- Valuation discount to sector peers

- Stable cash flows from long-term PPAs (72% of capacity)

Key Risks

- Continued margin pressure from high fuel costs

- Regulatory delays in tariff approvals

- Execution risks in new capacity additions

Most brokerages maintain a ‘Hold’ rating with target prices between ₹550-630. The stock split announcement could trigger short-term volatility, while long-term performance will depend on margin recovery and capacity utilization.

Final Verdict

Adani Power’s Q1 results reflect the challenging operating environment for power generators, though the company maintains relatively stable cash flows from its contracted capacity. The 1:5 stock split is a strategic move to enhance retail participation and could improve liquidity in coming months.

Investor Takeaway: Current levels may appeal to long-term investors comfortable with sector cyclicality, but the stock likely needs visibility on margin improvement to sustain a re-rating. The record date for the split (expected October-November 2025) may provide a near-term catalyst.

Research Sources

• Business Standard Q1 Results Analysis

• Economic Times Market Data

• NSE India Official Filings

• HDFC Securities Research Note

• Kotak Institutional Equities

• Adani Power Investor Presentation

Disclaimer: This analysis is for informational purposes only and not investment advice. Please consult a qualified financial advisor before making investment decisions. Past performance is not indicative of future results.