TVS Motor Share is a bullish trend in the share market. During share ups and downs, you should know all about the share details before investing. In this blog, we are going to discuss TVS Motor Share Price Target 2025, 2027, 2028, 2030, 2040. We will try to analyze the share base in the company’s overall performance.

We also look after the company’s profit growth in the last 5 years, the last 5 year’s sales growth, and the last 5 years’ ROE percentage similarly we also compare the TVS Motor Share growth, the share price return amount of the share become increasing or decreased through the last 5 year’s. We also take advice from experts about which time we should invest in the share, which may be helpful for you also. Let’s have a look at the TVS Motor Share Price Target from 2025 to 2040.

Overview Of Tata Motor Limited

TVS Motor Limited was established in the year 1911. The headquarters of the company is situated in Chennai, Tamil Nadu, India. The company is an Indian multinational motorcycle manufacturing company. The company is also the second-largest two-wheeler exporter in India, with exports to over 80 countries in India. The company mainly manufactures two-wheelers, three-wheelers, and automobile parts. The company has a total of 4 places to manufacture two-wheelers and 1 three-wheeler manufacturing plant in India.

Fundamental Analysis Of Tata Motor Limited

| Company Name | Tata Motors Limited |

| Market Cap | ₹1,32,526.85 Crore |

| Book Value | ₹210.38 |

| Face Value | ₹1 |

| 52 Week High | ₹2,958 |

| 52 Week Low | ₹2,171.40 |

| DIV. YIELD | 0.37% |

| P/E | 49.25 |

| P/B | 13.34 |

| ROE | 30.24% |

TVS Motor Share Price Target 2025

TVS Motor Share Price Target 2025 forecast may vary from ₹2,715.89 to ₹2,921.64

TVS Motor Limited also expanded its Sales Amount, which was ₹16,780.21 Crore in March 2021, and increased to ₹20,810.54 Crore in March 2022. The company mainly manufactures scooters TVS Jupiter, TVS Jupiter 125, TVS Zest 110, etc. The company’s product is present now in 3800 cities. The tax amount of the company was ₹513.26 Crore in March 2023, which increased to ₹698.52 Crore in March 2024.

| Month | TVS Motor Share Price Target 2025 (1st Price Target) | TVS Motor Share Price Target 2025 (2nd Price Target) |

| June | ₹2,715.89 | ₹2,798.37 |

| July | ₹2,795.46 | ₹2,826.29 |

| August | ₹2,824.98 | ₹2,847.21 |

| September | ₹2,845.19 | ₹2,869.49 |

| October | ₹2,865.74 | ₹2,887.08 |

| November | ₹2,885.33 | ₹2,903.16 |

| December | ₹2,901.55 | ₹2,921.64 |

Also Read – Voltas Share Price Target

TVS Motor Share Price Target 2027

TVS Motor Share Price Target 2027 forecast may vary from ₹3,185.26 to ₹3,387.68.

Recently, the company launched the Victor and Fiero-F 2 models. The company also plans a major foray into the three-wheeler and quadricycles market through fresh investments of ₹500 Crores. The company also launched the TVS Centra 125 cc TVS Victor GLX, and four-stroke Max in the pipeline. The company is also looking to set up manufacturing units in Indonesia or Vietnam.

| Month | TVS Motor Share Price Target 2027 (1st Price Target) | TVS Motor Share Price Target 2027 (2nd Price Target) |

| January | ₹3,185.26 | ₹3,202.32 |

| February | ₹3,201.47 | ₹3,232.61 |

| March | ₹3,215.30 | ₹3,235.05 |

| April | ₹3,230.16 | ₹3,263.50 |

| May | ₹3,259.72 | ₹3,270.29 |

| June | ₹3,268.49 | ₹3,287.99 |

| July | ₹3,285.18 | ₹3,298.18 |

| August | ₹3,295.77 | ₹3,321.49 |

| September | ₹3,319.20 | ₹3,343.65 |

| October | ₹3,340.38 | ₹3,355.38 |

| November | ₹3,353.19 | ₹3,368.27 |

| December | ₹3,365.77 | ₹3,387.68 |

TVS Motor Share Price Target 2028

TVS Motor Share Price Target 2028 forecast may vary from ₹3,385.45 to ₹3,568.61.

TVS Motor Limited has an annual 3-wheeler production capacity of more than 240,000 units, and the company has a 2-wheeler production capacity of 4.96 million units. The company has an annual sales rate of more than 3 million units. In the financial year 2024-25, the company has consolidated revenue of ₹391.5 billion. The company has more than 50 million customers overall in India.

| Month | TVS Motor Share Price Target 2028 (1st Price Target) | TVS Motor Share Price Target 2028 (2nd Price Target) |

| January | ₹3,385.45 | ₹3,405.23 |

| February | ₹3,404.19 | ₹3,417.39 |

| March | ₹3,380.28 | ₹3,393.22 |

| April | ₹3,389.60 | ₹3,408.67 |

| May | ₹3,405.32 | ₹3,427.37 |

| June | ₹3,425.84 | ₹3,447.46 |

| July | ₹3,445.28 | ₹3,469.71 |

| August | ₹3,467.50 | ₹3,489.36 |

| September | ₹3,487.90 | ₹3,505.63 |

| October | ₹3,503.33 | ₹3,524.91 |

| November | ₹3,522.19 | ₹3,548.69 |

| December | ₹3,545.72 | ₹3,568.61 |

TVS Motor Share Price Target 2030

TVS Motor Share Price Target 2030 forecast may vary from ₹3,925.17 to ₹4,274.32.

In the year 1980, TVS 50, India’s first two-seater moped rolled out of the factory at Hosur in Tamil Nadu, India. In the year 2001, after parting ways with Suzuki, the company was renamed TVS Motor. In the year 2017, the company launched its most-awaited motorcycle, the Apache RR 310. In the year 2020, the company acquired Norton Motorcycle Company. In Nepal, the company also has an official distributor named Jagdamba Motors Pvt. Limited.

| Year | TVS Motor Share Price Target 2030 |

| 1st Price Target | ₹3,925.17 |

| 2nd Price Target | ₹4,274.32 |

TVS Motor Share Price Target 2040

TVS Motor Share Price Target 2040 forecast may vary from ₹7,475.29 to ₹7,785.69.

Three-wheeler sales have grown at a CAGR of 7% over the last 9 years which increasing to 2.27 lakh units in the financial year 2003. TVS Motor Limited is expected to roll out its first three-wheeler by the financial year 2005 to garner a 30% market share with around 100,000 unit sales by the end of the year 2008. The last 10 years’ Stock Price CAGR percentage is described portion below.

- 10 Years 21.34%

- 5 Years 4.12%

- 3 Years -16.01%

- 1 Year -42.75%

| Year | TVS Motor Share Price Target 2040 |

| 1st Price Target | ₹7,475.29 |

| 2nd Price Target | ₹7,785.69 |

TVS Motor Share Price Target Prediction In The Last Few Years

For the last few years, TVS Motor Share has increased rapidly. The last 6 month’s share growth was +517.40 (26.14%), the last 1 month’s share growth was -140.85 (-5.34%), the last 1 year’s share growth was +886.50 (55.05%), the last 5 year’s share growth was +2,044.60 (451.95%) and the maximum share growth was +2,485.80 (22,195.36%).

TVS Motor Share Price return percentage was -5.76% for the last 1 month, the last 3 months’ share price return percentage was -3.69%, the last 1 year’s share price return percentage was 55.10%, the last 3 year’s share price return percentage was 250.85%, the last 5 year’s share price return percentage was 454.01%. TVS Motor Share always gives good returns to investors. If anyone wants to invest in the share it will be profitable on a long-term basis.

The Few Years’ Performance Of Tata Motor Limited

Profit Growth

The company’s last 5 years’ profit growth percentage is described in the portion below.

- In the last 5 years, 25.96%

- In the last 3 years, 50.47%

- In the last 1 year, 40.1%

The Net Profit growth of the company was ₹1,499.56 Crore in March 2023, which increased to ₹2,096.23 Crore in March 2024. The Operating Profit of the company was ₹2,689.52 Crore in March 2023, which increased to ₹3,485.23 Crore in March 2024.

Sales Growth

The company’s last 5 years’ profit growth percentage is described in the portion below.

- In the last 5 years, 11.96%

- In the last 3 years, 24.01%

- In the last 1 year, 20.98%

The Net Sales amount of the company was ₹26,380.63 Crore in March 2023 which increased to ₹31,778.52 Crore in March 2024.

ROE Percentage

The company’s last 5 years’ ROE percentage is described below.

- In the last 5 years, 22.10%

- In the last 3 years, 25.99%

- In the last 1 year, 30.52%

ROCE Percentage

The company’s last 5 years’ ROCE percentage is described below.

- In the last 5 years, 24.52%

- In the last 3 years, 29.01%

- In the last 1 year, 33.96%

Total Assets Amount

The Total Assets amount was ₹13,999.25 Crore in March 2023 which increased to ₹16,123.63 Crore in March 2024.

Total Liabilities

The Total Liabilities of the company were ₹13,994.52 Crore in March 2023, which increased to ₹16,145.22 Crore in March 2024.

Total Expenditure Amount

The Total Expenditure of the company was ₹23,704.65 Crore in March 2023 which increased to ₹28,296.74 Crore in March 2024.

Net Cash Flow Amount

The Net Cash Flow amount of the company was ₹-94.85 Crore in March 2023 which increased to ₹252.12 Crore in March 2024.

Other Income Amount

The Other Income amount of the company was ₹100.59 Crore in March 2023 which increased to ₹178.63 Crore in March 2024.

Also Read – Cochin Shipyard Share Price Target

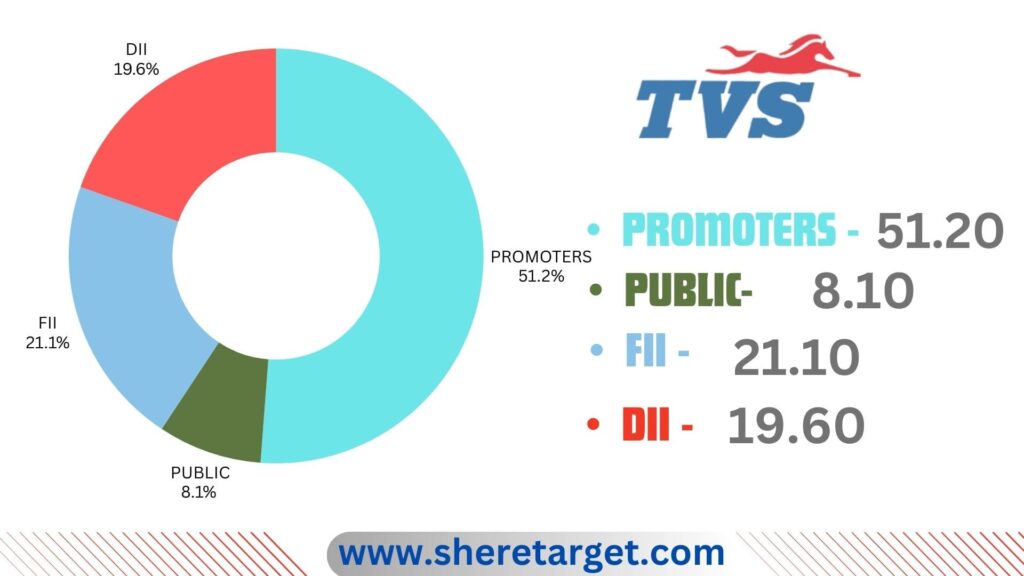

Discussion About Shareholding Pattern Of TVS Motor Limited

TVS Motor Limited mainly has four types of shareholding patterns, such as promoter holding, public holding, DII, and FII. We can majorly influence the company’s growth depending on the shareholding pattern.

Promoter Holding

Promoter Holding capacity is the percentage of the share owned by the company’s promoter or the company’s owner. The Promoter Holding Capacity in the company’s share is 51.20%.

Public Holding

Public Holding capacity is the indicator of the percentage that is held by the public rather than the promoters. The public holding capacity of the company’s share is 8.10%.

FII

The full form of FII is Foreign Institutional Investor, which invests funds from outside of its home country. The FII investor percentage in the company’s shares is 21.10%.

DII

The full form of DII is Domestic Institutional Investor, which means some Indian institutions like mutual funds, insurance companies, and pension funds invest money in the country’s assets. The DII investor percentage in the company’s shares is 19.60%.

Peer’s Company Of TVS Motor Limited

| Company Name | Market Cap (Crore) |

| Atul Auto | ₹1,710.50 |

| Hero Motocorp | ₹97,912.65 |

| Bajaj Auto | ₹280,652.98 |

| Scooters India | ₹688.23 |

Should I Invest In TVS Motor Share Right Now?

Positive Sides

- The last 3 years’ profit growth of the company was very good, which was 50.47%.

- The last 3 years’ revenue growth was good, 24.01%.

- In the last 3 years, the ROE percentage of the company was 25.99%.

- In the last 3 years, ROCE percentage was good, which was 29.01%.

- The company has an efficient cash conversion cycle of -43.96 days.

- The company has good cash flow management, and PAT stands at 1.96.

- The company also decreased the debt amount by 732.12 Crore, and the company has a healthy interest cover ratio of 16.32.

- The company has a good promoter holding capacity, which is 51.20%.

Negative Sides

- The company has a high trading PE ratio, which is 50.89.

- The Global Economic crisis may affect the company’s growth.

- The company has some debt.

What Is The Future Growth Of TVS Motor Limited

Strength

- ‘Scotty’ as a company brand has become a second name for the Scotty rate segment.

- The company also planned to launch and expand its network of dealers will help the company consolidate its gains.

- The company always tries to improve its R&D department for further improvement and to innovate new products.

- The export of the bikes is limited, which is an untapped international market.

- The company also has a good number of service centers.

Weakness

- The company has strong competitors in the Indian and international markets.

- Increasing fuel prices may affect the company’s growth.

- Any changes in government policies may affect the company’s growth.

- A better transport system may decrease the sales of two-wheelers.

Also Read – Ambuja Cement Share Price Target

FAQ

Who is the CEO of TVS Motor Limited?

Mr. K N Radhakrishnan is the CEO of TVS Motor Limited.

What is the TVS Motor Share Price Target for 2024?

TVS Motor Share Price Target for 2024 is ₹2,095.85 to ₹2,456.79.

What is the TVS Motor Share Price Target for 2025?

TVS Motor Share Price Target for 2025 is ₹2,715.89 to ₹2,921.64.

What is the TVS Motor Share Price Target for 2027?

TVS Motor Share Price Target for 2027 is ₹3,185.26 to ₹3,387.68.

What is the TVS Motor Share Price Target for 2028?

TVS Motor Share Price Target for 2028 is ₹3,385.45 to ₹3,568.61.

What is the TVS Motor Share Price Target for 2030?

TVS Motor Share Price Target for 2030 is ₹3,925.17 to ₹4,274.32.

What is the TVS Motor Share Price Target for 2040?

TVS Motor Share Price Target for 2040 is ₹7,475.29 to ₹7,785.69.

Conclusion

This website is written to help the investor gain some basic knowledge about the market strategy of TVS Motor Share. For making this blog, we take consultation from experts and do research about the company. It is expected that the TVS Motor Share Price Target will be a good choice to invest in on a long-term basis. The motorcycle manufacturing sectors in India and outside of the country are always increasing as a result of the company, and the share may increase rapidly.

We try to give an in-depth idea about the share. If you think it is helpful to you can share it. If you have any questions, please let us know through the comment box. We will try to reply to your questions and solve your problem. Thanks for visiting this website and thanks for being with us.

Disclaimer – We are not SEBI-registered advisors. A financial market is always risky to anyone. This website is only for training and educational purposes. So before investing, we are requested to discuss certified expertise. We will not be responsible for anyone’s profit or loss.