The Voltas Share is a bullish trend in the share market. During share ups and downs, you should know all about the share details before investing. In this blog, we are going to discuss Voltas Share Price Target 2025, 2027, 2028, 2030, 2040. We will try to analyze the share base in the company’s overall performance.

We also look at the company’s profit growth in the last 5 years, the last 5 years’ sales growth, and the last 5 years’ ROE percentage. Similarly, we also compare the Share growth, the share price return amount of the share has increased or decreased over the last 5 years. We also take advice from experts about which time we should invest in the share, which may also be helpful for you. Let’s have a look at Voltas Share Price Target from 2025 to 2040.

Overview About Voltas Limited

Voltas Limited was established in 1954, and its headquarters are in Mumbai. The company mainly designs, develops, and manufactures products, including air conditioners, air coolers, refrigerators, washing machines, microwaves, air purifiers, water dispensers, and more. The company is India’s largest air-conditioning company.

Fundamental Analysis Of Voltas Limited

| Company Name | Voltas Limited |

| Market Cap | ₹41,820.96 Crore |

| Book Value | ₹245.87 |

| Face Value | ₹1 |

| P/B | 5.39 |

| 52 Week High | ₹1,950.58 |

| 52 Week Low | ₹1135.55 |

| DIV. YIELD | 0.56% |

| PE | 54.39 |

| ROE | 8.50% |

| ROA | 5.62% |

| Current Ratio | 1.49 |

Dividend History Of Voltas Limited

| Year | Dividend Medium | Dividend Amount Per Share |

| 2024 | Final | ₹5.5000 (550%) |

| 2023 | Final | ₹4.2500 (425%) |

| 2022 | Final | ₹5.5000 (550%) |

| 2021 | Final | ₹5.000 (500%) |

| 2020 | Final | ₹4.0000 (400%) |

Voltas Share Price Target 2025

Voltas Share Price Target 2025 forecast may vary from ₹1,262.37 to ₹1,338.72.

In the year 1972, the company developed and deployed cooling solutions for the Rajdhani Express. In the year 2018, the company established Voltas Beko, which launched India’s first Window AC with an inverter technology. In the year 2020, the company launched a wide range of innovative UV products. In the year 2022, the company introduced India’s first AC with a HEPA Filter with a unique value proposition of pure & flexible air conditioning.

| Month | Voltas Share Price Target 2025 (1st Price Target) | Voltas Share Price Target 2025 (2nd Price Target) |

| May | ₹1,262.37 | ₹1,266.29 |

| June | ₹1,263.08 | ₹1,272.82 |

| July | ₹1,269.26 | ₹1,283.98 |

| August | ₹1,279.50 | ₹1,301.03 |

| September | ₹1,296.37 | ₹1,315.63 |

| October | ₹1,313.92 | ₹1,324.19 |

| November | ₹1,320.65 | ₹1,329.44 |

| December | ₹1,327.05 | ₹1,338.72 |

Also Read – Cochin Shipyard Share Price Target

Voltas Share Price Target 2027

Voltas Share Price Target 2027 forecast may vary from ₹1,340.77 to ₹1,458.01.

In the year 2024, the company launched its smart air inverter AC series, packed with smart features. In the years 2023-24, the company’s touchpoints amounted was 30,000. In the same year, the company invests around ₹450-500 Crores in the new manufacturing facility in Chennai. In the Chennai plant services, the company has a manufacturing capacity from 0.75 tons to 2.0 tons with a 1 to 5-star rating.

| Month | Voltas Share Price Target 2027 (1st Price Target) | Voltas Share Price Target 2027 (1st Price Target) |

| January | ₹1,340.77 | ₹1,352.03 |

| February | ₹1,350.25 | ₹1,369.33 |

| March | ₹1,495.62 | ₹1,315.15 |

| April | ₹1,312.06 | ₹1,328.62 |

| May | ₹1,326.64 | ₹1,342.25 |

| June | ₹1,340.53 | ₹1,368.62 |

| July | ₹1,365.03 | ₹1,389.19 |

| August | ₹1,387.90 | ₹1,398.31 |

| September | ₹1,396.60 | ₹1,420.39 |

| October | ₹1,419.73 | ₹1,432.90 |

| November | ₹1,430.44 | ₹1,446.06 |

| December | ₹1,444.88 | ₹1,458.01 |

Voltas Share Price Target 2028

Voltas Share Price Target 2028 forecast may vary from ₹1,450.36 to ₹1,594.32.

Voltas Limited is recognized as India’s premier air conditioning and engineering solutions provider. In the year 1956, Voltas Limited made history by installing eight crystal air conditioners. In the year 1960, the company installed India’s first all-season climatiser at the Ashoka Hotel in New Delhi. In the year 1964, the company inaugurated India’s first integrated RAC manufacturing plant in Thane. In the year 2011, the company developed and launched the all-weather AC range.

| Month | Voltas Share Price Target 2028 (1st Price Target) | Voltas Share Price Target 2028 (1st Price Target) |

| January | ₹1,450.36 | ₹1,465.98 |

| February | ₹1,462.80 | ₹1,478.65 |

| March | ₹1,472.03 | ₹1,485.22 |

| April | ₹1,483.69 | ₹1,499.30 |

| May | ₹1,497.44 | ₹1,516.72 |

| June | ₹1,512.27 | ₹1,527.16 |

| July | ₹1,525.06 | ₹1,542.39 |

| August | ₹1,540.88 | ₹1,556.12 |

| September | ₹1,550.68 | ₹1,568.37 |

| October | ₹1,565.33 | ₹1,578.39 |

| November | ₹1,575.03 | ₹1,588.93 |

| December | ₹1,587.67 | ₹1,594.32 |

Voltas Share Price Target 2030

Voltas Share Price Target 2030 forecast may vary from ₹1,925.30 to ₹2,258.06.

To cater to specific market demands, Voltbek imports premium products like high-capacity fully automatic front-load washing machines, microwave ovens, and dishwashers. In commercial air conditioners, the new inverter scroll chillers have a cooling capacity ranging from 12 TR to 72 TR. The company is also expanding its Visi Cooler line-up with the additions of 4 new models- Minibar 50 ltrs, a large single door in 550 ltrs, and two large double door models in 750 & 1000 ltrs.

| Year | Voltas Share Price Target 2030 |

| 1st Price Target | ₹1,925.30 |

| 2nd Price Target | ₹2,258.06 |

Voltas Share Price Target 2040

Voltas Share Price Target 2040 forecast may vary from ₹5,285.36 to ₹5,527.25.

Voltas Limited experienced robust sales of air conditioners. In the financial year 2023-24, the company sold over 2 million AC units. The Air Cooler segment of the company has emerged as an extension of Volta’s product line. The company launched high-capacity tall coolers in 85 Lts and 110 Lts. Voltas has launched a smart, safe, and sturdy water heater range. Voltas Beko solidified its position among the semi-automatic washing machines in 2023-24.

| Year | Voltas Share Price Target 2040 |

| 1st Price Target | ₹5,285.36 |

| 2nd Price Target | ₹5,527.25 |

The Last Few Years’ Performance Of Voltas Limited

Profit Growth

The last 5 years’ profit growth percentage of the company is described in the portion below.

- In the last 5 years, 5.6%

- In the last 3 years, 1.98%

- In the last 1 year, 58%

The company’s Net Profit was ₹1,406.25 Crore in March 2023, decreasing to ₹604.98 Crore in March 2024. The operating profit was ₹427.23 Crore in March 2023, increasing to ₹519.36 Crore in March 2024.

Sales Growth

The last 5 years’ Sales growth percentage of the company is described in the portion below.

- In the last 5 years, 5.38%

- In the last 3 years, 10.95%

- In the last 1 year, 13.29%

The Net Sales amount of the company was ₹2,701.26 Crore in June 2023, which increased to ₹3,921.65 Crore in June 2024.

ROE Percentage

The last 5 years’ ROE percentage of the company is described in the portion below.

- In the last 5 years, 13.94%

- In the last 3 years, 14.25%

- In the last 1 year, 8.59%

ROCE Percentage

The last 5 years’ ROCE percentage of the company is described in the portion below.

- In the last 5 years, 17.35%

- In the last 3 years, 16.85%

- In the last 1 year, 10.56%

Total Expenditure Amount

The Total Expenditure of the company was ₹2,535.96 Crore in June 2023, which increased to ₹3,629.85 Crore in March 2024.

Total Assets Amount

The Total Assets amount was ₹10,043.25 Crore in March 202,3, which increased to ₹11,801.56 Crore in March 2024.

The Net Cash Flow Amount

The Net Cash Flow amount of the company was -78.30 Crore in March 2023, which increased to ₹119.23 Crore in March 2024.

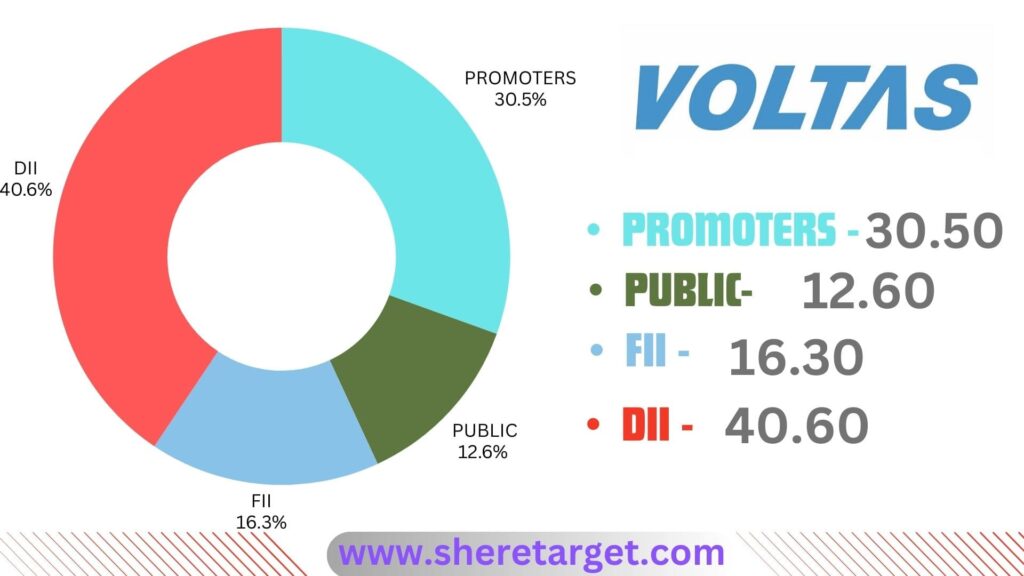

Discussion About Shareholding Pattern Of Voltas Limited

Voltas Limited mainly has four types of shareholding patterns ,such as promoter holding, public holding, DII, and FII. We can majorly influence the company’s growth depending on the shareholding pattern.

Promoter Holding

Promoter Holding capacity is the percentage of the share owned by the company’s promoter or the company’s owner. The Promoter Holding Capacity in the company’s share is 30.50%.

Public Holding

Public Holding capacity is the indicator of the percentage that is held by the public rather than the promoters. The public holding capacity of the company’s share is 12.60%.

FII

The full form of FII is Foreign Institutional Investor, which invests funds from outside of its home country. The FII investor percentage in the company’s shares is 16.30%.

DII

The full form of DII is Domestic Institutional Investor, which means some Indian institutions like mutual funds, insurance companies, and pension funds invest money in the country’s assets. The DII investor percentage in the company’s share is 40.60%.

Peer’s Company Of Voltas Limited

| Company Name | Market Cap (Crore) |

| Havells India Limited | ₹1,22,510.71 |

| Blue Star Limited | ₹41,546.49 |

| Dixon Technologies Limited | ₹90,629.82 |

| Kaynes Technology India Limited | ₹35,716.78 |

Also Read – Bank Of Baroda Share Price Target

Why Should I Invest In Voltas Share Right Now?

Positive Sides

- The company has a very small amount of debt the interest cover ratio of the company is high, which is 37.35.

- The company has an efficient cash conversion cycle of 8.65 days.

- The FII investor percentage of the company is high, which is 16.30%.

Negative Sides

- The last 3 years’ profit growth of the company is not so high, which is 1.98%.

- The last 3 years’ revenue growth of the company is poor, which is 10.86%.

- The PE ratio of the company is high, which is 81.29.

- The EBITDA of the company is high, which is 60.25.

- The last 3 years’ sales growth of the company is not so high, which is 10.95%.

What Is The Future Growth Of Voltas Limited

Strengths

- Voltas Limited is India’s largest air conditioning company.

- Leaders in terms of market share in the cooling products segment.

- Creative R&D and marketing in the cooling solutions business.

- The demand for ACs is increasing rapidly in Tier 2,3 cities.

Weakness

- Due to the increased price of inputs and continued price erosion, there is a downtrend in the consumer durables market.

- There are many competitor companies in the domestic market, so the competition is always high.

- The sluggish economy and high fluctuation in the exchange rate.

- Dependence on copper for electromechanical projects keeps the profit margin lower.

- The company is unable to target green-conscious customers.

FAQ

What Is the Voltas Share Price Target for 2025?

Voltas Share Price Target for 2025 is ₹1,262.37 to ₹1,338.72.

What Is Voltas Share Price Target for 2027?

Voltas Share Price Target for 2027 is ₹1,340.77 to ₹1,458.01.

What Is Voltas Share Price Target for 2028?

Voltas Share Price Target for 2028 is ₹1,450.36 to ₹1,594.32.

What Is Voltas Share Price Target for 2030?

Voltas Share Price Target for 2030 is ₹1,925.30 to ₹2,258.06.

What Is Voltas Share Price Target for 2040?

Voltas Share Price Target for 2040 is ₹5,285.36 to ₹5,527.25.

Who is the owner of Voltas Limited?

Voltas Limited was established through a partnership between Tata Sons and Volkart Brothers.

Conclusion

This website is written to help the investor gain some basic knowledge about the market strategy of Voltas Share. For making this blog, we take consultation from experts and do research about the company. It is expected that the Voltas Share Price Target will be a good choice to invest in on a long-term basis. The demand for the electronics consumer sector in India and outside of the country always increases as a result of the company, and the share may increase rapidly.

We try to give an in-depth idea about the share. If you think it is helpful to you, you can share it. If you have any questions, please let us know through the comment box. We will try to reply to your questions and solve your problem. Thanks for visiting this website, and thanks for being with us.

Disclaimer – We are not SEBI-registered advisors. A financial market is always risky to anyone. This website is only for training and educational purposes. So, before investing, we are requested to discuss certified expertise. We will not be responsible for anyone’s profit or loss.