JSW Steel Share is in a bullish trend in the share market. During share ups and downs, you should know all about the share details before investing. In this blog, we are going to discuss the JSW Steel Share Price Target 2025, 2026, 2028, 2030, and 2035. We will try to analyze the share base in the company’s overall performance.

We also look at the company’s profit growth in the last 5 years, the last 5 years’ sales growth, and the last 5 years’ ROE percentage. Similarly, we also compare the share growth, the share price return, amount whether the share has increased or decreased over the last 5 years. We also take advice from experts about when we should invest in the share, which may be helpful for you. Let’s have a look at the JSW Steel Share Price Target from 2025 to 2035.

Overview Of JSW Steel Limited

JSW Steel Limited is an Indian multinational steel producer based in Mumbai and is a flagship company of the JSW Group. After the merger of Bhushan Power & Steel, Ispat Steel, and Jindal Vijayanagar Steel Limited, JSW Steel became India’s second-largest private sector steel company. The company was established in the year 1982.

Fundamental Analysis Of JSW Steel Limited

| Company Name | JSW Steel Limited |

| Market Cap | ₹2,38,173.95 Crore |

| P/B | 2.98 |

| P/E | 41.26 |

| Book Value | ₹327.62 |

| Face Value | ₹1 |

| 52 Week High | ₹1,075.59 |

| 52 Week Low | ₹854.35 |

| DIV. YIELD | 0.29% |

| ROA | 4.50% |

| ROE | 11.69% |

| Current Ratio | 0.89% |

JSW Steel Share Price Target 2025

JSW Steel Share Price Target 2025 forecast may vary from ₹965.38 to ₹1025.33.

Influencing Key Factors Of JSW Steel Share Price Target 2025

- Infrastructure of The Company

- JSW Steel Limited is one of India’s leading integrated and geographically diverse steel manufacturers. The company’s goal is to partner in India’s growth story by supplying steel for vital infrastructure projects, providing value-added steel solutions through innovation, while investing in sustainability and improving the well-being of the broader community. In the year 2024, the company’s domestic crude steel manufacturing capacity was 28.9 MTPA.

- Partnering In India’s High-Speed RAIL Journey

- JSW Steel also contributes significantly to India’s energy sector, providing materials for solar and wind energy projects. The company’s high-performance steel products are integral to constructing roubst and efficient energy facilities that aid the nation’s shift to sustainable energy sources.

- Making Vehicles Safer and Efficient

- To support India’s growing infrastructure needs, JSW Steel supplies high-strength steel for the construction of highways and bridges. The company’s materials enhance the durability and safety of these essential transportation links, facilitating economic growth and connectivity across regions.

| Month | JSW Steel Share Price Target 2025 (1st Price Target) | JSW Steel Share Price Target 2025 (2nd Price Target) |

| June | ₹965.38 | ₹972.64 |

| July | ₹970.26 | ₹979.92 |

| August | ₹976.55 | ₹982.03 |

| September | ₹980.62 | ₹993.96 |

| October | ₹992.41 | ₹1,002.26 |

| November | ₹1,001.28 | ₹1,012.35 |

| December | ₹1,011.80 | ₹1025.33 |

JSW Steel Share Price Target 2026

JSW Steel Share Price Target 2026 forecast may vary from ₹1020.68 to ₹1,076.36.

Influencing Key Factors Of JSW Steel Share Price Target 2026

- Supporting Nuclear Power Initiatives

- The company’s specialty steel products are critical in constructing extensive water, oil & gas pipelines. These high-durability materials ensure the integrity and longevity of pipelines, which are crucial for the nation’s resource distribution network.

- Setting The Stage For Transformative Growth

- As JSW Steel, the company focuses on end-to-end digital transformation across the company’s operations from mining to logistics. The company stands on the cusp of multideadal opportunities, and the company leveraging the power of digitalisation and data analytics to improve decision-making, increase productivity, enhance operational efficiency, strengthen systems and processes, and make the workplaces safer.

- Marketing

- The company’s digital engagement project utilises omnichannel capabilities and AI-driven automation to refine lead management and personalise customer integrations. This includes the integration of AI chatbots and automated lead enrichment processes, enhancing customer satisfaction and sales efficiency.

| Month | JSW Steel Share Price Target 2026 (1st Price Target) | JSW Steel Share Price Target 2026 (2nd Price Target) |

| January | ₹1020.68 | ₹1,029.44 |

| February | ₹1,027.22 | ₹1,036.80 |

| March | ₹978.36 | ₹984.03 |

| April | ₹982.60 | ₹990.55 |

| May | ₹989.50 | ₹999.32 |

| June | ₹997.26 | ₹1,012.91 |

| July | ₹1,008.16 | ₹1,018.32 |

| August | ₹1,017.06 | ₹1,029.36 |

| September | ₹1,025.93 | ₹1,039.62 |

| October | ₹1,037.28 | ₹1,050.13 |

| November | ₹1,049.65 | ₹1,062.83 |

| December | ₹1,058.21 | ₹1,076.36 |

Also Read – Rama Steel Share Price Target

JSW Steel Share Price Target 2028

JSW Steel Share Price Target 2028 forecast may vary from ₹1,115.29 to ₹1,206.82.

Influencing Key Factors Of JSW Steel Share Price Target 2028

- Mining

- The ‘Pit to Plant’ logistics managment system, featuring RFID-based vehicle authorisation and automated weighbridge operations, has reduced truck turnaround times by 51%. This increase in efficiency ensures the timely delivery of raw materials to the plant, optimising the company’s mining operations.

- Robust Financial Profit and Strong Credit Ratings

- JSW Steel employs a disciplined approach to financial managment and capital allocation. The company has maintained a healthy balance sheet with a net debt-to-equity ratio of 0.93x and a net debt-to-equity to EBITDA ratio of 2.62x, supported by ₹12,591 Crore in cash and cash equivalents. The company’s solid financial management is validated by favourable international and domestic credit ratings, ensuring well-positioned for future growth.

- Revenue From Operation

- The company’s revenue increased by 5.6% every year. The company’s revenue was ₹1,66,965 Crore in the year 2023, which increased to ₹1,76,009 Crore in the year 2024. The company’s CAGR was 19.0% in the last 5 years.

| Month | JSW Steel Share Price Target 2028 (1st Price Target) | JSW Steel Share Price Target 2028 (2nd Price Target) |

| January | ₹1,115.29 | ₹1,126.60 |

| February | ₹1,124.28 | ₹1,136.16 |

| March | ₹1,134.09 | ₹1,145.25 |

| April | ₹1,142.85 | ₹1,154.90 |

| May | ₹1,149.60 | ₹1,157.25 |

| June | ₹1,155.08 | ₹1,150.32 |

| July | ₹1,148.64 | ₹1,160.25 |

| August | ₹1,158.36 | ₹1,166.29 |

| September | ₹1,164.05 | ₹1,179.26 |

| October | ₹1,178.20 | ₹1,186.20 |

| November | ₹1,183.92 | ₹1,194.35 |

| December | ₹1,192.18 | ₹1,206.82 |

JSW Steel Share Price Target 2030

JSW Steel Share Price Target 2030 forecast may vary from ₹1,302.48 to ₹1,393.06.

Influencing Key Factors Of JSW Steel Share Price Target 2030

- Growth Potential In Domestic Steel Demand

- India is the second-largest producer and consumer of crude steel globally and currently has an installed capacity of 175 MTPA. The National Steel Policy (2017) aims to increase this capacity to 300 MTPA by the financial year 2023-31. Moreover, India’s per capita finished steel consumption remains below the global average, suggesting significant growth potential in demand.

- Government Infrastructure Initiatives

- JSW Steel has become a preferred supplier, providing high-strength TMT Bars, HR Plates, and LRPC, significantly contributing to the construction of these vital development projects across the country. Key projects, including the development of new highways, ports, and urban infrastructure under initiatives like the National Infrastructure Pipeline and Gati Shakti Plan, are expected to consume vast quantities of steel.

- Lease Expiries And Auction Dynamics

- The upcoming expiry of numerous iron ore leases by the financial year 2030 is set to reshape the steel industry. To secure new leases, companies must navigate government auctions, positioning themselves as advantageous strategic investments and alliances. JSW Steel is looking forward to securing raw materials requirements by participating in the Government auctions of iron ore and acquiring strategically important iron ore mines.

| Year | JSW Steel Share Price Target 2030 |

| 1st Price Target | ₹1,302.48 |

| 2nd Price Target | ₹1,393.06 |

JSW Steel Share Price Target 2035

JSW Steel Share Price Target 2035 forecast may vary from ₹1,862.09 to ₹1,954.27.

Influencing Key Factors Of JSW Steel Share Price Target 2035

- Expansion Of Green Steel Production

- JSW Steel is investing in green steel production by exploring the use of green hydrogen and implementing carbon capture, utilisation, and storage technologies to reduce its carbon footprint and meet sustainability goals. The company also holds a WBCSD membership, is part of the Responsible Steel initiative, and has been a Worldsteel champion six times in a row.

- Overseas Operations

- The company has steelmaking assets consisting of a 1.5 MNTP Electric Arc Furnace, a 2.8 MNTPA continuous slab caster, and a 3.0 MNTPA hot strip mill at Mingo Junction, Ohio, in the USA. Further, the Baytown facility in the USA has a 1.2 MTPA plate mill and a 0.55 MNTPA pipe mill. The facility is located near a port and is close to key customers in the oil and gas industry. JSW Steel plate and pipe mill is in the process of modernizing the existing facilities at Baytown.

| Year | JSW Steel Share Price Target 2035 |

| 1st Price Target | ₹1,862.09 |

| 2nd Price Target | ₹1,954.27 |

Last Few Years’ Performance Of JSW Steel Limited

Profit Growth

- In the last 5 years, -0.26%

- In the last 3 years, -1.56%

- In the last 1 year, 63.29%

The company’s Net Profit was ₹4,968.32 Crore in March 2023, which increased to ₹8,065.23 Crore in March 2024. The company’s Operating Profit was ₹15,168 Crore in March 2023, which increased to ₹21,999 Crore in March 2024.

Sales Growth

The company’s sales growth percentage over the last 5 years is described below.

- In the last 5 years, 11.89%

- In the last 3 years, 25.31%

- In the last 1 year, 2.72%

The Net Sales amount of the company was ₹1,13,725 Crore in March 2023, which increased to ₹1,35,186 Crore in March 2024.

ROE Percentage

The ROE percentage growth of the company in the last 5 years is described below.

- In the last 5 years, 16.95%

- In the last 3 years, 16.82%

- In the last 1 year, 11.89%

ROCE Percentage

The ROCE percentage growth of the company in the last 5 years is described below.

- In the last 5 years, 15.96%

- In the last 3 years, 18.20%

- In the last 1 year, 15.12%

Total Expenditure Amount

The company’s Total Expenditure was ₹27,402.26 Crore in December 2024 and increased to ₹27,403 Crore in March 2025.

The Net Cash Flow Amount

The Net Cash Flow amount of the company was ₹5998 Crore in March 2023, which decreased to ₹-8,795.35 Crore in March 2024.

Peer Company Of JSW Steel Limited

| Company Name | Market Cap (Crore) |

| Aanchal Ispat | ₹1.46 |

| APL Apollo | ₹53,121.99 |

| Azad India Mobi | ₹511.26 |

| Beekay Steel | ₹999.36 |

| DEE Development | ₹1,923.06 |

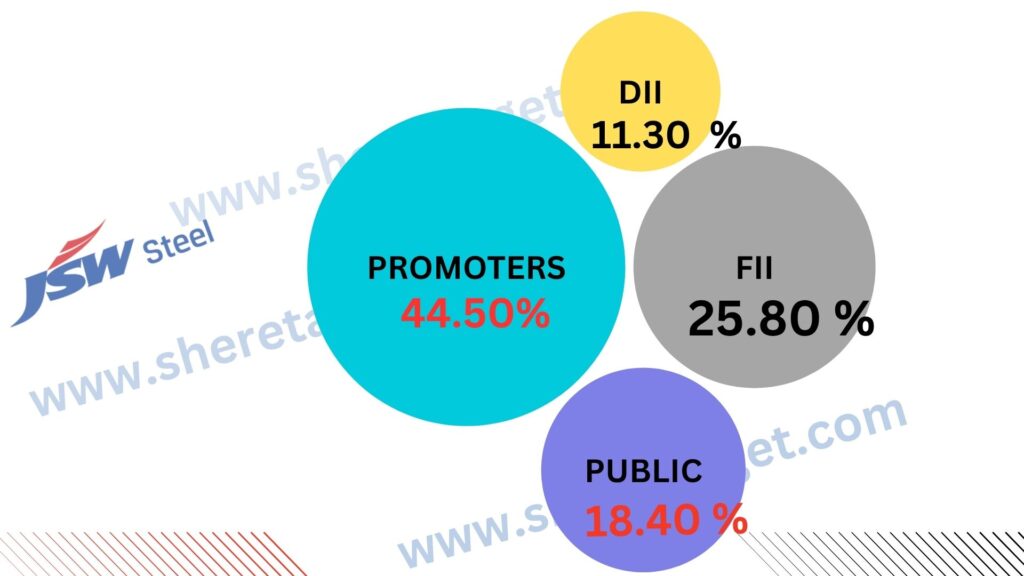

Discussion About Shareholding Pattern Of JSW Steel Limited

JSW Steel Limited mainly has four types of shareholding patterns, such as promoter holding, public holding, DII, and FII. Depending on the shareholding pattern, we can majorly influence the company’s growth.

| Investor Type | Percentage |

| Promoter Holding (Owned by the company’s promoter) | 44.50% |

| Public Holding (Held by the public) | 18.40% |

| FII (Invest by Foreign Institutional Investor) | 25.80% |

| DII (Invest money by Domestic Institutional Investor) | 11.30% |

What Is The Expert Advice About The Investment In JSW Steel Share

Positive Sides

- In the last 3 years, the company had a high revenue growth which was 24.53%.

- The company has an efficient cash conversion cycle of 16.23 days.

- The company has a good cash flow managment, PAT stands at 1.88.

- The company’s PEG ratio is 0.68.

- The company has a strong degree of operating leverage, Average Operating Leverage stands at 5.14.

- The company has been maintaining effective average operating margins of 20.89% in the last 5 years.

- In the last 3 years, the company has been maintaning a good ROE ratio, which is 16.82%.

Negative Sides

- The company has shown poor profit growth, which was -1.56%.

- The company has a poor sales growth, which was 2.72% in the last 1 year.

The Last Few Years’ Share Price Updation Of JSW Steel Share

JSW Steel Share always gives good returns to investors, which is described in the portion below.

- In the last 1 month, the share growth was +3.10 (0.32%).

- In the last 6 month’s share growth was -32.20 (-3.31%).

- In the last 1 year’s share growth was 82.50 (9.29%).

- In the last 5 year’s share growth was 774.68 (392.86%).

- In the maximum share, growth was +931.59 (2,388.70%).

- JSW Steel share price return percentage was 0.33% in the last 1 month.

- The last 3 months’ share price return percentage was -4.02%.

- The last 1 year’s share price return percentage was 9.30%.

- The last 3 years’ share price return percentage was 67.92%.

- The last 5 years’ share price return percentage was 393.26%.

Also read – Hindalco Share Price Target

Risk Factors Of JSW Steel Limited

- Compliance Risk

- Roubst legal compliance managment systems ensure awareness and compliance, technology is being utilised to track compliance, timelines with suitable escalations, action plans, and reviews.

- Environmental Protection

- Steelmaking inherently involves the emission of carbon dioxide, dust, and other co-product gases along with water consumption, which pose a risk to the environment and sustainable growth.

- Cyber Security

- Cybersecurity risk could damage reputation and lead to financial loss, such as theft of corporate information, theft of financial information may risk the company’s profitability.

FAQ

What is JSW Steel Share Price Target for 2025?

JSW Steel Share Price Target for 2025 is ₹965.38 to ₹1,025.33.

What is JSW Steel Share Price Target for 2026?

JSW Steel Share Price Target for 2026 is ₹1,020.68 to ₹1076.36.

What is JSW Steel Share Price Target for 2028?

JSW Steel Share Price Target for 2028 is ₹1,115.29 to ₹1,206.82.

What is JSW Steel Share Price Target for 2030?

JSW Steel Share Price Target for 2030 is ₹1,302.48 to ₹1,393.06.

What is JSW Steel Share Price Target for 2035?

JSW Steel Share Price Target for 2035 is ₹1,862.09 to ₹1,954.27.

Conclusion

This website is written to help the investor gain some basic knowledge about the market strategy of JSW Steel Share. For making this blog, we take consultation from experts and research the company. It is expected that the JSW Steel Share Price Target will be a good choice to invest in on a long-term basis. The demand for the steel manufacturer sector in India and outside of the country always increases, as a result of which the company and its share may increase rapidly.

We try to give an in-depth idea about the share. If you think it is helpful to you, you can share it. If you have any questions, please let us know through the comment box. We will try to reply to your questions and solve your problem. Thanks for visiting this website and thanks for being with us.

Disclaimer – We are not SEBI-registered advisors. A financial market is always risky to anyone. This website is only for training and educational purposes. So, before investing, we are requested to discuss certified expertise. We will not be responsible for anyone’s profit or loss.