Adani Ports Share is a bullish trend in the share market. In the time of share ups and downs, you should know all about share details before investing. In this blog, we are going to discuss Adani Ports Share Price Target 2025, 2027, 2028, 2030, 2040. We try to analysis about the share base in the company’s overall performance.

We also look after the company’s profit growth in the last 5 years, the last 5 year’s sales growth, and the last 5 years’ ROE percentage similarly we also compare the Adani Ports Share growth, the share price return amount of the share become increasing or decreased through the last 5 year’s. We also take advice from experts about which time we should invest in the share it may be helpful for you also. Let’s have a look at Adani Ports Share Price Target from 2025 to 2040.

Overview About Adani Ports & Special Economic Zone Limited

Adani Ports & Special Economic Zone Limited is India’s largest private port operator which has a network of 12 ports and terminals. The company is under the Adani Group and the company was established in the year 1998. The headquarters of the company is situated in Ahmedabad, Gujarat. India’s first port-based SEZ at Mundra and the first deep-water transshipment port at Thiruvananthapuram also under the Adani Ports Limited.

Fundamental Analysis Of Adani Ports Company

| Company Name | Adani Ports & Special Economic Zone Limited |

| Market Cap | ₹2,30,616.24 Crore |

| P/B | 7.10 |

| Face Value | ₹2 |

| Book Value | ₹139.53 |

| 52 Week High | ₹1,622.45 |

| 52 Week Low | ₹993.85 |

| DIV. YIELD | 0.58% |

| PE Ratio | 96.97 |

| ROA | 2.19% |

| ROE | 6.04% |

History Of Adani Ports Share Price Target From The Year 2024 to 2040

| Year | 1st Price Target | 2nd Price Target |

| Adani Ports Share Price Target 2025 | ₹1,067.98 | ₹1,398.48 |

| Adani Ports Share Price Target 2027 | ₹1,705.06 | ₹2,079.66 |

| Adani Ports Share Price Target 2028 | ₹2,101.60 | ₹2,523.56 |

| Adani Ports Share Price Target 2030 | ₹2,908.80 | ₹3,289.54 |

| Adani Ports Share Price Target 2040 | ₹7,099.54 | ₹7,451.54 |

Adani Ports Share Price Target 2025

Adani Ports Share Price Target 2025 range may vary from ₹1,067.98 to ₹1,398.48.

Influencing Key Factors Of Adani Ports Share Price Target 2025

- Development Of The Adani Ports Limited

- Adani Ports Limited is India’s largest port developer and operator comprising 12 ports and terminals which has 538 MMT of operating capacity. The company also possesses the largest container-handling capacity in India. Nearly 62% of the company’s capacity is on the west coast of India and 38% on the east coast of India. The company created a new record by handling 36,274 rakes transporting 98.32 MMT of cargo in that year.

- Presence Of The Company In State Wise

- Adani Ports Limited is present in different countries like Goa, Kerala, Andhra Pradesh, Maharashtra, Tamil Naru, and Odisha. Ports in Vizhinjam (Kerala, India) and Colombo (Sri Lanka) are under construction. The company provides its business in different countries to gain more profit.

- Adani Ports Performace In Railway Sector

- Adani Ports created a new record by handling 36,274 raks transporting 98.32 MMT of cargo in the financial year 2021-2022. Mundra ranked the highest number of TEUs handled by rail 18.55 lakh TEUs in a year. Dharma handled 30 MMT of rail-bound cargo. The company handled 11 MMT and the Gangavaram port handled 18 MMT of rail-bound cargo which is also profitable for the company’s growth.

| Month | Adani Ports Share Price Target 2025 (1st Price Target) | Adani Ports Share Price Target 2025 (2nd Price Target) |

| February | ₹1,067.98 | ₹1,124.99 |

| March | ₹1,119.65 | ₹1,178.22 |

| April | ₹1,169.01 | ₹1,257.80 |

| May | ₹1,249.65 | ₹1,360.73 |

| June | ₹1,205.55 | ₹1,296.24 |

| July | ₹1,134.37 | ₹1,189.53 |

| August | ₹1,185.60 | ₹1,268.86 |

| September | ₹1,201.53 | ₹1,270.39 |

| October | ₹1,269.07 | ₹1,390.75 |

| November | ₹1,380.29 | ₹1,479.64 |

| December | ₹1,302.64 | ₹1,398.48 |

Also Read – Asian Paints Share Price Target

Adani Ports Share Price Target 2027

Adani Ports Share Price Target 2027 range may vary from ₹1,705.06 to ₹2,079.66.

Influencing Key Factors Of Adani Ports Share Price Target 2027

- Maritime India Vision 2030

- Maritime India was launched in November 2020 to catalyze investment of ₹1,00,000 to 1,25,000 Crore in the area of capacity augmentation and development of world-class port infrastructure. The policy covers more than 150 initiatives across the port, shipping, and waterway modes to transform the country’s logistical effectiveness.

- NMP In Ports

- As per the NMP scheme, the total estimated capex for 31 identified port projects considered for monetization was estimated at ₹14,485 Crore for the year 2022-2025. Out of the 31 projects, 13 projects with an expected capex of ₹6,925 Crore were envisaged to be tendered out in the financial year 2021-2022. In the financial year 2023-2025 a total of 18 projects added up to ₹7,169 Crore.

- Stake Of Different Countries

- In March 2024, the company revealed its acquisition of Gopalpur Port in Odisha which is situated on India’s east coast. The acquisition involved purchasing a 56% stake from the Shapoorji Pallonji Group and a 39% stake from Orissa Stevedores Limited in Gopalpur Port Limited which was valued at ₹3,080 Crore.

| Month | Adani Ports Share Price Target 2027 (1st Price Target) | Adani Ports Share Price Target 2027 (2nd Price Target) |

| January | ₹1,705.06 | ₹1,768.54 |

| February | ₹1,750.57 | ₹1,797.69 |

| March | ₹1,789.13 | ₹1,845.78 |

| April | ₹1,839.59 | ₹1,898.90 |

| May | ₹1,895.74 | ₹1,946.73 |

| June | ₹1,939.29 | ₹1,986.54 |

| July | ₹1,975.56 | ₹2,098.60 |

| August | ₹2,089.09 | ₹2,187.49 |

| September | ₹2,175.90 | ₹2,289.55 |

| October | ₹1,945.96 | ₹1,996.08 |

| November | ₹1,959.17 | ₹1,986.89 |

| December | ₹1,985.70 | ₹2,079.66 |

Adani Ports Share Price Target 2028

Adani Ports Share Price Target 2028 range may vary from ₹2,101.60 to ₹2,523.56.

Influencing Key Factors Of Adani Ports Share Price Target 2028

- Holding A License For The Indian Railway

- Adani Ports Limited holds a category 1 License for the Indian Railways that helps in pan-India cargo movement. The trains owned by Adani Logistics were used to dispatch 30,000 tonnes of food grains to feed over 60 lakh citizens across the states of Tamil Nadu, Karnataka, West Bengal, and Maharashtra during the 2020 COVID-19 lockdown.

- Milestones Of The Company

- The Milestones of the company are Maruti Suzuki’s A-star sails to Europe from Mundra Port. Adani Auto Terminal Commence Terminal Operation. In the year 2015, Adani Group announced a scheme of arrangement- Adani Ports and Special Economic Zone Limited commissioned a bulk terminal at Tuna Tekra, Kandia Port.

- Initiatives For Crop Productivity

- The company’s drip irrigation systems for increasing crop productivity, and reducing weeding in Mundra, Gujarat in which 50% subsidiary was from the Government and 25% was contributed by Adani Foundation with technical support. More than 600 farmers are benefited. This new sector also benefits the company.

| Month | Adani Ports Share Price Target 2028 (1st Price Target) | Adani Ports Share Price Target 2028 (2nd Price Target) |

| January | ₹2,101.60 | ₹2,199.44 |

| February | ₹2,193.38 | ₹2,287.76 |

| March | ₹2,285.54 | ₹2,396.55 |

| April | ₹2,389.30 | ₹2,469.65 |

| May | ₹2,465.68 | ₹2,512.42 |

| June | ₹2,503.55 | ₹2,566.40 |

| July | ₹2,559.60 | ₹2,698.69 |

| August | ₹2,695.45 | ₹2,717.76 |

| September | ₹2,679.59 | ₹2,716.84 |

| October | ₹2,513.18 | ₹2,498.50 |

| November | ₹2,517.63 | ₹2,579.54 |

| December | ₹2,418.55 | ₹2,523.56 |

Adani Ports Share Price Target 2030

Adani Ports Share Price Target 2030 range may vary from ₹2,908.80 to ₹3,289.54.

Influencing Key Factors Of Adani Ports Share Price Target 2030

- Installed Capacity Of Adani Ports Limited

- Another one is Dhamra Port which has an installed capacity of 45 MMTPA. It is a gateway port for Nepal, Bangladesh, and Inland waterways connecting to industrial and mining belts. It is also connected to the railway network through Non-governmental railways, which covers 63 km. The port also completed a surface water reservoir capacity of 8 lakh KL and has a rainwater harvesting capacity of 50,000 liters.

- Increasing The Net Worth Amount

- Adani Ports Limited increases its Net Worth amount every year. In the year 2022, the company’s Net Worth amount was ₹42,383 Crore which increased to ₹46,923 in the year 2023. The increased net worth amount of the company also helps to improve the company’s profit growth.

- Logistics Facility

- Adani Logistics Limited is the most diversified logistic service provider in the country with a presence across all major markets. The company also delivers integrated solutions for different industries like automobiles, white goods, chemicals, heavy metals, FMCG, cement, retail, etc. Adani Ports is the largest private train operator with 63 freight trains, 12 GPW trains, and 7 agri trains through a wholly owned subsidiary of Adani Agri Logistics Limited. The company also delivers warehousing solutions on a pan-Inddia basis.

| Month | Adani Ports Share Price Target 2030 (1st Price Target) | Adani Ports Share Price Target 2030 (2nd Price Target) |

| January | ₹2,908.80 | ₹2,994.65 |

| February | ₹2,990.55 | ₹3,069.06 |

| March | ₹3,023.70 | ₹3,097.32 |

| April | ₹3,091.53 | ₹3,178.38 |

| May | ₹3,170.92 | ₹3,298.45 |

| June | ₹3,295.66 | ₹3,334.90 |

| July | ₹3,329.75 | ₹3,415.40 |

| August | ₹3,414.87 | ₹3,499.06 |

| September | ₹3,487.07 | ₹3,587.32 |

| October | ₹3,580.43 | ₹3,678.65 |

| November | ₹3,478.31 | ₹3,389.56 |

| December | ₹3,158.79 | ₹3,289.54 |

Also Read – Suzlon Energy Share Price Target

Adani Ports Share Price Target 2040

Adani Ports Share Price Target 2040 range may vary from ₹7,099.54 to ₹7,451.54.

Influencing Key Factors Of Adani Ports Share Price Target 2040

- Facility In Agri Logistics

- Adani Ports Limited operates 7 BCBFG rakes for the transportation of food grains from base depots in the North to field reports across numerous locations in India. The company has 21 storage infrastructure facilities (14 operational, 3 under implementation & 4 awarded) in 9 states across India. The company also connects major food grain-producing states viz Punjab, Haryana, and Madhya Pradesh with major consumption centers located in Karnataka, Tamil Naru.

- Future Expansion Plan Of The Company

- With ports coming up on the eastern and western coastlines of India, the company emerging with a stronger pan-India presence. Vizhinjam Port is an ambitious plan for the company to develop India’s first Mega Transhipment Container Terminal at Vizhinjam, Kerala.

- Adani Ports Services

- Adani Ports Limited leading private rail operator in containerized transportation, connecting all major seaports across India. The company’s road transportation business also connects the freight with the company’s logistics park. The company’s warehousing solutions with built-to-suit options. The company also provides customized solutions for Steel Coil and Liquid Logistics which will be more profitable for future expansion.

| Year | Adani Ports Share Price Target 2040 |

| 1st Price Target | ₹7,099.54 |

| 2nd Price Target | ₹7,451.54 |

Last Few Year’s Performance Of Adani Ports & Special Economic Zone Limited

Profit Growth

The profit growth percentage of the company in the last 5 years is described below.

- In the last 5 years -8%

- In the last 3 years -3.42%

- In the last 1 year 463.01%

The Net Profit amount of the company was -478.13 Crore in March 2023 which increased to ₹1,742.63 Crore in March 2024. The Operating Profit amount of the company was ₹3,310.25 Crore in March 2023 which increased to ₹4,430.52 Crore in March 2024 and it increased rapidly.

Sales Growth

The sales growth percentage of the company in the last 5 years is described below.

- In the last 5 years 5.01%

- In the last 3 years 15.95%

- In the last 1 year 29.99%

The Net Sales amount of the company was ₹1,435.42 Crore in June 2023 which increased to ₹1,896 Crore in June 2024.

ROE Percentage

The ROE percentage growth of the company in the last 5 years is described below.

- In the last 5 years 4.79%

- In the last 3 years 1.69%

- In the last 1 year 5.98%

ROCE Percentage

The ROCE percentage growth of the company in the last 5 years is described below which also increased rapidly.

- In the last 5 years 7.25%

- In the last 3 years 5.98%

- In the last 1 year 7.42%

Total Expenditure Amount

The company’s total expenditure was ₹601.05 Crore in June 2023, which increased to ₹831.45 Crore in March 2024.

The Net Cash Flow Amount

The company’s net cash flow amount was ₹-4,768.52 Crore in March 2023, which increased to ₹283.23 Crore in March 2024.

Revenue Amount

The total revenue amount of the company was ₹8,245.23 Crore in March 2023 which increased to ₹8,801.42 Crore in March 2024. The Net Revenue amount from operation was ₹5,163.78 Crore in March 2023 which increased to ₹6,902.65 Crore in March 2024.

Total Expenses

The total expenses amount of the company was ₹7,708.39 Crore in March 2023 which decreased to ₹6,301.23 Crore in March 2024.

Peers Company Of Adani Ports Limited

| Company Name | Market Cap (Crore) |

| JSW Infrastructure Limited | ₹68,989.52 |

| Gujarat Pipavav Port Limited | ₹10,925.39 |

| RITES | ₹17,095.23 |

| GMR Airports | ₹104,0123.45 |

Dividend History Of Adani Ports Limited

| Year | Dividend Medium | Dividend Amount Per Share |

| 2024 | Final | ₹6.0000 (300%) |

| 2023 | Final | ₹5.0000 (250%) |

| 2022 | Final | ₹5.0000 (250%) |

| 2021 | Final | ₹5.0000 (250%) |

| 2020 | Interim | ₹3.2000 (160%) |

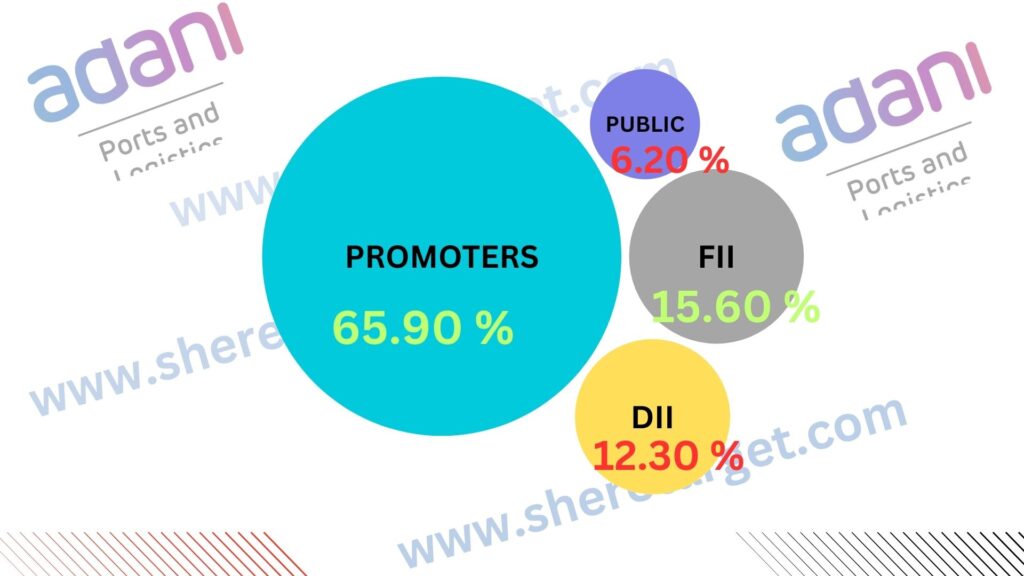

Discussion About Share Holding Pattern Of Indian Oil Limited

Indian Oil Limited mainly has four types of shareholding patterns: promoter holding, public holding, DII, and FII. Depending on the shareholding pattern, we can majorly influence the company’s growth.

| Investor Type | Percentage |

| Promoter Holding (Owned by the company’s promoter) | 65.90% |

| Public Holding (Held by the public) | 6.20% |

| FII (Invest by Foreign Institutional Investor) | 15.60% |

| DII (Invest money by Domestic Institutional Investor) | 12.30% |

The Last Few Year’s Share Price Updation Of Adani Ports Share

Adani Ports Share always gives good returns to investors which is described in the below portion.

- The last 6 month’s share growth was +161.90 (12.78%).

- The last 1 month’s share growth was -67.95 (-4.545).

- The last 1 year’s share growth was +598.75 (72.03%).

- The last 5 year’s share growth was +1,049.30 (275.62%).

- The maximum share growth was +1,244.20 (669.64%).

- Adani Ports Share Price return percentage was -1.28% in the last 3 months.

- The last 1 year’s share price return percentage was 72.63%.

- The last 3 years’ share price return percentage was 86.52%.

- The last 5 years’ share price return percentages were 289.42%.

Adani Ports Share always gives good returns to investors if anyone wants to invest in the share it will be profitable on a long-term basis.

What Is The Expert Advise About The Investment In Adani Ports Share

Advantages

- The last 3 years revenue growth of the company was 15.89%.

- The company has a high promoter holding capacity is 65.90%.

- The company has good cash flow management, PAT stands at 2.98.

- The company maintains an effective average operating margin of 52.67% in the last 5 years.

- The company’s cash conversion cycle is very good which is 71.98 days.

- The company’s PEG ratio is good which is 0.32.

- The company’s average operating leverage stands at 4.65.

- The last 6 month’s share growth was +161.90 (12.78%), and the last 1 year’s share price return percentage was 72.63%.

- The company’s average operating leverage stands at 4.65.

Disadvantages

- The profit growth of the company is very poor which is -3.42%.

- The company’s PE Ratio is very high which is 149.87.

- The ROE ratio is very poor which is 1.69%.

- The company has a high EBITDA which is 54.28.

Risk Factors Of Adani Ports Share

Negative Sides

- Any allegations of Environmental violation against the company may affect the company’s growth.

- The functions of the international price of coal may affect the company’s growth.

- Many times the company facing delays in security clearance for the government in the port may affect the company’s growth.

- The company has a limited presence throughout the country which may affect the company’s growth.

- There are many competitor companies in the presence market.

- Adani Ports’ share is related to trade wars, a shift in international trade war may affect the company’s growth.

Also Read – HAL Share Price Target

FAQ

What is Adani Ports Share Price Target for 2025?

Adani Ports Share Price Target for 2025 is ₹1,067.98 to ₹1,398.48.

What is Adani Ports Share Price Target for 2027?

Adani Ports Share Price Target for 2027 is ₹1,705.06 to ₹2,079.66.

What is Adani Ports Share Price Target for 2028?

Adani Ports Share Price Target for 2028 is ₹2,101.60 to ₹2,523.56.

What is Adani Ports Share Price Target for 2030?

Adani Ports Share Price Target for 2030 is ₹2,908.80 to ₹3,289.54.

What is Adani Ports Share Price Target for 2040?

Adani Ports Share Price Target for 2040 is ₹7,099.54 to ₹7,451.54.

Who is the CEO of Adani Ports Limited?

Mr. Ashwani Gupta is the CEO of Adani Ports Limited.

Conclusion

This website is written to help the investor gain some basic knowledge about the market strategy of Adani Ports Share. For making this blog we take consultation from expertise and doing research about the company. It is expected that Adani Ports Share Price Target will be a good choice to invest in on a long-term basis. The demand for the port & terminal operators sector in India and outside of the country always increases as a result of the company and the share may increase rapidly.

We try to give an in-depth idea about the share. If you think it is helpful to you you can share it. If you have any questions please let us know through the comment box we will try to reply to your questions and solve your problem. Thanks for visiting this website and thanks for being with us.

Disclaimer – We are not SEBI-registered advisors. A financial market is always risky to anyone. This website is only for training and educational purposes. So before investing, we are requested to discuss certified expertise. We will not be responsible for anyone’s profit or loss.