Current Share Price and Performance: Swiggy Limited shares are currently trading at ₹394.40 on the NSE (as of December 5, 2025), representing a significant decline from the company’s trading levels since its landmark IPO listing on November 13, 2024. The stock opened for listing at ₹455.95, which was substantially above the IPO price band of ₹371-₹390. Within the first year of trading, Swiggy has experienced considerable volatility, hitting a 52-week high of ₹617 in December 2024 and a 52-week low of ₹297, demonstrating the high-risk nature of newly listed companies in the Indian market.

From its IPO opening price of ₹455.95, the stock has declined approximately 13.50% to its current level of ₹394.40. This performance underscores the broader challenges facing the Indian tech and e-commerce sector, which has experienced correction pressures since mid-2025. The stock’s volatility reflects investor concerns about the company’s path to profitability and the competitive intensity in the food delivery and quick commerce space dominated by strong rivals like Zomato.

Share Price History and Key Milestones

IPO Launch (November 2024)

Swiggy’s IPO was one of India’s most anticipated public market debuts, opening for subscription on November 6-8, 2024, at a price band of ₹371-₹390 per share. The company successfully raised ₹11,327.43 crore through a combination of ₹4,499 crore in fresh equity issuance and ₹6,828.43 crore in offer-for-sale by existing shareholders. The IPO received strong institutional interest, with subscription ratios of 5.80x from qualified institutional buyers, 1.08x from retail investors, and 1.59x from employees. The shares listed on both NSE and BSE on November 13, 2024, with an opening price reflecting strong market demand above the IPO price band.

Peak and Correction Phase (December 2024 – January 2025)

Following its listing, Swiggy shares surged significantly, reaching a peak of ₹617 in December 2024, representing approximately 35% gains from the IPO price band midpoint. This initial enthusiasm reflected optimistic investor sentiment regarding Swiggy’s market position as India’s leading food delivery platform and its successful Instamart quick-commerce division. The peak coincided with strong quarterly performance announcements and expectations of rapid scaling in the high-growth quick-commerce segment.

Correction and Current Consolidation (February 2025 – December 2025)

Since February 2025, the stock has experienced a significant correction, declining from levels above ₹540 to the current ₹394.40. This downtrend reflects multiple headwinds including concerns about profitability timelines, intensifying competition from better-capitalized rivals, and broader market correction in newly-listed technology stocks. The correction accelerated in November 2025, with the stock losing momentum amid profit-taking and institutional repositioning.

Financial Performance and Operational Metrics

Revenue and Growth

Swiggy demonstrated robust revenue growth, with consolidated revenues reaching ₹5,561 crore in the September 2025 quarter (Q2 FY26), representing 52.5% year-on-year growth. This growth is driven by simultaneous expansion across three key verticals: food delivery, quick commerce (Instamart), and other services. The company’s gross order value (GOV) across all segments grew to ₹8,542 crore in the June 2025 quarter (Q1 FY26) with healthy 18.8% year-on-year expansion. Food delivery monthly transacting users increased by 17% year-on-year, demonstrating consistent user acquisition and retention.

EBITDA and Path to Profitability

A critical development is Swiggy’s improving operational metrics. Adjusted EBITDA margin improved to 2.8% of GOV in Q1 FY26, representing a 125 basis point year-on-year improvement. This demonstrates the company’s disciplined focus on unit economics and operational efficiency. Management has explicitly committed to achieving profitability by the June 2026 quarter, a significant milestone for investors. The company plans to double business operations without proportional new investments, emphasizing efficiency gains through existing infrastructure optimization and technology leverage.

Segment Performance

The food delivery segment has shown margin improvement of approximately 200 basis points quarter-on-quarter to -2.6% adjusted EBITDA margin, with the adjusted EBITDA loss shrinking to ₹849 crore. The out-of-home consumption segment maintained profitability with 0.5% adjusted EBITDA margins and 52% year-on-year GOV growth, demonstrating balanced portfolio expansion.

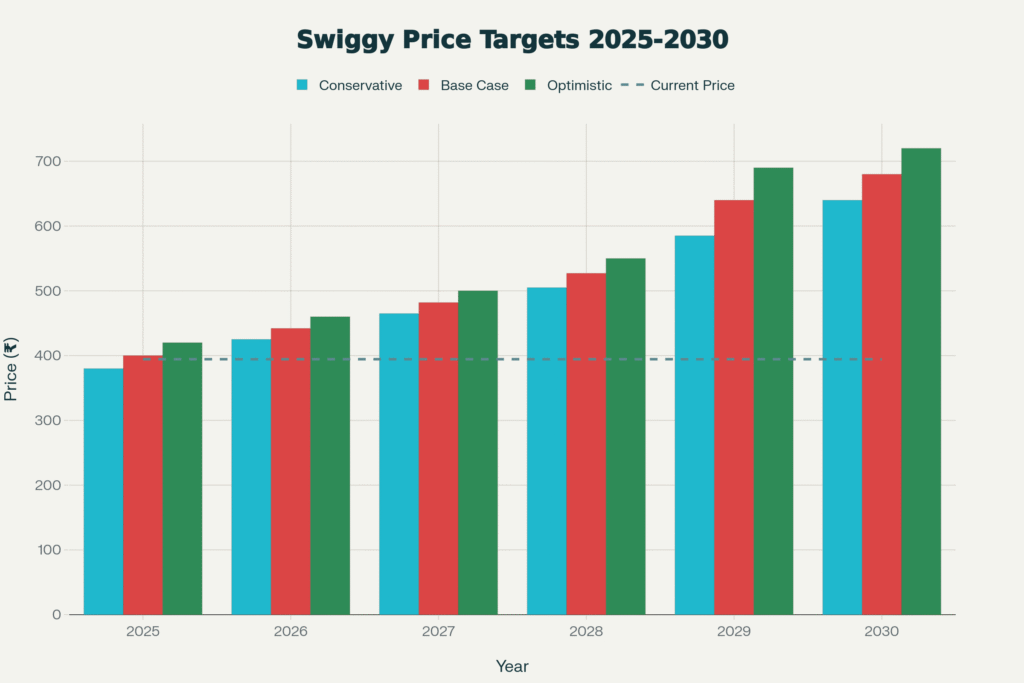

Analyst Price Targets and Future Predictions (2025-2030)

2025 Outlook

Analyst consensus for the remainder of 2025 and early 2026 presents a moderately positive outlook: The target price range for late 2025 is projected between ₹380-₹420, with the midpoint around ₹400. This reflects cautious optimism regarding Swiggy’s first year as a public company, with intense scrutiny focused on quarterly earnings, GMV growth, and evidence of sustainable profitability trajectory. Key metrics under observation include average order value, order frequency, and contribution margin levels, particularly for the Instamart quick-commerce vertical.

2026 Projections

By 2026, analyst expectations become increasingly bullish. The consensus price target range is ₹425-₹460, with market-in-india projections suggesting ₹442 as the midpoint. This represents 12.2% upside from current levels and reflects expectations of successful IPO stabilization and early signs of meaningful progress toward profitability. Catalysts include successful expansion into Tier 2 and Tier 3 cities, revenue diversification through advertising and subscription programs (Swiggy One), and improved unit economics through operational leverage.

2027-2028 Outlook

The 2027 price target range of ₹465-₹500 assumes Swiggy achieves consistent profitable growth, with the base case suggesting ₹482. By 2028, as Swiggy transitions toward mature profitability, the target range widens to ₹505-₹550, reflecting growing confidence in the business model’s sustainability and market leadership position. These projections assume successful diversification into high-frequency categories and achievement of positive free cash flow generation.

2029-2030 Long-Term Vision

The most ambitious projections emerge for 2029-2030, reflecting potential for significant appreciation. The consensus range for 2030 stands at ₹640-₹720, with base-case targets around ₹680 representing 72.6% upside from current levels. More aggressive projections from certain analysts suggest even higher targets, with some forecasting ₹1,270-₹1,510 by 2030, implying potential returns exceeding 250%. These long-term targets assume Swiggy successfully establishes itself as a diversified everyday essentials and services platform with significant network effects.

Analyst Consensus and Key Assumptions

Bullish Case – BestMate Equity Research

BestMate Equity Research initiated coverage with a BUY rating and target price of ₹564 (representing 43% upside), based on conservative valuation multiples of 6.0x P/S on FY26E revenue. The research highlights Swiggy as undervalued despite recent brokerage downgrades, with three price targets across different time horizons: conservative target of ₹520 (15.7% upside) over 9-12 months, base case of ₹564 (25.3% upside) over 12-18 months, and optimistic target of ₹650 (44.5% upside) over 18-24 months.

Broad Analyst Consensus (TradingView)

According to a survey of 24 analysts tracked on TradingView, the average 12-month price target is ₹485.13, with a wide range from ₹285 (downside scenario) to ₹740 (optimistic case). This broad range reflects divergent views on Swiggy’s ability to achieve profitability targets and navigate competitive pressures. The consensus lean is toward a BUY rating with 15 buy recommendations, 3 hold ratings, and 4 sell ratings from analysts covering the stock in the past three months.

Critical Success Factors for Price Appreciation

The realization of these price targets hinges on several critical execution factors:

Profitability Achievement: The company’s June 2026 profitability target is paramount. Achieving positive EBITDA and working toward net profitability would justify sustained valuation premiums and attract dividend-focused institutional investors.

Unit Economics Improvement: Continued margin expansion in food delivery and Instamart segments, driven by operational leverage and reduced customer acquisition costs, would validate the business model’s sustainability.

Market Share Dynamics: Maintaining or gaining market share against well-capitalized competitors like Zomato and emerging quick-commerce players like Zepto is essential for long-term value creation.

Monetization Diversification: Growth in advertising revenue, subscription programs (Swiggy One), and private label products would reduce dependence on core delivery commissions and improve profitability profiles.

International Expansion: Potential expansion into Southeast Asian markets could open a new growth vector, though this remains a longer-term optionality.

Investment Considerations and Risks

While analyst targets present attractive upside potential, investors should be cognizant of significant risks:

Competitive Intensity: The Indian food delivery and quick commerce markets remain highly competitive with aggressive pricing and significant cash burn among participants. Zomato’s operational maturity and Zepto’s well-funded quick-commerce platform present formidable competitive challenges.

Regulatory Uncertainty: Potential regulatory changes concerning gig worker classifications, platform fees, or data localization could impact unit economics and profitability timelines.

Macroeconomic Sensitivity: Consumer discretionary spending on food delivery and out-of-home consumption is vulnerable to economic downturns, inflation, or increased interest rates impacting consumer purchasing power.

Valuation Multiples: Current trading multiples remain elevated relative to profitability benchmarks, leaving limited room for execution disappointments or broader market correction.

Investment Outlook

Swiggy presents a dual-narrative investment opportunity. The near-term outlook (2025-2026) suggests consolidation around the ₹380-₹460 range as investors await profitability demonstrations and quarterly execution updates. The medium-term outlook (2026-2028) appears constructive, with reasonable 12-18 month targets around ₹520-₹564 suggesting 30-45% appreciation potential from current levels.

The long-term outlook (2027-2030) presents the most compelling value proposition, with base-case targets around ₹680-₹720 implying 70%+ returns, contingent on successful execution of the profitability agenda and market leadership maintenance. However, the wide dispersion of analyst targets reflects genuine uncertainty about execution, competitive dynamics, and market conditions over the five-year horizon.

For growth-oriented investors with a 2-3 year investment horizon and moderate-to-high risk tolerance, current valuation levels near ₹394-₹400 appear to offer a reasonable entry point, particularly given management’s explicit profitability commitments and operational momentum toward positive EBITDA. Risk-averse investors should await confirmation of June 2026 profitability milestones before initiating or increasing positions.