Amara Raja Share is a bullish trend in the share market. In the time of share ups and downs, you should know all about share details before investing. In is blog we are going to discuss Amara Raja Share Price Target 2025, 2027, 2028, 2030, 2040. We try to analysis about the share base in the company’s overall performance.

We also look after the company’s profit growth in the last 5 years, the last 5 year’s sales growth, and the last 5 years’ ROE percentage similarly we also compare the share growth, the share price return amount if the share becomes increasing or decreased through the last 5 year’s. We also take advice from experts about which time we should invest in the share it may be helpful for you also. Let’s have a look at Amara Raja Share Price Target from 2025 to 2040.

Overview Of Amara Raja Energy & Mobility Limited

- Amara Raja Energy & Mobility is India’s largest automotive batteries and allied products manufacturer.

- The company offers a wide range of batteries for Telecom, Railways, Motive, Defence, etc.

- The company also exported its products to more than 50 countries worldwide.

- The company is the pioneer in manufacturing Value Regulated Lead Acid (VRLA) batteries in India.

- The company also offers Li-ion cells, battery packs, and charging solutions for Light Electric Vehicles and the telecom industry.

Fundamental Analysis Of Amara Raja Limited

| Company Name | Amara Raja Energy & Mobility Limited |

| Market Cap | ₹22,552.49 Crore |

| Book Value | ₹395.41 |

| Face Value | ₹1 |

| 52 Week High | ₹1,776.29 |

| 52 Week Low | ₹737.70 |

| P/B | 3.08 |

| DIV. YIELD | 0.82% |

Influencing Factors For Amara Raja Share Price Target

- Increasing Demand For Electrical Vehicle

- Uses Of Advanced Technologies

- Expert R&D Department

- Strong Financial Support

- National and International market expansion

- Supportive Governmental Policies

- Raw Material Prices

Amara Raja Share Price Target 2025

| Year | Amara Raja Share Price Target 2025 |

| 1st Price Target | ₹1,246.79 |

| 2nd Price Target | ₹1,598.37 |

If we look at Amara Raja Share Price Target 2025 forecast the 1st Price Target is ₹1,246.79 and the 2nd Price Target is ₹1,598.37.

Factors which influence the Price Target

- Increase In Market Demand

- By the end of the year 2025, the use of EV Electronics will increase rapidly in the International and Domestic markets. With the increase of EV Electronics products, the company’s manufacturing products lithium-iron batteries demand will increase in parallel.

- Increase In Manufacturing Capacity

- With the increase in product demand, the company also tries to increase its manufacturing capacity with the help of advanced technology and expert employees.

- Strong Financial Condition

- The company’s revenue amount and EBITDA are increasing due to the increase in EV Vehicles and batteries.

Risk Factors

- An increase in the price rate of raw materials may affect the company’s production capacity.

- Low product visibility and brand awareness may affect the company’s productivity.

Also Read – Bharat Electronics Share Price Target

Amara Raja Share Price Target 2027

| Year | Amara Raja Share Price Target 2027 |

| 1st Price Target | ₹1,946.37 |

| 2nd Price Target | ₹2,259.76 |

If we look at Amara Raja Share Price Target 2027 forecast the 1st Price Target is ₹1,946.37 and the 2nd Price Target is ₹2,259.76.

Factors which influence the Price Target

- Support From Governmental Field

- The company has strong governmental support as the company deals with renewable energy sources. The Indian Government provides some favorable policies for the company as the company increases the use of renewable energy sources.

- Diversification Of Products

- By the end of the year 2027, the company will be able to diversify its product portfolio to telecom and energy storage solutions systems.

- Increase The Use Of Renewable Energy Sources

- To reduce pollution the company also tries to increase renewable energy sources like the company increases the production of solar and wind energy storage batteries.

Risk Factors

- Any changes to governmental policies may affect the company’s growth.

- Any delay in the raw material’s supply chain can affect the company’s product manufacturing facilities.

Amara Raja Share Price Target 2028

| Year | Amara Raja Share Price Target 2028 |

| 1st Price Target | ₹2,347.19 |

| 2nd Price Target | ₹2,701.85 |

If we look at Amara Raja Share Price Target 2028 forecast the 1st Price Target is ₹2,347.19 and the 2nd Price Target is ₹2,701.85.

Influencing Key Factors

- Uses Of Advanced Technology

- The company also tries to improve the product’s capability by using advanced technology. By searching the company tries to improve the durability of products, and reduce the charging times will give the company a new product area.

- Invest In The Digital Solution

- The company also started to invest in digital solutions for a better customer experience. The company also supplies products on an online basis which is more reachable to customers.

- Through digital solutions, the company can apply more advanced technology to improve product quality.

- International Market Expansion

- The company rapidly spread its business in the International market. International market expansion like in South Asia, Africa, and Europe may increase the product demand and affect the company’s annual revenue growth. China, Brazil, and South Korea will record some of the strongest market gains.

Risk Factors

- In this case, other battery manufacturers may offer lower prices which affect the company’s sales growth.

- Any delay in supply chain material can affect the company’s production capacity.

Amara Raja Share Price Target 2030

| Year | Amara Raja Share Price Target 2030 |

| 1st Price Target | ₹3,546.10 |

| 2nd Price Target | ₹3,846.51 |

If we look at Amara Raja Share Price Target 2030 forecast the 1st Price Target is ₹3,546.10 and the 2nd Price Target is ₹3,846.51.

Influencing Key Factors

- Strong Partnership

- The company has a strong partnership with some big companies like Ashok Leyland Fiat, General Motors, Hindustan Motors, Honda, Mahindra & Mahindra, Maruti, Tata Motors, Ford, etc. The company is a supplier to the biggest companies which is the very positive side for the company’s growth.

- Revolution Into Lithium-Ion Batteries

- Amara Raja company’s lead-acid battery has huge market demand but the company diversified its product portfolio to Lithium-Ion batteries for uses of renewable energy sources. These Lithium-Ion batteries are used in Electrical vehicles.

Risk Factors

Amara Raja company facing competition from other battery manufacturing companies and EV sectors like Ola Electric. With the help of new technology advancement and strong financial support, the company will be able to maintain the company’s annual revenue.

Amara Raja Share Price Target 2040

| Year | Amara Raja Share Price Target 2040 |

| 1st Price Target | ₹6,915.64 |

| 2nd Price Target | ₹7,260.69 |

If we look at Amara Raja Share Price Target 2040 forecast the 1st Price Target is ₹6,915.64 and the 2nd Price Target is ₹7,260.69.

Factors which influence the Price Target

- Key Brand Factors

- The company’s product has a brand like Amaron and PowerZone by which the company sells its products.

- Strong R&D Department

- The company has a strong R&D department to renovate new products. The company also invests a huge amount every year to develop next-generation battery technologies. The innovation in energy storage solutions will confirm the company’s product demand in this sector.

- Pioneer In New Energy Storage Technologies

- By the end of the year 2040, the company will be the pioneer in the energy storage sector by providing quantum batteries or ultra-efficient lithium-based technologies. Amara Raja will be the battery solution provider for smart grids, electric vehicles, and advanced energy storage systems.

Risk Factors

- Development Of New Technologies

- With the consumption of the new era, the development of new technology may become harmful to Amara Raja Company. Any other form of energy storage (like solid-state batteries) may compete with the company’s position.

- Slower Development Of Ev Infrastructure

- In case any slower development of Ev infrastructure may affect the company’s product’s demand.

Peer’s Company Of Amara Raja Energy & Mobility Limited

| Company Name | Market Cap(Crore) |

| Exide Ind | ₹35,732.46 |

| HBL Eng | ₹17,695.78 |

| Panasonic Energ | ₹343.29 |

| Eveready Ind | ₹2,846.92 |

| High Energy | ₹561.39 |

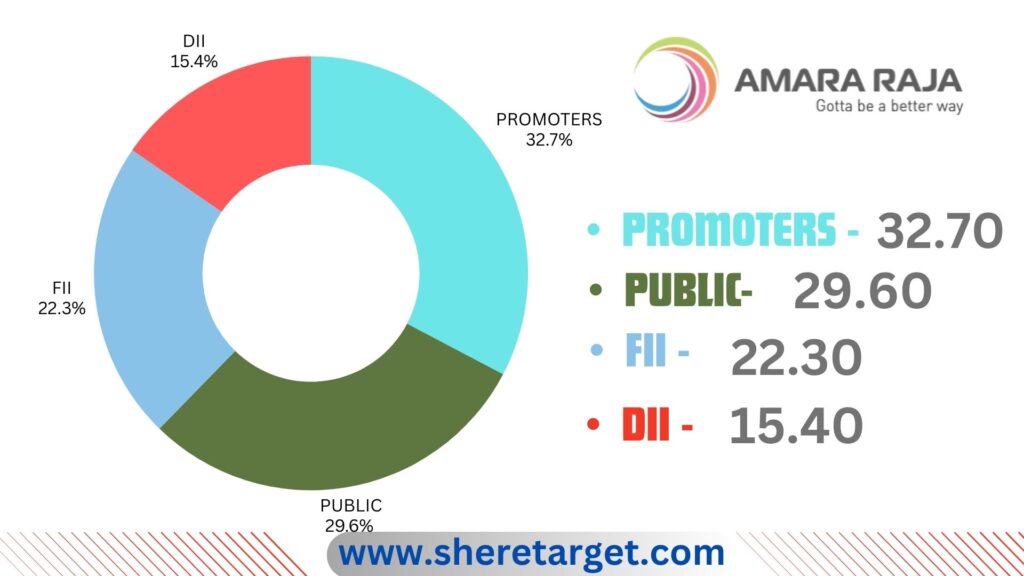

Discussion About Share Holding Pattern Of Amara Raja Limited

Amara Raja Limited mainly has four types of shareholding patterns such as promoter holding, public holding, DII, and FII. We can majorly influence the company’s growth depending on the shareholding pattern.

| Investor Type | Percentage |

| Promoter Holding (Owned by the company’s promoter) | 32.70% |

| Public Holding (Held by the public) | 29.60% |

| FII (Invest by Foreign Institutional Investor) | 22.30% |

| DII (Invest money by Domestic Institutional Investor) | 15.40% |

What Is The Advice From Expert To Invest In Amara Raja Share?

Positive Sides

- The last 3 years’ revenue growth of the company was 17.15%.

- The company’s debt amount decreased by ₹57.96 Crore.

- The company’s has a healthy interest cover ratio of 38.26.

- The company has an efficient cash conversation cycle of 47.26 days.

- The company has good cash flow management, PAT stands at 1.42.

- The company has a healthy liquidity position with a current ratio of 2.15.

The Few Year’s Performance Of Amara Raja Limited

Profit Growth

The company’s last 5 year’s profit growth percentage is described in the below portion.

- In the last 5 years 14.26%

- In the last 3 years 12.03%

- In the last 1 year 24.26%

The Net Profit amount of the company was ₹731.29 Crore in March 2023 which increased to ₹906.38 Crore in March 2024. The Operating Profit amount of the company was ₹1,524.08 Crore in March 2023 which increased to ₹1,648.29 Crore in March 2024.

Sales Growth

The last 5 year’s Sales growth percentage of the company is described in the below portion.

- In the last 5 years 11.26%

- In the last 3 years 17.26%

- In the last 1 year 9.02%

The Net Sales amount was ₹10,425.39 Crore in March 2023 which increased to ₹11,265.19 Crore in March 2024.

ROE Percentage

The company’s last 5 year’s ROE percentage is described below.

- In the last 5 years 16.25%

- In the last 3 years 14.25%

- In the last 1 year 15.01%

ROCE Percentage

The company’s last 5 year’s ROCE percentage is described below.

- In the last 5 years 21.02%

- In the last 3 years 19.15%

- In the last 1 year 21.01%

The Net Cash Flow Amount

The company’s Net Cash Flow was ₹56.25 Crore in March 2023, decreasing to ₹-0.23 Crore in March 2024.

Total Liabilities

The company’s Total Liabilities were ₹7,956.18 Crore in March 2023, increasing to ₹8,835.49 Crore in March 2024.

Total Expenditure Amount

The Total Expenditure amount of the company was ₹266.49 Crore in March 2023 which increased to ₹669.49 Crore in March 2024.

Other Income Amount

The Other Income Amount was ₹92.36 Crore in March 2023 which increased to ₹102.26 Crore in March 2024.

Tax Amount

The Tax amount of the company was ₹267.89 Crore in March 2023 which increased to ₹306.29 Crore in March 2024.

Also Read – Apollo Tyres Share Price Target

Dividend History Of Amara Raja Limited

| Year | Dividend Medium | Dividend Amount Per Share |

| 2024 | Final | ₹5.10 |

| 2023 | Final | ₹3.20 |

| 2022 | Final | ₹0.50 |

| 2021 | Interim | ₹5.00 |

| 2020 | Final | ₹0.50 |

The Last Few Year’s Share Price Prediction Of Amara Raja Share

Amara Raja Share is both the Indian Stock Exchange BSE (Bombay Stock Exchange) and NSE (National Stock Exchange). The last few year’s share growth is described in the below portion.

- The last 6 month’s share growth was -446.15 (-26.83%).

- The last 1 month’s share growth was -47.65 (-3.77%).

- The last 1 year’s share growth was +396.55 (48.33%).

- The last 5 year’s share growth was +501.10 (70.00%).

- The maximum share growth was +1,203.54 (8,941.60%).

- Amara Raja Share Price return percentage was -3.99% in the last 1 month.

- The last 3 month’s share price return percentage -12.41%.

- The last 1 year’s share price return percentage is 50.26%.

- The last 3 year’s share price return percentage is 101.26%.

- The last 5 year’s share price return percentage is 70.32%.

Also Read – Voltas Share Price Target

FAQ

What is Amara Raja Share Price Target for 2025?

Amara Raja Share Price Target for 2025 is ₹1,246.79 to ₹1,598.37.

What is Amara Raja Share Price Target for 2027?

Amara Raja Share Price Target for 2027 is ₹1,946.37 to ₹2,259.76.

What is Amara Raja Share Price Target for 2028?

Amara Raja Share Price Target for 2028 is ₹2,347.19 to ₹2,701.85.

What is Amara Raja Share Price Target for 2030?

Amara Raja Share Price Target for 2030 is ₹3,546.10 to ₹3,846.51.

What is Amara Raja Share Price Target for 2040?

Amara Raja Share Price Target for 2040 is ₹6,915.64 to ₹7,260.69.

Conclusion

This website is written to help the investor gain some basic knowledge about the market strategy of Amara Raja Share. For making this blog we take consultation from expertise and doing research about the company. It is expected that the Amara Raja Share Price Target will be a good choice to invest in on a long-term basis. The demand for the battery manufacturing sector in India and outside of the country always increases as a result of the company and the share may increase rapidly.

We try to give an in-depth idea about the share. If you think it is helpful to you you can share it. If you have any questions please let us know through the comment box we will try to reply to your questions and solve your problem. Thanks for visiting this website and thanks for being with us.

Disclaimer – We are not SEBI-registered advisors. A financial market is always risky to anyone. This website is only for training and educational purposes. So before investing, we are requested to discuss certified expertise. We will not be responsible for anyone’s profit or loss.