Hindalco Share is in a bullish trend in the share market. In the time of share ups and downs, you should know all about share details before investing. In this blog, we are going to discuss Hindalco Share Price Target 2025, 2027, 2028, 2030, 2040. We try to analyze the share base in the company’s overall performance.

We also look at the company’s profit growth in the last 5 years, the last 5 years’ sales growth, and the last 5 years’ ROE percentage. Similarly, we also compare the Share growth, the share price return amount of the share has increased or decreased over the last 5 years. We also take advice from experts about when to invest in shares, which may be helpful for you as well. Let’s have a look at Hindalco Share Price Target from 2025 to 2040.

| Company Name | Hindalco Industries Limited |

| Market Cap | ₹1,46,896.26 Crore |

| Book Value | ₹313.26 |

| Face Value | ₹1 |

| 52 Week High | ₹773 |

| 52 Week Low | ₹546.38 |

| P/B | 2.12 |

| DIV. YIELD | 0.79% |

| ROA | 3.86% |

| ROE | 6.05% |

| Current Ratio | 1.63 |

Overview Of Hindalco Industries Limited

Hindalco Industries Limited was established in the year 1958, and is an Indian aluminium and copper manufacturing company. The headquarters of the company are situated in Mumbai, India. The company was established by the Aditya Birla Group, named Hindustan Aluminium Corporation Limited, which was renamed as Hindalco in the year 1989.

Hindalco Share Price Target 2025

Hindalco Share Price Target for 2025 forecast may vary from ₹632.59 to ₹672.62.

Hindalco Industries Limited is the metals flagship company, which is an industry leader in aluminium, copper, and specialty Alumina manufacturing. The company operates 19 manufacturing units in India, the company has 21 mining operations in India,33 overseas facilities, has 17 facilities for recycling capabilities. In the financial year 2023-24, the company’s revenue from operations amounted was ₹224,205 Crore, which increased by 15% compared to the previous year, and the operating cash flow amount was ₹19,209 Crore.

| Month | Hindalco Share Price Target 2025 (1st Price Target) | Hindalco Share Price Target 2025 (2nd Price Target) |

| June | ₹632.59 | ₹655.27 |

| July | ₹649.88 | ₹659.75 |

| August | ₹657.47 | ₹668.32 |

| September | ₹664.92 | ₹671.29 |

| October | ₹669.90 | ₹679.53 |

| November | ₹663.15 | ₹672.68 |

| December | ₹664.70 | ₹672.62 |

Hindalco Share Price Target 2027

Hindalco Share Price Target for 2027 forecast may vary from ₹705.29 to ₹738.62.

In the financial year 2023-24, the company’s primary aluminium metal production was 1.33 Mn MT, which was the highest production ever. In the same year, the company’s newly developed products were 62, and the company’s Alumina production capacity was 8%, which was also the highest production. The company spends ₹797 Crore in the same year for the R&D department. The company’s copper cathodes are branded as Birla Copper. The company’s copper unit can produce 500 KT of copper cathodes.

| Month | Hindalco Share Price Target 2027 (1st Price Target) | Hindalco Share Price Target 2027 (2nd Price Target) |

| January | ₹705.29 | ₹714.32 |

| February | ₹710.75 | ₹721.90 |

| March | ₹682.66 | ₹691.16 |

| April | ₹688.26 | ₹698.98 |

| May | ₹695.70 | ₹708.79 |

| June | ₹706.16 | ₹716.48 |

| July | ₹714.47 | ₹724.66 |

| August | ₹721.78 | ₹730.94 |

| September | ₹727.32 | ₹737.44 |

| October | ₹731.25 | ₹740.59 |

| November | ₹731.05 | ₹739.68 |

| December | ₹728.61 | ₹738.62 |

Also Read – Vedanta Share Price Target

Hindalco Share Price Target 2028

Hindalco Share Price Target for 2028 forecast may vary from ₹735.64 to ₹771.64.

The Fabrication plant of the company at Renukoot comprises 4 Main Sections: Remelt Shop, Cast House, Rolling Mills, Extrusion & Conform, which produce Wire Rods, Coils, and Extruded Products. The company’s production of Cold Rolled Coils is used for Bus cabins & body insulation, cladding in buildings, aluminum composite panels, false ceilings & panels, Electrical bus bar ducting, flexible transformer strips, etc.

| Month | Hindalco Share Price Target 2028 1st Price Target) | Hindalco Share Price Target 2028 (2nd Price Target) |

| January | ₹735.64 | ₹745.29 |

| February | ₹743.11 | ₹753.06 |

| March | ₹724.55 | ₹733.94 |

| April | ₹731.01 | ₹739.60 |

| May | ₹737.69 | ₹746.46 |

| June | ₹744.17 | ₹752.29 |

| July | ₹751.44 | ₹760.95 |

| August | ₹758.21 | ₹767.88 |

| September | ₹765.61 | ₹775.19 |

| October | ₹773.36 | ₹782.50 |

| November | ₹776.53 | ₹787.86 |

| December | ₹762.23 | ₹771.64 |

Hindalco Share Price Target 2030

Hindalco Share Price Target for 2030 forecast may vary from ₹808.99 to ₹844.51.

The company manufactures products, AI-clad sheets/coils used for Automobile radiators, Intercoolers, air conditioners, etc. The flooring sheets/ tread plates are used for flooring for buses, trucks, and rail coaches. The Building Sheets are used for cladding for roofs, warehouses, aircraft hangers, indoor & outdoor stadium insulation, poultry farms, false ceilings, etc. The current assets of the company were ₹35,145 Crore in March 2023, which decreased to ₹30,625 Crore in March 2024.

| Year | Hindalco Share Price Target 2030 |

| 1st Price Target | ₹808.99 |

| 2nd Price Target | ₹844.51 |

Hindalco Share Price Target 2040

Hindalco Share Price Target for 2040 forecast may vary from ₹1,194.17 to ₹1,234.06.

Hindalco Limited produces high-purity ingots through the smelting process. Alloy ingots of various grades are also produced, mainly used for the production of castings in the Auto Industry as well as electrical applications. The company’s production of Aluminium is used for Pressure cookers, roofing sheets, roll bond sheets, lamp shades, etc. Hindalco, through the wholly owned subsidiary AV Metals Inc., acquired 75,416,537 common shares of Novelis.

| Year | Hindalco Share Price Target 2040 |

| 1st Price Target | ₹1,194.17 |

| 2nd Price Target | ₹1,234.06 |

Also Read – Castrol India Share Price Target

The Last Few Years’ Performance Of Hindalco Limited

Profit Growth

The company’s last 5 years’ profit growth percentage is described in the portion below.

- In the last 5 years, 25.97%

- In the last 3 years, 55.01%

- In the last 1 year, 12.56%

The Net Profit of the company was ₹3,467 Crore in March 2023, which increased to ₹3,768 Crore in March 2024. The Operating Profit amount was ₹7,356 Crore in March 2023, which decreased to ₹7,289 Crore in March 2024.

Sales Growth

The sales growth percentage of the company in the last 5 years is described below.

- In the last 5 years, 12.78%

- In the last 3 years 25.04%

- In the last 1 year, 8.01%

The Net Sales amount of the company was ₹20,701 Crore in September 2023, which increased to ₹22,378 Crore in September 2024.

ROE Percentage

The company’s last 5 years’ ROE percentage is described below.

- In the last 5 years, 5.86%

- In the last 3 years, 8.01%

- In the last 1 year, 6.08%

ROCE Percentage

The company’s last 5 years’ ROCE percentage is described below.

- In the last 5 years, 7.96%

- In the last 3 years 10.26%

- In the last 1 year, 9.01%

Total Expenditure Amount

The Total Expenditure of the company was ₹18,960 Crore in September 2023, which increased to ₹19,605 Crore in September 2024.

Total Assets Amount

The Total Assets amount was ₹96,930 Crore in March 2023, which increased to ₹97,563.49 Crore in March 2024.

The Net Cash Flow Amount

The Net Cash Flow amount of the company was ₹-2,936 Crore in March 2023, which increased to ₹390 Crore in March 2024.

Total Liabilities

The Total Liabilities of the company were ₹96,923 crores in March 2023, which increased to ₹97,254 crores in March 2024.

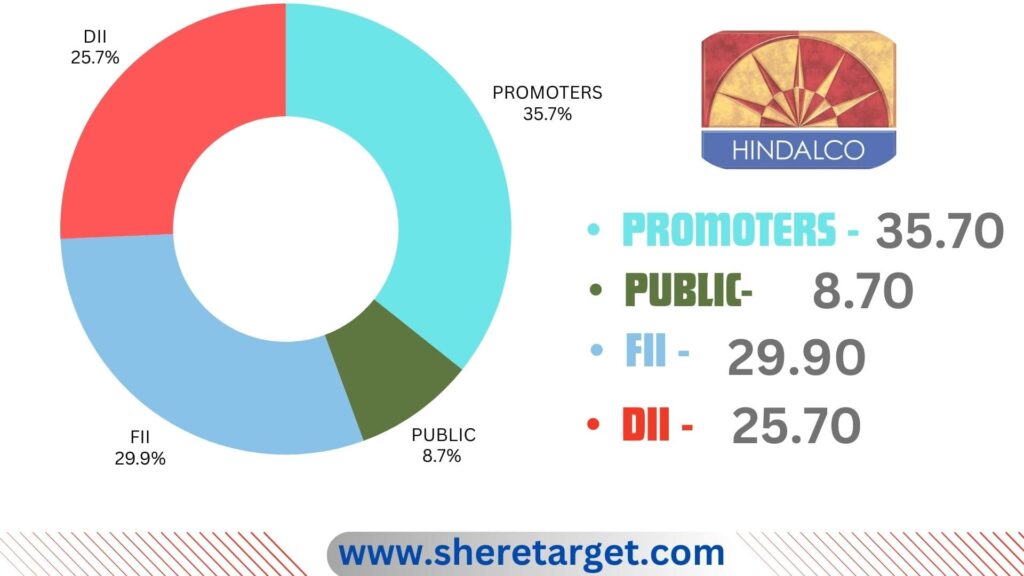

Discussion About Shareholding Pattern Of Hindalco Limited

Hindalco Limited mainly has four types of shareholding patterns: promoter holding, public holding, DII, and FII. We can majorly influence the company’s growth depending on the shareholding pattern.

Promoter Holding

Promoter Holding capacity is the percentage of the share owned by the company’s promoter or the company’s owner. The Promoter Holding Capacity in the company’s share is 35.70%.

Public Holding

Public Holding capacity is the indicator of the percentage that is held by the public rather than the promoters. The public holding capacity of the company’s share is 8.70%.

FII

The full form of FII is Foreign Institutional Investor which invests funds from outside of its home country. The FII investor percentage in the company’s share is 29.90%.

DII

The full form of DII is Domestic Institutional Investor, which means some Indian institutions like mutual funds, insurance companies, and pension funds invest money in the country’s assets. The DII investor percentage in the company’s shares is 25.70%.

Peers Company Of Hindalco Industries Limited

| Company Name | Market Cap (Crore) |

| Hindustan Zinc Limited | ₹2,12,964.56 |

| National Aluminium Company Limited | ₹42,410.95 |

| Hindustan Copper Limited | ₹28,125.49 |

| Gravita India Limited | ₹15,594.72 |

Hindalco Share Price Target Prediction In The Last Few Years

Hindalco Share is on both the Indian Stock Exchange, BSE (Bombay Stock Exchange), and NSE (National Stock Exchange). The last 1 month’s share growth was +38.40 (6.18%), the last 6 month’s share growth was -15.70 (-2.36%), the last 1 year’s share growth was +132.15 (24.80%), the last 5 year’s share growth was +456.75 (219.33%), and the maximum share growth was +620.51 (1,394.72%).

Hindalco Share price return percentage was 5.67% in the last 1 month, the last 1 year’s share price return percentage was 24.26%, the last 3 years’ share price return percentage was 44.48%, and the last 5 years’ share price return percentage was 217.96%. Hindalco Share always gives a good return to investors. If anyone wants to invest in the share, it will be profitable on a long-term basis.

Why Should I Invest In Hindalco Share Right Now?

Positive Sides

- In the last 3 years, the company’s profit growth was very good which was 55.01%.

- The last 3 years’ revenue growth of the company was 24.85%.

- The company has an efficient cash conversion cycle of 37.40 days.

- The company has good cash flow management, and PAT stands at 1.88.

- The company decreased its debt amount by 5,836 crores.

- The company’s FII investor percentage also increased to 29.90%.

- The company’s Sales percentage was good in the last 3 years, which was 25.04%.

Negative Sides

The last 3 years’ ROE percentage was poor, which was 8.01%.

What Is The Future Growth Of Hindalco Industries Limited?

Strength

- The company has a global brand image.

- The company has a well-established distribution network, covering a geographically wide and scattered market.

- The company is a cost-effective producer.

- The R&D team of the company collaborates with universities and other research organizations.

- Recycling in the company should be adopted as a routine production.

Weakness

- The company has strong domestic and global competitors such as TATA, POSCO, MITTLE, etc.

- The company should update its technology compared to the global aluminium industry.

FAQ

What is Hindalco Share Price Target for 2025?

Hindalco Share Price Target 2025 forecast is ₹632.59 to ₹672.62.

What is Hindalco Share Price Target for 2027?

Hindalco Share Price Target 2027 forecast is ₹705.29 to ₹738.62.

What is Hindalco Share Price Target for 2028?

Hindalco Share Price Target 2028 forecast is ₹735.64 to ₹771.64.

What is Hindalco Share Price Target for 2030?

Hindalco Share Price Target 2030 forecast is ₹808.99 to ₹844.51.

What is Hindalco Share Price Target for 2040?

Hindalco Share Price Target 2040 forecast is ₹1,194.17 to ₹1,234.06.

What are the main products of Hindalco Industries Limited?

The main products of Hindalco Industries Limited are Aluminum, and it is also a global leader in flat-rolled products.

What is the old name of Hindalco Limited?

The old name of Hindalco Limited is Hindustan Aluminium Corporation Limited.

Conclusion

This website is written to help the investor gain some basic knowledge about the market strategy of Hindalco Share. For making this blog, we take consultation from expertise and do research about the company. It is expected that the Hindalco Share Price Target will be a good choice to invest in on a long-term basis. The demand for the Aluminium manufacturing sector in India and outside of the country always increases as a result of the company, and the share may increase rapidly.

We try to give an in-depth idea about the share. If you think it is helpful to you, you can share it. If you have any questions, please let us know through the comment box. We will try to reply to your questions and solve your problem. Thanks for visiting this website, and thanks for being with us.

Disclaimer – We are not SEBI-registered advisors. A financial market is always risky to anyone. This website is only for training and educational purposes. So, before investing, we are requested to discuss certified expertise. We will not be responsible for anyone’s profit or loss.