BHEL Share is a bullish trend in the share market. During share ups and downs, you should know all about share details before investing. In this blog, we are going to discuss BHEL Share Price Target 2025, 2027, 2028, 2030, 2040. We will try to analyze the share base in the company’s overall performance.

We also look after the company’s profit growth in the last 5 years, the last 5 year’s sales growth, and the last 5 years’ ROE percentage similarly we also compare the share growth, the share price return amount of the share become increasing or decreased through the last 5 year’s. We also take advice from experts about which time we should invest in the share it may be helpful for you also. Let’s have a look at BHEL Share Price Target from 2025 to 2040.

What Is Bharat Heavy Electricals Limited (BHEL) Company?

Bharat Heavy Electricals Limited (BHEL) was established in the year 1956. The company is owned by the Government of India, with administrative control by the Ministry Of Heavy Industries. The company is the largest government-owned industrial technology company, the main products of the company are Boilers, Electric Motors, Generators, Electric Locomotives, Heat Exchangers, Industrial Valves, etc.

Overview About BHEL

| Company Name | Bharat Heavy Electricals Limited |

| Market Cap | ₹92,940.12 Crore |

| P/B | 3.70 |

| 52 Week High | ₹340.96 |

| 52 Week Low | ₹176 |

| DIV. YIELD | 0.20% |

| Book Value | ₹72.26 |

| Face Value | ₹2 |

| ROE | 1.06% |

| ROA | 0.50% |

| Current Ratio | 1.37 |

Dividend History Of BHEL

| Year | Dividend Medium | Dividend Amount Per Share |

| 2024 | Final | ₹0.2500 (12.5%) |

| 2023 | Final | ₹0.4000 (20%) |

| 2022 | Final | ₹0.4000 (20%) |

| 2019 | Final | ₹1.2000 (60%) |

| 2018 | Final | ₹1.0200 (51%) |

History Of BHEL Share Price Target From The Year 2025 to 2040

| Year | 1st Price Target | 2nd Price Target |

| BHEL Share Price Target 2025 | ₹296.14 | ₹410.95 |

| BHEL Share Price Target 2027 | ₹522.47 | ₹639.47 |

| BHEL Share Price Target 2028 | ₹637.12 | ₹756.20 |

| BHEL Share Price Target 2030 | ₹826.41 | ₹962.58 |

| BHEL Share Price Target 2040 | ₹2,401.59 | ₹2,558.01 |

BHEL Share Price Target 2025

BHEL Share Price Target 2025 forecast may vary from ₹217.25 to ₹325.27.

BHEL-manufactured equipment constitutes 55% of thermal power generation capacity. 47% of nuclear power generation capacity and 45% of hydropower generation capacity in the country. Footprints in 86 countries. The company has 11 GW of power generation capacity built outside India. The company has 410 compressors and 90 oil drilling rigs, and it has 760 locomotives supplied to Indian Railways and Industries.

| Month | BHEL Share Price Target 2025 (1st Price Target) | BHEL Share Price Target 2025 (2nd Price Target) |

| May | ₹217.25 | ₹266.39 |

| June | ₹264.68 | ₹275.27 |

| July | ₹274.82 | ₹285.93 |

| August | ₹281.03 | ₹296.38 |

| September | ₹294.67 | ₹310.99 |

| October | ₹308.26 | ₹318.64 |

| November | ₹311.75 | ₹322.35 |

| December | ₹319.66 | ₹325.27 |

BHEL Share Price Target 2027

BHEL Share Price Target 2027 forecast may vary from ₹330.29 to ₹442.68.

BHEL is the only company in India that has design and engineering capabilities in TG sets for nuclear applications. In the year 2021-22, the company invested ₹700 Crore in R&D sectors for more development of the company. Steam turbines, generators, boilers, and matching auxiliaries for fossil-fuel applications up to 1000 MW unit size. Over 65% of the power generated in India comes from BHEL-supplied equipment. Overall, it has installed power equipment for over 90,000 MW.

| Month | BHEL Share Price Target 2027 (1st Price Target) | BHEL Share Price Target 2027 (2nd Price Target) |

| January | ₹330.29 | ₹342.53 |

| February | ₹339.05. | ₹348.09 |

| March | ₹345.12 | ₹356.32 |

| April | ₹355.80 | ₹368.64 |

| May | ₹365.92 | ₹378.09 |

| June | ₹376.89 | ₹387.37 |

| July | ₹395.18 | ₹410.23 |

| August | ₹408.90 | ₹422.39 |

| September | ₹420.18 | ₹432.61 |

| October | ₹429.08 | ₹440.19 |

| November | ₹438.72 | ₹449.61 |

| December | ₹432.30 | ₹442.68 |

BHEL Share Price Target 2028

BHEL Share Price Target 2028 forecast may vary from ₹445.90 to ₹545.29.

BHEL is India’s largest engineering and manufacturing enterprise in the energy and infrastructure sectors. The company has a pan-India presence, including a network of 16 manufacturing facilities, 2 repair units, 4 regional offices, 8 service centers, 15 regional marketing centers, 3 overseas offices, and 1 subsidiary. BHEL is the leader among Indian power plant equipment manufacturers and exceeds 193 GW. More than 1.2 GW total solar portfolio.

| Month | BHEL Share Price Target 2028 (1st Price Target) | BHEL Share Price Target 2028 (2nd Price Target) |

| January | ₹445.90 | ₹453.29 |

| February | ₹449.08 | ₹456.62 |

| March | ₹455.81 | ₹468.92 |

| April | ₹460.27 | ₹468.09 |

| May | ₹467.80 | ₹472.28 |

| June | ₹469.88 | ₹478.92 |

| July | ₹476.09 | ₹489.27 |

| August | ₹487.65 | ₹498.32 |

| September | ₹495.26 | ₹512.09 |

| October | ₹510.35 | ₹527.36 |

| November | ₹526.08 | ₹536.11 |

| December | ₹530.19 | ₹545.29 |

Also Read – Cochin Shipyard Share Price Target

BHEL Share Price Target 2030

BHEL Share Price Target 2030 forecast may vary from ₹665.09 to ₹768.93.

BHEL manufactures 235 MW nuclear turbine generator sets, and in the future, it will be 500 MW. In the financial year 2021-22, the industry sector orders were worth ₹5,661 Crore, which was ₹4,284 Crores in the previous year. BHEL manufactured 1350 HP Diesel Electric Shunting Locomotives, and orders were received for 6000 HP Electric Locomotives from NTPC. BHEL has become a major contributor to India’s self-defence equipment production.

| Year | BHEL Share Price Target 2030 |

| 1st Price Target | ₹665.09 |

| 2nd Price Target | ₹768.93 |

BHEL Share Price Target 2040

BHEL Share Price Target 2040 forecast may vary from ₹1,868.23 to ₹1,996.06.

BHEL is one of the few firms worldwide with the capability to design and manufacture heat exchangers for military aircraft and supply Heat Exchangers for TEAS. The company’s revenue was ₹16,297 Crore in 2021-22, which increased to ₹20,154 Crore in 2021-22.

| Year | BHEL Share Price Target 2040 |

| 1st Price Target | ₹1,868.23 |

| 2nd Price Target | ₹1,996.06 |

Also Read – Bank Of Baroda Share Price Target

The Last Few Years’ Performance Of BHEL

Profit Growth

The company’s last 5 years’ profit growth percentage is described below.

- In the last 5 years, -26.48%

- In the last 3 years, -27.99%

- In the last 1 year, -58.40%

The Net Profit of the company was ₹624.52 Crore in the year 2023, which decreased to ₹260.12 Crore in the year 2024. The Operating Profit of the company was ₹-2,018.59 Crore in the year 2023, which became ₹-4,258.36 Crore in the year 2024.

ROE Percentage

The company’s last 5 years’ ROE percentage is described below.

- In the last 5 years, -1.94%

- In the last 3 years, 27.62%

- In the last 1 year, 1.06%

ROCE Percentage

The company’s last 5 years’ ROCE percentage is described below.

- In the last 5 years, 0.1%

- In the last 3 years, 3.44%

- In the last 1 year, 3.30%

Total Expenditure Amount

The Total Expenditure of the company was ₹5,182.53 Crore in June 2023, which increased to ₹5,662.58 Crore in March 2024.

Total Assets Amount

The Total Assets amount was ₹53,168.25 Crore in March 2023, which increased to ₹55,242.63 Crore in March 2024.

The Net Cash Flow Amount

The Net Cash Flow amount of the company was 824.12 Crore in March 2023, which increased to ₹274.36 Crore in March 2024.

Tax Amount

The Tax Amount of the company was ₹61.75 Crore in March 2023, which decreased to ₹-39.45 Crore in March 2024.

The Last Few Year’s Share Price Prediction Of BHEL Share

In the last 1 year, BHEL share has grown rapidly. The last 6 month’s share growth was +16.40 (6.49%), the last 1 month’s share growth was +4.75 (1.79%), the last 1 year’s share growth was +137.15 (103.55%), the last 5 year’s share growth was +215.25 (396.05%) and the maximum share growth was +251.90 (1,423.16%).

BHEL Share Price return percentage was 2.78% in the last 1 month, the last 3 months’ share price return percentage was -16.54 %, the last 1 year’s share price return percentage was 111.62%, the last 3 year’s share price return percentage was 265.5% and the last 5 year’s share price return percentage was 536.12%. BHEL Share gives a good return to investors. If anyone wants to invest in the share it will be profitable on a long-term basis.

Peer Company Of BHEL

| Company Name | Market Cap (Crore) |

| ABB India Limited | ₹1,85,823.46 |

| Suzlon Energy Limited | ₹1,02,578.23 |

| CG Power & Industrial Solutions Limited | ₹1,28,637.12 |

| Siemens Limited | ₹2,85,293.59 |

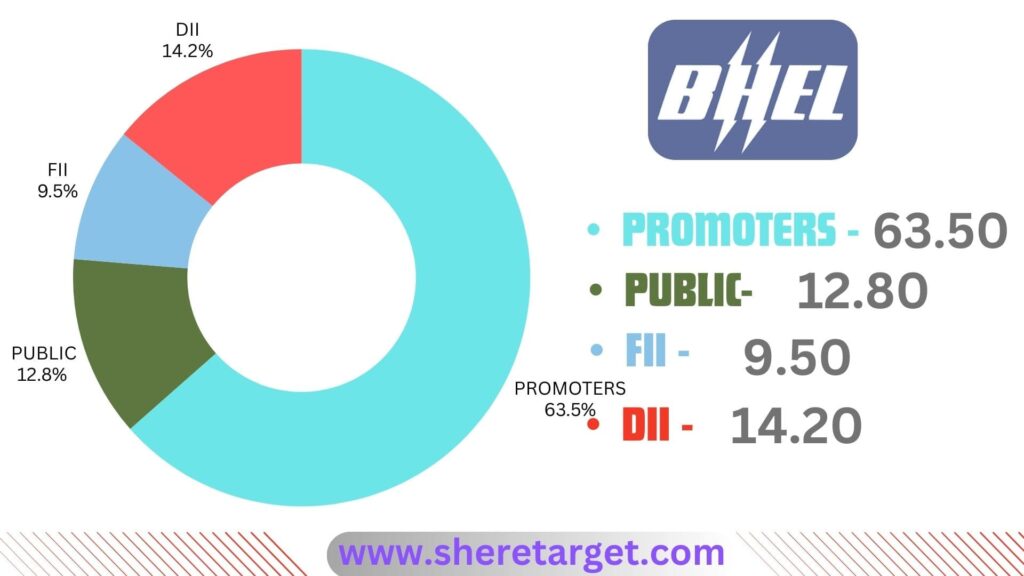

Discussion About Shareholding Pattern Of BHEL

BHEL mainly has four types of shareholding patterns ,such as promoter holding, public holding, DII, and FII. We can majorly influence the company’s growth depending on the shareholding pattern.

Promoter Holding

Promoter Holding capacity is the percentage of the share owned by the company’s promoter or the company’s owner. The Promoter Holding Capacity in the company’s share is 63.50%.

Public Holding

Public Holding capacity is the indicator of the percentage that is held by the public rather than the promoters. The public holding capacity of the company’s share is 12.80%.

FII

The full form of FII is Foreign Institutional Investor, which invests funds from outside of its home country. The FII investor percentage in the company’s share is 9.50%.

DII

The full form of DII is Domestic Institutional Investor, which means some Indian institutions like mutual funds, insurance companies, and pension funds invest money in the country’s assets. The DII investor percentage in the company’s share is 14.20%.

Why Should I Invest In BHEL Share Right Now?

Positive Sides

- BHEL has a good promoter holding capacity, which is 63.50%, which means many good investor wants to invest in the shares.

- The company has an efficient cash conversion cycle of -147.01 days.

Negative Sides

- The company has a trading high PE of -754.23.

- The ROCE percentage of the company is very poor, which is 3.44% in the last 3 years.

- The company is trading at a high EBITDA of 140.96.

- The company has a negative cash flow from operations, which is -3,713.52.

- In the last 5 years, the EBITDA margin of the company has been poor, which is -15.08%.

What Is The Future Growth Of BHEL

Advantages

- The company has a high operational speed.

- The company has a very high power-to-weight ratio.

- Low lubricant oil cost and consumption a good points for the company’s growth.

- The company spread its business throughout India and outside India.

Disadvantages

- The procurement process of the company is cumbersome and subject to auditing.

- Role clarity on whether the equipment being equipment supplier or a solution provider.

- Purchase preference may be extended to the distribution sector.

Also Read – Voltas Share Price Target

FAQ

What Is BHEL Share Price Target for 2025?

BHEL Share Price Target for 2025 is ₹217.25 to ₹325.27.

What Is BHEL Share Price Target for 2027?

BHEL Share Price Target for 2027 is ₹330.29 to ₹442.68.

What Is BHEL Share Price Target for 2028?

BHEL Share Price Target for 2028 is ₹445.90 to ₹545.29.

What Is BHEL Share Price Target for 2030?

BHEL Share Price Target for 2030 is ₹665.09 to ₹768.93.

What Is BHEL Share Price Target for 2040?

BHEL Share Price Target for 2040 is ₹1,868.23 to ₹1,996.06.

Is BHEL a government company?

Bharat Heavy Electricals Limited is the largest government-owned electrical company.

Who is the current CEO of BHEL?

Mr. Sadashiv Murthy Koppu is the CEO of BHEL.

Conclusion

This website is written to help the investor gain some basic knowledge about the market strategy of BHEL Share. For making this blog, we take consultation from experts and do research about the company. It is expected that the BHEL Share Price Target will be a good choice to invest in on a long-term basis. The demand for the electronics consumer sector in India and outside of the country always increases as a result of the company, and the share may increase rapidly.

We try to give an in-depth idea about the share. If you think it is helpful to you, you can share it. If you have any question,s please let us know through the comment box. We will try to reply to your questions and solve your problem. Thanks for visiting this website, and thanks for being with us.

Disclaimer – We are not SEBI-registered advisors. A financial market is always risky to anyone. This website is only for training and educational purposes. So, before investing, we are requested to discuss certified expertise. We will not be responsible for anyone’s profit or loss.