IRCTC Share is a bullish trend in the share market. During share ups and downs, you should know all about share details before investing. In this blog, we are going to discuss about IRCTC Share Price Target 2025, 2027, 2028, 2030, 2040. We will try to analyze the share base in the company’s overall performance.

We also look after the company’s profit growth in the last 5 years, the last 5 year’s sales growth, and the last 5 years’ ROE percentage similarly we also compare the IRCTC Share growth, the share price return amount of the share become increasing or decreased through the last 5 years. We also take advice from experts about which time we should invest in the share it may be helpful for you also. Let’s have a look at IRCTC Share Price Target from 2025 to 2040.

What Is IRCTC Limited?

Indian Railway Catering and Tourism Corporation Limited is a public sector enterprise under the Ministry of Railways. The company provides ticketing, catering, and tourism services for the state-owned Indian Railways. The company was established in 1999 by the government of India. The headquarters of the company is situated in New Delhi.

Fundamental Analysis Of IRCTC Limited

| Company Name | Indian Railway Catering And Tourism Corporation Limited |

| Market Cap | ₹65,281 Crore |

| Book Value | ₹48.26 |

| Face Value | ₹2 |

| P/B | 17.56 |

| 52 Week High | ₹1,150.14 |

| 52 Week Low | ₹736.25 |

| DIV. YIELD | 0.82% |

| PE Ratio | 54.60 |

| ROA | 19.25% |

| ROE | 38.95% |

| Current Ratio | 1.84 |

The Last Few Years’ Performance of IRCTC Limited

Profit Growth

The company’s last 5 year’s profit growth percentage is described in the below portion.

- In the last 5 years 29.52%

- In the last 3 years 82.12%

- In the last 1 year 11.01%

The Net Profit Growth of the company was ₹1,006.85 Crore in March 2023 which increased to ₹,152.45 Crore in March 2024. The operating profit amount of the company was ₹1,278.63 Crore in March 2023 which increased to ₹1,468.85 Crore in March 2024.

Sales Growth

The last 5 year’s Sales growth percentage of the company is described in the below portion.

- In the last 5 years 17.99%

- In the last 3 years 76.52%

- In the last 1 year 21.42%

The Net Sales amount of the company was ₹993.01 Crore in September 2023 which increased to ₹1,085 Crore in September 2024.

ROE Percentage

The company’s last 5 year’s ROE percentage is described below.

- In the last 5 years 37.12%

- In the last 3 years 42.15%

- In the last 1 year 38.63%

ROCE Percentage

The company’s last 5 year’s ROCE percentage is described below.

- In the last 5 years 51.23%

- In the last 3 years 57.10%

- In the last 1 year 53.41%

Total Assets Amount

The Total Assets amount was ₹5,332.45 Crore in March 2023 which increased to ₹6,01.85 Crore in March 2024.

Total Expenditure Amount

The Total Expenditure amount of the company was ₹626.96 Crore in March 2023 which increased to ₹692.56 Crore in March 2024.

Net Cash Flow Amount

The Net Cash Flow amount of the company was ₹61.52 Crore in March 2023 which increased to ₹263.10 Crore in March 2024.

Other Income Amount

The Other Income amount of the company was ₹48.10 Crore in September 2023 which increased to ₹60.25 Crore in September 2024.

EBITDA Amount

The company’s EBITDA amount was ₹1,397.66 Crore in the year 2023 which increased to ₹1,632.47 Crore in the financial year 2024.

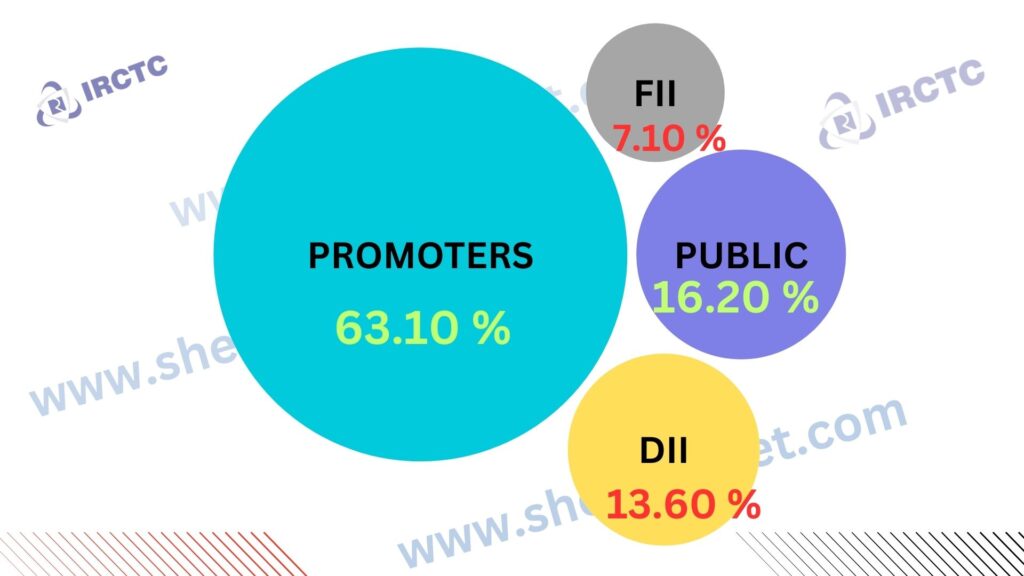

Discussion About Share Holding Pattern Of IRCTC Limited

IRCTC Limited mainly has four types of shareholding patterns: promoter holding, public holding, DII, and FII. We can majorly influence the company’s growth depending on the shareholding pattern.

| Investor Type | Percentage |

| Promoter Holding (Owned by the company’s promoter) | 63.10% |

| Public Holding (Held by the public) | 16.20% |

| FII (Invest by Foreign Institutional Investor) | 7.10% |

| DII (Invest money by Domestic Institutional Investor) | 13.60% |

Also Read – Zee Entertainment Share Price Target

Peers Company Of IRCTC Limited

| Company Name | Market Cap (Crore) |

| BLS E-Services | ₹2,012.59 |

| AGS Transact | ₹945.69 |

| FSN E-Co Nykaa | ₹49,185.63 |

| Infibeam Avenue | ₹7,545.68 |

What Is The Expert Analysis About The Investment Of IRCTC Share Right Now?

Positive Sides

- The last 3 year’s profit growth of the company was very good which was 82.12%.

- The revenue growth of the company was very good in the last 3 years which was 76.51%.

- The last 3 year’s ROE percentage of the company was good which was 42.15%.

- The last 3 year’s ROCE percentage of the company was good which was 53.41%.

- The company is virtually debt-free and has a healthy interest coverage ratio of 81.96.

- The company has a high promoter holding capacity which is 63.10%.

- The company has an efficient cash conversation cycle of -1,267.85 days.

- The company has been maintaining an effective average operating margins of 35.23% in the last 5 years.

- The last 3 years Sales growth of the company was good which was 76.52%.

Negative Sides

- The company has a high PE ratio which was 54.60.

- The company is trading at a high EBITDA of 37.44.

IRCTC Share Price Target Prediction In The Last Few Years

For the last few years, IRCTC Share increased rapidly.

- The last 1 month’s share growth was +1.65 (0.20%).

- The last 6 month’s share growth was -8.85 (-1.07%).

- The last 1 year’s share growth was +115.50 (16.50%).

- The last 5 year’s share growth was +635.55 (354.72%).

- The maximum share growth was +660.17 (423.65%).

- IRCTC Share Price return percentage was -1.08% in the last 1 month.

- The last 3 month’s share price return percentage was -1.17%.

- The last 1 year’s share price return percentage was +16.49%.

- The last 3 year’s share price return percentage was 5.19%.

- The last 5 year’s share price return percentage was +354.69%.

IRCTC Share always gives a good return to investors if anyone wants to invest in the share it will be profitable in the long-term basis.

IRCTC Share Price Target 2025

IRCTC Share Price Target 2025 range may vary from ₹815.69 to ₹906.55.

Influencing Key Factors Of IRCTC Share Price Target 2025

- Increasing The Net Worth Amount

- The Net Worth amount of the company was ₹2,480.42 Crore in the year 2023 which increased to ₹3,230.98 Crore in the year 2024. The Profit before tax amount was ₹1,357.63 Crore in the year 2023 which increased to ₹1,497.95 Crore in the year 2024.

- Internet Ticketing Facility

- Internet Ticketing facility is a big platform for the company’s growth. In the financial year 2024 82.68% of shares in reserved ticket booking of Indian Railways. In the financial year 2023-24, on average 12.39 lakh tickets were booked online. The company’s next-generation e-ticketing is supported by a very high-capacity server to book 28,000 tickets per minute which is a very good corner for the company’s profit.

- Increasing Revenue From Operation

- The company’s revenue from the operation sector increasing rapidly. In the year 2023, the company’s revenue amount was ₹3,542.48 Crore which increased to ₹4,271.19 Crore in the year 2024, an increase of 17.20% which is helping the investment for next year’s business purposes which is a good part for the company.

| Month | IRCTC Share Price Target 2025 (1st Price Target) | IRCTC Share Price Target 2025 (2nd Price Target) |

| February | ₹815.69 | ₹822.69 |

| March | ₹785.78 | ₹795.36 |

| April | ₹794.87 | ₹815.83 |

| May | ₹812.44 | ₹823.46 |

| June | ₹821.30 | ₹833.88 |

| July | ₹830.97 | ₹838.99 |

| August | ₹834.17 | ₹848.39 |

| September | ₹845.72 | ₹858.33 |

| October | ₹857.10 | ₹871.99 |

| November | ₹869.31 | ₹882.37 |

| December | ₹880.03 | ₹906.55 |

Risk Factors

- There are many competitors of the company from both private and public sector organizations. Some of the competitors include private tours & travelers, Airlines most of the customers prefer for time-saving, other state road transport corporations, etc which may affect the company’s profit margin.

- Some competitor apps of the company like make mytrip.com, yatra.com, ixigo, cleartrip, etc. But at a later stage, they have established a joint venture with these providers which may affect the IRCTC’s profit growth.

IRCTC Share Price Target 2027

IRCTC Share Price Target 2027 range may vary from ₹1,023.30 to ₹1,126.49.

Influencing Key Factors Of IRCTC Share Price Target 2027

- Provide Catering FctilityThrough Vendors

- IRCTC Limited also manages train-side vending contracts on mail/express and the superfast train that operates without pantry cars. The company’s innovative approach to catering enables efficient service delivery through onboard vendors which contributes 45.65% to revenue. The expertise in managing on-board catering services for the Indian Railways extends to cover 1,200 passenger tarins which include Rajdhani, Shatabdi, Duronto, etc.

- Provide Drinking Water

- IRCTC Limited manufactures and provides Rail Neer packaged drinking water to travelers which contributes 7.66% to revenue and produces 39.50 Crore bottles in the year 2024 which opens another side to the company for increasing the net profit amount.

- In Tourism Sector

- The company provides different tour packages with dedicated trains to specific destinations which offer an enriched tourist experience including luxury train tours, hotel bookings, theme-based Bharat Gaurav itineraries, and rail tour packages, etc, that contribute 16.43% to revenue and make 15.60 lakh tourists travel in the year 2023-24.

| Month | IRCTC Share Price Target 2027 (1st Price Target) | IRCTC Share Price Target 2027 (2nd Price Target) |

| January | ₹1,023.30 | ₹1,036.95 |

| February | ₹1,033.01 | ₹1,044.36 |

| March | ₹1,043.55 | ₹1,058.69 |

| April | ₹1,056.35 | ₹1,069.01 |

| May | ₹975.16 | ₹990.77 |

| June | ₹988.35 | ₹1,022.85 |

| July | ₹1,020.15 | ₹1,036.89 |

| August | ₹1,035.11 | ₹1,047.37 |

| September | ₹1,044.03 | ₹1,065.27 |

| October | ₹1,062.64 | ₹1,089.99 |

| November | ₹1,087.77 | ₹1,099.20 |

| December | ₹1,098.22 | ₹1,126.49 |

Risk Factors

- All the deals with customers in this company are done through an online Internet app the company may face cyber threats which may destroy the customer’s trust.

- The company’s business is totally technology base any technological failure may hamper the company’s profitability.

Also Read – TVS Motor Share Price Target

IRCTC Share Price Target 2028

IRCTC Share Price Target 2028 range may vary from ₹1,125.02 to ₹1,218.69.

Influencing Key Factors Of IRCTC Share Price Target 2028

- Provides Bus Ticket

- In January 2021, the company also launched a dedicated bus portal to enable our customers to buy bus tickets online. At present online bus booking can be made across 27 states and 7 UTs and customers can choose from either or all three modes of transportation namely air, rail, and road which become more profitable for the company’s growth.

- Advanced Booked Ticket

- Through the IRCTC online app, passengers can book reserved tickets up to 60 days earlier and confirmed reservation tickets will show to the passengers with berth or seat number details. In case of no confirmation reservation, a wait-list number is assigned which becomes more helpful to customers and increases the customer number. In 2013, flight and hotel booking services were added as part of online reservation services.

- Launched Loyalty Program

- From the year 2011, IRCTC launched a loyalty program called Subh Yatra for frequent travelers where passengers could avail discounts on all tickets by paying upfront annual subscription fees which became more interesting to passengers.

| Month | IRCTC Share Price Target 2028 (1st Price Target) | IRCTC Share Price Target 2028 (2nd Price Target) |

| January | ₹1,125.02 | ₹1,138.30 |

| February | ₹1,137.82 | ₹1,151.42 |

| March | ₹1,150.92 | ₹1,162.40 |

| April | ₹1,159.79 | ₹1,170.67 |

| May | ₹1,169.20 | ₹1,182.29 |

| June | ₹1,085.11 | ₹1,099.03 |

| July | ₹1,098.38 | ₹1,128.47 |

| August | ₹1,125.32 | ₹1,142.39 |

| September | ₹1,140.46 | ₹1,168.95 |

| October | ₹1,165.69 | ₹1,182.82 |

| November | ₹1,180.66 | ₹1,198.91 |

| December | ₹1,195.09 | ₹1,218.69 |

Risk Factor

- The high Internet speed is one of the important things for the growth of the business.

- As a result of many competitor companies the Operating Profit Margin of the company also decreased in March 2022 the percentage was 40% which decreased to 34% in March 2023.

IRCTC Share Price Target 2030

IRCTC Share Price Target 2030 range may vary from ₹1,305.33 to ₹1,422.64.

Influencing Key Factors Of IRCTC Share Price Target 2030

- Provide Travel Insurance

- IRCTC also offers travel insurance for passengers through third-party insurers. Through this scheme, the company provides financial support to passengers in the event of an accident that occurs during the train journey. In case of death, the company provides up to ₹10 lacks, permanent total disability of up to ₹10 lacks, permanent partial disability of up to ₹7.5 lacks, hospitalization expenses for injury up to ₹2 lacks, etc which increases the passenger’s support and interest.

- Provides E-Catering Services

- From the year 2014, IRCTC launched E-Catering services which allowed passengers to order food from private restaurants online and have it delivered to their seats. In the financial year 2023-24, the number of the company’s partner restaurants was 2,000, and the average number of orders booked was 40,669 during that year.

- Arrange Retiring Rooms & Dormitories

- To increase the approach toward accommodation services at stations the Railway Board has been requested to issue instructions to Zonal Railway to expedite handling over the 100 more sites of Retiring Rooms, especially to A category stations to IRCTC which increases more attraction of the passengers.

| Month | IRCTC Share Price Target 2030 (1st Price Target) | IRCTC Share Price Target 2030 (2nd Price Target) |

| January | ₹1,305.33 | ₹1,324.98 |

| February | ₹1,320.46 | ₹1,338.17 |

| March | ₹1,335.69 | ₹1,353.06 |

| April | ₹1,350.18 | ₹1,371.53 |

| May | ₹1,369.55 | ₹1,388.03 |

| June | ₹1,265.19 | ₹1,292.62 |

| July | ₹1,290.03 | ₹1,315.36 |

| August | ₹1,312.32 | ₹1,332.17 |

| September | ₹1,330.59 | ₹1,357.37 |

| October | ₹1,355.27 | ₹1,375.93 |

| November | ₹1,372.66 | ₹1,392.51 |

| December | ₹1,390.48 | ₹1,422.64 |

Risk Factors

- As the company is a Government-owned company any changes in government policies, or regulations may affect the company’s profit growth.

- The cash flow from financing activity has negative cash flow which was -435 Crore in March 2023 which became -405 Crore in March 2024 which negatively affects the company’s profit growth.

IRCTC Share Price Target 2040

IRCTC Share Price Target 2040 range may vary from ₹2,582.64 to ₹2,632.45.

Influencing Key Factors Of IRCTC Share Price Target 2040

- Provide Private Trains

- In the year 2020, the IRCTC began operating the first private train, Tejas Express from New Delhi to Lucknow. IRCTC also operates Ahmedabad – Mumbai Central Tejas Express and Kashi Makahal Express. IRCTC also offers election special trains and another special trains like Maharajas Express, Vistadome Coach, etc which increase the net profit amount of the company.

- Increasing Revenue Of The Company

- The revenue amount of the company increasing rapidly. In the year 2015, the company’s revenue amount was ₹1059 Crore which increased to ₹3541 Crore in March 2023 which is a very good side for the company’s growth.

- Up-gradation Of Food Plaza Units

- Food Plazas are multi-cuisine outlets in the stations providing a variety of food items under one roof. As of 31.03.2024, the company managed 146 Food Plaza across the Indian Railway network which became more profitable for the company.

| Year | IRCTC Share Price Target 2040 |

| 1st Price Target | ₹2,582.64 |

| 2nd Price Target | ₹2,632.45 |

Risk Factors

- The monopoly business of a government company can face sudden problems and affect profit growth.

- In the year 2022, in October the Government stated that 50% of the revenue of IRCTC would have to be given to the Government as a convenience fee, later Indian Railway withdrew the statement. At that time IRCTC’s Share Price fell by 20% and the company’s Market Capital also decreased. Some of the few reasons for the share price.

What Is The Future Growth Of IRCTC Limited Company?

Strength

- The company provides tickets to the public in comfort.

- The ticket booking facilities are easily accessible to customers.

- The company provides fast and hassle-free booking which is a positive side for the customers.

- The company provides a high-quality package of drinking water.

- The company is fully backed by the government of India.

Weakness

- The company has delayed in decision-making process.

- The company does not have of full-fledged marketing team.

Also Read – Eicher Motors Share Price Target

FAQ

What is the IRCTC Share Price Target for 2025?

IRCTC Share Price Target for 2025 is ₹815.69 to ₹906.55.

What is the IRCTC Share Price Target for 2027?

IRCTC Share Price Target for 2027 is ₹1,023.30 to ₹1,126.49.

What is the IRCTC Share Price Target for 2028?

IRCTC Share Price Target for 2028 is ₹1,125.02 to ₹1,218.69.

What is the IRCTC Share Price Target for 2030?

IRCTC Share Price Target for 2030 is ₹1,305.33 to ₹1,422.64.

What is the IRCTC Share Price Target for 2040?

IRCTC Share Price Target for 2040 is ₹2,582.64 to ₹2,632.45.

Conclusion

This website is written to help the investor gain some basic knowledge about the market strategy of IRCTC Share. For making this blog we take consultation from expertise and doing research about the company. It is expected that the IRCTC Share Price Target will be a good choice to invest in on a long-term basis. The demand for the Tourism industry in India and outside of the country always increases as a result of the company and the share may increase rapidly.

We try to give an in-depth idea about the share. If you think it is helpful to you you can share it. If you have any questions please let us know through the comment box we will try to reply to your questions and solve your problem. Thanks for visiting this website and thanks for being with us.

Disclaimer – We are not SEBI-registered advisors. A financial market is always risky to anyone. This website is only for training and educational purposes. So before investing, we are requested to discuss certified expertise. We will not be responsible for anyone’s profit or loss.