Ambuja Cement Share is a bullish trend in the share market. During share ups and downs, you should know all about share details before investing. In this blog, we are going to discuss Ambuja Cement Share Price Target 2025, 2027, 2028, 2030, and 2040. We will try to analyze the share base in the company’s overall performance.

We also look after the company’s profit growth in the last 5 years, the last 5 year’s sales growth, and the last 5 years’ ROE percentage similarly we also compare the Share growth, the share price return amount of the share become increasing or decreased through the last 5 year’s. We also take advice from experts about which time we should invest in the share it may be helpful for you also. Let’s have a look at Ambuja Cement Share Price Target from 2025 to 2040.

Overview About Ambuja Cement Limited

Ambuja Cement Limited was established in the year 1983. The headquarters of the company are situated in Mumbai, Maharashtra. The company is a major Indian cement-producing company known as Gujarat Ambuja Cement Limited. The group markets cement and clinker for both domestic and export markets.

Fundamental Analysis Of Ambuja Cement Limited

| Company Name | Ambuja Cement Limited |

| Market Cap | ₹1,37,326.98 Crore |

| Book Value | ₹186.95 |

| Face Value | ₹2 |

| 52 Week High | ₹707.01 |

| 52 Week Low | ₹452.90 |

| P/B | 2.90 |

| DIV. YIELD | 0.35% |

| PE | 36.29 |

| ROE | 8.10% |

| ROA | 5.84% |

| Current Ratio | 2.33 |

Dividend History Of Ambuja Cement Limited

| Year | Dividend Medium | Dividend Amount Per Share |

| 2024 | Final | ₹2.0000 (100%) |

| 2023 | Final | ₹2.5000 (125%) |

| 2022 | Final | ₹6.3000 (315%) |

| 2021 | Final | ₹1.000 (50%) |

| 2020 | Interim | ₹1.5000 (75%) |

Also Read – BHEL Share Price Target

Ambuja Cement Share Price Target 2025

Ambuja Cement Share Price Target forecast for 2025 may vary from ₹541.09 to ₹612.38.

Ambuja Cement Limited launched Ambuja Plus Cement in the year 2014. Ambuja Cement has reported a 26% year-on-year increase in stand-alone net profit. The company has a total of 18 integrated cement plants in India. The Profit Before tax of the company was ₹3,730 Crore in the year 2022-23, which increased to ₹5,902 Crore in the year 2023-24.

| Month | Ambuja Cement Share Price Target 2025 (1st Price Target) | Ambuja Cement Share Price Target 2025 (2nd Price Target) |

| May | ₹541.09 | ₹553.67 |

| June | ₹552.92 | ₹561.59 |

| July | ₹560.91 | ₹572.20 |

| August | ₹570.69 | ₹582.06 |

| September | ₹579.66 | ₹586.18 |

| October | ₹582.37 | ₹593.64 |

| November | ₹590.52 | ₹605.37 |

| December | ₹604.99 | ₹612.38 |

Ambuja Cement Share Price Target 2027

Ambuja Cement Share Price Target forecast for 2027 may vary from ₹614.09 to ₹716.38.

Ambuja Cement Limited has a total of 19 Grinding and blending units, 6 bulk terminals, 10 captive ships, 86 ready mix plants, and a total of channel partners is 1,00,000. The company has ambitious plans to increase cement capacity to 140 MTPA by the year 2028. The company also has capacity addition through the organic route to 2.25 MTPA. The company’s ongoing cement capacity expansion is 20 MTPA across the nation.

| Month | Ambuja Cement Share Price Target 2027 (1st Price Target) | Ambuja Cement Share Price Target 2027 (2nd Price Target) |

| January | ₹614.09 | ₹623.69 |

| February | ₹622.62 | ₹631.82 |

| March | ₹630.28 | ₹640.37 |

| April | ₹638.15 | ₹646.09 |

| May | ₹644.39 | ₹656.93 |

| June | ₹654.27 | ₹663.12 |

| July | ₹660.38 | ₹672.12 |

| August | ₹670.99 | ₹679.63 |

| September | ₹677.16 | ₹683.75 |

| October | ₹680.48 | ₹691.02 |

| November | ₹690.37 | ₹705.67 |

| December | ₹703.66 | ₹716.38 |

Ambuja Cement Share Price Target 2028

Ambuja Cement Share Price Target forecast for 2028 may vary from ₹720.38 to ₹810.03.

Ambuja Cement Limited is an established cement brand in India. The company has a manufacturing capacity of 29.67 million tonnes. Ambuja Cement is the first to introduce 53-grade cement in the market. Ambuja Cement Limited set up a greenfield integrated plant in Rajasthan with a clinker capacity of 3.0 MTPA and a cement grinding capacity of 1.8 MTPA. Ambuja is the first cement company to receive the ISO 9002 quality certificate.

| Month | Ambuja Cement Share Price Target 2028 (1st Price Target) | Ambuja Cement Share Price Target 2028 (2nd Price Target) |

| January | ₹720.38 | ₹729.64 |

| February | ₹728.69 | ₹736.37 |

| March | ₹734.16 | ₹745.38 |

| April | ₹743.93 | ₹755.69 |

| May | ₹754.10 | ₹765.33 |

| June | ₹764.13 | ₹775.67 |

| July | ₹774.46 | ₹787.95 |

| August | ₹786.39 | ₹789.70 |

| September | ₹780.23 | ₹790.31 |

| October | ₹779.30 | ₹786.93 |

| November | ₹784.38 | ₹795.60 |

| December | ₹798.26 | ₹810.03 |

Ambuja Cement Share Price Target 2030

Ambuja Cement Share Price Target forecast for 2030 may vary from ₹930.26 to ₹1,025.39.

The products under the company are Ambuja Kawach, Ambuja Cool Walls, Ambuja Compocem, Ambuja Buildcem, Ambuja Railcem, etc. In the financial year 2023-24, the company’s investment amount is ₹10,000 Crore to increase the company’s green power share to 60% of the 140 MTPA planned capacity.

| Year | Ambuja Cement Share Price Target 2030 |

| 1st Price Target | ₹930.26 |

| 2nd Price Target | ₹1,025.39 |

Ambuja Cement Share Price Target 2040

Ambuja Cement Share Price Target forecast for 2040 may vary from ₹1,575.26 to ₹1,725.38.

The company’s product, Ambuja Plus, is a specially formulated cement to make concrete stronger and denser. Ambuja Compocem is a whiter and brighter cement with superfine quality. Ambuja Cool Walls are eco-friendly bricks that keep homes cooler. Another one is Ambuja PuraSand which is slit free high-quality product. The company’s Book Value per share was ₹195 Crore in the year 2022-23, which increased to ₹232 Crore in the year 2023-24.

| Year | Ambuja Cement Share Price Target 2040 |

| 1st Price Target | ₹1,575.26 |

| 2nd Price Target | ₹1,725.38 |

Also Read – Voltas Share Price Target

The Last Few Years’ Share Price Prediction Of Ambuja Cement Share

For the last few years, Ambuja Cement Share increased rapidly. The last 6 month’s share growth was -13.10 (-2.10%), the last 1 month’s share growth was -20.15 (-3.20%), the last 1 year’s share growth was +179.80 (41.79%), the last 5 year’s share growth was +420.80 (222.41%) and the maximum share growth was +592.69 (3,423.97%).

Ambuja Cement Share Price return percentage was -11.29 % in the last 3 months, the last 1 year’s share price return percentage was 39.19%, the last 3 years’ share price return percentage was 50.46%, and the last 5 years’ share price return percentage was 226.75%. Ambuja Cement Share gives a good return to investors. If anyone wants to invest in the share it will be profitable on a long-term basis.

The Last Few Year’s Performance Of Ambuja Cement Limited

Profit Growth

The last 5 years’ profit growth percentage of the company is described in the portion below.

- In the last 5 years, 9.49%

- In the last 3 years, 9.30%

- In the last 1 year, -8.58%

The company’s Net Profit was ₹2554.25 Crore in March 2023, decreasing to ₹2,335.96 Crore in March 2024. The Operating Profit was ₹3,225.23 Crore in March 2023, increasing to ₹3,380.56 Crore in March 2024.

Sales Growth

The last 5 years’ Sales growth percentage of the company is described in the portion below.

- In the last 5 years, 9.57%

- In the last 3 years, 16.38%

- In the last 1 year, -10.69%

The Net Sales Amount of the company was ₹4,730.01 Crore in June 2023, which decreased to ₹4,516.25 Crore in June 2024.

ROE Percentage

The last 5 years’ ROE percentage of the company is described in the below portion.

- In the last 5 years, 8.92%

- In the last 3 years, 9.75%

- In the last 1 year, 8.10%

ROCE Percentage

The company’s last 5 years’ ROCE percentage is described in the below portion.

- In the last 5 years, 11.43%

- In the last 3 years, 12%

- In the last 1 year, 9.99%

Total Expenditure Amount

The Total Expenditure of the company was ₹16,765.23 Crore in March 2023, which decreased to ₹14,549.63 Crore in March 2024.

Total Assets Amount

The Total Assets amount was ₹35,905.23 Crore in March 2023, which increased to ₹44,129.63 Crore in March 2024.

The Net Cash Flow Amount

The Net Cash Flow amount of the company was -3,708.23 Crore in March 2023, which increased to ₹848.25 Crore in March 2024.

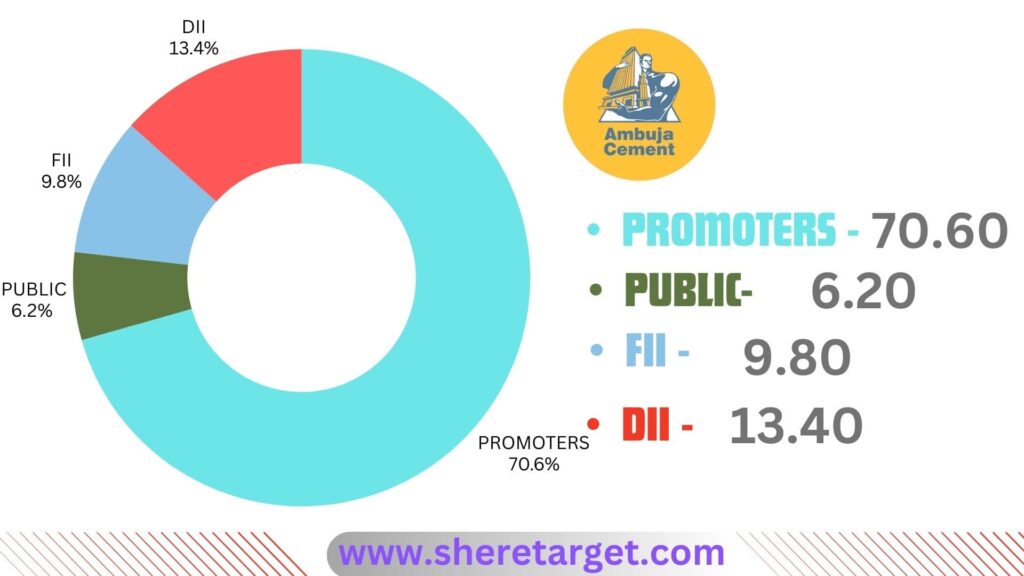

Discussion About Shareholding Pattern Of Ambuja Cement Limited

Ambuja Cement Limited mainly has four types of shareholding patterns: promoter holding, public holding, DII, and FII. We can majorly influence the company’s growth depending on the shareholding pattern.

Promoter Holding

Promoter Holding capacity is the percentage of the share owned by the company’s promoter or the company’s owner. The Promoter Holding Capacity in the company’s share is 70.60%.

Public Holding

Public Holding capacity is the indicator of the percentage that is held by the public rather than the promoters. The public holding capacity of the company’s share is 6.20%.

FII

The full form of FII is Foreign Institutional Investor which invests funds from outside of its home country. The FII investor percentage in the company’s share is 9.80%.

DII

The full form of DII is Domestic Institutional Investor, which means some Indian institutions like mutual funds, insurance companies, and pension funds invest money in the country’s assets. The DII investor percentage in the company’s share is 13.40%.

Peer’s Company Of Ambuja Cement Limited

| Company Name | MarketCap (Crore) |

| UltraTech Cement Limited | ₹28,754.07 |

| Shree Cement Limited | ₹92,232.06 |

| ACC Limited | ₹44,776.99 |

| Dalmia Bharat Limited | ₹35,349.05 |

Why Should I Invest in Ambuja Cement Share Right Now?

Positive Sides

- The last 3 years’ revenue growth of the company was 16.39%.

- The company is virtually debt-free and has a healthy interest-cover ratio which is 20.16.

- The cash flow managment of the company is good, PAT stands at 1.20.

- The Promotor Holding Capacity of the company is good, which is 70.60%.

- The cash conversion cycle of the company is good, which is -92.20 days.

- The company has a healthy liquidity position with a current ratio of 2.32.

- The Sales growth of the company is very good, which is 16.38% in the last 3 years.

Negative Sides

- The company’s profit growth is poor, at 9.30% in the last 3 years.

- The company has a high PE ratio, which is 66.58.

- The EBITDA amount of the company is high, which is 34.10.

What Is The Future Growth Of Ambuja Cement Limited

Strengths

- Ambuja Cement Limited is the first cement producer in the country to embrace the modern approach of an integrated logistics system.

- The company has a well-developed system of inbound raw materials.

- The company has a large distribution network of around 11,500 outlets, which is very good for the company’s growth.

- The company is the first cement industry in India to use a water transport system for domestic as well as export purposes.

Weakness

- The company has only a few numbers of ports to load and transport.

- There are many other competitor companies it is difficult to maintain the same profit growth of the company.

Also Read – Cochin Shipyard Share Price Target

FAQ

What Is the Ambuja Cement Share Price Target for 2025?

Ambuja Cement Share Price Target for 2025 is ₹541.09 to ₹612.38.

What Is the Ambuja Cement Share Price Target for 2027?

Ambuja Cement Share Price Target for 2027 is ₹614.09 to ₹716.38.

What Is the Ambuja Cement Share Price Target for 2028?

Ambuja Cement Share Price Target for 2028 is ₹720.38 to ₹810.03.

What Is the Ambuja Cement Share Price Target for 2030?

Ambuja Cement Share Price Target for 2030 is ₹930.26 to ₹1,025.39.

What Is the Ambuja Cement Share Price Target for 2040?

Ambuja Cement Share Price Target for 2040 is ₹1,575.26 to ₹1,725.38.

Conclusion

This website is written to help the investor gain some basic knowledge about the market strategy of Ambuja Cement Share. For making this blog, we take consultation from experts and do research about the company. It is expected that the Ambuja Cement Share Price Target will be a good choice to invest in on a long-term basis. The demand for the Cement manufacturing sector in India and outside of the country always increases as a result of the company, and the share may increase rapidly.

We try to give an in-depth idea about the share. If you think it is helpful to you can share it. If you have any questions, please let us know through the comment box. We will try to reply to your questions and solve your problem. Thanks for visiting this website and thanks for being with us.

Disclaimer – We are not SEBI-registered advisors. A financial market is always risky to anyone. This website is only for training and educational purposes. Before investing, we are requested to discuss certified expertise. We will not be responsible for anyone’s profit or loss.