When Hyundai Motor India hit the stock market in October 2024 with India’s largest-ever IPO, investors had mixed feelings. The ₹27,870 crore offering priced at ₹1,960 per share, but the debut was tepid at best. Fast forward to today, and everyone wants to know: where is this stock headed? Let me break down what analysts are saying, what the numbers tell us, and what you should consider before making any investment decisions.

The Current Situation

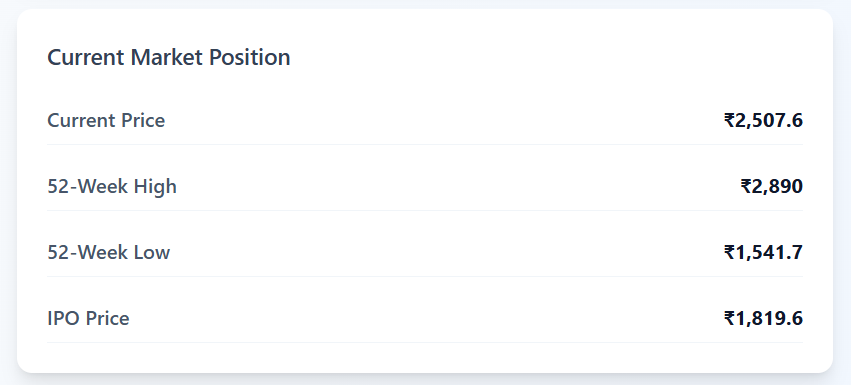

As of October 3, 2025, Hyundai Motor India shares are trading at ₹2,507.60, representing a solid 37.81% gain since its IPO listing in October 2024 at ₹1,819.60. The stock has been quite volatile, touching a 52-week high of ₹2,890.00 and dipping to a 52-week low of ₹1,541.70.

The company currently carries a market cap of approximately ₹2.06 lakh crore, making it one of the heavyweights in the Indian auto sector. With a 14.90% market share in India’s passenger vehicle segment, Hyundai maintains its position as the country’s second-largest car manufacturer.

Breaking Down the Price Targets: Year by Year

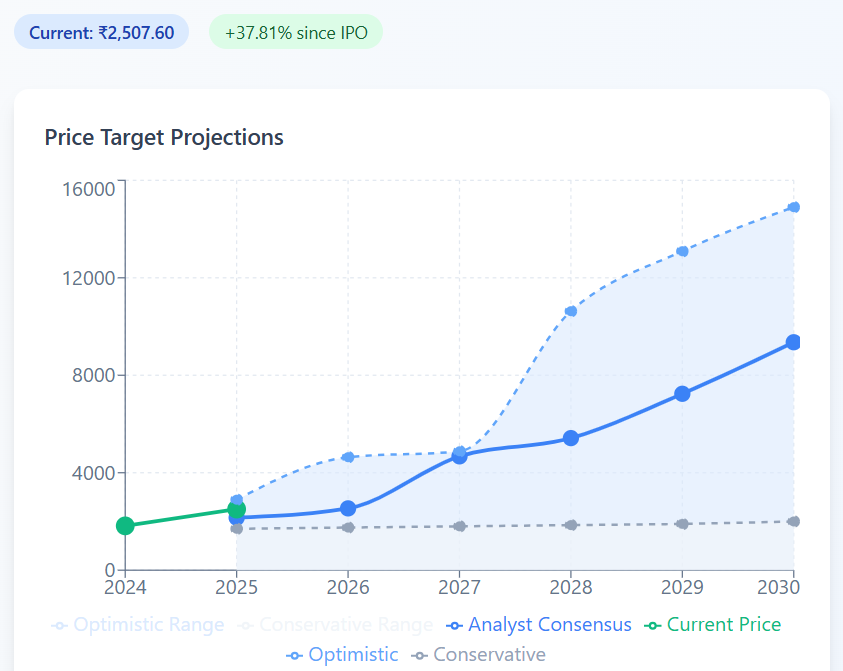

Here’s where things get interesting. Analysts are all over the map with their predictions, and the range is honestly staggering. Let me show you what different forecasts are suggesting:

2025 Target: ₹1,700 – ₹2,894

For the remainder of 2025, we’re looking at:

- Conservative estimate: ₹1,700-₹1,950

- Analyst consensus (22 analysts): ₹2,155

- Optimistic estimate: ₹2,894

The conservative targets actually sit below the current trading price, which tells you some analysts think the stock has gotten ahead of itself.

2026 Target: ₹1,750 – ₹4,637

The range widens considerably for 2026:

- Conservative range: ₹1,750-₹2,100

- Analyst consensus: Around ₹2,537

- Optimistic projections: Up to ₹4,637

That optimistic target would represent an 85% gain from current levels—not impossible, but it requires a lot of things going right.

2027 Target: ₹1,800 – ₹4,881

By 2027, projections continue spreading out:

- Base case: ₹1,800-₹2,250

- Mid-range: ₹4,672

- Upper range: ₹4,881

2028 Target: ₹1,850 – ₹10,630

Now we’re entering wildly different territory:

- Conservative: ₹1,850-₹2,400

- Moderate: ₹5,421

- Aggressive: ₹10,630

That aggressive target would mean the stock more than quadruples. These aren’t just different opinions—they’re different worldviews about where the auto industry is headed.

2029 Target: ₹1,900 – ₹13,092

The spread gets even more dramatic:

- Conservative: ₹1,900-₹2,550

- Mid-range: ₹7,240

- High-end: ₹13,092

2030 Target: ₹2,000 – ₹14,899

Looking all the way to 2030:

- Conservative: ₹2,000-₹2,700

- Moderate: ₹9,355

- Optimistic: ₹14,899

Let me visualize this range for you:

What’s Behind These Wild Predictions?

The massive divergence in price targets—from ₹1,700 to ₹14,899 by 2030—isn’t just analysts throwing darts at a board. It reflects genuine uncertainty about several critical factors.

The Strong Fundamentals

Let’s start with what’s working. Hyundai Motor India has some impressive numbers under the hood:

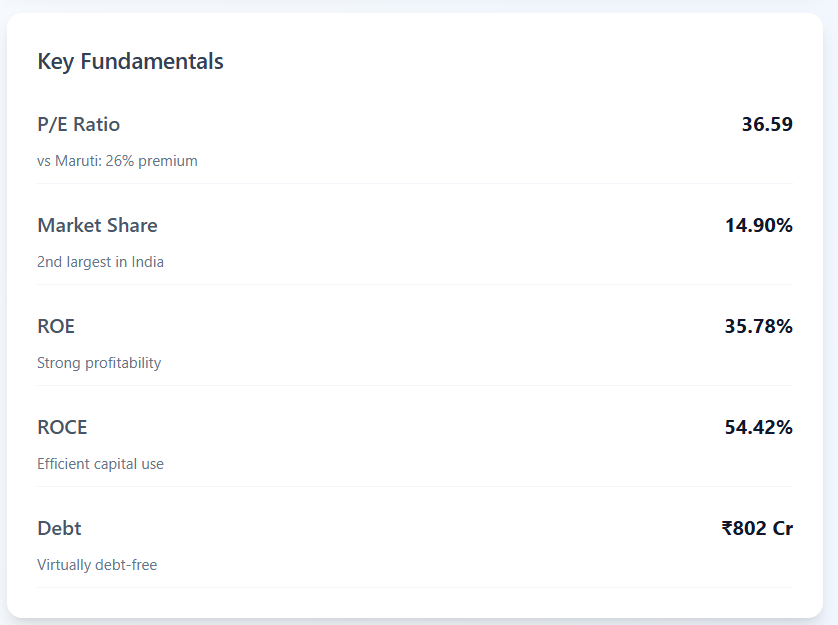

Revenue Growth: The company has posted 19% revenue growth over the past three years, which is solid considering the challenges the auto industry faced during that period.

Profitability Metrics: With an ROE of 35.78% and ROCE of 54.42% maintained over three years, these numbers tell you the company knows how to make money with the capital it has. That ROCE figure is particularly impressive—it means for every rupee of capital employed, the company generates 54 paise in operating profit.

Debt-Free Balance Sheet: The company is virtually debt-free with total debt of just ₹801.88 crores. In an industry where many players carry heavy debt loads, this is a significant advantage and provides flexibility for future investments.

Market Position: With a 14.90% market share in India’s passenger vehicle segment, Hyundai has established itself as a formidable player. That’s not market leadership, but it’s a solid second place with room to grow.

The Valuation Puzzle

Here’s where analysts start getting nervous. At current levels, Hyundai Motor India trades at a P/E ratio of 36.59, which represents a 26% premium to Maruti Suzuki. Think about that—you’re paying more for Hyundai than for the market leader.

Even more striking: the stock is trading at a 2,593% premium to its intrinsic value estimates. That’s not a typo. The market is pricing in phenomenal growth expectations.

InCred Equities maintains a “Reduce” rating with a target price of ₹2,023, suggesting a potential 19% downside from current levels. Their concern? The recent GST rate cuts primarily benefit compact car segments where Hyundai has limited presence compared to SUVs and premium vehicles.

Recent Performance Challenges

The Q1 FY2026 results raised some eyebrows:

- Net profit declined 8.1% year-on-year to ₹1,369.23 crores

- Revenue dropped 5.6% to ₹16,179.62 crores

- Domestic volume weakness affected overall performance

These aren’t catastrophic numbers, but they’re not the growth story that justifies premium valuations either.

The Electric Vehicle Wildcard

Here’s where things get really interesting. The EV transition could be either Hyundai’s biggest opportunity or its biggest challenge.

Hyundai is aggressively expanding its EV portfolio with models like Ioniq and Kona, positioning itself to capture the growing electric vehicle market in India. Government support through subsidies and tax benefits for EVs will likely boost demand.

But there are questions:

Infrastructure Readiness: Will charging infrastructure develop fast enough across India’s diverse geography?

Price Competition: Can Hyundai compete with aggressive pricing from companies like Tata Motors in the EV space while maintaining premium positioning?

Consumer Adoption: How quickly will Indian consumers actually make the switch? The aspirational middle class might prefer conventional premium vehicles over entry-level EVs.

Manufacturing Economics: The company is investing in new manufacturing facilities to meet both domestic and export demand. However, high overheads from new plants may pressure margins until optimal capacity utilization is achieved.

Export Strength: The Hidden Gem

One factor that doesn’t get enough attention: Hyundai’s India operations serve as an export hub to Latin America, Africa, and Asia. Export revenues account for approximately 15% of net sales, providing revenue diversification that many competitors lack.

This export strength could become more valuable as the company scales up production. It also insulates Hyundai somewhat from domestic market volatility—when India slows down, exports might pick up the slack.

The Risk Factors Nobody Wants to Talk About

Let’s be real about what could go wrong:

Market Share Erosion: The GST rate cut benefits compact car segments where Hyundai has limited presence compared to SUVs and premium vehicles. This could accelerate market share loss to competitors better positioned in the mass market.

Input Cost Volatility: Fluctuations in steel, semiconductor, and battery costs directly affect margins and profitability. We’ve seen how chip shortages crippled the industry. Battery cost volatility makes pricing EVs particularly challenging.

Competition Intensity: The Indian automotive market is getting crowded. Traditional players are fighting back, new entrants are trying to carve out niches, and everyone’s chasing the same EV customers. This competition will pressure both growth and margins.

Premium Positioning Vulnerability: Hyundai’s focus on premium segments works great in good times. But in an economic downturn, consumers trade down, and Hyundai’s sweet spot becomes a vulnerability.

Breaking Down the Scenarios

Let me walk you through what needs to happen for each price target scenario to play out:

Conservative Scenario (₹2,000-₹2,700 by 2030)

This scenario assumes:

- Hyundai maintains current market share but doesn’t gain significantly

- EV transition is slow and margins remain under pressure

- Export growth is steady but unspectacular

- Competition intensifies, limiting pricing power

This is the “muddle through” scenario. The company stays profitable and pays dividends, but you’re not getting rich.

Moderate Scenario (₹9,355 by 2030)

This requires:

- Successful EV launches that capture 20-25% of Hyundai’s sales mix

- Market share gains in premium segments

- Strong export growth with improved capacity utilization

- Stable input costs and maintained margins

This is what analysts who “like the stock” are betting on. It’s optimistic but not crazy.

Optimistic Scenario (₹14,899 by 2030)

This demands:

- Dominance in India’s premium EV segment

- Significant market share gains overall (approaching 18-20%)

- Massive export expansion

- Multiple expansion as the market re-rates the company

- Perfect execution on all fronts

This is the “everything goes right” scenario. It’s possible, but it requires Hyundai to outperform on every metric simultaneously.

What the Smart Money Is Doing

Looking at institutional activity and analyst recommendations provides some clues. The promoter holding stands at 82.5%, which means limited free float. This can create volatility—when there’s buying pressure, the stock can spike quickly, but selling pressure can also push it down hard.

The average 12-month target from 22 analysts at ₹2,155 sits below the current price of ₹2,507.60. That’s noteworthy. It suggests analysts think the stock has run ahead of fundamentals in the near term.

Should You Invest? The Honest Answer

Look, I can give you all the numbers, but the decision depends on your investment horizon and risk tolerance.

Short-term (6-12 months): The picture is murky. With analyst consensus below current price and valuation concerns mounting, there’s limited upside being projected. The stock might consolidate or even pull back to the ₹2,000-₹2,200 range.

Medium-term (2-4 years): This is where conviction matters. If you believe in India’s auto market growth and Hyundai’s ability to capture premium market share, the ₹4,000-₹5,500 range starts looking reasonable. You’ll need to stomach volatility and potentially some near-term underperformance.

Long-term (5+ years): The ₹9,000-₹14,000 targets require believing that Hyundai will successfully navigate the EV transition, gain market share, and expand exports significantly. That’s possible, but it’s definitely not guaranteed.

My Take: What I’m Watching

If you’re considering this stock, here are the metrics I’d track quarterly:

- EV sales penetration – What percentage of Hyundai’s sales are coming from electric models? This needs to hit 15-20% by 2027 for the optimistic scenarios to play out.

- Market share trends – Is Hyundai gaining or losing ground? Anything below 14% is concerning; anything above 16% is exciting.

- Export growth – Is the international business expanding as planned? Watch for any commentary about new export markets or volume increases.

- Margin stability – Can the company maintain operating margins above 10% despite input cost pressures? This is crucial for profitability.

- Capacity utilization – New plant investments need to generate returns. Watch for utilization rates above 75-80%.

- Product pipeline – Are new launches generating buzz and sales? Hyundai needs to maintain its reputation for quality and value.

The Bottom Line

Hyundai Motor India is a solid company with strong fundamentals, good management, and a credible EV strategy. But the stock price has already run up 37.81% from its IPO price, and current valuations are pricing in a lot of optimism.

The price targets ranging from ₹1,700 to ₹14,899 by 2030 tell you everything you need to know: there’s genuine uncertainty here. The automotive industry is going through its biggest transformation in a century, and nobody really knows how it will shake out.

Conservative analysts see limited upside and potential downside. Optimistic analysts see a company perfectly positioned to dominate premium segments in the world’s third-largest auto market. Both can’t be right—but both could be wrong.

My personal view? If you’re bullish on India’s auto sector and want premium exposure with EV upside, Hyundai makes sense as a long-term hold at the right entry point. But I wouldn’t chase it at current prices. Wait for a pullback to ₹2,200 or below to get a better risk-reward setup.

And whatever you do, size your position appropriately. This isn’t a stock to bet the farm on—it’s a quality name that deserves a spot in a diversified portfolio if you believe in the India growth story. The wide range of analyst opinions tells you this isn’t a sure thing.

Do your own research, understand your risk tolerance, and remember that anyone claiming to know exactly where this stock will be in five years is selling you something. The only target that really matters is the one that lets you sleep well at night while building long-term wealth.