SEPC Share is a bullish trend in the share market. During share ups and downs, you should know all about share details before investing. In this blog, we are going to discuss SEPC Share Price Target 2025, 2026, 2028, 2030, and 2035. We will try to analyze the share base in the company’s overall performance.

We also look at the company’s profit growth in the last 5 years, the last 5 years’ sales growth, and the last 5 years’ ROE percentage. Similarly, we also compare the share growth, the share price return amount of the share has increased or decreased over the last 5 years. We also take advice from experts about when we should invest in the share, which may be helpful for you. Let’s have a look at the SEPC Share Price Target from 2025 to 2035.

What Is SEPC Limited?

SEPC Limited provides solutions to engineering challenges by offering multi-disciplinary design, engineering, construction, procurement, and project management services. The company also focused on providing turnkey solutions in the business segments of power, water infrastructure, process & metallurgy, etc. The company was established in the year 2000 the head quarters of the company is situated in Chennai.

Fundamental Analysis Of SEPC Limited

| Company Name | Shriram EPC Limited |

| Market Cap | ₹2,270.85 Crore |

| Book Value | ₹9.12 |

| Face Value | ₹10 |

| 52 Week High | ₹34.01 |

| 52-Week Low | ₹11.82 |

| P/B | 1.58 |

| P/E | 106.01 |

| ROE | 2.01% |

| ROA | 1.42% |

| ROCE | 4.78% |

Last Few Year’s Performance Of SEPC Limited

Profit Growth

- In the last 5 years, -4.96%

- In the last 3 years, 29.01%

- In the last 1 year, 300.69%

The Net Profit of the company was ₹-11.96 Crore in March 2023, which increased to ₹23.01 Crore in March 2024. The Operating Profit of the company was ₹-57.23 Crore in March 2023, which increased to ₹34.86 Crore in March 2024.

Sales Growth

The sales growth percentage of the company in the last 5 years is described below.

- In the last 5 years, -5.96%

- In the last 3 years, 2.01%

- In the last year, 48.56%

The Net Sales amount of the company was ₹379.25 Crore in March 2023, which increased to ₹561.58 Crore in March 2024.

ROE Percentage

The ROE percentage growth of the company in the last 5 years is described below.

- In the last 5 years -11.23%

- In the last 3 years -9.36%

- In the last 1 year, 2.63%

ROCE Percentage

The company’s ROCE percentage growth in the last 5 years is described below, and it has also increased rapidly.

- In the last 5 years, 0.85%

- In the last 3 years, 1.96%

- In the last 1 year, 5.10%

Total Expenditure Amount

The company’s Total Expenditure was ₹164.25 Crore in March 2023, which decreased to ₹130.62 Crore in March 2024.

The Net Cash Flow Amount

The Net Cash Flow amount of the company was ₹27.26 Crore in March 2023, which became -₹14.59 Crore in March 2024.

Total Assets Amount

The Total Assets of the company were ₹1,586.01 Crore in March 2023, which increased to ₹1,785.36 Crore in March 2024.

Also Read – Patel Engineering Share Price Target

SEPC Share Price Target 2025

SEPC Share Price Target 2025 forecast may vary from ₹14.24 to ₹31.36.

Influencing Key Factors Of SEPC Share Price Target 2025

- Mining Capacity

- SEPC provides high-end engineering services for all types of mining activities in copper, iron, coal, gold, and uranium mines. These activities involve the planning, developing, and producing ore/coal as a consortium with overseas companies.

- Mineral Processing

- SEPC provides EPC solutions for processing both ferrous and nonferrous minerals. SEPC Limited, in partnership with the world’s leading mineral processing companies, delivers customized solutions based on the latest technologies in the field.

- Other Sides Project Handling Capacity

- SEPC Limited also handles projects in different sectors, such as water and wastewater treatment plants, power plants, and industrial facilities, which provide profit growth to the company and are also profitable for the company’s growth.

| Month | SEPC Share Price Target 2025 (1st Price Target) | SEPC Share Price Target 2025 (2nd Price Target) |

| April | ₹14.24 | ₹17.06 |

| May | ₹16.19 | ₹20.35 |

| June | ₹19.88 | ₹21.14 |

| July | ₹21.90 | ₹24.57 |

| August | ₹22.39 | ₹25.01 |

| September | ₹23.67 | ₹27.56 |

| October | ₹25.89 | ₹29.38 |

| November | ₹27.66 | ₹30.12 |

| December | ₹27.64 | ₹31.36 |

SEPC Share Price Target 2026

SEPC Share Price Target 2026 forecast may vary from ₹29.96 to ₹36.69.

Influencing Key Factors Of SEPC Share Price Target 2026

- Water Infrastructure Facility

- SEPC Limited provides Turnkey solutions, which include the Design & Implementation of Environmental projects like Water & Sewage Treatment Plants, Water Distribution, Pipe Rehabilitation, Underground Drainage systems, Intake wells & Pumphouses, etc. The company has also done different projects related to water infrastructure facilities in different states all over India.

- Process And Metallurgy

- SEPC Limited provides turnkey contracting solutions, including Design, Engineering, and Construction for Cement Plants, Ferrous and nonferrous industries, Process Plants, Coke Ovens, and by-product Plants, Material Handling, Transportation, etc. The company has ferrous and nonferrous industry clients in Madras, Zambia, Maithan, and other countries.

| Month | SEPC Share Price Target 2026 (1st Price Target) | SEPC Share Price Target 2026 (2nd Price Target) |

| January | ₹29.96 | ₹31.02 |

| February | ₹30.67 | ₹33.65 |

| March | ₹25.49 | ₹28.89 |

| April | ₹26.96 | ₹29.52 |

| May | ₹28.30 | ₹31.54 |

| June | ₹29.24 | ₹32.49 |

| July | ₹30.40 | ₹34.68 |

| August | ₹32.15 | ₹34.56 |

| September | ₹32.05 | ₹35.32 |

| October | ₹32.85 | ₹35.21 |

| November | ₹33.70 | ₹37.52 |

| December | ₹30.55 | ₹36.69 |

SEPC Share Price Target 2028

SEPC Share Price Target 2028 forecast may vary from ₹45.20 to ₹54.39.

Influencing Key Factors Of SEPC Share Price Target 2028

- Material Handling Plants

- SEPC Limited has also done different in Material Handling projects in Mysore, the company handled fuel and ash handling systems for co-gen power plant, in Lakshmi Energy and Foods Limited, the company handled fuel and ash handling system for Biomass power plant, in Steel Authority Of India Limited, Durgapur Steel Plant the company work for coal handling plant with storage silos, etc which also increases the company’s profit growth.

- Power Supply

- SEPC Limited is one of the companies in India that actively develops a broad range of renewable energy projects. It is more than just an EPC contractor providing turnkey contracting solutions for biomass power plants, thermal power plants, wind farms, etc. The company also provides power solution projects in Tamil Nadu, Punjab, Rajasthan, Maharashtra, and many other states.

| Month | SEPC Share Price Target 2028 (1st Price Target) | SEPC Share Price Target 2028 (2nd Price Target) |

| January | ₹45.20 | ₹48.32 |

| February | ₹45.87 | ₹49.16 |

| March | ₹38.60 | ₹41.55 |

| April | ₹40.33 | ₹44.92 |

| May | ₹42.16 | ₹46.51 |

| June | ₹43.64 | ₹47.06 |

| July | ₹45.22 | ₹48.26 |

| August | ₹46.35 | ₹49.50 |

| September | ₹47.29 | ₹50.83 |

| October | ₹49.54 | ₹53.66 |

| November | ₹49.81 | ₹52.29 |

| December | ₹50.16 | ₹54.39 |

SEPC Share Price Target 2030

SEPC Share Price Target 2030 forecast may vary from ₹62.85 to ₹70.25.

Influencing Key Factors Of SEPC Share Price Target 2030

- Overseas Projects Facility

- Moon Iron & Steel Company

- SEPC Limited completed many overseas projects, like Moon Iron & Steel Company (MISCO), a closed joint stock company based in the Sultanate of Oman. MISCO had set up a 1.2 MTPA capacity of steel plant complex at Sohar Industrial Estate in the Sultanate of Oman. The final product of the plant is 700,000 tonnes per annum of rebars/ 1,200,000 tonnes per annum of square billets.

- Ministry Of Water & Irrigation, Tanzania Project

- The JV Company – L & T Shriram EPC JV had received a contract from the Ministry of Water & Irrigation, Tanzania, for the extension of the Lake Victoria pipeline from Nzega to Tabora town in Tanzania, which became profitable for the company.

| Month | SEPC Share Price Target 2030 (1st Price Target) | SEPC Share Price Target 2030 (2nd Price Target) |

| January | ₹62.85 | ₹65.21 |

| February | ₹64.26 | ₹67.58 |

| March | ₹57.10 | ₹60.64 |

| April | ₹59.37 | ₹61.75 |

| May | ₹59.44 | ₹62.13 |

| June | ₹61.66 | ₹64.21 |

| July | ₹63.51 | ₹65.45 |

| August | ₹64.18 | ₹66.21 |

| September | ₹62.49 | ₹66.41 |

| October | ₹65.20 | ₹68.35 |

| November | ₹65.12 | ₹68.33 |

| December | ₹67.23 | ₹70.25 |

Also Read – RVNL Share Price Target

SEPC Share Price Target 2035

SEPC Share Price Target 2035 forecast may vary from ₹125.68 to ₹136.29.

Influencing Key Factors Of SEPC Share Price Target 2035

- SEPC (FZE), Sharjah, United Arab Emirates

- SEPC (FZE) is a 100% subsidiary company of SEPC Limited, which was incorporated in Sharjah under the laws of the United Arab Emirates. The company takes care of the supply of equipment for the projects executed outside India, sourcing from various suppliers from all over the world, including India.

- Entered Into A Joint Operation

- In December 2004, SEPC Limited entered into a joint operation agreement with Hamon Thermopack Engineers Private Limited, a subsidiary of Hamon Thermal Europe SA, and Hamon B.V., to carry out projects regarding cooling tower solutions. On 5TH February 2007, a joint venture share transfer and shareholders agreement was entered into between Hamon Thermal Europe SA and Hamon Thermal Engineers Private Limited with SEPC Limited.

| Month | SEPC Share Price Target 2035 |

| 1st Price Target | ₹125.68 |

| 2nd Price Target | ₹136.29 |

Peer Company Of SEPC Limited

| Company Name | Market Cap (Crore) |

| Larsen & Toubro Limited | ₹4,29,654.28 |

| IRB Infrastructure Developers Limited | ₹27,201.68 |

| NBCC (India) Limited | ₹24,072.36 |

| Rail Vikas Nigam Limited | ₹72,195.37 |

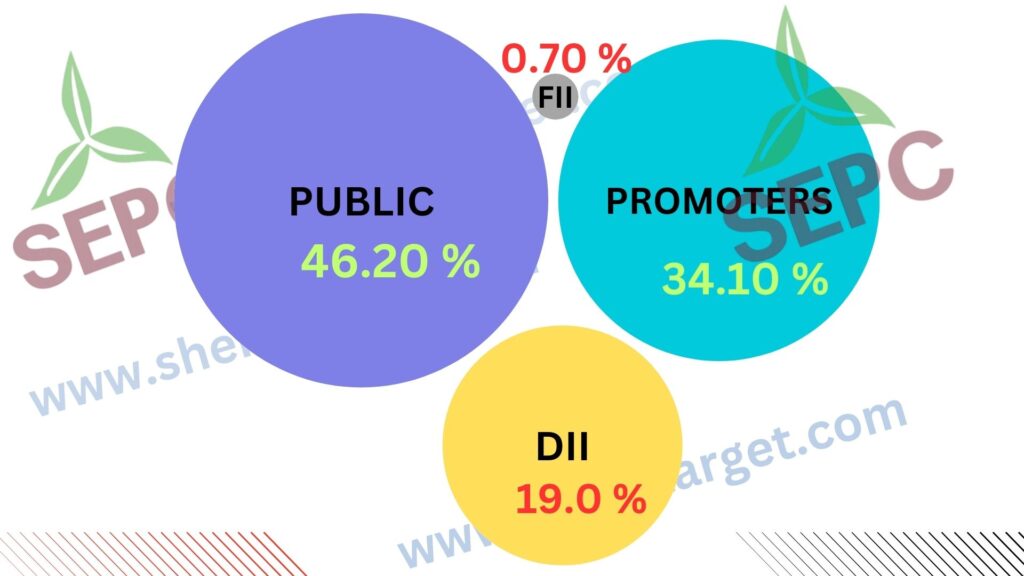

Discussion About Shareholding Pattern Of SEPC Limited

SEPC Limited mainly has four shareholding patterns: promoter holding, public holding, DII, and FII. We can majorly influence the company’s growth depending on the shareholding pattern.

| Investor Type | Percentage |

| Promoter Holding (Owned by the company’s promoter) | 34.10% |

| Public Holding (Held by the public) | 46.20% |

| FII (Invest by Foreign Institutional Investor) | 0.70% |

| DII (Invest money by Domestic Institutional Investor) | 19.00% |

The Last Few Years’ Share Price Update Of SEPC Share

SEPC Share always gives good returns to investors, which is described in the portion below.

- The last 6 months’ share growth was -15.78 (-51.73%).

- The last 1 month’s share growth was +0.43 (3.11%).

- The last 1 year’s share growth was -5.55 (-28.02%).

- The last 5 years’ share growth was +6.67 (87.88%).

- The last maximum share growth was +6.67 (87.89%).

- SEPC share price return percentage was -13.22 % in the last 1 month.

- The last 3 months’ share price return percentage was -23.69 %.

- The last 1 year’s share price return percentage was -28.60 %.

- The last 3 years’ share price return percentage was 62.15%.

- The last 5 years’ share price return percentage was 458.83%.

What Is The Expert Advise About The Investment In SEPC Share

Positive Sides

- In the last 3 years, the company’s profit growth was good, which was 29.01%.

- The company’s PEG ratio is 0.69.

- The company has a healthy liquidity position with a current ratio of 2.96.

Negative Sides

- The company has a poor revenue growth of 1.85% in the last 3 years.

- In the last 3 years, the company’s ROE was -9.36%.

- In the last 3 years, the company’s ROCE ratio was 1.96%.

- The company has a high PE ratio of 106.01.

- The company’s tax rate is low, which is 0.

- The company has a low EBITDA margin of -5.20% in the last 5 years.

Risk Factors Of SEPC Limited

- SEPC Limited has some financial risk factors, like the company having a small amount of debt, which may increase the company’s risk factors.

- Any changes in legal acts may affect the company’s profit growth.

- Increasing the prices of raw materials like polymer and polyethylene may affect the company’s profit growth.

- Increasing the tax amount may affect the company’s profit growth.

Also Read – Adani Enterprises Share Price Target

FAQ

What is the SEPC Share Price Target for 2025?

SEPC Share Price Target for 2025 is ₹14.24 to ₹31.36.

What is the SEPC Share Price Target for 2026?

SEPC Share Price Target for 2026 is ₹29.96 to ₹36.69.

What is the SEPC Share Price Target for 2028?

SEPC Share Price Target for 2028 is ₹45.20 to ₹54.39.

What is the SEPC Share Price Target for 2030?

SEPC Share Price Target for 2030 is ₹62.85 to ₹70.25.

What is the SEPC Share Price Target for 2035?

SEPC Share Price Target for 2035 is ₹125.68 to ₹136.29.

Conclusion

This website is written to help the investor gain some basic knowledge about the market strategy of SEPC shares. For making this blog, we consulted experts and researched the company. It is expected that the SEPC Share Price Target will be a good choice to invest in on a long-term basis. The demand for the by offering multi-disciplinary design, engineering, construction, procurement, and project management services always increases as a result of the company, and the share may increase rapidly.

We try to give an in-depth idea about the share. If you think it is helpful to you you can share it. If you have any questions please let us know through the comment box we will try to reply to your questions and solve your problem. Thanks for visiting this website and thanks for being with us.

Disclaimer – We are not SEBI-registered advisors. A financial market is always risky to anyone. This website is only for training and educational purposes. So before investing, we are requested to discuss certified expertise. We will not be responsible for anyone’s profit or loss.