Tata Motors Share is experiencing a bullish trend in the share market. You should know all about the share details before investing during the ups and downs. In this blog, we will discuss the Tata Motors Share Price Target 2025, 2026, 2028, 2030, and 2035. We will try to analyze the share base in the company’s overall performance.

We also look at the company’s profit growth in the last five years, sales growth in the last five years, and ROE percentage. Similarly, we compare share growth, share price return, and whether the share has increased or decreased over the last five years. We also seek advice from experts about when to invest in the shares, which may be helpful for you. Let’s look at the Tata Motors Share Price Target from 2025 to 2035.

Overview Of Tata Motors Limited

Tata Motors Limited is an Indian multinational automotive company that was established in the year 1945. The headquarters of the company are situated in Mumbai. The company mainly produces cars, trucks, vans, and buses. Tata Motors has auto manufacturing and vehicle plants in Jamshedpur, Lucknow, Sanand, Pantnagar, Dharwad, and Pune in India.

Fundamental Analysis Of Tata Motors Limited

| Company Name | Tata Motors Limited |

| Market Cap | ₹2,40,969.63 Crore |

| P/B | 7.06 |

| P/E | 39.01 |

| 52 Week High | ₹1,181.36 |

| 52 Week Low | ₹542.63 |

| DIV. YIELD | 0.96% |

| Book Value | ₹92.68 |

| Face Value | ₹2 |

| ROE | 30.63% |

Tata Motors Share Price Target 2025

Tata Motors Share Price Target 2025 forecast is ₹649.62 to ₹805.47.

Influencing Key Factors Of Tata Motors Share Price Target 2025

- Development In Commercial Vehicles

- Tata Motors Limited has taken the lead in electric mobility, with over 2,600 electric buses now in operation on Indian roads. Tata Motors is the first in the industry to receive India’s first auto PLI certificate in the four-wheeled goods vehicle category.

- Development In Passenger Vehicles

- As India transitions towards a greener, more sustainable future, Tata Motors is at the forefront of the electrification revolution. As a more sustainable offering, the company’s EVs are enabled with innovative technologies and a digital design language, which strongly appeals to Indian Customers.

- JLR

- In February 2021, Jaguar Land Rover Business announced a change in direction under the new Reimagine strategy. At the core of this is the rapid electrification of both Jaguar and Land Rover. JLR aims to achieve net-zero carbon emissions across its supply chain, products, and operations by 2039, with all brands offering pure-electric options by the year 2030.

| Month | Tata Motors Share Price Target 2025 (1st Price Target) | Tata Motors Share Price Target 2025 (2nd Price Target) |

| May | ₹649.62 | ₹676.75 |

| June | ₹665.18 | ₹698.37 |

| July | ₹695.03 | ₹726.49 |

| August | ₹724.60 | ₹769.36 |

| September | ₹765.34 | ₹786.20 |

| October | ₹784.93 | ₹801.49 |

| November | ₹786.59 | ₹795.48 |

| December | ₹779.28 | ₹805.47 |

Also Read – Ola Electric Share Price Target

Tata Motors Share Price Target 2026

Tata Motors Share Price Target 2026 forecast is ₹795.39 to ₹925.59.

Influencing Key Factors Of Tata Motors Share Price Target 2026

- Increasing Revenue Amount

- The Revenue of the company increased on a parallel basis. In the financial year 2023, the company’s revenue amount was ₹3,46,968 Crore, which increased to ₹ 4,38,930 Crore in the year 2024.

- Involving Consumer Performance

- As demographics shift, the company sees a rising base of young and aspirational. The company is offering at the lowest total cost of ownership (TCO). The industry is the first to transition from being purely an original equipment manufacturer (OEM) to becoming a holistic provider of related services and solutions to enhance overall productivity and service a wide variety of applications for both cargo and public transport.

- Strong Domestic Demand

- According to the IMF forecasts, India’s GDP growth is projected to remain consistently strong at 6.8% in 2024 and 6.5% in 2025. This strength is attributed to the sustained domestic demand and a growing working-age population. The Government of India recently announced in the interim budget its intent to increase capex spending by 11%, 11.11 lakh crore, signalling a commitment to infrastructure development. This sharp focus is on improving productivity in the manufacturing and agriculture sectors.

| Month | Tata Motors Share Price Target 2026 (1st Price Target) | Tata Motors Share Price Target 2026 (2nd Price Target) |

| January | ₹795.39 | ₹816.45 |

| February | ₹810.70 | ₹846.42 |

| March | ₹775.79 | ₹798.63 |

| April | ₹795.08 | ₹820.14 |

| May | ₹816.57 | ₹842.60 |

| June | ₹839.11 | ₹852.91 |

| July | ₹849.83 | ₹865.90 |

| August | ₹860.29 | ₹896.75 |

| September | ₹891.02 | ₹926.97 |

| October | ₹902.86 | ₹962.72 |

| November | ₹906.18 | ₹946.38 |

| December | ₹879.60 | ₹925.59 |

Tata Motors Share Price Target 2028

Tata Motors Share Price Target 2028 forecast is ₹1,186.93 to ₹1,465.59.

Influencing Key Factors Of Tata Motors Share Price Target 2028

- New Variant In Commercial Vehicles Unit

- Tata Motors Limited is India’s largest CV manufacturer with the widest product and service portfolio across the cargo and public transportation segments. In the financial year 2024, the company launched 140 new products, new product variants was more than 700. 18% share was from consolidated revenue, and 2,600 was E-buses operational. The net volume was 4,05,472 Units. The TML e-bus fleet cumulatively crossed 140 million km.

- Resilience In Semiconductor Supply Chain

- Overall, semiconductor supply returned to normalcy in the year 2024, primarily on account of the reduction in the demand-supply gap. Semiconductor (including water fab) manufacturing and suppliers are closely monitored, and near or medium-term supply disruptions are unlikely. International business saw marginal growth and maintained market share across geographic regions, such as SAARC, MENA, with healthy financials despite.

- Increasing EBITDA Amount

- The EBITDA percentage of the company is increasing. In the financial year 2023, the EBITDA percentage was 10.9%, which increased to 14.8% in the year 2024.

| Month | Tata Motors Share Price Target 2028 (1st Price Target) | Tata Motors Share Price Target 2028 (2nd Price Target) |

| January | ₹1,186.93 | ₹1,214.37 |

| February | ₹1,209.48 | ₹1,253.67 |

| March | ₹1,024.79 | ₹1,087.49 |

| April | ₹1,075.31 | ₹1,146.28 |

| May | ₹1,134.64 | ₹1,179.59 |

| June | ₹1,175.05 | ₹1,253.29 |

| July | ₹1,249.66 | ₹1,286.02 |

| August | ₹1,280.35 | ₹1,325.10 |

| September | ₹1,319.62 | ₹1,375.01 |

| October | ₹1,295.75 | ₹1,349.64 |

| November | ₹1,352.57 | ₹1,395.44 |

| December | ₹1,402.69 | ₹1,465.59 |

Tata Motors Share Price Target 2030

Tata Motors Share Price Target 2030 forecast is ₹1,740.88 to ₹2,019.42.

Influencing Key Factors Of Tata Motors Share Price Target 2030

- Sales Volume Of Commercial Vehicles

- The Sales Network of Commercial Vehicles reached 1,311 touchpoints (more than 75 over the year 2023), and 160 Service Touch Points were added in the year 2024. The company’s after-sales network includes approximately 23,000 Tata Champions (Retailers) and 55,000 Tata Gurus (Roadside Mechanics). The company deployed more than 1,100 E-buses under the CESL tender along with 12 fully equipped depots.

- Distribution Network

- Tata Motors Limited has the largest distribution network for automobiles in India. The distribution network of Tata Motors has been a key factor in its success in the domestic market. A substantial number of the company’s vehicles are sold directly to dealers from the company’s regional sales offices. The company sells Government and military vehicles as well as a small number of other vehicles directly to customers. The company also has a strong after-sales service network comprising over 650 authorized service centers.

| Year | Tata Motors Share Price Target 2030 |

| 1st Price Target | ₹1,740.88 |

| 2nd Price Target | ₹2,019.42 |

Tata Motors Share Price Target 2035

Tata Motors Share Price Target 2035 forecast is ₹3,396.28 to ₹3,686.72.

Influencing Key Factors Of Tata Motors Share Price Target 2035

- Milestones Of The Company

- Tata Motors enters Bangladesh’s new car market. Tata Ace races through the one-million market in just 2,680 days. Tata Safari Storme, the Real SUV, hits the road. Launch of PT Tata Motors Indonesia. Tata Motors plant at Dharwad comes on stream. Tata Motors enters into a distribution agreement in Myanmar and launches of Tata Ace in South Africa.

- ICE Portfolio

- The company presented 12 vehicles and concepts of India’s best-designed vehicles and the smartest range of personal mobility solutions. The company’s India-centric, new-age personal mobility solutions come with smarter and safer technologies and world-class powertrains that deliver low emissions and superior performance.

- Electric Vehicles Segment

- In the last 3 years, the company’s volumes increased from 1.3K to 50K vehicles and established the company’s market leader with around 84% VAHAN market share in the financial year 2022-23. Tiago EV launched, strong response with over 10,000 bookings on the day of launch. Acquisition of Ford India Sanand Plant, to unlock capacity of 300,000 vehicles p.a., scalable to 420,000 vehicles per year. Tiago EV recognised as ‘Electric Vehicle of the year’ by 6 media houses, Motor Vikatan, Motorscribes, Autocar, Car India, Acko Drive, etc.

| Year | Tata Motors Share Price Target 2035 |

| 1st Price Target | ₹3,396.28 |

| 2nd Price Target | ₹3,686.72 |

Also Read – Apollo Tyres Share Price Target

Last Few Years’ Performance Of Tata Motors Limited

Profit Growth

- In the last 5 years, 32.35%

- In the last 3 years, 75.26%

- In the last 1 year, 190.42%

The Net Profit of the company was ₹2,795.46 Crore in March 2023, which increased to ₹7,914.67 Crore in March 2024. The Operating Profit amount was ₹4,623.52 Crore in March 2023, which increased to ₹7,693.36 Crore in March 2024.

Sales Growth

The sales growth percentage of the company in the last 5 years is described below.

- In the last 5 years, 2.05%

- In the last 3 years, 35.16%

- In the last year, 12.51%

The Net Sales amount of the company was ₹65,801.76 Crore in March 2023, which increased to ₹73,856.17 Crore in March 2024.

ROE Percentage

The ROE percentage growth of the company in the last 5 years is described below.

- In the last 5 years, -3.68%

- In the last 3 years, 12.54%

- In the last 1 year, 30.68%

ROCE Percentage

The company’s ROCE percentage growth in the last 5 years is described below, and it has also increased rapidly.

- In the last 5 years, 3.95%

- In the last 3 years, 11.62%

- In the last 1 year, 23.68%

Total Expenditure Amount

The Total Expenditure of the company was ₹61,452.89 Crore in March 2023, which increased to ₹65,715.36 Crore in March 2024.

The Net Cash Flow Amount

The Net Cash Flow amount of the company was -₹1,396.45 Crore in March 2023, which became ₹2,289.64 Crore in March 2024.

Total Assets Amount

The company’s Total Assets were ₹60,345.75 Crores in March 2023 and increased to ₹64,685.37 Crores in March 2024.

Peer Company Of Tata Motors Limited

| Company Name | Market Cap (Crore) |

| Maruti Suzuki India Limited | ₹3,95,449.37 |

| Mahindra & Mahindra Limited | ₹3,82,724.98 |

| Bajaj Auto Limited | ₹2,22,809.64 |

| Eicher Motors Limited | ₹1,52,088.16 |

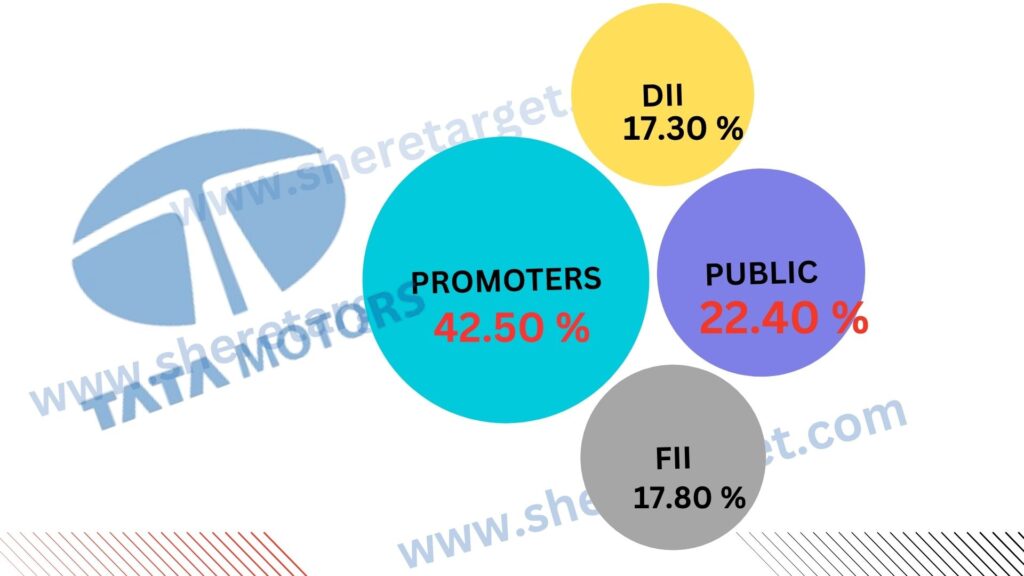

Discussion About Shareholding Pattern Of Tata Motors Limited

Tata Motors Limited mainly has four types of shareholding patterns, such as promoter holding, public holding, DII, and FII. Depending on the shareholding pattern, we can majorly influence the company’s growth.

| Investor Type | Percentage |

| Promoter Holding (Owned by the company’s promoter) | 42.50% |

| Public Holding (Held by the public) | 22.40% |

| FII (Invest by Foreign Institutional Investor) | 17.80% |

| DII (Invest money by Domestic Institutional Investor) | 17.30% |

The Last Few Years’ Share Price Updation Of Tata Motors Share

Tata Motors Share always gives investors good returns, as described in the portion below.

- The last 6 months’ share growth was -137.95 (-16.83%).

- The last 1 month’s share growth was +102.02 (17.60%).

- The last 1 year’s share growth was -306.75 (-31.03%).

- The last 5 years’ share growth was +600.75 (741.21%).

- The maximum share growth was +650.07 (2,048.76%).

- Tata Motors’ share price return percentage was 17.35% in the last 1 month.

- The last 3 months’ share growth was -3.74%.

- The last 1 year’s share growth was -31.20%.

- The last 3 years’ share growth was 66.53%.

- The last 5 years’ share growth was +724.62%.

If anyone wants to invest in Tata Motors shares, it will be profitable on a long-term basis.

What Is The Expert Advice About The Investment In Tata Motors Shares

Positive Sides

- In the last 3 year’s the company had a good profit growth which was 75.26%.

- In the last 3 year’s the company had a good revenue growth which was 34.96%.

- The company has an efficient cash conversion cycle of -27.96 days.

- The company has a strong degree of Operating Leverage, Average Operating Leverage stands at 12.96.

- The company’s PEG ratio is 0.23.

Negative Sides

- The company’s Tax rate is low at -0.85.

- The company has a high PE ratio of 39.01.

Risk Factors Of Tata Motors Limited

- Tata Motors Limited has faced controversy over developing the ‘Nano’.

- Asok Leyland, Tata’s biggest competitor in the Indian heavy commercial vehicle market.

- The company has a minimum presence in Europe & US Markets.

- Price fluctuation of steel and aluminium can affect the company’s production.

- A delay in technological development can hamper the company’s production.

Also Read – TVS Motor Share Price Target

FAQ

What is Tata Motors Share Price Target for 2025?

Tata Motors Share Price Target for 2025 is ₹649.62 to ₹805.47.

What is Tata Motors Share Price Target for 2026?

Tata Motors Share Price Target for 2026 is ₹795.39 to ₹925.59.

What is Tata Motors Share Price Target for 2028?

Tata Motors Share Price Target for 2028 is ₹1,186.93 to ₹1,465.59.

What is Tata Motors Share Price Target for 2030?

Tata Motors Share Price Target for 2030 is ₹1,740.88 to ₹2,019.42.

What is Tata Motors Share Price Target for 2035?

Tata Motors Share Price Target for 2035 is ₹3,396.28 to ₹3,686.72.

Conclusion

This website is written to help the investor gain some basic knowledge about the market strategy of Tata Motors shares. For making this blog, we consulted experts and researched the company. It is expected that the Tata Motors Share Price Target will be a good choice to invest in on a long-term basis. The demand for the manufacture of cars, trucks, vans, and buses manufacturing sector in India and outside of the country always increases, as a result of the company, and the share may increase rapidly.

We try to give an in-depth idea about the share. If you think it is helpful to you can share it. If you have any questions, please let us know through the comment box. We will try to reply to your questions and solve your problem. Thanks for visiting this website and thanks for being with us.

Disclaimer – We are not SEBI-registered advisors. A financial market is always risky to anyone. This website is only for training and educational purposes. So, before investing, we are requested to discuss certified expertise. We will not be responsible for anyone’s profit or loss.