Divis Lab Share is a bullish trend in the share market. During share ups and downs, you should know all about share details before investing. In this blog, we are going to discuss Divis Lab Share Price Target 2025, 2026, 2028, 2030, and 2035. We will try to analyze the share base in the company’s overall performance.

We also look at the company’s profit growth in the last 5 years, the last 5 years’ sales growth, and the last 5 years’ ROE percentage. Similarly, we also compare the share growth, the share price return, amount whether the share has increased or decreased over the last 5 years. We also take advice from experts about when we should invest in the share, which may be helpful for you. Let’s have a look at the Divis Lab Share Price Target from 2025 to 2035.

Overview Of Divis Laboratories Limited

Divis Laboratories Limited is an Indian Multinational Pharmaceutical company and producer of active pharmaceutical ingredients and intermediates (APIs), with its headquarters situated in Hyderabad. The company manufactures and custom-synthesizes generic APIs, intermediates. The company also manufactures and supplies nutraceutical ingredients through its subsidiary, Divis Nutraceuticals.

Fundamental Analysis Of Divis Laboratories Limited

| Company Name | Divi’s Laboratories Limited |

| Market cap | ₹1,62,325.63 Crore |

| Book Value | ₹536 |

| Face Value | ₹2 |

| P/E | 77.96 |

| P/B | 11.52 |

| 52 Week High | ₹6,312.36 |

| 52 Week Low | ₹3,830 |

| DIV. YIELD | 0.49% |

| ROE | 12.06% |

Last Few Years’ Performance Of Divi’s Laboratories Limited

Profit Growth

- In the last 5 years, 3.59%

- In the last 3 years, -6.95%

- In the last 1 year, -13.24%

The Net Profit of the company was ₹1,823 crores in March 2023, which decreased to ₹1,586 crores in March 2024. The Operating Profit of the company was ₹2,350 Crores in March 2023, which decreased to ₹2,136.32 Crores in March 2024.

Sales Growth

The sales growth percentage of the company in the last 5 years is described below.

- In the last 5 years, 9.68%

- In the last 3 years, 4.26%

- In the last year, 0.60%

The Net Sales amount of the company was ₹7,636 Crore in March 2023, which decreased to ₹7,626 Crore in March 2024.

ROE Percentage

The ROE percentage growth of the company in the last 5 years is described below.

- In the last 5 years, 19.86%

- In the last 3 years, 18.59%

- In the last 1 year, 12.85%

ROCE Percentage

The company’s ROCE percentage growth in the last 5 years is described below, and it has also increased rapidly.

- In the last 5 years, 25.65%

- In the last 3 years, 24.35%

- In the last 1 year, 17.01%

Total Expenditure Amount

The Total Expenditure of the company was ₹5,289 Crore in March 2023, which increased to ₹5,496 Crore in March 2024.

The Net Cash Flow Amount

The Net Cash Flow amount of the company was -₹1,086 Crore in March 2023, which increased to ₹2,00 Crore in March 2024.

Total Assets Amount

The company’s Total Assets were ₹14,795 Crores in March 2023 and increased to ₹15,896 Crores in March 2024.

Also Read – Torrent Pharmaceuticals Share Price Target

Divis Lab Share Price Target 2025

Divis Lab Share Price Target 2025 forecast may vary from ₹6,012.16 to ₹7,689.03.

Influencing Key Factors Of Divis Lab Share Price Target 2025

- Custom Synthesis System

- The company’s Custom Synthesis segment offers contract manufacturing services of APIs and Intermediates for global innovator companies across a vast portfolio of products in diverse therapeutic areas. The company’s competent and qualified R&D team consists of more than 400 scientists specialising in developing innovative processes and continuously optimising them to maintain a competitive leadership position. The company is a global partner trusted by leading pharmaceutical companies in over 100 countries, including 12 out of the top 20 big pharmaceutical companies.

- Robust Workforce

- With a highly skilled and diverse team of professionals across departments. The company is committed to delivering world-class products to customers. The company’s disciplined execution of sustainable chemistry makes it a trusted partner for global innovator companies.

- Large-Scale And Reliable Production Facilities

- The company’s state-of-the-art manufacturing facilities and research capabilities have earned a reputable name in the global pharmaceutical market. With 2 manufacturing units and a third one under construction, the company has an enormous scale of production and is one of the world’s largest API Companies.

| Month | Divis Lab Share Price Target 2025 (1st Price Target) | Divis Lab Share Price Target 2025 (2nd Price Target) |

| May | ₹6,012.16 | ₹6,324.79 |

| June | ₹6,320.40 | ₹6,556.23 |

| July | ₹6,549.70 | ₹6,710.64 |

| August | ₹6,705.52 | ₹6,893.06 |

| September | ₹6,889.15 | ₹7,025.67 |

| October | ₹7,014.20 | ₹7,245.36 |

| November | ₹7,239.42 | ₹7,467.86 |

| December | ₹7,459.67 | ₹7,689.03 |

Divis Lab Share Price Target 2026

Divis Lab Share Price Target 2026 forecast may vary from ₹7,725.89 to ₹9,263.49.

Influencing Key Factors Of Divis Lab Share Price Target 2026

- API-Centric Portfolio

- The company’s portfolio of 160 products covers diverse therapeutic areas, making it a leading manufacturer and supplier of high-quality Generics, Custom Synthesis of APIs and intermediates, and Nutraceutical ingredients.

- Expanding Global Reach

- With a focus on innovation and excellence, Divi’s has established a strong global presence across several geographic locations worldwide, including the area of Americas, Europe, Asia, and the rest of the world.

- Company’s Revenue Segment

- The company draws 46% of its revenue from the top 5 products, and nearly 41% of the revenue from the top 5 customers in the year 2023. In the same year, some of the key API products include Valsartan, Naproxen, Dextromethorphan, Gabapentin, Levodopa, Valacyclovir, etc. From Valsartan, the company’s yearly revenue increased percentage was 116.8% (in the year 2023).

| Month | Divis Lab Share Price Target 2026 (1st Price Target) | Divis Lab Share Price Target 2026 (2nd Price Target) |

| January | ₹7,725.89 | ₹7,875.62 |

| February | ₹7,769.27 | ₹7,901.70 |

| March | ₹7,234.01 | ₹7,425.16 |

| April | ₹7,419.43 | ₹7,689.32 |

| May | ₹7,680.91 | ₹7,896.30 |

| June | ₹7,889.25 | ₹8,015.59 |

| July | ₹8,004.74 | ₹8,205.76 |

| August | ₹8,201.39 | ₹8,426.35 |

| September | ₹8,419.60 | ₹8,653.11 |

| October | ₹8,649.75 | ₹8,875.32 |

| November | ₹8,869.55 | ₹9,023.75 |

| December | ₹9,005.37 | ₹9,263.49 |

Divis Lab Share Price Target 2028

Divis Lab Share Price Target 2028 forecast may vary from ₹12,012.75 to ₹13,712.85.

Influencing Key Factors Of Divis Lab Share Price Target 2028

- Manufacturing Units

- The company operates 2 manufacturing units at Hyderabad (Telangana) and Visakhapatnam (Andhra Pradesh). The company also has research centers at Sanathnagar, Hyderabad, and at the manufacturing sites.

- Intangible Assets

- Harnessing intellectual property, patents, and proprietary technology for API synthesis, regulatory approvals, certification, and a skilled workforce to drive innovation and ensure high quality.

- Customers And Partners

- High-quality APIs, intermediates, and nutraceuticals, meeting the specific requirements of customers and partners. Contract manufacturing offering customised solutions.

- Recent Position Of The Company

- The company recently reached the milestone of being one of the top 3 Active Pharmaceutical Ingredients (API) manufacturers in the world and one of the top API companies in Hyderabad.

| Month | Divis Lab Share Price Target 2028 (1st Price Target) | Divis Lab Share Price Target 2028 (2nd Price Target) |

| January | ₹12,012.75 | ₹12,207.59 |

| February | ₹12,179.63 | ₹12,385.29 |

| March | ₹11,759.03 | ₹11,962.40 |

| April | ₹11,959.16 | ₹12,204.94 |

| May | ₹12,197.43 | ₹12,335.46 |

| June | ₹12,329.59 | ₹12,576.40 |

| July | ₹12,570.24 | ₹12,786.24 |

| August | ₹12,779.63 | ₹12,925.76 |

| September | ₹12,989.25 | ₹13,186.29 |

| October | ₹13,179.50 | ₹13,320.87 |

| November | ₹13,318.62 | ₹13,524.70 |

| December | ₹13,519.66 | ₹13,712.85 |

Divis Lab Share Price Target 2030

Divis Lab Share Price Target 2030 forecast may vary from ₹17,102.34 to ₹19,465.89.

Influencing Key Factors Of Divis Lab Share Price Target 2030

- Supply Chain

- Divi’s has been a global leader in more than 10 Generic APIs, supplying 100s/1000s of Tonnes every year to customers in more than 95 countries.

- Quality Systems

- Divi’s complies with cGMP guidelines for both manufacturing units, having been inspected numerous times by the FDA, EU GMP, HEALTH CANADA, TGA, ANVISA, COFEPRIS, PMDA, and MFDS health authorities.

- Partnership With Big Pharmaceutical Companies

- 12 out of the top 20 Big Pharma companies across the US, EU, and Japan are associated with Divi’s for more than 10 years.

- Divi’s competent and qualified R&D team, with over 500 scientists, specializes in developing innovative processes and continuously optimizes its leadership position.

| Year | Divis Lab Share Price Target 2030 |

| 1st Price Target | ₹17,102.34 |

| 2nd Price Target | ₹19,465.89 |

Also Read – Cipla Share Price Target

Divis Lab Share Price Target 2035

Divis Lab Share Price Target 2035 forecast may vary from ₹30,159.63 to ₹32,652.86.

Influencing Key Factors Of Divis Lab Share Price Target 2035

- Quality Control

- The company’s quality control is equipped with all types of analytical instruments (UPLCS, HPLC, GC, moisture analyzers, XRPD, and all microbiological equipment) and is not dependent on outsourcing of testing. More than 1600 dedicated employees in the Quality Control Team are involved in routine analysis of raw materials, in-process samples, intermediates, packing materials, end-of-run cleaning samples, and environmental monitoring of bio burdens in API pharma areas.

- Developments Of Manufacturing Units

- Both manufacturing units have more than 64 production buildings and 70 pharma suites with a total reaction capacity of more than 14,500m, making it one of the largest API manufacturing facilities in the world.

- Commercial-Scale Manufacturer

- The pilot plants at Divi’s are capable of handling high-potency products (products with exposure level up to 10mcg/m3) and several low-dose products under cGMP. Divis is a commercial-scale manufacturer of non-potent & highly potent APIs to deliver from gram scale to 1000s of tons under cGMP.

| Year | Divis Lab Share Price Target 2035 |

| 1st Price Target | ₹30,159.63 |

| 2nd Price Target | ₹32,652.86 |

Peer Company Of Divis Lab Limited

| Company Name | Market Cap (Crore) |

| Aarti Drugs | ₹4,200.25 |

| Abbott India | ₹64,345.89 |

| Ajanta Pharma | ₹32,464.66 |

| Alembic Pharma | ₹18,048.62 |

| Alkem Lab | ₹63,255.86 |

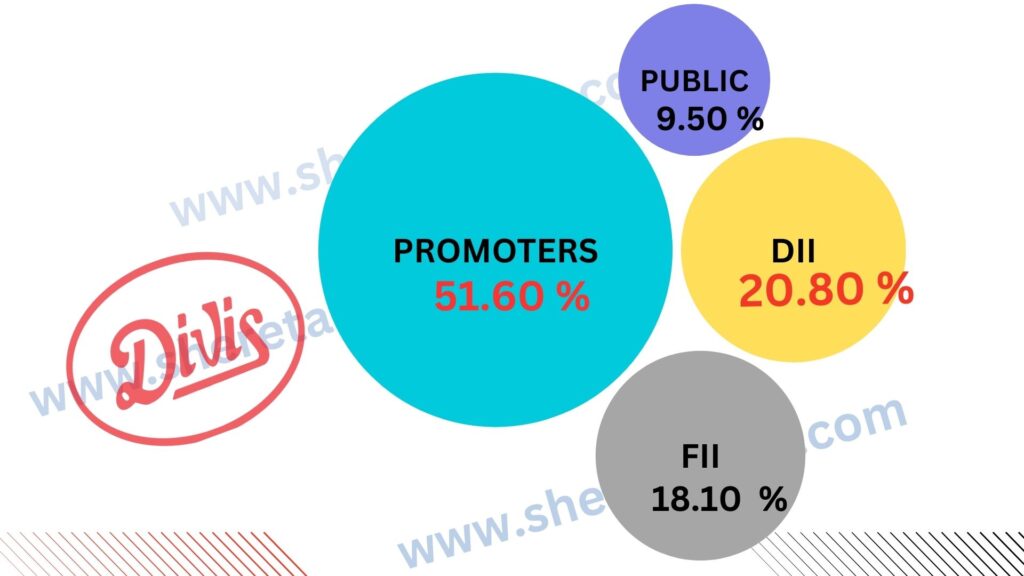

Discussion About Shareholding Pattern Of Divis Lab Limited

Divis Lab Limited mainly has four types of shareholding patterns such as promoter holding, public holding, DII, and FII. Depending on the shareholding pattern, we can majorly influence the company’s growth.

| Investor Type | Percentage |

| Promoter Holding (Owned by the company’s promoter) | 51.60% |

| Public Holding (Held by the public) | 9.50% |

| FII (Invest by Foreign Institutional Investor) | 18.10% |

| DII (Invest money by Domestic Institutional Investor) | 20.80% |

The Last Few Years’ Share Price Updation Of Divis Lab Limited Share

Divis Lab Share always gives good returns to investors, which is described in the portion below.

- The last 6 months’ share growth was +471.35 (8.17%).

- The last 1 month’s share growth was +503.50 (8.78%).

- The last 1 year’s share growth was +2,345.45 (60.25%).

- The last 5 years’ share growth was +3,902.80 (167.13%).

- The maximum share growth was +6,229.00 (69,211.11%).

- Divis Labs share price return percentage was 8.38% in the last 1 month.

- The last 3 months’ share price return percentage was 6.38%.

- The last 1 year’s share price return percentage was 59.68%.

- The last 3 years’ share price return percentage was 45.52%.

- The last 5 years’ share price return percentage was 166.53%.

What Is The Expert Advice About The Investment In Divis Lab Share

Positive Sides

- The company is virtually debt-free and has a good interest cover ratio of 534.

- The company has been maintaining a healthy ROCE ratio in the last 3 years, which was 24.35%.

- The company has a good promoter holding capacity of 51.60%.

- The company has a healthy liquidity position with a current ratio of 5.86.

- The company has been maintaining effective average operating margins of 35.96% in the last 5 years.

Negative Sides

- The company’s profit growth was not good in the last 3 years, which was -6.95%.

- The company has shown poor revenue growth of 4.85% in the last 3 years.

- The company is trending at a high PE of 77.96.

- The company is trending at a high EBITDA of 51.26.

Also Read – Zomato Share Price Target

FAQ

What is Divis Lab Share Price Target for 2025?

Divis Lab Share Price Target for 2025 is ₹6,012.16 to ₹7,689.03.

What is Divis Lab Share Price Target for 2026?

Divis Lab Share Price Target for 2026 is ₹7,725.89 to ₹9,263.49.

What is Divis Lab Share Price Target for 2028?

Divis Lab Share Price Target for 2028 is ₹12,012.75 to ₹13,712.85.

What is Divis Lab Share Price Target for 2030?

Divis Lab Share Price Target for 2030 is ₹17,102.34 to ₹19,465.86.

What is Divis Lab Share Price Target for 2035?

Divis Lab Share Price Target for 2035 is ₹30,159.63 to ₹32,652.86.

Conclusion

This website is written to help the investor gain some basic knowledge about the market strategy of Divis Lab Share. For making this blog, we take consultation from experts and research the company. It is expected Divis Lab Share Price Target will be a good choice to invest in on a long-term basis. The demand for the pharmaceutical ingredients manufacturer sector in India and outside of the country always increases, as a result of which the company and its share may increase rapidly.

We try to give an in-depth idea about the share. If you think it is helpful to you, you can share it. If you have any questions, please let us know through the comment box. We will try to reply to your questions and solve your problem. Thanks for visiting this website and thanks for being with us.

Disclaimer – We are not SEBI-registered advisors. A financial market is always risky to anyone. This website is only for training and educational purposes. So, before investing, we are requested to discuss certified expertise. We will not be responsible for anyone’s profit or loss.