APL Apollo Tubes Share is in a bullish trend in the share market. During share ups and downs, you should know all about the share details before investing. In this blog, we are going to discuss the APL Apollo Tubes Share Price Target 2025, 2026, 2028, 2030, and 2035. We will try to analyze the share base in the company’s overall performance.

We also look at the company’s profit growth in the last 5 years, the last 5 years’ sales growth, and the last 5 years’ ROE percentage. Similarly, we also compare the share growth, the share price return, amount whether the share has increased or decreased over the last 5 years. We also take advice from experts about when we should invest in the share, which may be helpful for you. Let’s have a look at the APL Apollo Tubes Share Price Target from 2025 to 2035.

Overview Of APL Apollo Tubes Limited

APL Apollo Tubes Limited is the largest producer of Electric Resistance Welded (ERW) steel pipes and tubes in India, with a capacity to produce more than 25.6 lakh tonnes per annum. It caters extensively to the region and exports to over 20 countries globally. The company’s vast distribution network is spread across India, with warehouses and branch offices in 29 cities.

Fundamental Analysis Of APL Apollo Tubes Limited

| Company Name | APL Apollo Tubes Limited |

| Market Cap | ₹53,396.26 Crore |

| Book Value | ₹112.96 |

| Face Value | ₹2 |

| P/B | 17.9 |

| P/E | 160.02 |

| 52 Week High | ₹1,930.82 |

| 52 Week Low | ₹1,253.06 |

| DIV. YIELD | 0.4% |

| ROE | 16.92% |

| ROA | 8.84% |

| Current Ratio | 1.00 |

Last Few Years’ Performance Of APL Apollo Tubes Limited

Profit Growth

- In the last 5 years, 29.96%

- In the last 3 years, 44.26%

- In the last 1 year, -11.39%

The company’s Net Profit was ₹512.39 Crore in March 2023, which increased to ₹454.96 Crore in March 2024. The company’s Operating Profit was ₹798.06 Crore in March 2023, which decreased to ₹706.59 Crore in March 2024.

Sales Growth

The company’s sales growth percentage over the last 5 years is described below.

- In the last 5 years, 18.29%

- In the last 3 years, 33.26%

- In the last 1 year, -2.96%

The Net Sales amount of the company was ₹3,795.36 Crore in December 2023, which decreased to ₹3,768.23 Crore in March 2024.

ROE Percentage

The ROE percentage growth of the company in the last 5 years is described below.

- In the last 5 years, 17.29%

- In the last 3 years, 22.38%

- In the last 1 year, 16.93%

ROCE Percentage

The ROCE percentage growth of the company in the last 5 years is described below.

- In the last 5 years, 21.59%

- In the last 3 years, 27.95%

- In the last 1 year, 22.59%

Total Expenditure Amount

The company’s Total Expenditure was ₹3,689.29 Crore in December 2024 and decreased to ₹3,559.62 Crore in March 2025.

The Net Cash Flow Amount

The Net Cash Flow amount of the company was ₹7.86 Crore in March 2023, which decreased to ₹-44.59 Crore in March 2024.

APL Apollo Tubes Share Price Target 2025

APL Apollo Tubes Share Price Target 2025 forecast may vary from ₹996.38 to ₹1,064.39.

Influencing Key Factors Of APL Apollo Tubes Share Price Target 2025

- Latest Global Technology First Time In India

- This technology opens a new era in steel tube production. The use of Direct Forming Technology (DFT) was pioneered by APL Apllo in India and is the only company using the high-tech production methodology most elaborately. The DFT system is the result of many years of experience and knowledge in the tube field. This method brings undisputed advantages in terms of flexibility, production capability, and cost reduction.

- Distribution Network

- The company established a vast distribution network with 650 distributors, 40,000 retailers, and 29 warehouses cum branches that gives a country wide presence to its portfolio of over 400 products. It also exports to over 35 countries.

- Acquisition Of High-Margin Product

- APL Apollo is acquiring a stake in Apollo Tricoat Limited, which manufactures Tricoat Tubes. This product is made through the latest galvanization technology, and it has a tri-layer of protective coating – paint, zinc, and UV organic coating. It is eco eco-friendly product which is widely used for electric conduits and appliances, and greenhouses. It is a high-margin product, and it will help APL Apollo Tubes to strengthen its position in the global steel tubes industry.

| Month | APL Apollo Tubes Share Price Target 2025 (1st Price Target) | APL Apollo Tubes Share Price Target 2025 (2nd Price Target) |

| June | ₹996.38 | ₹1,012.29 |

| July | ₹1,010.52 | ₹1,021.37 |

| August | ₹1,019.76 | ₹1,027.03 |

| September | ₹1,026.40 | ₹1,037.15 |

| October | ₹1,035.90 | ₹1,046.92 |

| November | ₹1,045.25 | ₹1,055.37 |

| December | ₹1,054.99 | ₹1,064.39 |

APL Apollo Tubes Share Price Target 2026

APL Apollo Tubes Share Price Target 2026 forecast may vary from ₹1,060.72 to ₹1,128.18.

Influencing Key Factors Of APL Apollo Tubes Share Price Target 2026

- GST

- With 60% of the market being unorganized, GST, hailed as India’s biggest and most notable tax reform, has opened up new opportunities for the company. The advantages of APL that could be capitalized upon are the shift of business from the unorganized segment. The company has close to 15% market share, which could increase going ahead, in the company’s opinion, owing to GST.

- Entry Into New Industries

- The management expects to make inroads into new industries such as Truck & Bus Body, Agricultural Implements, Sports Equipment, Solar Tracking System, etc., led by the acceptance of the superior quality products as a result of the new technology.

- Export Opportunities

- Export markets of Europe, Japan, and the USA hold a strong potential as DFT products are well accepted in these advanced economies. The management is betting on DFT to be a key catalyst in ramping.

| Month | APL Apollo Tubes Share Price Target 2026 (1st Price Target) | APL Apollo Tubes Share Price Target 2026 (2nd Price Target) |

| January | ₹1,060.72 | ₹1,072.09 |

| February | ₹1,069.20 | ₹1,081.92 |

| March | ₹1,054.68 | ₹1,068.35 |

| April | ₹1,065.52 | ₹1,078.86 |

| May | ₹1,075.08 | ₹1,088.31 |

| June | ₹1,082.77 | ₹1,093.26 |

| July | ₹1,094.51 | ₹1,105.02 |

| August | ₹1,104.92 | ₹1,112.67 |

| September | ₹1,087.23 | ₹1,096.27 |

| October | ₹1,094.92 | ₹1,110.90 |

| November | ₹1,108.37 | ₹1,118.03 |

| December | ₹1,116.22 | ₹1,128.18 |

Also Read – JSW Steel Share Price Target

APL Apollo Tubes Share Price Target 2028

APL Apollo Tubes Share Price Target 2028 forecast may vary from ₹1,190.33 to ₹1,275.09.

Influencing Key Factors Of APL Apollo Tubes Share Price Target 2028

- Increasing Product Demand

- Steel pipe and tube manufacturing are among the fastest-growing industries across the globe. India is among the leading ERW steel tubes manufacturing hubs in the world, with domestic demand levels of 10 MTPA. Other countries manufacturing steel pipes and tubes include China, Turkey, Italy, and the US. Demand is led by increased infrastructure construction, the automobile and energy sectors. Domestic EWR pipe industry to grow at 10-12% CAGR through the financial year 2019.

- Customized/Small Orders To Drive Market Share Gains

- Introduction of DFT would enable APL to produce pipes in smaller batches, as low as 10-20 MT, against the traditional requirement of having to process 400- 500 MT before making any changes. Thus, the ability to accept small orders in customized sizes would enable it to be the first to offer its customers the size that just meets their requirement. Having received encouraging responses to customized sizes, the company has already developed 12 new sizes, which APL shall leverage going forward.

- Increasing EBITDA

- The company’s EBITDA amount was ₹2,805 Mn in the fourth quarter of the year 2024, which increased to ₹3,016 Mn in the first quarter of the year 2025.

| Month | APL Apollo Tubes Share Price Target 2028 (1st Price Target) | APL Apollo Tubes Share Price Target 2028 (2nd Price Target) |

| January | ₹1,190.33 | ₹1,201.06 |

| February | ₹1198.26 | ₹1,212.35 |

| March | ₹1,180.73 | ₹1,189.03 |

| April | ₹1,187.62 | ₹1,198.36 |

| May | ₹1,195.06 | ₹1,216.28 |

| June | ₹1,212.95 | ₹1,223.49 |

| July | ₹1,220.19 | ₹1,229.37 |

| August | ₹1,227.62 | ₹1,234.83 |

| September | ₹1,232.06 | ₹1,244.76 |

| October | ₹1,235.57 | ₹1,245.06 |

| November | ₹1,249.14 | ₹1,260.28 |

| December | ₹1,262.37 | ₹1,275.09 |

APL Apollo Tubes Share Price Target 2030

APL Apollo Tubes Share Price Target 2030 forecast may vary from ₹1,342.62 to ₹1,418.06.

Influencing Key Factors Of APL Apollo Tubes Share Price Target 2030

- Front Runner For Steel For Green

- APL Apollo Tubes is the first company to innovate readymade doorframes, fences, planks, and handrails as Steel for Green concept, which replaced conventional wood application in building construction. The company’s products are saving 250,000 trees every year. Going forward, the company will be saving more and more trees to keep the planet greener. The company’s innovation narrow and thicker color-coated galvanized sheet, which will save more trees.

- Enreached Presence

- Over the years, the company has worked untiringly to entrench its presence in Tier B & C towns. Essentially, because these smaller towns are proven drivers of India’s economy, even in the time of COVID-19. The company is looking to add about 20% of its existing dealer strength in the financial year 2022 in East India to establish a meaningful presence in this market.

- Powerful Brand

- The APL Apollo Tubes brand enjoys a very strong recall due to the company’s intelligent branding strategy, which involves investing in national-level, mass-appealing sporting events and onboarding Amitabh Bachchan as the brand ambassador. A survey covering more than 800 dealers revealed that approximately 30% of their customers requested the APL Apollo brand. Brand investments are expected to intensify as the product segments and range expand.

| Year | APL Apollo Tubes Share Price Target 2030 |

| 1st Price Target | ₹1,342.62 |

| 2nd Price Target | ₹1,418.06 |

APL Apollo Tubes Share Price Target 2035

APL Apollo Tubes Share Price Target 2035 forecast may vary from ₹1,788.25 to ₹1,856.92.

Influencing Key Factors Of APL Apollo Tubes Share Price Target 2035

- Assured Liquidity

- The credit shift in the terms of sale from credit to cash augurs well for the company. For two reasons, it becomes a zero-debt company, and it funds its capex requirements through internal funds. The combination is expected to accelerate cash generation. This could lead to a re-rating of the company on the bourses.

- Airport Creation

- The government had announced the creation of 100 additional airports in India by the year 2024. The majority of these airports are located in Tier 1 and 2 cities to strengthen connectivity. While a few airports have commenced operations, some others are under construction. These large projects provide considerable growth opportunities for structural steel players.

- Value Driven Growth

- Developed colour Coated Tubes and 500 sq Columns – pioneering products for the Indian market, decided to merge Apollo Tricoat into APL Apollo, which premises to enhance the value-added project portfolio of APL Apollo considerably.

| Year | APL Apollo Tubes Share Price Target 2035 |

| 1st Price Target | ₹1,788.25 |

| 2nd Price Target | ₹1,856.92 |

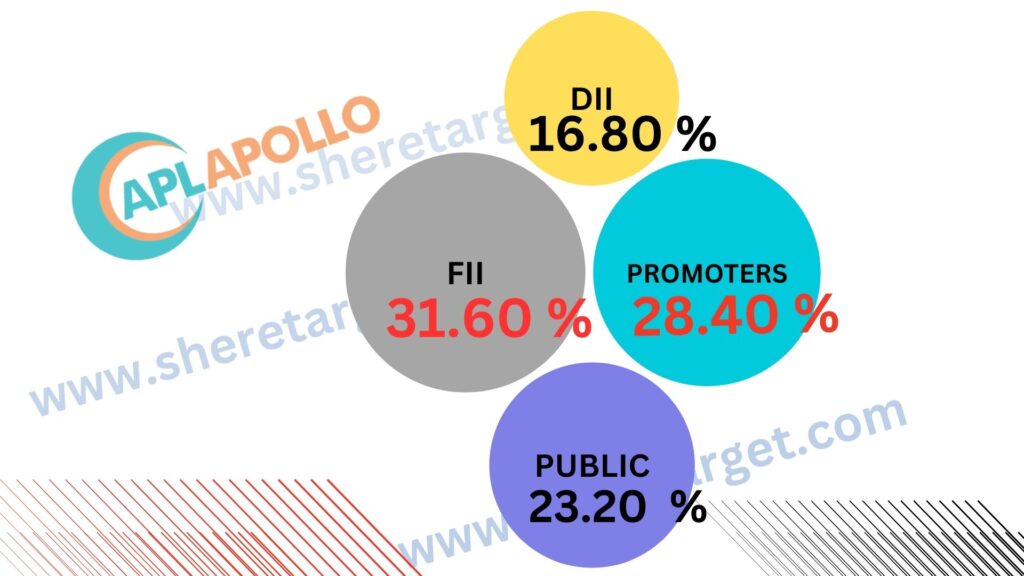

Discussion About Shareholding Pattern Of APL Apollo Tubes Limited

APL Apollo Tubes Limited mainly has four types of shareholding patterns, such as promoter holding, public holding, DII, and FII. Depending on the shareholding pattern, we can majorly influence the company’s growth.

| Investor Type | Percentage |

| Promoter Holding (Owned by the company’s promoter) | 28.40% |

| Public Holding (Held by the public) | 23.20% |

| FII (Invest by Foreign Institutional Investor) | 31.60% |

| DII (Invest money by Domestic Institutional Investor) | 16.80% |

Peer Company Of APL Apollo Tubes Limited

| Company Name | Market Cap (Crore) |

| Azad India Mobi | ₹522.06 |

| Beekay Steel | ₹1,010.26 |

| Cosmic CRF | ₹1,285.92 |

| DEE Development | ₹1,922.38 |

| Gallantt Ispat | ₹1,840.27 |

What Is The Expert Advice About The Investment In APL Apollo Tubes Share

Positive Sides

- In the last 3 years, the company has shown a good profit growth, which was 44.26%.

- In the last 3 years, the company has shown a good revenue growth which was 32.59%.

- The company has significantly decreased its debt amount by ₹367.29 Crore.

- In the last 3 year’s the company has been maintaning a good ROE ratio, which was 22.38%.

- In the last 3 year’s company’s ROCE percentage was good, which was 27.26%.

- The company has a healthy interest cover ratio of 13.69.

- The company has an efficient cash conversion cycle of -10.15 days.

- The company has good cash flow management, PAT stands at 1.87.

- In the last 3 years, the company’s Sales Growth was very good, which was 33.26%.

Negative Sides

- The company is trading at a high PE of 160.02.

- The company is trading at a high EBITDA of 87.01.

The Last Few Years’ Share Price Updation Of APL Apollo Tubes Share

APL Apollo Tubes Share always gives good returns to investors, which is described in the portion below.

- The last 1month’s share growth was +258.70 (15.58%).

- The last 6 months’ share growth was +305.40 (18.89%).

- The last 1 year’s share growth was +292.20 (17.93%).

- The last 5 years’ share growth was +1,762.08 (1,101.85%).

- Maximum share growth was +1,907.94 (13,569.99%).

- APL Apollo Tubes share price return percentage was 19.05% in the last 1 month.

- The last 3 months’ share price return percentage was 31.92%.

- The last 1 year’s share price return percentage was 22.59%.

- The last 3 years’ share price return percentage was 97.68%.

- The last 5 years’ share price return percentage was 1,071.18%.

Also Read – Tata Steel Share Price Target

Risk Factors Of APL Apollo Tubes Limited

- Volatility In Steel Prices

- As the raw material cost (mainly HRC and Zinc) forms 85% of total sales, product demand and margins are directly affected due to volatility in steel prices. An increase in prices may affect demand as consumers can alter their purchases, whereas a sharp decline in steel prices may lead to inventory loss.

- Borrowings

- The company is continuously increasing its borrowings, which can be a point of concern for the investors.

- Capital Allocation

- APL Apollo Tubes Limited, through its wholly owned subsidiary Shree Udyod Limited, is acquiring a stake in Rahul Gupta’s company, which is Apollo Tricoat Tubes Limited.

- Replacement Market

- There is a shift from galvanized pipes to PVC tubes are increasingly being used in Agriculture, Infrastructure, Construction, and Sewage sectors as a replacement for galvanized pipes. They are less costly and lightweight. It does not require much manpower and is easy to install.

FAQ

What is the APL Apollo Tubes Share Price Target for 2025?

APL Apollo Tubes Share Price Target for 2025 is ₹996.38 to ₹1,064.39.

What is the APL Apollo Tubes Share Price Target for 2026?

APL Apollo Tubes Share Price Target for 2026 is ₹1,060.72 to ₹1,128.18.

What is the APL Apollo Tubes Share Price Target for 2028?

APL Apollo Tubes Share Price Target for 2028 is ₹1,190.33 to ₹1,275.09.

What is the APL Apollo Tubes Share Price Target for 2030?

APL Apollo Tubes Share Price Target for 2030 is ₹1,342.62 to ₹1,418.06.

What is the APL Apollo Tubes Share Price Target for 2035?

APL Apollo Tubes Share Price Target for 2035 is ₹1,788.25 to ₹1,856.92.

Conclusion

This website is written to help the investor gain some basic knowledge about the market strategy of APL Apollo Tubes Share. For making this blog, we take consultation from experts and research the company. It is expected that the APL Apollo Tubes Share Price Target will be a good choice to invest in on a long-term basis. The demand for the still manufacturer sector in India and outside of the country always increases, as a result of which the company and its share may increase rapidly.

We try to give an in-depth idea about the share. If you think it is helpful to you, you can share it. If you have any questions, please let us know through the comment box. We will try to reply to your questions and solve your problem. Thanks for visiting this website and thanks for being with us.

Disclaimer – We are not SEBI-registered advisors. A financial market is always risky to anyone. This website is only for training and educational purposes. So, before investing, we are requested to discuss certified expertise. We will not be responsible for anyone’s profit or loss.