Wipro Share is a bullish trend in the share market. In the time of share ups and downs, you should know all about share details before investing. In is blog, we are going to discuss Wipro Share Price Target 2025, 2027, 2028, 2030, 2040. We try to analysis about the share base in the company’s overall performance.

We also look at the company’s profit growth in the last 5 years, the last 5 years’ sales growth, and the last 5 years’ ROE percentage. Similarly, we also compare the Share growth, the share price return amount of the share has increased or decreased over the last 5 years. We also take advice from experts about which time we should invest in the share, which may be helpful for you also. Let’s have a look at the Wipro Share Price Target from 2025 to 2040.

Overview About Wipro Limited

Wipro Limited is an Indian multinational technology company. The company’s headquarters are situated in Bangalore, Karnataka, and were established in 1945. The company provides information technology, business process services, and consulting services to customers. The company provides services in 168 countries.

Fundamental Analysis Of Wipro Limited

| Company Name | Wipro Limited |

| Market Cap | ₹2,79,305.29 Crore |

| P/B | 4.59 |

| Book Value | ₹61.89 |

| Face Value | ₹2 |

| 52 Week High | ₹324.55 |

| 52 Week Low | ₹225.05 |

| DIV. YIELD | 2.27% |

| P/E | 25.79 |

| ROE | 15.30% |

| ROA | 10.95% |

| Current ratio | 2.75% |

History Of Wipro Share Price Target From The Year 2025 to 2040

| Year | 1st Price Target | 2nd Price Target |

| Wipro Share Price Target 2025 | ₹262.59 | ₹290.61 |

| Wipro Share Price Target 2027 | ₹335.26 | ₹370.39 |

| Wipro Share Price Target 2028 | ₹372.23 | ₹407.82 |

| Wipro Share Price Target 2030 | ₹442.68 | ₹478.95 |

| Wipro Share Price Target 2040 | ₹828.59 | ₹865.92 |

Wipro Share Price Target 2025

Wipro Share Price Target for 2025 forecast may vary from ₹262.59 to ₹290.61.

Wipro Limited is a leading technology services and consulting company that focuses on building innovative solutions for its clients. The company operates in the IT Services and IT Products segments. Under IT Services, it includes digital strategy advisory, custom application design, development, re-engineering, cloud and infrastructure, mobility, hardware, and software design services to enterprises. In February 2002, the company became the first software technology services company in India to be certified for ISO certification.

| Month | Wipro Share Price Target 2025 (1st Price Target) | Wipro Share Price Target 2025 (2nd Price Target) |

| June | ₹262.59 | ₹270.36 |

| July | ₹268.67 | ₹275.23 |

| August | ₹260.91 | ₹270.33 |

| September | ₹267.09 | ₹274.15 |

| October | ₹272.82 | ₹279.90 |

| November | ₹278.86 | ₹284.56 |

| December | ₹282.92 | ₹290.61 |

Also Read – Zee Entertainment Share Price Target

Wipro Share Price Target 2027

Wipro Share Price Target for 2027 forecast may vary from ₹335.26 to ₹370.39.

Wipro Limited serves enterprises in various industries, primarily in the Indian market, comprising the government, defense, IT-enabled services, telecommunications, utilities, manufacturing, and financial services sectors. The company has 17 cyber defense centers, 46 automation platforms and accelerators, 55% Fortune 100 companies, and more than 600 CRS clients across the globe.

| Month | Wipro Share Price Target 2027 (1st Price Target) | Wipro Share Price Target 2027 (2nd Price Target) |

| January | ₹335.26 | ₹342.62 |

| February | ₹340.82 | ₹348.80 |

| March | ₹326.91 | ₹333.18 |

| April | ₹330.95 | ₹339.68 |

| May | ₹337.26 | ₹347.92 |

| June | ₹345.69 | ₹353.37 |

| July | ₹351.02 | ₹359.98 |

| August | ₹357.20 | ₹365.82 |

| September | ₹363.47 | ₹369.61 |

| October | ₹358.91 | ₹365.89 |

| November | ₹362.22 | ₹368.72 |

| December | ₹364.92 | ₹370.39 |

Wipro Share Price Target 2028

Wipro Share Price Target for 2028 forecast may vary from ₹372.23 to ₹407.82.

In the financial year 2023, from the IT segments, the company’s revenue amounted was $11.2 billion, which increased 11.5% compared to the previous year. In the same year, the company’s operating margin percentage was 15.8%, and the operating cash flow by net income percentage was 116%. The company has a strong R&D Department for further improvement in the year 2023. The company’s investment amount was ₹3,678 million in R&D Purposes, which increased 26% compared to the previous year.

| Month | Wipro Share Price Target 2028 (1st Price Target) | Wipro Share Price Target 2028 (2nd Price Target) |

| January | ₹372.23 | ₹378.59 |

| February | ₹375.91 | ₹383.44 |

| March | ₹360.67 | ₹368.82 |

| April | ₹365.89 | ₹372.67 |

| May | ₹369.29 | ₹375.50 |

| June | ₹372.58 | ₹379.92 |

| July | ₹377.28 | ₹386.69 |

| August | ₹384.17 | ₹391.55 |

| September | ₹389.70 | ₹396.62 |

| October | ₹395.28 | ₹402.37 |

| November | ₹401.59 | ₹408.95 |

| December | ₹399.67 | ₹407.82 |

Wipro Share Price Target 2030

Wipro Share Price Target for 2030 forecast may vary from ₹442.68 to ₹478.95.

Wipro Limited continues to invest in building world-class talent areas such as consulting, domain, architects, and cutting-edge technologies such as AI, data sciences, cybersecurity, engineering, and niche areas such as Web3, 5G, quantum computing, etc. The company is also partnered with Microsoft, Google, SAP, AWS, and many other hyperscale partners. The Net Income Turnover amount was 15.26% in the year 2022, which decreased to 12.62% in the year 2023.

| Year | Wipro Share Price Target 2030 |

| 1st Price Target | ₹442.68 |

| 2nd Price Target | ₹478.95 |

Also Read – Cochin Shipyard Share Price Target

Wipro Share Price Target 2040

Wipro Share Price Target for 2040 forecast may vary from ₹828.59 to ₹865.92.

Wipro Engineering Edge expands its capabilities and services in emerging technologies such as cloud, Industry 4.0, IoT, Silicon Design, data, and AI platforms. In recent times, the company has had 185 international offices, and 2 data centers, also has 31 National Offices & 3 data centers. In the financial year 2022-23, the company’s Return on Net Worth percentage was 15.10%, and the profit after tax amount was ₹115 billion. The Gross Utilization percentage was 77.1% in the year 2022, which decreased to 72.9% in the year 2023.

| Year | Wipro Share Price Target 2040 |

| 1st Price Target | ₹828.59 |

| 2nd Price Target | ₹865.92 |

Last Few Years’ Performance Of Wipro Limited

Profit Growth

The profit growth percentage of the company in the last 5 years is described below.

- In the last 5 years, 3.96%

- In the last 3 years, 3.25%

- In the last 1 year, -0.65%

The Net Profit of the company was ₹9,178.96 Crore in March 2023, which decreased to ₹9,119.25 Crore in March 2024. The Operating Profit of the company was ₹ 11,658 Crore in March 2023, which decreased to ₹11,552.41 Crore in March 2024.

Sales Growth

The sales growth percentage of the company in the last 5 years is described below.

- In the last 5 years, 6.98%

- In the last 3 years, 10.01%

- In the last 1 year, -1.43%

The Net Sales amount was ₹16,682.59 Crore in September 2023, which increased to ₹16,901.45 Crore in September 2024, which also increased rapidly.

ROE Percentage

The ROE percentage growth of the company in the last 5 years is described below.

- In the last 5 years, 19.22%

- In the last 3 years, 18.98%

- In the last 1 year, 15.91%

ROCE Percentage

The ROCE percentage growth of the company in the last 5 years is described below, which has also increased rapidly.

- In the last 5 years, 23.56%

- In the last 3 years, 22.85%

- In the last 1 year, 21.01%

Total Expenditure Amount

The company’s total expenditure was ₹13,943.16 Crore in September 2023, which increased to ₹13,635 Crore in September 2024.

Total Assets Amount

The total Assets Amount of the company was ₹85,245.59 Crore in March 2023, which decreased to ₹81,625.39 Crore in March 2024.

The Net Cash Flow Amount

The company’s net cash flow amount was ₹-371.65 Crore in March 2023, which became ₹-737.19 Crore in March 2024.

Other Income Amount

The Other Income amount of the company was ₹2,836.15 Crore in March 2023, which increased to ₹3,179.65 Crore in March 2024.

Peer’s Company Of Wipro Limited

| Company Name | Market Cap (Crore) |

| Tata Consultancy Services Limited | ₹16,05,519.47 |

| Infosys Limited | ₹8,12,149.45 |

| HCL Technologies Limited | ₹5,26,123.36 |

| LTI Mindtree Limited | ₹1,95,732.15 |

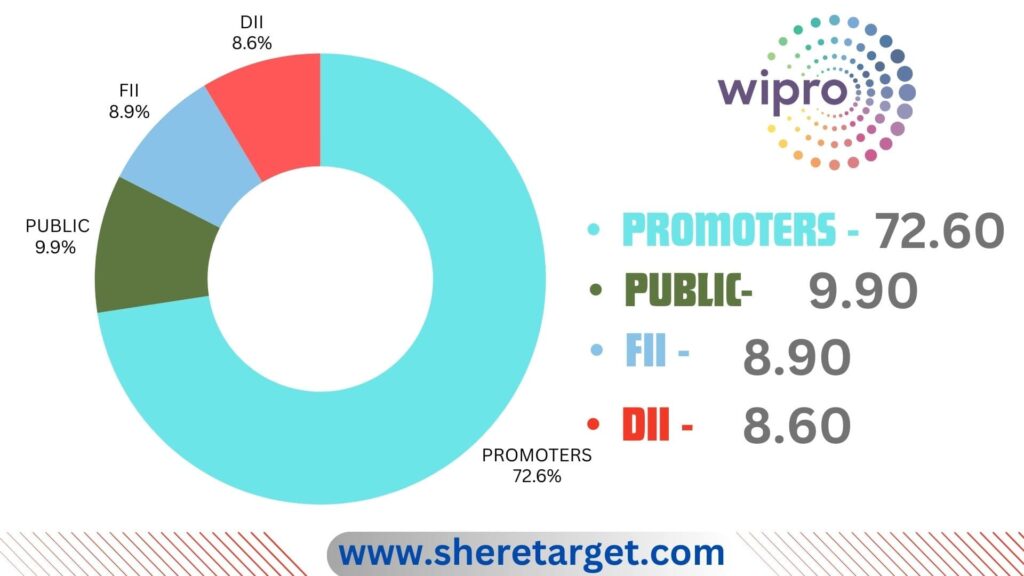

Discussion About Shareholding Pattern Of Wipro Limited

Wipro Limited mainly has four types of shareholding patterns these are Promoter Holding, Public Holding, DII, and FII. Depending on the shareholding pattern, we can majorly influence the company’s growth.

Promoter Holding

Promoter Holding capacity is the percentage of the share owned by the company’s promoter or the company’s owner. The Promoter Holding Capacity in the company’s share is 72.60%.

Public Holding

Public Holding capacity is the indicator of the percentage that is held by the public rather than the promoters. The Public Holding Capacity in the company’s share is 9.90%.

FII

The full form of FII is Foreign Institutional Investor, which invests funds from outside of its home country. The FII investor percentage in the company’s share is 8.90%.

DII

The full form of DII is Domestic Institutional Investor, which means some Indian institutions like mutual funds, insurance companies, and pension funds invest money in the country’s assets. The FII investor percentage in the company’s shares is 8.60%.

The Last Few Years Share Price Updation Of Wipro Share

Wipro Share is on both the Indian Stock Exchange, BSE (Bombay Stock Exchange), and NSE (National Stock Exchange). The last 1 month’s share growth was +21.95 (7.66%), the last 6 month’s share growth was +70.67 (29.70%), the last 1 year’s share growth was +98.40 (46.80%), the last 5 year’s share growth was +186.77 (153.18%), the maximum share growth was +301.80 (4,373.91%).

Wipro Share Price return percentage was 7.78% in the last 1 month, the last 3 month’s share price return percentage was 20.25%, the last 1 year’s share price return percentage was 47.26%, the last 3 year’s share price return percentage was -3.25%, and the last 5 year’s share price return percentage was 158.25%. Wipro Share always gives a good return to investors. If anyone wants to invest in the share, it will be profitable on a long-term basis.

Why Should I Invest In Wipro Share Right Now?

Positive Sides

- The company is virtually debt-free.

- The company has an efficient cash conversion cycle of 156.10.

- The last 3 years’ ROE percentage of the company was very poor, which was 18.98%.

- The last 3 years’ ROCE percentage was very good, which was 22.85%.

- The company has a good promoter holding capacity, which is 72.60%, which means many good investors want to invest in the shares.

Negative Sides

- The last 3 years’ profit growth of the company was very poor, which was -3.25%.

- The company’s last 3-year sales growth was -1.43% in the last 1 year.

What Is The Future Growth Of Wipro Limited?

Strength

- The company has brand recognition.

- The company provides quality products to its customers.

- The company has a strong R&D department, and the company invests a huge amount for more improvement of the company.

- The company has a strong financial background.

- The company is growing in the national and international markets.

- The company has good delivery capabilities and client satisfaction.

- The company also works in the emerging technology areas like Bluetooth, WAP, etc.

Weakness

- The company has many competitors in the domestic market

- As the company is making a profit due to the high exchange rate, if it comes down, it may be a problematic issue for the company’s growth.

- A slowdown in the banking, financial services & insurance sectors may affect the company’s growth.

Also Read – Vedanta Share Price Target

Dividend History Of Wipro Limited

| Year | Dividend Medium | Dividend Amount Per Share |

| 2024 | Interim | ₹1.000 |

| 2023 | Interim | ₹1.000 |

| 2022 | Interim | ₹5.000 |

| 2021 | Interim | ₹1.000 |

| 2020 | Interim | ₹1.000 |

| 2019 | Interim | ₹1.0000 |

FAQ

What is the full form of Wipro?

The full form of Wipro is Western India Palm Refined Oils Limited.

What is the main function of Wipro Limited?

The main function of Wipro Limited is to provide IT solutions and services for the corporate segment in India, offering system integration, network integration, software & hardware solutions, and IT Services.

Who is the CEO of Wipro Limited?

Mr. Srini Pallia is the CEO of Wipro Limited.

What is the Wipro Share Price Target for 2025?

Wipro Share Price Target for 2025 is ₹262.59 to ₹290.61.

What is the Wipro Share Price Target for 2027?

Wipro Share Price Target for 2027 is ₹335.26 to ₹370.39.

What is the Wipro Share Price Target for 2028?

Wipro Share Price Target for 2028 is ₹372.23 to ₹407.82.

What is the Wipro Share Price Target for 2030?

Wipro Share Price Target for 2030 is ₹442.68 to ₹478.95.

What is the Wipro Share Price Target for 2040?

Wipro Share Price Target for 2040 is ₹828.59 to ₹865.92.

Conclusion

This website is written to help the investor gain some basic knowledge about the market strategy of Wipro Shares. For making this blog, we take consultation from experts and do research about the company. It is expected Wipro Share Price Target will be a good choice to invest on a long-term basis. The demand for the technology sector always increases as a result of the company, and the share may increase rapidly.

We try to give an in-depth idea about the share. If you think it is helpful to you, you can share it. If you have any questions, please let us know through the comment box. We will try to reply to your questions and solve your problem. Thanks for visiting this website and thanks for being with us.

Disclaimer – We are not SEBI-registered advisors. A financial market is always risky to anyone. This website is only for training and educational purposes. So, before investing, we are requested to discuss certified expertise. We will not be responsible for anyone’s profit or loss.